Education Dept. Changed the Rules for Student Loan Relief

The little weasel Miguel Cardona has a grin on his face. They have been screwing these people over for decades. Department of Education did not check the fine print for FFEL loans. And now that Mohela said they will lose money, they yank the carpet out from under 800.000 people. God forbid they screw over a Federal Loan Servicer. What is Mohela:

MOHELA has worked with student loans for several decades as a private lender. It has been a relatively small player as a federal loan servicer. But in December 2021, the Department of Education announced that MOHELA is taking over the PSLF and Teach Grant programs from FedLoan Servicing. Sep 1, 2022

Looks like Mohela got a sweetheart deal going on with the Department of Education.

~~~~~~~~

“In a reversal, the Education Dept. is excluding many from student loan relief” NPR, All Things Considered, Corey Turner

In a remarkable reversal affecting the fortunes of many student loan borrowers, the U.S. Department of Education has quietly changed its guidance around who qualifies for President Biden’s sweeping student debt relief plan.

At the center of the change are borrowers who took out federal student loans many years ago, both Perkins loans and Federal Family Education Loans. FFEL loans, issued and managed by private banks but guaranteed by the federal government, were once the mainstay of the federal student loan program until the FFEL program ended in 2010.

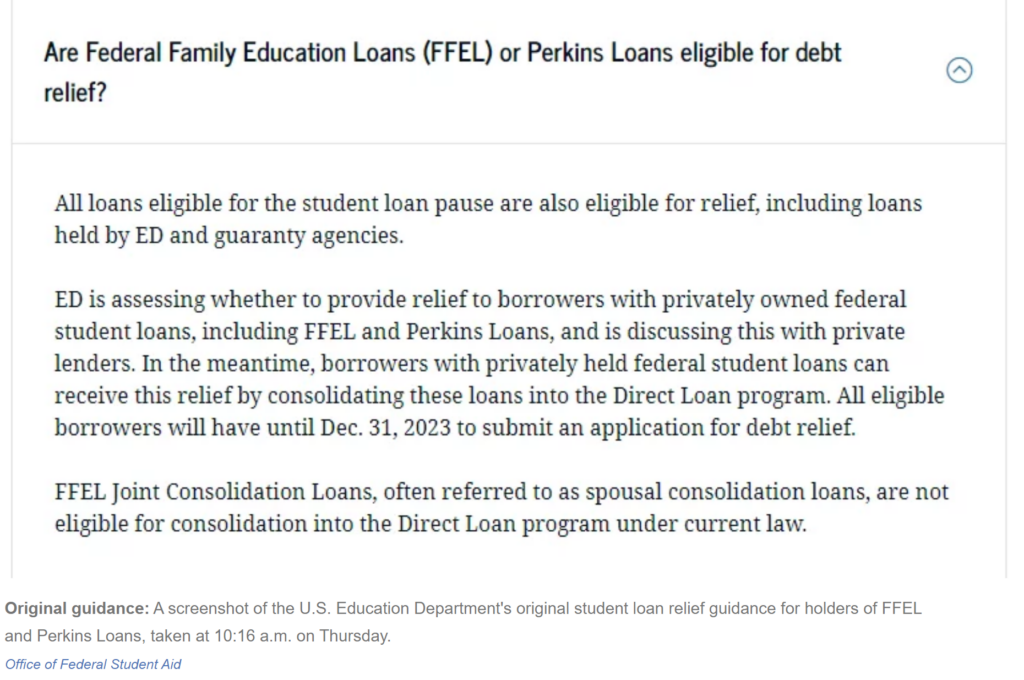

Today, according to federal data, more than 4 million borrowers still have commercially-held FFEL loans. Until Thursday, the department’s own website advised these borrowers they could consolidate these loans into federal Direct Loans and thereby qualify for relief under Biden’s debt cancellation program.

Before:

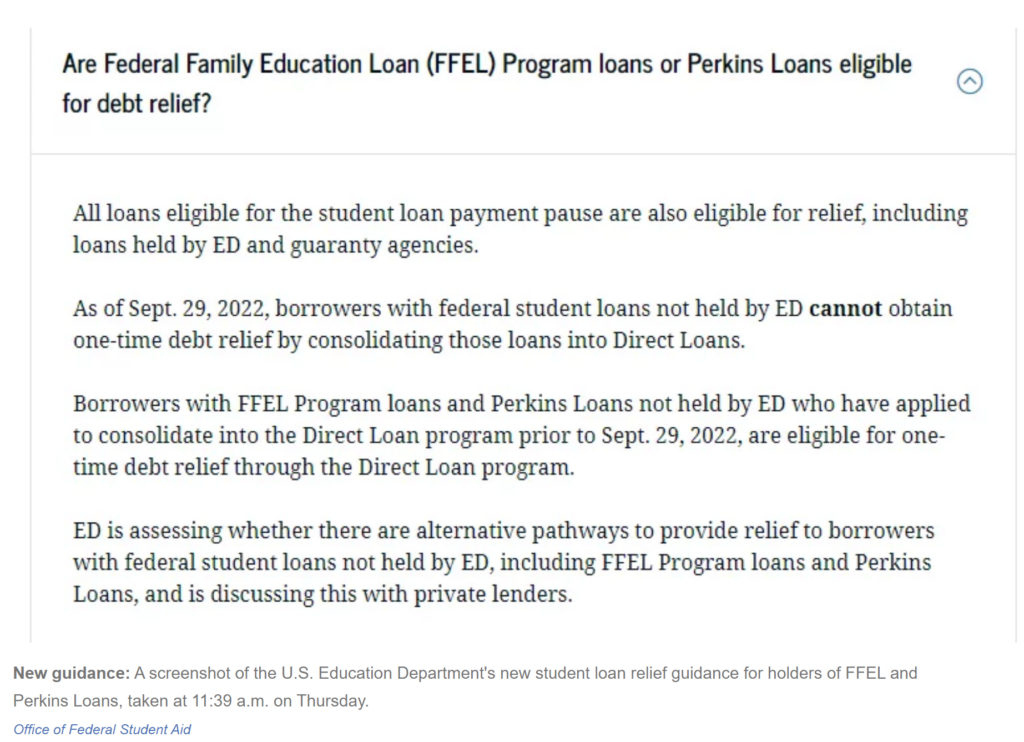

After:

An administration official tells NPR roughly 800,000 borrowers would now be excluded from relief. Though many more borrowers could end up getting less relief than they were entitled to under the old guidance. These are the roughly 1.5 million FFEL borrowers who also have Direct Loans, which still qualify for cancellation, though their FFEL loans no longer do.

It’s unclear why the department reversed its decision on allowing FFEL borrowers with commercially-held loans to consolidate and then qualify for debt relief.

