‘Tax the Ultra-Rich and Do It Now’

Two articles here, each on the same topic about extreme wealth going untaxed or taxed less than those in lower income brackets. The first story is about a letter sent to World Economic attendees sent by a bunch of millionaires. The second story is about historian and correspondent Rutger Bregman having a moment at Devos in 2019. Rutger claims he delivered a blast about taxes. If you listen to the clip, it sounds like he had a conversation with them. I do not hear the sounds of impatience.

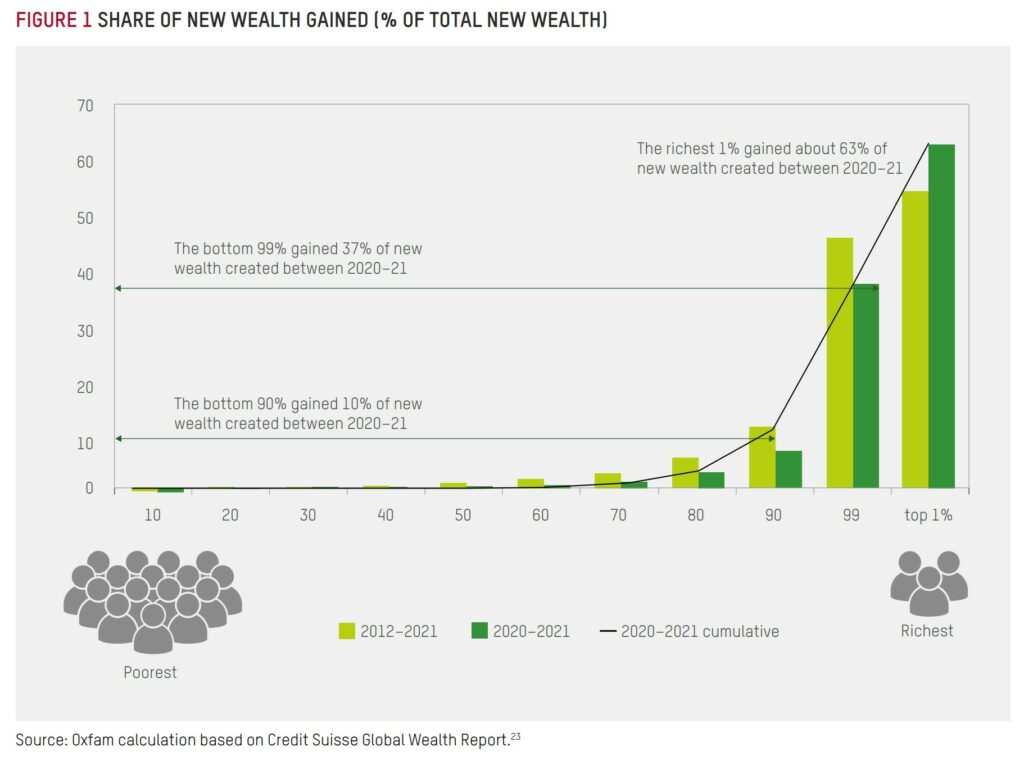

In any case, 4 years later and the proponents of taxation are still delivering the same message. In 2020, 1% of the global population took in $26 trillion of the $42 trillion in new wealth (chart) created since 2020 . . . 62% of the new wealth.

I have only skimmed over the data in these articles. I will do a deeper dive later. Others may wish to get to the data earlier than I. The links are all there for review and the taking. Interesting take in the article and not enough anger as to the whys allowing this to happen.

200+ Millionaires to World Leaders at Davos: ‘Tax the Ultra-Rich and Do It Now,’ commondreams.org, Jake Johnson, May 2023

A group of 200+ millionaires from 13 countries published an open letter Tuesday calling on world leaders gathering in Davos to tackle skyrocketing inequality by taxing rich people like themselves, warning that extreme concentrations of wealth at the top are “unsustainable.”

A letter from global millionaires, was hand-delivered to World Economic Forum attendees.

“We are living in an age of extremes. Rising poverty and widening wealth inequality; the rise of anti-democratic nationalism; extreme weather and ecological decline; deep vulnerabilities in our shared social systems; and the shrinking opportunity for billions of ordinary people to earn a livable wage.”

