Household or Establishment Survey, which is Right?

Yesterday, we went off on the topic discussing changes or increases to the Household numbers. This commentary by Dean Baker looks like it might fit with our earlier discussion.

Job Growth: Is the Household or Establishment Survey Right? cepr.net. Dean Baker.

The January report showed that the economy added 517,000 jobs in January, far more than most analysts had expected. The household survey showed the unemployment rate dipping down to 3.4 percent, the lowest rate since 1969. However, it showed a gain in employment of just 84,000 after removing the effect of new population controls.

It is not unusual to see large monthly gaps between job growth in the establishment survey and employment growth in the household survey, so the January gap should not bother us. However, there has been a large gap over the last year. The establishment survey shows a gain of 4,970,000 since January of 2022, while the household survey has shown an increase in employment of just 2,760,000, leaving a gap of more than 2.2 million.

The main definitional differences don’t change the picture much. Self-employment is up by 250,000 over the last year. This would make the gap larger since this would contribute to the growth in employment in the household survey, but not show up as payroll jobs in the establishment survey. There was also an increase in private household employment of 95,000. This would be included in the household survey but not in the establishment data.

Going the other way, agricultural employment is down by 20,000, which would reduce employment in the household survey, but not affect the establishment survey, which only measures non-farm employment. The number of multiple job holders is up by 540,000 over the last year. These multiple jobs count in the establishment survey (unless they are self-employed). They would not add to the number of employed in the household survey.

Netting these out would reduce the gap by 260,000, which still leaves job growth in the establishment survey over the last year 1,940,000 above employment growth in the household survey. Having closely followed the monthly jobs data for over three decades, I have always been partial to the establishment survey.

It is a much larger survey and its sample is employers, which typically have many employees, rather than households that typically have one or two potential workers. In past years, gaps have almost always been closed on the household side, with changes in annual population controls eliminating most of the gap between the surveys.

What If the Household Survey Is Right?

It is at least worth considering the possibility that the household survey could be closer to the mark for 2022. There are two important data points that raise this possibility.

The first is the Quarterly Census of Employment and Wages (QCEW) data. The QCEW relies on unemployment insurance filings, which give a virtual census of payroll employment. The establishment survey is benchmarked to QCEW annually. However, the benchmark takes place with the January data, using the QCEW data from the prior year’s first quarter. The QCEW data from March 2022 were just included in the establishment survey, increasing employment growth in the year from March 2021 to March 2022 by 568,000.

We now have data from the QCEW for the second quarter of 2022. The Philadelphia Fed has been doing an analysis of these reports when they are issued. Its analysis shows an increase in jobs in the second quarter of just 10,500. That compares to an increase of 1,121,500 jobs in the establishment survey.[1] There are reasons to view the Philadelphia Fed analysis with some skepticism. They have not done it for very many years, and the seasonal adjustment factors following the pandemic will undoubtedly be unusual.

Nonetheless, it is certainly possible that its analysis is close to the mark, implying an overstatement of job growth in the establishment survey of more than 1.1 million in just the second quarter. That would bring the establishment and household surveys more in line.

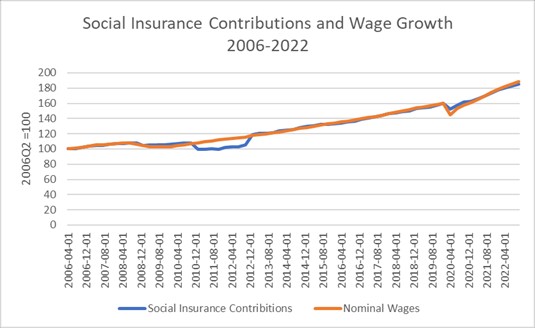

The other important data point suggesting the establishment survey may be overstating job growth is the gap in 2022 between the growth in nominal wages implied by the establishment survey (reported aggregate hours multiplied by the growth in average hourly earnings [AHE]), and the growth in social insurance contributions (mostly Social Security and Medicare). Ordinarily, these series follow each other closely as shown below.

Source: BEA, BLS, and author’s calculations.

In principle, the growth in social insurance contributions should follow the growth in nominal wages with the exception that changes in the share of earnings going to the self-employed will not be picked up in this wage measure. Also, insofar as a larger share of wage income goes above the cutoff for the Social Security tax, there would also be a gap with nominal wage growth exceeding the growth in social insurance contributions.

From the start of the AHE series in 2008 to the first quarter of 2022, nominal wages as calculated by this method increased by 78.7 percent. Social insurance contributions increased by 78.1 percent, a gap averaging 0.04 percentage points a year. The short-term gaps shown in the graph are easily explained by government suspensions or delays of a portion of the Social Security tax following the Great Recession and in the pandemic.

However, in the three quarters from the first quarter of 2022 to the fourth quarter of 2022 nominal wages increased by 5.5 percent. This compares to just a 4.0 percent increase in social insurance contributions. At an annualized rate, social insurance contributions grew 5.4 over the last three quarters of 2022, while nominal wages grew at a 7.4 percent rate.

Employment in the household survey grew 1.9 percent in the year from January 2022 to January 2023. Taking 75 percent of this annual growth for the three quarters between the first quarter and the fourth quarter puts the growth rate of employment at 1.5 percent. The average workweek length declined from 34.67 hours in the first quarter to 34.5 hours in the fourth quarter, a drop of 0.5 percent. This would imply growth in aggregate hours of roughly 1.0 percent based on the household survey’s employment numbers. Working from the 4.0 percent increase in social insurance contributions over this period, this would imply 3.0 percent growth in the nominal wage over the three quarters, or 4.0 percent at an annual rate. That might be a bit low, but not implausible.

