No recession yet, but no paucity of yellow flags

If you are not reading New Deal democrat as he marks the progress of the economy over the last year, you really should start. The detail on what certain economic markers determine are in his weekly analysis done on a daily basis for various markers.

Updating 3 high frequency indictors: no recession yet, but no paucity of yellow flags

– by New Deal democrat

Aside from the Fed’s rate decision which will be announced this afternoon, it’s a slow economic news week. In general, the punditry which I read seems to be settling on a consensus that we are going to manage to have a soft landing. With the exception of jobs and payrolls, the rest of the indicators I track in sequence continue to indicate a recession is near. Let me update three high frequency indicators I’ve been paying particular attention to.

1. Redbook consumer spending

This is a weekly update of same store spending, measured nominally YoY. The trend here is pretty self-explanatory:

YoY consumer spending was holding up in double-digits until the middle of last summer. Since then the trend, albeit with some waxing and waning, has been pretty consistent. The average of the last 3 weeks has been just below 3% YoY.

For comparison, here is monthly nominal retail sales YoY since last March:

The trend is similar, but the decline in Redbook has been considerably more pronounced. If the monthly series follows, March nominal retail sales will decline further YoY. And as indicated that’s before consumer inflation is taken into account, which as of February was 6.0% YoY.

Further, if the trend continues, even nominally Redbook will be negative YoY by midyear.

2. Temporary employment

Temporary employment is a leading sector of the jobs market. The American Staffing Association has been posting a “Staffing Index” since 2006. Typically the Index slowly increases during the year, with major seasonal fluctuations around the 4th of July, Thanksgiving, and Christmas-New Year’s. Here’s what it looks like since January 2022, and the onset of the Great Recession, 2006-07, for comparison:

The 6% YoY downturn in February through early March this year has been the biggest since the series was begun. That being said, there was a similar downturn in late 2015 (not shown) without the economy coming close to recession.

For comparison, note that there has been a similar YoY downturn in termporary employment in the official payrolls report:

The last few weeks suggest this downturn in the monthly jobs report will continue.

3. Payroll tax withholding

This is a decent coincident proxy for the total jobs market. Almost everybody pays payroll taxes, and it stands to reason if wages and/or jobs growth stagnate, so will the taxes from those paychecks.

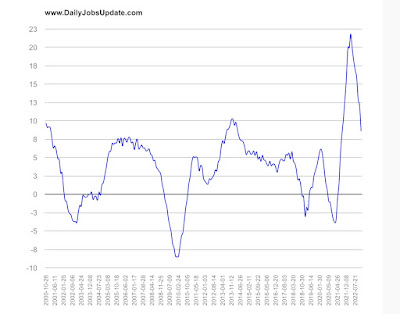

Matt Trivisonno of the Daily Jobs Update keeps track of these graphically, and makes a free graph available with a 90 day delay. Which means that the below graph includes the period up through roughly December 15. By way of further explication, the comparison is taxes paid during the entire previous 365 day period, vs. the entire 365 day period before that:

YoY payroll taxes peaked at about 22% in March 2022. Remember that my rule of thumb for non-seasonal adjusted data is that it probably has peaked if the YoY comparison has declined by more than 50% within the ensuing 12 months.

As of December 15, this had declined to about 8.5% – i.e., more than half, suggesting that, if we could seasonally adjust, we would find that payroll taxes paid had turned negative.

Because the data is public at the Department of the Treasury’s site, I can further report to you that as of March 20, the entire previous 365 day period resulted in 5.9% more payroll taxes paid than the 365 day period between March 20, 2021 and March 20, 2022. This is almost a 75% YoY decline.

But the data is a little more nuanced. During the 1st fiscal Quarter of 2022-23, payroll taxes paid were only 1.2% higher than Q1 of 2021-22. So far in the fiscal 2nd quarter this year, taxes are up 7.1% compared with Q2 of 2022 through March 20. That’s a pretty strong rebound.

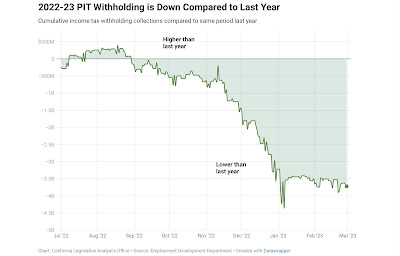

And the rebound accords with information provided by California’s Treasury Department, shown below:

After a steep YoY decline in late 2022, there has been no further YoY decline in 2023 so far. Since California includes about 1/8th of the entire US population, and an even bigger share of the economy, this is good information.

Interestingly, the Treasurer’s Office for California indicated that they believed the big shortfall in 2022 was due to the downturn in the stock market, which meant that stock options tied to an increase in share prices could not be cashed. The stock market recovered pretty nicely between November and February, so likely some of those stock options were now in the money and could be cashed.

Probably the closest monthly analog is aggregate payrolls in the jobs report, shown YoY below:

Again, there is deceleration, but no nominal downturn yet.

Put the three data series together, we see that two short leading indicators, temporary help and consumer spending adjusted for inflation (since consumption leads employment) have turned down, but no coincident downturn in overall employment. In short, no recession yet, but no paucity of yellow flags.