In a statement to NPR, a department spokesperson says, “Our goal is to provide relief to as many eligible borrowers as quickly and easily as possible, and this will allow us to achieve that goal while we continue to explore additional legally-available options to provide relief to borrowers with privately owned FFEL loans and Perkins loans, including whether FFEL borrowers could receive one-time debt relief without needing to consolidate. Borrowers with privately held federal student loans who applied to consolidate their loans into Direct Loans before September 29, 2022 will obtain one-time debt relief. The FFEL program is now defunct and only a small percentage of borrowers have FFEL loans.”

The tell in that statement is “legally-available.”

Multiple legal experts tell NPR the reversal in policy was likely made out of concern that the private banks that manage old FFEL loans could potentially file lawsuits to stop the debt relief, arguing that Biden’s plan would cause them financial harm.

When FFEL borrowers consolidate their old loans into federal Direct Loans, these private banks essentially lose business. If these banks’ financial health depends, at least in part, on the assumption that they would be holding and profiting from these debts over the long-term, then losing borrowers to Biden’s debt relief plan could, possibly, constitute harm.

In fact, a new lawsuit filed Thursday by six state attorneys general, makes this very argument. One of the plaintiffs, Missouri, is home to MOHELA, which manages both federal Direct Loans and these old FFEL program loans.

“The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of an asset (the FFELP loans themselves) that it currently owns,” says the complaint.

“The consolidation of MOHELA’s FFELP loans harms the entity by depriving it of the ongoing interest payments that those loans generate.”

In response to the lawsuit, Persis Yu, of the Student Borrower Protection Center, says,

“FFEL lenders have shown their true colors. Instead of working in the interest of student loan borrowers – their customers – these lenders are holding hostage relief to millions of borrowers in order to keep making a buck off of borrowers suffering.”

Changing the policy now, and limiting the number of FFEL borrowers who can conceivably qualify for debt relief, may make these FFEL banks less likely to legally oppose debt relief.

*Checks grad school loan statement*

Damn it.

Michael:

They may find another way to do this. I cannot imagine the larger percentage of these loans are that secure. They are close to default or in default.