The letters asks . . .

“Why, in this age of multiple crises, do you continue to tolerate extreme wealth? The solution is plain for all to see . . . Tax the ultra-rich and do it now. It’s simple, commonsense economics. It is an investment in our common good and a better future that we all deserve, and as millionaires we want to make that investment.”

The letter comes on the heels of two analyses detailing how the global rich have captured a disproportionate share of the wealth generated in recent years with the help of policies that often allow them to pay a lower tax rate than ordinary workers, who are bearing the brunt of price increases, falling real wages, and economic instability.

According to a study published Monday by Oxfam International, the global 1% took in $26 trillion of the $42 trillion in new wealth created since 2020, nearly twice as much as the share grabbed by the bottom 99%.

Four Years Earlier

‘You have a wallet, right?’: Rutger Bregman on his Davos moment, and taxation ‘hypocrisy,’ ICIJ, Razzan Nakhlawi. April 2019

Dutch historian and De Correspondent journalist Rutger Bregman didn’t expect to blast global elites at the World Economic Forum in Davos this year. But after days of listening to billionaire speakers promoting philanthropy schemes as a solution for world inequality, he couldn’t take it anymore.

“We’ve got to be talking about taxes,” he declared. “That’s it, taxes, taxes, taxes.”

Shutting down tax avoidance schemes and forcing the wealthy to pay more in taxes is the only real solution to the problems that plague the world, he said — but the uber rich who swooped into town in their private jets didn’t even want to talk about it.

“It feels like I’m at a firefighters conference, and no one is allowed to speak about water.”

Bregman’s rant blew up online, but he suggests his virality comes with growing public support for fairer taxation. He cites the International Consortium of Investigative Journalist’s extensive reporting into secretive financial structures in places like Panama, Bermuda and the British Virgin Islands, as a catalyst for the shift.

The author sat down with Bregman to talk tax hikes on the super-rich and his infamous run-in with American conservative television personality Tucker Carlson.

On Inequality

You can have a whole long theoretical debate about how high should the top marginal tax rate be. Some people would say, well, a top marginal tax rate of 70 or 80%, that’s ridiculous, that will never work, that will destroy our economy. But you could also just look at history and then you’ll just find out that in the 50s and 60s, we had those kinds of tax rates under often conservative politicians, like [Dwight D.] Eisenhower, as I mentioned at Davos. And, it worked perfectly well.

It just opens your eyes. Just to see that things were often radically different in the past.

So often we talk about these issues as zero-sum policies: I take a bit from you so that I can give it to someone else. The actual evidence shows that there are a lot of win-win policies out there. That if you eradicate poverty, that healthcare costs go down, crime goes down, kids perform much better in school. Every dollar you invest, you get a return of three or four dollars.

Even if you don’t have a heart, at least you have a wallet, right? I think that’s very important to emphasize, it’s also what I’ve tried to do in Davos, is to emphasize that it’s not really about partisanships, these are really bipartisan ideas. I don’t think we’re at a point where this is about left versus right, but it’s more about plutocracy versus democracy.

Taxes as part of the inequality

A couple of days ago, Nancy Pelosi [speaker of the United States House of Representatives] asked a question about Medicare-for-all. She asked, “How are we ever going to pay for that?” My answer was, again, taxes, taxes, taxes. It’s not very difficult.

If you look around the globe, you just see that the countries with the strongest welfare state, the strongest systems of social support and higher levels of taxation are also the places where people actually want to live. If you ask citizens from around the world, imagine the perfect country: what level of inequality would it have? What level of social mobility would it have? They say, well, something like Denmark sounds good. I always say this, if people want to experience the American dream, just move to Denmark. Your chances are much higher there.

Resistance to these ideas

Davos, for example. I mean, it was a very weird experience I had. People talking about all sorts of issues: inequality, about feminism, about participation, about inclusion, all such wonderful things. But they don’t talk about taxes. I was at the one panel where tax avoidance was the main subject.

