Inflation, Should the Fed continue to raise rates – and whether it is “behind the curve”

A note on inflation and whether the Fed should continue to raise rates – and whether it is “behind the curve”

No important economic releases today (july 18), and almost no reporting by States as to COVID counts over the weekend, so let’s back up and take a look at something that’s been simmering on my intellectual back stove, so to speak: should the Fed be raising rates to combat this inflation? Has inflation already peaked? Or is the Fed way behind the curve and needs to raise rates a lot more?

Menzie Chinn has a guest post up, indicating that if the Fed had been following their own rules, they would have started raising rates during 2021. At the end of the day, I agree. Here’s why.

To begin with, I agree that if the sole sources of inflation are supply-based (the same amount of money chasing a shortfall in products), there’s no real point in raising rates. You can raise rates to 10% or 100%, but if there’s a supply bottleneck, it’s not going to solve your problem; it’s just going to create lots of unemployment. In other words, for supply bottlenecks, the best strategy is to leave high inflation alone, and don’t try to bring down employment.

But if inflation is demand-based (more money chasing the same amount of goods as before), then raising rates to tamp down on demand makes sense.

Which one – or how much of each – do we have?

One good part of the answer is that inflation is a global phenomenon, it’s not just limited to the US, as this chart helpfully put up by Kevin Drum shows:

If the source of inflation were US domestic stimulus, we wouldn’t see that type of global chart.

That suggests that, at least globally, the primary source of inflation is supply-based bottlenecks.

In the US, there have been 3 major sectors of inflation: energy (oil and gas), vehicles, and housing. Let’s look at them in order.

In the case of the price of gas, that did get tight by late last year, rising to $4/gallon over autumn and winter. But the real spike took place at the end of February when Russia invaded Ukraine, and sanctions were imposed:

This is a supply shortfall, caused by a geopolitical event. Per my note above, the Fed shouldn’t be raising rates because of gas prices.

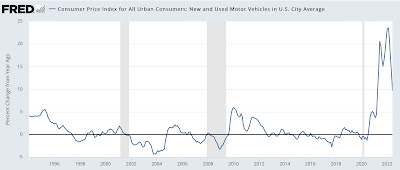

Next is motor vehicles:

These spiked due to a computer chip shortfall sourced to Chinese and Taiwanese factories, in large part due to those governments’ “zero COVID” or strict lockdown policies. Again, this is a supply shortfall, and raising rates is not going to cause either jurisdiction to make more computer chips (If I were Biden, I would have invoked the Defense Production Act long ago to substitute US-made chips during the COVID emergency, but that’s another issue)

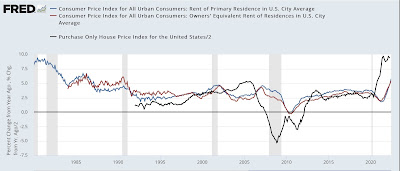

Finally, here is housing:

Housing appears to have strong elements of both supply *and* demand at issue. On the supply side, existing homeowners more or less stopped putting their houses up for sale even before COVID hit, and definitely during the teeth of the pandemic:

Only now is increasing inventory coming on the market.

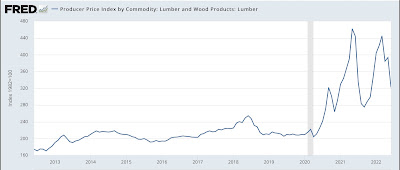

Further on the supply side, the price of lumber in particular skyrocketed:

This caused a huge backlog of houses under construction that were not completed:

But on the other hand, it’s also clear that extremely low-interest rates, with record low monthly mortgage payments in “real” terms, spike a surge in demand:

As night follows day, the record surge in house prices in 2021 and so far in 2022 has spilled over into rent increases and thereby in “owners’ equivalent rent,” the official CPI measure of housing inflation (we’ll come back to the black line, real GDP, later):

Housing is 33% of the entire CPI and over 40% of the core CPI.

So, is the main driver a shortfall in housing supply, or a surge in housing demand?

To look at that, I compared the growth in the total US population since the turn of the Millennium with the total amount of housing stock available in the US, which is helpfully estimated by the Census Bureau:

And the answer is, that the available amount of housing stock has indeed kept up with population growth (by the way, this would be true even if I had measured from the worst possible comparison point just before the Great Recession). While there are certainly particular areas where that has not been true, and prices have been nuts for a long time (California!), the simple fact is that averaged over the country, that is not the case.

