Barney Frank Disagrees with Senator Elizabeth Warren on the weakening of financial rules

This is conversation between Summers and Frank are from March 13th. In this conversation, Barney could be right. He is refusing to agree that raising the limit for banks was a bad idea. If so, then how do you protect the public and the bank from bank managers doing stupid things? Gambling again with other people’s money is something they seem to be accustom to doing.

JUANA SUMMERS, HOST:

Two banks have failed in the last few days. The federal government deemed both Silicon Valley Bank and Signature Bank systemic risks to the financial system, and regulators moved to ensure depositors would be able to access their funds. Former Congressman Barney Frank is uniquely positioned to weigh in on these collapses. He served on the board of Signature Bank, passed signature legislation following the 2008 financial collapse known as the Dodd-Frank Act and he chaired the House Financial Services Committee and joins me now.

Welcome.

BARNEY FRANK: Thank you.

SUMMERS: In an op-ed for The New York Times, Senator Elizabeth Warren says that the recent bank failures – and I’m quoting here – “are the direct result of leaders in Washington weakening the financial rules.” And she is talking there specifically about the rollback of parts of your legislation. Legislation which was designed to avoid another financial crisis like the one in 2008. Those are rollbacks you were supporting. Are you having second thoughts about that now?

FRANK: No, I disagree. I didn’t like that whole bill because there were parts of it in the housing discrimination and the like. But, no, I don’t think there is any sign that the rollback caused the problem in the first place. The regulator taking the lead in closing Signature Bank was the financial regulator for the state of New York. Their authority was in no way affected by the 2018 increase in the level of banks subject to the closest supervision. So whatever the regulator in New York decided to do could have been done before. But secondly, I was on the board of Signature both before and after…

SUMMERS: Right.

FRANK: …The change. And I can tell you personally there was no diminution of regulation. 2018 didn’t say no regulation or weak regulation. It said you wouldn’t regulate a bank at $50 billion in assets the same way you wouldn’t regulate a bank at several trillion. But they retain strong power to regulate. I think the cause of this problem was crypto. The fact that – and it starts, if you notice, with FTX.

SUMMERS: OK.

AB: To Barney’s point, Signature was warned not to comingle deposits “of FTX customer funds within its proprietary, blockchain-based payments network.”

Statistica Capital, an algorithmic trading firm, and Statistica Ltd. claim the bank “had actual knowledge of and substantially facilitated the now-infamous FTX fraud,” according to a filing in the U.S. District Court for the Southern District of New York dated Feb. 6.

“In particular, Signature knew of and permitted the commingling of FTX customer funds within its proprietary, blockchain-based payments network, Signet.”

Signature Bank Sued for ‘Substantially Facilitating’ FTX Comingling, coindesk.com, Jamie Crawley

and earlier in January of this year:

Binance Says Signature Bank Won’t Support Transactions for Crypto Exchange Customers of Less Than $100K, coindesk.com, James Rubin

Nearly a quarter of the New York-based bank’s $103 billion in total deposits, or roughly 23.5%, came from the crypto industry as of September 2022. But given the recent “issues” in the space, Signature will reduce that amount to under 20% and potentially under 15% eventually, Signature CEO Joseph J. DePaolo said at a New York conference hosted by investment bank Goldman Sachs. AB: FTX was 1 tenth of 1% of that amount. It was my understanding liquidity was the issue.

FRANK: There was no problem for years. And I think this is the regulators – particularly, say, in New York – sending the message to banks, crypto is toxic; stay away from it.

SUMMERS: And let me ask you about that. I’m curious here if you see more failures coming given what you’ve just said. Or was there something specific about Signature that made it vulnerable to a situation like this, which you were saying you believe is largely because of cryptocurrency, which some would consider a risky bet?

FRANK: No. In the first place, I think you’re going to see what the FDIC has done is to remove the two top operating officers of Signature and one semi-retired officer and left everybody else in place. You’re not going to see any significant change either in the personnel or the business model. I think particularly with the New York people in the lead, they were saying, stay away from crypto. Now, we were doing crypto. We were doing it in a responsible way. But I think they still wanted to send the message after SBB in particular to stay out of crypto. If the federal government had announced on Friday the two things it announced today – a liquidity facility for banks that are suffering from runs and a back-up for guaranteeing the deposits above 250 – Signature wouldn’t have had a problem.

SUMMERS: OK.

FRANK: Now, that is the one vulnerability we had. Signature is a business-oriented bank. We lend a lot to real estate…

SUMMERS: Right.

FRANK: …Housing. And that meant we had a lot of large deposits. And I argued back in 2010 that the 250 guarantee limit for businesses was way too small. And in fact, Democrats in this time lobbied hard to get that taken care of. We’ve got to be able to have a bank put money enough to cover its payrolls and help…

SUMMERS: I’m sorry.

FRANK: …Coming out of this…

SUMMERS: If I may, our time is short here, so I just want to jump in for one second. You know, President Biden has said that he wants to strengthen banking regulations so that failures like what we’ve just seen with these two banks are less likely. In the time that we have left, from your perch, do you think he is right?

FRANK: I asked you not to do this. I don’t know how much time is time left, but I don’t like to be asked complicated questions. And so no. What we have to do, I think…

SUMMERS: OK. But do you think that – sir, do you think that the president is correct when he says he wants to strengthen these regulations to make these things possible?