It was a small panel, and there was one journalist, Bastian Obermayer, from [ICIJ’s German partner] Süddeutsche Zeitung, the one who received the Pulitzer Prize [for the Panama Papers]. And, it took I think about 40, 45 minutes before he actually got the opportunity to say something. It was a bizarre experience. We were mainly listening to the minister of finance from Ireland, a notorious tax paradise, explaining how wonderful Ireland is and how they’re really not a tax paradise anymore, blah, blah, blah. Bastian was basically ignored by the rest of the panel. So, that was really the moment when I really decided, okay I’m going to make a speech about how bizarre this whole conference is.

The Moment Of . . .

The night before. I mean, I must say, I’m not an expert on issues of tax avoidance, I know quite a bit about it but obviously not as much as Bastian Obermayer. But then again you don’t need to be an expert to see how bizarre the situation we’re in right now. Inequality is spiraling out of control, the vast majority of people around the globe are in favor of higher taxes on the wealthy, and somehow it’s still not happening, and in Davos we’re still listening to people like Bono explaining what a just society would look like, right? People just can’t stand that anymore: the hypocrisy.

In the U.S., a growing support

Well it’s amazing, isn’t it? I mean in 2016, [U.S. Senator] Bernie Sanders was a lonely figure, right? I mean, a powerful figure but still quite lonely in the Democratic party. It sort of felt like he and [the Leader of the Labour Party in the United Kingdom] Jeremy Corbyn are like survivors, after the financial crash, and people were like, okay, we need new ideas, who has new ideas? And there were these two old guys who were leftovers from the 70s, they came out of their caves and they became hugely popular. But now what’s so exciting is that there is a new generation, like [U.S. Congresswoman] Alexandria Ocasio-Cortez, who is so young, so eloquent, so smart coming up with these new proposals.

Also, [critics] say, that sounds like communism; that sounds like Venezuela. And we say, whatever, it’s boring, that [argument] doesn’t work anymore. It’s a generation that’s not traumatized by the Cold War but just sees these things like, guaranteed maternity leave, universal childcare, Medicare-for-all as just common-sense, rational policies that the vast majority of people want. So, let’s implement them already. And how do we pay for it? Well, with taxes. It’s not that difficult.

What’s the priority? Loopholes or Tax Hikes?

I think I’d say [both]. I mean, it’s just so important that we are actually talking about these issues, and this is where all the leaks have been so important. The Panama Papers, the Paradise Papers, the Lux Leaks, etc. It just keeps the subject on the news agenda and that is so important.

In reality, there’s not going to be a distinction between, oh should we talk about top marginal tax rates first, or wealth taxes first, or about cracking down on tax paradises. It will all happen at the same time.

Tax issues are pretty unsexy, how do you get people to care?

I think you guys are doing a good job. You’re tying it to specific people, that helps. If it’s newsworthy, then people pay attention. Or look at what Oxfam is doing, every single year they get all the headlines with this simple fact that the billionaires own as much as half of the world population, I think that’s all brilliant work. It makes us focus on the right thing.

What kind of response have you got to your book, etc.

The thing that surprised me the most is how bipartisan the support has been that I received. So, you’d expect that the people on the left would love me and people on the right would hate me. I got some hate mail but I also got an extraordinary amount of emails from Fox News viewers, Republicans who are like, okay, normally I’m a fan of Tucker Carlson [a conservative television personality in the U.S.] but this time, I’m on your side because I think you are right and he should have just answered your questions that were legitimate questions and he didn’t.

The Cost of Extreme Wealth, End the age of extreme wealth. Tax the ultra rich, 2023

Survival of the Richest: How we must tax the super-rich now to fight inequality – executive summary, oi-files-d8-prod.s3.eu-west-2.amazonaws.com, multiple authors. OxFam, January 2023

‘Every Billionaire Is a Policy Failure,’ Says Oxfam as Global Elite Gather in Davos, commondreams.org,

The argument (which is out there) that the super-rich already pay ‘more than their share’ of income taxes, paying over half the amount collected is claimed & probably true. However, since their incomes take them way, way beyond what they need to live on, we have gone past the ordinary meaning of ‘what they ought to pay’, from proportional to exponential it would seem.

