Does The IRA Lower YOUR Health Insurance Premiums?

Let’s answer the question. I am going to break this up into several segments as it takes into consideration multiples of people, income, etc. I think it will be easier to absorb. A well-known expert in MIchigan has put together the answers. This is Part 1 – Single Individuals

“How much does the #IRA lower YOUR health insurance premiums? A case study in Virginia” | ACA Signups. Charles Gaba, 08/24/2022

Some History

Back in 2019, long before the American Rescue Plan passed, I (Charles) embarked on an ambitious project. I wanted to see what the real-world effects would be of passing a piece of legislation which would eliminate the Affordable Care Act’s so-called “Subsidy Cliff” while also strengthening the subsidy formula for those who qualified. Call it “ACA 2.0” for short, if you will (that’s what I do, anyway).

This legislation has been around in near-identical form under one official title or another for years, usually bundled within a larger healthcare package. In 2018 it was called the “Undo Sabotage & Expand Affordability of Health Insurance Act of 2018” (or “USEAHIA” which is about as awkward a title as I can imagine.

In 2019 it was rebranded as the “Protecting Pre-Existing Conditions and Making Healthcare More Affordable Act” or “PPECMHMAA,” which somehow managed to be even more awkward.

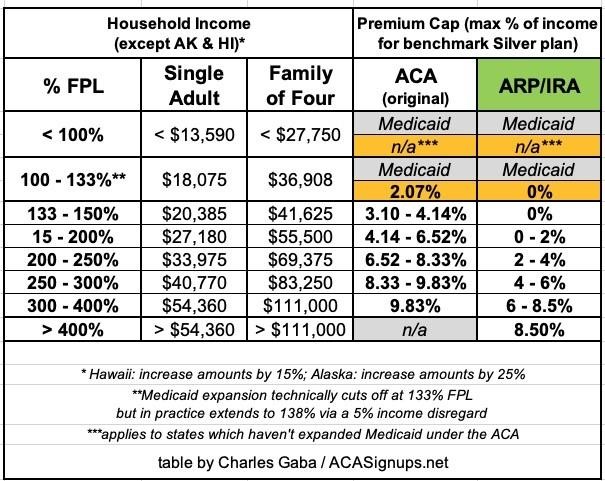

Clicking on the image will enlarge it

While the improved subsidies still aren’t permenent, this should at least set at ease the minds of 13 million Americans enrolled in ACA exchange policies for the next three years.

Now that the ink has finally dried on the IRA, I decided to go back to my original project to see how much some representative households will save in health insurance premiums in 2023 thanks to the extended financial assistance.

Insurance policy carriers, premiums, networks and so forth vary widely from state to state and even county to county. In this case study, I’m using Spotsylvania County, Virginia.

Similar to how I did a few years back, I’m using six different households at different income levels:

- Single adults aged 26, 50 or 64 *

- A single 30-year old parent with one young child

- A “nuclear family” (40-year old couple w/2 children age 12 & 10)

- A 60-year old couple

All of the calculations in the examples below are based on 2022 data. The Federal Poverty Level (FPL) for the various households increases slightly every year, and the unsubsidized premium price of the benchmark Silver policy tends to change from year to year…sometimes higher, sometimes lower. In Virginia specifically, unsubsidized premiums are expected to be around 13% lower overall next year, though this doesn’t necessarily mean that the benchmark Silver price for Spotsylvania will be.