Consumer spending continues OK, while income continues its seemingly relentless decline, Angry Bear, New Deal democrat

Double-Barreled Economic Threat Puts Congress on Edge

NY Times – March 23

In 2008, an imminent collapse of the banking system consumed Congress before lawmakers delivered a bailout. Three years later, a debt limit crisis enveloped Washington and led to a series of spending cuts after a dangerous brush with default and a first-ever downgrade in the nation’s credit rating.

Now unease about the banking system’s stability and a stalemate over raising the debt limit are engulfing the capital simultaneously, ratcheting up an already high level of financial anxiety as two economic challenges Congress has experienced before become intertwined.

“The stakes are exceptionally high when you are dealing with what amounts to a one-two punch of economic peril,” said Senator Ron Wyden, Democrat of Oregon and chairman of the Senate Finance Committee. “The messages that you send to the economy and the public with respect to banking and the full faith and credit of the United States — it doesn’t get more consequential than that.”

Republicans and Democrats acknowledge it is a scary case of déjà vu times two. But they diverge sharply on how recent bank failures — and uncertainty over how Congress should respond to them, if at all — will influence the debt limit fight later this summer.

At their just-concluded retreat in Florida, House Republicans took the line that shakiness in the banking system should strengthen their hand in the coming showdown over the debt limit. They argued that a Democrat-led spending spree spurred inflation, forced up interest rates and led to a precarious situation for all but the largest banks. The clear answer, to them, remains deep spending cuts, and they say they will still insist on cuts before making any move to raise the debt ceiling. …

But Jerome H. Powell, the Fed chair, on Wednesday disputed the notion that spending remained the chief driver of inflation.

“Spending was of course tremendously high during the pandemic,” he said at a news conference announcing an increase in interest rates. “As pandemic programs rolled off, spending actually came down.”

“Fiscal impulse is actually not what’s driving inflation right now,” he said. “It was at the beginning perhaps, but that’s not the story right now.”

Democrats say House Republicans are doing the exact opposite of what is required at a critical moment, even as the Fed offers assurances about the soundness of the banking system. They say the fallout from any banking instability should persuade Republicans that the last thing the economy needs is the specter of a default from a failure to raise the debt limit, which is projected to be reached as early as July without action by Congress. …

The metric Fed Chair Powell touted as the guide to economic troubles says a recession and rate cuts are coming this year

Fortune – March 23

A recession is certain and so are rate cuts this year. That’s the message from the bond market metric Federal Reserve Chairman Jerome Powell highlighted a year ago as the best guide to tip-off economic troubles in the US.

The expected three-month T-bill rate in 18 months’ time dropped to 134 basis points under the current rate. That’s below the previous record nadir it hit in January 2001 — about two months before the US economy fell into recession.

Treasuries rallied Wednesday after the Fed raised its benchmark rate by a quarter point as traders ramped up bets the central bank will soon reverse course and start cutting interest rates. They are certain the Fed will lower rates by July to at least undo this week’s increase, according to swaps tied to policy-meeting dates.

The market view contrasts with the Fed’s guidance that it expects to raise rates at least once from here, and with Powell’s comments that he doesn’t expect any reductions to borrowing costs this year. …

“Frankly, there’s good research by staff in the Federal Reserve system that really says to look at the short — the first 18 months — of the yield curve. That’s really what has 100% of the explanatory power of the yield curve. It makes sense. Because if it’s inverted, that means the Fed’s going to cut, which means the economy is weak.” — Fed Chair Powell on March 21, 2022

‘A recession is certain’

Fortune – March 21

‘Already past the point of no return’: JPMorgan says the U.S. is probably headed for a recession as economic ‘engines are about to turn off’

Small banks lost $120 billion in deposits during SVB tumult

Yahoo – March 24

Small and mid-sized banks lost $120 billion in deposits in just one week as turmoil gripped the regional banking world, according to new Federal Reserve data, while customers sought safer havens at the country’s largest financial institutions.

The dramatic movements happened during a tumultuous period marked by the seizures of Silicon Valley Bank and Signature Bank on March 10 and March 12, which sparked fears of potential runs at other banks.

As regional and community banks lost $120 billion during the week ending March 15, the 25 biggest banks raked in $67 billion in new deposits on a seasonally adjusted basis, according to new Fed data released Friday. The net outflow from all banks was $98 billion, an annual drop of 5.8%. Total industry deposits of $17.5 trillion was the lowest count since September 2021. …

Banks Are Borrowing More From the Fed

NY Times – March 23

Banks are turning to the Federal Reserve’s loan programs to access funding as turmoil sweeps the financial system in the wake several high-profile bank failures.

The collapse of Silicon Valley Bank on March 10 followed by Signature Bank on March 12 prompted depositors to pull their money from some banks and sent the stock prices for financial firms on a roller-coaster ride. The tumult has left some institutions looking for a ready source of cash — either to pay back customers or to make sure they have enough money on hand to weather a rough patch.

That is where the Fed comes in. The central bank was founded in 1913 partly to serve as a backstop to the banking system — it can loan financial institutions money against their assets in a pinch, which can help banks raise cash more quickly than they would be able to if they had to sell those securities on the open market.

But the Fed is now going further than that: Central bankers on March 12 created a program that is lending to banks against their financial assets as if those securities were still worth their original value. Why? As the Fed has raised interest rates to contain inflation over the past year, bonds and mortgage debt that paid lower rate of interest became less valuable. …