Fred:

What? Cornering 62% of all the new wealth created since 2020 going to 1% of the global population is not enough? $Twenty-six trillion of the $42 trillion created since 2020. This is on top of all previous wealth up till 2020.

The argument is enough is enough. A large percentage of the wealth they take could be utilized to solve the hunger, disease, and education of the 99% of the population. This would lower costs.

The super-wealthy paying as much as the Rest of US (proportional) is not sufficient.

Richest 1% bag nearly twice as much wealth as the rest

OXFAM – Jan 2023

‘Exponential’ taxation would mean they should be paying twice as much in income taxes.

Fred:

1. What are you trying to say about that link which is cited in my post?

2. What happens in 2025?

3. Maybe Biden only has to get to 2025, yes?

Not saying anything about your post.

I have a ex-GOP friend who is still quite conservative, who reminds me from time to time (he’s pretty well off) that ‘the rich pay most of the income taxes’ so I tell him they (he) could pay more. 50%+ may seems a lot, since there are numerically relatively few. My point (as is Oxfam’s) is that there’s no particular reason why it shouldn’t be 2/3, now is there?

In 2025, with all the shenanigans the GOP can attempt, they stand a good chance of defeating Biden, even against Dem urban & suburban majorities. As far as they are concerned, there is no stopping them.

The ‘conventional wisdom’ is that the less-wealthy folks who pay less than half of the income taxes collected will somehow feel ‘less connected’ politically if their taxes go down, which seems to ignore the fact that the wealthiest among us work pretty hard at keeping their taxes as low as possible. Are they (or their staffs) working at feeling ‘less connected politically’?

For the worker who drives on government built roads, and sends kids to government sponsored schools, and sees funds going to those who have less money but don’t work, it is hard to imagine how anyone can receive enough from the government to be willing to pay more in taxes. It requires understanding that it is the structure of society gives the rich far more than it gives the poor. Rich people can (usually) buy their way out of jail, send their kids to better schools, and helicopter above those roads.

Back in the day, when the tax rates for the wealthy were 90% on earnings above a certain level, the affluent as well as the wealthy wrote off a lot of expenses for country clubs and the like. Today, even with our much lower rates, they get around the rates that do exist by not “realizing” their gains in wealth and borrowing against them which is cheaper than the taxes would be. Really getting to the wealth in this country, much less the rest of the world, is very difficult because of things like Citizens United and the costs of political campaigns. It’s not a matter of logic; it’s a matter of power. Money talks and bullshit walks.

Not very convincing that borrowing in lieu of realizing gains is much of a bad practice. If the loan is for consumption, it gets paid back at some point with the borrower’s wealth. If it funds successful business or investment, well that is what loans are meant to do. Rebasing asset price base at inheritance is the real bad practice in my view.

Jack;

Yes on the 90% tax rate for individuals.

Eisenhower’s presidency did see some tax rates above 90%. The percentage only applied to the individual income taxes of top earners. For married people filing jointly in 1953, any income above $200,000 was taxed at 90%. Above $300,000 at 91% and above $400,000 at 92%. You are correct.

Corporations: From 1952 to 1963 which includes Eisenhower’s entire presidency, IRS historical data confirms the tax rate was 30% for the first $25,000 in profits a company made, and 52% for anything over that amount.

Think where we would be today?

Corporate and Individual Tax Rates More info. at this article.

It’s used for consumption and interest rates are cheaper, by far, than tax rates. A lot of wealthy people do it so I’m guessing it’s a effective money saver.

Again, to me the real advantage of taking loans instead of realizing gains is to possibly defer those gains a generation to a rebased price. Unrealized gains are not negotiable assets; sell some or taking a loan really should be of minimal interest to tax authorities, except if the owner can defer realizing through his/her lifetime via loans. The straightforward reforms would be to force realization on the estate, or simply have the inheritors also get the original price basis of assets. Proposals to tax unrealized gains I think would foolishly complicate tax matters even further to the advantage – after one or two election cycles – to the already wealthy and the tax services industry. Get rid of rebasing would be a significant improvement. Even that would be a heck of a fight, but at least it would be a pretty clear one to accomplish just one thing.

Eric:

Works if interest rates are low. They are not, right now.