Positive real retail sales in August, but YoY flatness continues

Positive real retail sales in August, but YoY flatness continues

– by New Deal democrat

Retail sales, probably my favorite monthly economic datapoint, increased 0.3% in August. Since consumer prices rose 0.1%, real retail sales rose 0.2%:

That’s certainly good news. Now here’s the bad news: July’s retail sales were revised downward by -0.4%, so that real retail sales, reported last month as +0.1%, are now shown down by a little less than -0.4%.

Thus as shown above real retail sales are still -1.1% below their April peak.

Ex-autos, retail sales were down -0.3%, and unchanged ex-autos and ex-gas, reversing July’s initially reported gains – which in the case of autos were revised down sharply to -0.4%.

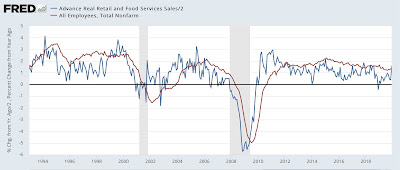

As I note almost every month, real retail sales (/2) are a good short leading indicator for employment. Here’s the long term view from 1993-2019:

While real retail sales were down YoY for several months, this month they are up 0.8% YoY, the second positive yearly comparison in a row. Here is the updated above comparison with payrolls since June 2021:

Retail sales continue to forecast a deceleration in monthly payroll gains. Here’s the monthly % change in payrolls for the past year:

Last autumn’s Booming payroll gains are a thing of the past. Payrolls gains averaging 0.2% (about 300,000) or less are what we should expect for the rest of this year.

https://www.federalreserve.gov/releases/g19/current/

July 2022

In July, consumer credit increased at a seasonally adjusted annual rate of 6.2 percent. Revolving credit increased at an annual rate of 11.6 percent, while nonrevolving credit increased at an annual rate of 4.4 percent.

Consumer Credit Outstanding 1

Seasonally adjusted. Billions of dollars except as noted.

{ table of annual metrics back to 2017 then quarterly for 2021 and 1H2022 and then monthly for 2Q2022 }

IMO, household debt is the bullet to watch.

the nonrevolving credit is mostly for cars and student loans, Ron, and it’s following the same trend as it’s been on over the past half dozen years…

however, the revolving credit is like Visa and Mastercard, and recent the annual rates of increase are noteworthy: +12.7% in the 4th quarter of 2021, 17.0% in the first quarter of this year, 14.6% in the second quarter, and +11.6% in July….those increases mean that consumers, instead of tightening their belts when prices rise, continue to buy what they otherwise would have without the price increases….if inflation persists, that behavior is unsustainable..

just to clarify this little bit:

July’s seasonally adjusted sales were revised down from the $682.8 billion reported last month to $681.3 billion, while June sales were revised 0.2% higher, from $682.6 billion to $684.1 billion, and hence the June to July decrease was revised from virtually unchanged (±0.5 percent) to down 0.4 percent (±0.2 percent) with this release..

the revision to June’s sales means that 2nd quarter sales were roughly $6.0 billion higher at an annual rate than was previously reported, which should be enough to add 0.10 percentage points to 2nd quarter GDP growth when the 3rd estimate is published at the end of the month…