Some Examples

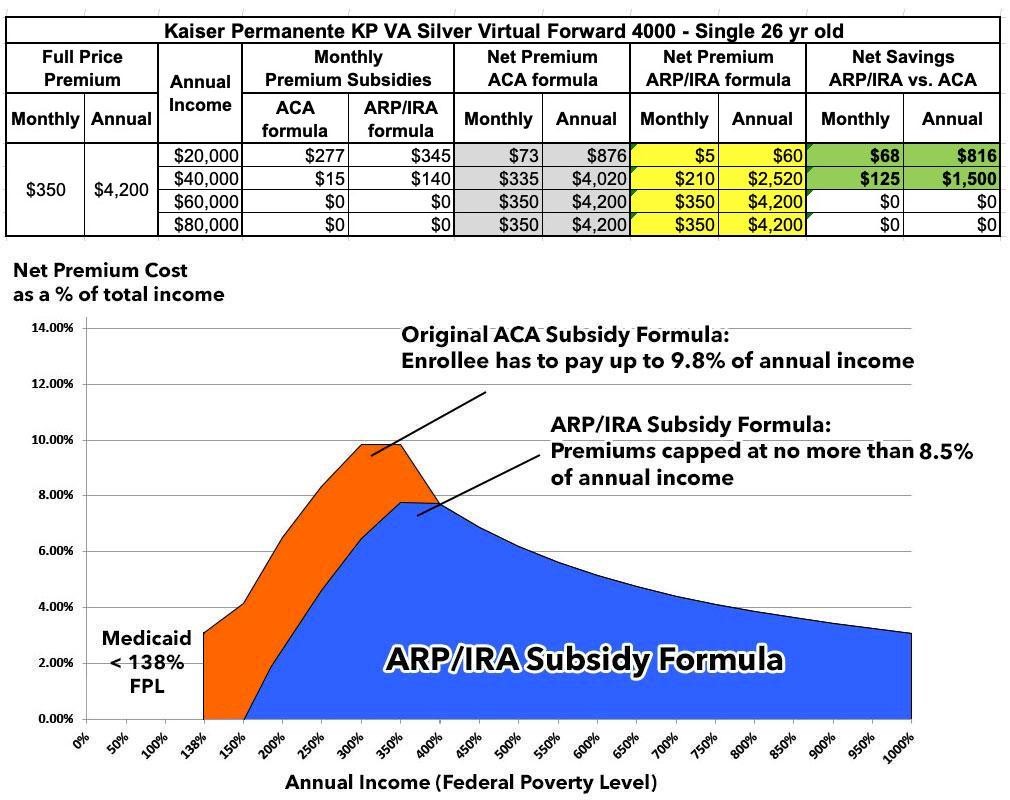

With all of that said, let’s take a look at the six households. The benchmark Silver plan in all cases in 2022 is the Kaiser Permanente KP VA Silver Virtual Forward 4000, which has a $4,000 deductible and an $8,550 maximum on out-of-pocket (MOOP) expenses for in-network care.

single 26-yr old adult

For a single 26-yr old adult, the full-price premium is $350/month or $4,200/year.

Under the original ACA subsidy formula and if they earn $20,000/year, they have to pay $73/month. Under the Inflation Reduction Act, they pay just $5/month in premiums after the enhanced subsidies are applied.

Additionally and thanks to the ACA’s Cost Sharing Reduction provision, the $4,000 deductible is chopped down to just $750, and their MOOP is reduced to just $2,500/year.

If they earn $40,000/year, their premiums were $335/month under the original formula and just $220/month under the IRA. The IRA saves them an extra $115/month or nearly $1,400 per year!

Once you get over around $55,000/year, there is no subsidy difference, however, since the full price premium never hits more than 8.5% of their income at that income level anyway.

