Core inflation using house permits

Core inflation using house prices rather than imputed rents

– by New Deal democrat

Later this morning existing home sales will be reported for October, which will mainly be of interest to me only for what happened with prices, and secondarily whether the problem of low inventory which has existed for 3 years is moving in the direction of resolution.

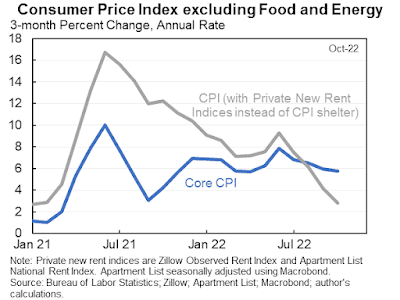

In the meantime, yesterday Jason Furman got some traction, and amplification by Paul Krugman, of the below graph which measures core inflation using new rent indices (e.g., Zillow) rather than owners’ equivalent rent:

The implication is – one embraced by Krugman – that inflation is already not a problem.

I don’t think this is really the case, because we are still using an imputation of hypothetical rents to measure house prices.

I already posted a graph of what core inflation ex-shelter would look like:

But let’s go one step further and measure what core inflation, *including* shelter looks like, using actual house prices as measured by the FHFA Index rather than owners equivalent rent, thus banishing the entire problem. Here it is:

Most importantly, as of August (the last month for which the house price index has been reported), YoY core inflation including house prices was 8.6%. At its peak 6 months earlier in February, it was 12.4%. If it were to continue to decline at that rate, in October core inflation using actual house prices would be 7.3% – declining fast, but still above the official 6.3% reading of core inflation using imputed rents. It would take until about next April for core inflation using house prices to get to the Fed’s comfort zone of 3% or less.

“October CPI reports total inflation increases at a 3.5% annual rate,” Angry Bear, angry bear blog

Please let them do this instead of the gobbledygook number they derive.

Some people rent, others are buying and paying off the mortgage, others own outright. Their cost of housing contains different items, but they should all be known. The imputed value number never made much sense, and we can do a lot better.

implication is – one embraced by Krugman – that inflation is already not a problem.

“

assuming that Krugman is correct you look for another reason for fed Governors to continue raising rates past that point where most people think they should stop. you then realize that fed governors return all their profits to the treasury of the United States Whenever there is profit from the buying and selling of T bonds and other treasury paper. Since they bought the treasury paper when rates were low if they sell-off this balance sheet now they will have a loss; but if they wait until rates are down they can make a profit that is returned to the government. so what do they do? they raise rates first to get mortgage rates and treasury rates down after which and only afterwards they sell off the balance sheet into a more advantageous Market thus return a profit to the US Treasury. This explains the overshoot that will put us temporarily into deflation. In fact, both M1 and M2 are already shrinking yet fed fed governors will continue with rate hikes for perhaps 4 months.