Does the Growth Reported in the Household Survey Make Sense?

On its face, the 2.76 million jobs reported in the household survey would seem a reasonable figure for job growth, except for the comparison with the extraordinary growth shown in the establishment data. The unemployment rate had fallen to 4.0 percent by January of last year, and it was already down to 3.6 percent by March.

Job growth averaged just 2.2 million in the four years before the pandemic, a period in which the unemployment rate fell from 4.8 percent to 3.5 percent. It is unclear that we should have expected substantially more rapid job growth in a period where the unemployment rate was already quite low by historical standards, and not far above the pre-pandemic low.

In addition, we are now seeing the peak years for retirement of the baby boom cohorts. Also, immigration was sharply curtailed during the pandemic.

Putting these factors together, the employment growth shown in the household survey is entirely consistent with the drop in unemployment it shows. If the job growth in the establishment survey is anywhere close to being right, it would imply a much larger drop in unemployment and/or a surge in employment either from an unmeasured increase in labor force participation or a growth in the population that has not been picked up in the Census Bureau’s data for some reason. From this standpoint, the household survey numbers seem more plausible than the extraordinary job growth reported in the establishment data.

Why Would the Establishment Survey Suddenly Be So Wrong?

There is no obvious explanation for why the establishment survey would suddenly start hugely overstating job growth in 2022. The most obvious source of error would be its birth-death model for incorporating the impact of new firms and firms going out of business. When the economy went into a free fall in 2008, following the collapse of Lehman, it was easy to see that this model was overstating job growth. It was imputing a similar number of jobs to the same months in 2006 and 2007 when the economy was still growing at a healthy pace.

The birth-death imputations for 2022 don’t seem obviously out-of-line in the same way. That doesn’t mean that they may not still be overstating growth, but there is not an apparent error as was the case in the fall of 2008 and winter of 2009. (The benchmark revision for March 2009 was -902,000.)

One way to investigate the possible source of error would be to compare job growth by industry in the CES data for the second quarter of 2022 with the job growth reported in the QCEW. Looking at the restaurant sector, the CES reports a job gain of 588,000 between the first and second quarters of last year. The QCEW shows an increase 490,000 for the same period. (These data are not seasonally adjusted.) It would be possible to go through the data sector by sector to see if there is a pattern to the gaps in reported job growth. This can also be done with state-level data. Anyhow, if the CES proves to be substantially overstating job growth, we should know this when we have the preliminary benchmark revision this summer and have a better idea of possible causes.

The Meaning of Overstated Job Growth in the CES

If the household survey gives us a more accurate measure of job growth, it would radically alter our view of the state of the economy. While we may not have a good sense of what job growth was in a specific month, if we are on a pace that gives us 2.76 million jobs over the course of a year (230,000 a month), then the economy is not adding jobs at a pace that is necessarily unsustainable. The fears over inflation prompted by the January figure of 517,000 would be much more contained if the number were someone near 230,000.

This slower pace of job growth is also more consistent with the picture we have seen of slower wage growth. The rate of wage growth slowed sharply over the course of 2022. For the month of January, it was just 0.3 percent. That seems hard to reconcile with a labor market that added 4,970,000 jobs over the course of a year, when the unemployment rate had already fallen to 4.0 percent.

A slower pace of job growth would also radically alter the picture we now have of productivity growth over the course of 2022. Reported productivity growth was negative in the first half of 2022, the worst two-quarter performance in more than half a century. While we likely did see very poor productivity growth, due to both supply chain problems and rapid turnover in the labor force, if job growth was considerably slower than indicated in the CES, then productivity growth would be correspondingly better.

This is a big deal since it could mean that we are in fact on a path of more rapid productivity growth than we were seeing before the pandemic. That would both go far towards alleviating inflationary pressures and allowing more rapid gains in living standards.

Conclusion: The Household Survey Could Be Right

I would be reluctant to accept that the household survey gives us a better measure of job growth than the establishment survey. Over time, there is zero question that the establishment survey has a far better track record.

However, the job growth reported in the establishment survey in 2022 is so extraordinary that it really is necessary to question its accuracy. The employment growth shown in the household survey would still be quite impressive, especially in an economy that started the year at a historically low unemployment rate. We will know the answer to this question when we get the preliminary benchmark data in August, but for now, we should be open-minded to accepting the possibility that the household survey is closer to the mark.

1 These figures are actually for the sum of state job growth, which is slightly different from the national job growth shown in the establishment survey, primarily due to differences in the individual state and national seasonal adjustment factors. It is appropriate to compare the sum of the states in the establishment survey with the QCEW data, since the Philadelphia Fed was using state adjustment factors in its calculations.

For Run:

https://www.nytimes.com/2023/02/07/health/cystic-fibrosis-drug-trikafta.html

February 7, 2023

‘Miracle’ Cystic Fibrosis Drug Kept Out of Reach in Developing Countries

Vertex Pharmaceuticals is not making its drug, Trikafta, available in poorer countries, where thousands of diagnosed patients stand to benefit.

By Stephanie Nolen and Rebecca Robbins

ltr

Not sure where Dan is. I saw these (thank you). And was wondering why you put them here. Obviously, you wanted me to see them. Much appreciated. I will post them in a bit.

It also alerted me to put up an “Open Thread. ” Dan usually does this too. Much be vacationing. So, the Open Thread is up.

Bill

For Run:

https://www.nytimes.com/2023/02/07/health/medicine-insurance-payments.html

February 7, 2023

The Medicine Is a Miracle, but Only if You Can Afford It

A wave of new treatments have cured devastating diseases. When the costs are too much, even for the insured, patients hunt for other ways to pay.

By Gina Kolata and Francesca Paris