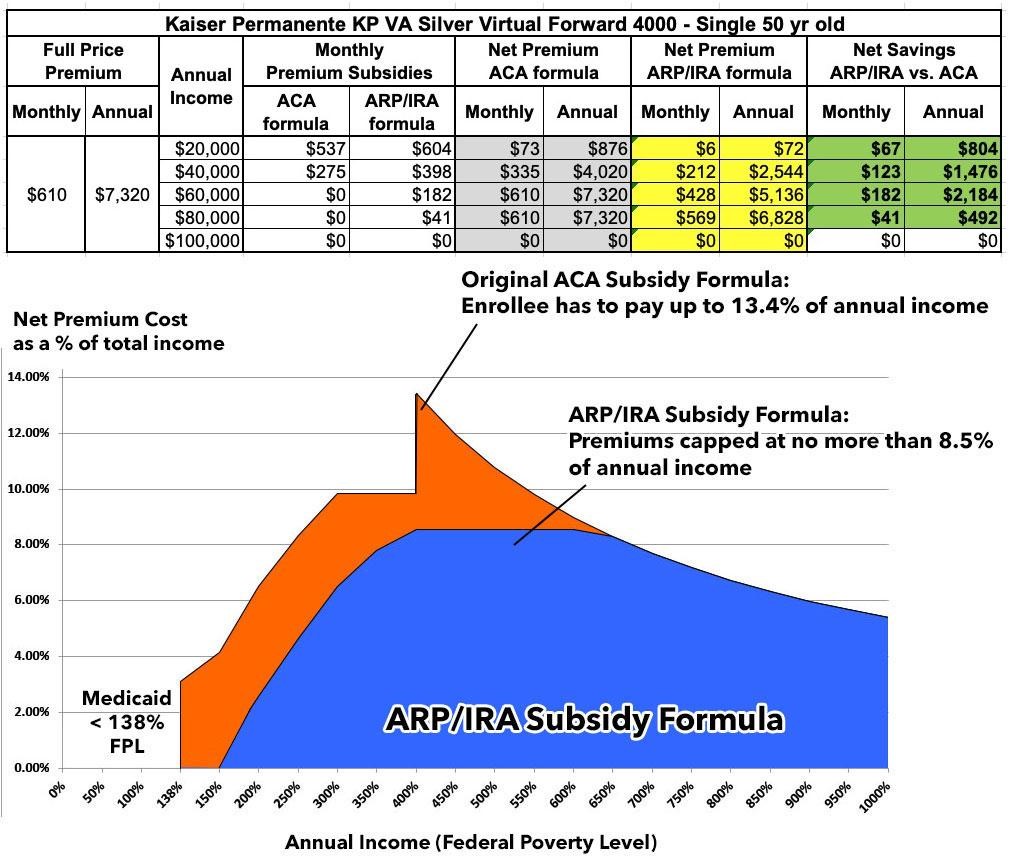

50-year old single enrollee

What about a 50-year old single enrollee? Their full-price premium is $610/month or $7,320/year.

At the $20,000 and $40,000 income levels, the situation is the same as for the 26-yr old: They’d still save either $67/month ($804/year) or $123/month ($1,476/year) under the Inflation Reduction Act versus the original ACA subsidy calculation.

However, things are different at the $60,000 and $80,000 level: The full-price premium is considerably higher for a 50-yr old vs. a 26-yr old. The enhanced subsidies of the IRA makes a dramatic difference when you move over the 400% FPL threshold . . . the dreaded “Subsidy Cliff.” The original ACA formula cut subsidies off entirely for households which earned more than 4x the poverty level.

At $60,000/year, the 50-yr old enrollee goes from paying the full $610/month to just $425/month . . . saving them nearly $2,200/year. At $80,000, they receive $41/month in subsidies, still saving them nearly $500.