FRANK: What I want is – yes. First of all, I think we need to strengthen the regulations on crypto not just in banking but through the SEC. Secondly, I think it’s important for the stability of the country, economically and for fairness to workers, not banks, to make sure that companies can have insurance sufficient to cover their payrolls. So, yeah, we need, I think, not just general banking regulation.

SUMMERS: OK.

FRANK: But we need specific regulation tightening…

SUMMERS: All right.

FRANK: …Up crypto.

SUMMERS: And we’re…

FRANK: That’s been this…

SUMMERS: We’re going to have to leave it there.

FRANK: I asked you that…

SUMMERS: Former congressman and former Signature Bank board member Barney Frank. Thank you.

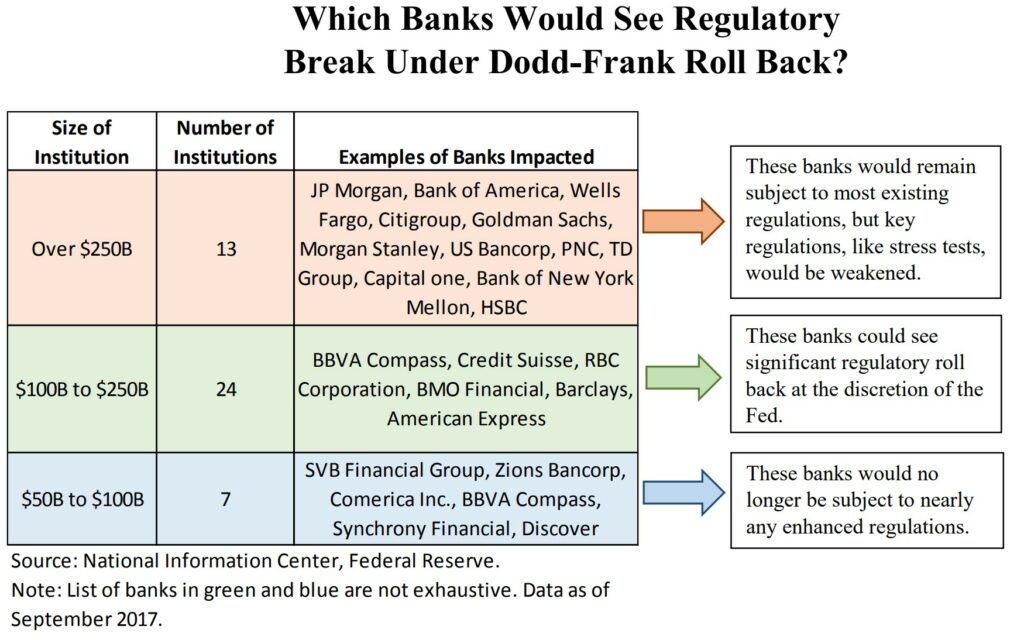

– Fact Sheet: The Senate’s Bipartisan Dodd-Frank Rollback Bill – Center for American Progress. Gregg Gelzinis and Joe Valenti. Credit Suisse was one of the 38 banks under the $50 billion limit rules. “Rolling back regulations for 25 of the 38 largest banks in the United States, which include the U.S. holding companies of foreign megabanks, the bill also weakens some regulations for the largest Wall Street banks.” My argument at the time was why $250 billion? Why not $150billion. Those 25 banks in 2018 held “$3.5 trillion in assets, or roughly one-sixth of the assets in the entire banking sector.” And here we are again . . .

– Dodd-Frank Roll Back Bill: A Windfall for Big Banks, Joint Economic Committee- Democrats, senate.gov,

Barney Frank sits on the Board of Signature Bank

New Yorker – March 15

… Probably your most lasting achievement in Congress was Dodd-Frank. Why go work on the board of a bank?

Let me answer by quoting Sheila Bair, who was one of the toughest regulators ever. She was head of the F.D.I.C., and, when she went to the board of a Spanish bank, people said, “How can you, having been a regulator, go on a bank board?” She said, “Oh, are you saying that no one that believes in strong regulation should be on a bank board?” [In 2012, Bair wrote, in her book, “There should be a lifetime ban on regulators working for financial institutions they have regulated.”] …

Barney Frank, a co-author of key banking legislation, was on the board of one of the failed banks.

NY Times – March 13

Barney Frank, the former congressman from Massachusetts who helped write the Dodd-Frank Act — the legislation passed in the wake of the 2008 financial crisis with the intention of shielding the economy from a similar crisis — said on Monday he was disappointed in the decision of regulators to shut down Signature Bank on Sunday, where he had been a board member since 2015.

Mr. Frank said in an interview on Monday that the bank’s failure had come as a shock to him, because its situation seemed to have stabilized by Sunday. Regulators, he believed, took control of Signature to send a message to other banks to stay away from cryptocurrencies.

“They shoot one man to encourage the others,” Mr. Frank said, referring to an adage about using a single military execution as an incentive for the subject’s peers to behave differently that he thought applied to the regulators’ handling of Signature. “I think we were shot to encourage the others to stay away from crypto.”

Signature, which took deposits from digital asset companies, was known as a crypto-friendly bank, even though it did not directly deal with cryptocurrency assets.

But Mr. Frank’s interest in the bank related to its focus on making loans to developers building affordable housing and accessing the federal low income housing tax credit, a system that Mr. Frank championed during his time in Congress. …