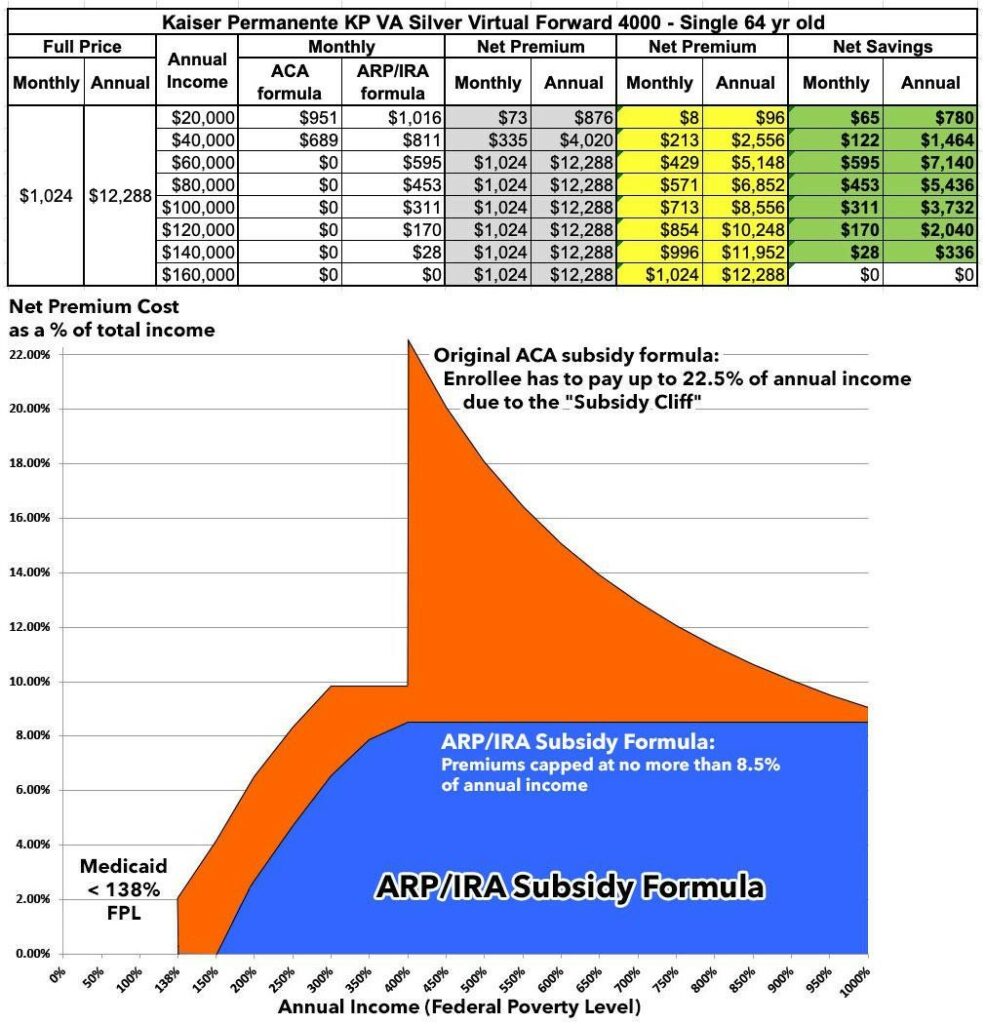

64-year old single enrollee

What about a single 64-year old, though? They do not qualify for Medicare. They still need solid healthcare coverage.

At full price they’d have to pay over $1,000/month or over $12,000/year. The good news is that the original ACA subsidy formula ensured that healthcare premiums would at least be within reason for single adults earning up to around $54,000/year. The bad news, prior to the 2021, if you earned even one dollar more than the cut-off amount, you would lose all financial help and had to pay full price…which still amounted to over 22% of this enrollee’s income at ~$55,000/year. The “subsidy cliff” turned into a chasm for those in their early 60’s.

Thanks to the American Rescue Plan and the Inflation Reduction Act, the Cliff is gone. Instead, premiums are capped at no more than 8.5% of income . . . saving them as much as $600/month or nearly $7,200/year in premium payments! This gradually tapers off as their income goes up, disappearing at around 11x the poverty level.

How much does the #IRA lower YOUR health insurance premiums? A case study in Virginia. | ACA Signups, Charles Gaba, 8/24/2022

“By Congressional District: How much more will #ACA enrollees pay in 2023 if #AmRescuePlan subsidies AREN’T made permanent?” | ACA Signups, Charles Gaba, June 2022