In other words, housing inflation is primarily a demand, not a supply, issue, and since it is the single biggest slice of the CPI, that should have started to be addressed by the Fed once real GDP caught back up to its pre-pandemic levels, which according to the black line in the graph above was Q2 of 2021.

Had the Fed started raising rates then, it would have been attacking a CPI level of about 4%, and would have had a much better chance of obtaining a “soft landing” than it has now. In fact, the only way I see the US avoiding recession at this point is if gas prices move all the way back down to the $4/gallon level, very soon, and stay there or below.

https://www.bu.edu/econ/files/2011/01/GKcr2005.pdf

The incredible Volcker disinflation$

Marvin Goodfriend a , Robert G. King b,

aResearch Department, Federal Reserve Bank of Richmond, Richmond, VA 23261, USA

bDepartment of Economics, Boston University, Boston, MA 02215, USA

Available online 29 August 2005

The link above is to a venerable research paper on the war on inflation battled a long time ago in a presidential administration far, far away by the then Volcker Fed. The sheer size of the paper speaks to the uncertainty of Fed policy effectiveness managing inflation with little but dubious credibility and expectations formed beyond the means of policy to address. The short of it is that actual borrowing interest rates are set by bond markets for both Treasury and private lending rather than the FOMC. So, one must ask whether the Fed pulling on a string is any more effective than the Fed pushing on a string when inflation expectations are well anchored by supply shocks as they are now? Of course, the Fed can eventually prevail using extreme measures to yank on the money supply and inter-bank overnight lending rate anchor chain until the US economy bleeds out, but that seems like an extreme measure and likely will do nothing to redirect investment into the weak points of the supply chain.

If I recall correctly, then run has raised this question a few times before now albeit without the onerous reference source that I link to above.

onerous – the research paper linked above is over 1,000 pages long. It is just a little light reading for anyone that believes they fully grok Fed policy with respect to controlling inflation. In the best of times then Fed policy follows expected inflation rather than leads inflation. In other times, then stuff happens, mostly not good stuff. The inflation problems of the 70’s were initiated by supply shocks, primarily the OPEC oil embargo (’73-’74), rising trade deficits, and technology shocks reducing unskilled labor demand. Since the problem was not monetary in nature, then the Fed was powerless to control it until nearly a decade later when the Volcker shock countered the spiral in 1982. By that time, then the structural economic problems had been resolved and it was only the inflationary spiral that remained, which was a thing within the monetary domain to be handled by the Fed.

Note: I did not read the paper that I linked to above. My guess is that any thousand page research paper on the Volcker recession is neither succinct nor cogent. Piles of BS come in various and vastly different sizes. It is noteworthy because of the sheer size of its pile.

“…technology shocks reducing unskilled labor demand…”

[The reduced unskilled labor demand provided much of the stag, while the rising wages of tech workers provided ongoing wage-flation.]

Ron

New Deal Democrat

I would like to assume that the Fed and other people in power are as smart as you and know this, so why are they raising interest rates?

food prices have gone up considerably… I don’t see where you explain that. (because of gas prices driving costs of food production?)

Nor do I see why house prices are going up…other than rents are going up because of predatory monopolies in rental housing. there may be other causes i don’t know about. (house prices went up before lumber prices, if i remember.)

Of course it could take a thousand pages to explain all this.

Coberly,

With inflation high and persisting, then the FOMC felt pressure to do something and raising the Fed Funds rates was the only arrow in their inflation quiver. The Fed Funds rate is still only at 1.5-1.75%, not near zero historic lows, but quite low historically. Since 2001, the Fed Funds rates has frequently been lower, but this is the new normal of economic shocks and low inflation, except now its not low any more. Prime rate, the only commercial lending rate indexed directly from the Fed Funds rate, runs 3% above the Fed Funds rate. Some variable rate HELOC and credit cards are indexed off of the Prime rate. So, Fed rate hikes are not nothing, but they do not control fixed mortgage rates or corporate lending either. However, inflation expectations do effect bond buyers and they expect the Fed to do the Fed’s something that brings inflation down even if it means crashing the US economy. So, the Fed Funds rate increases so far are signaling that the Fed is willing to crash the US economy to stop inflation.

We have lots of problems in the food supply chain now. Rising oil price is a big part of it, Covid-19 is not entirely out of the picture yet, heat and drought matter. Michael Smith has written on this extensively here at AB.

Real estate prices usually rise when mortgage interest rates fall, but when mortgage interest rates fall real estate prices are sticky enough that the correction is limited. Mortgage interest rates are now much higher than early 2020, but about the same as in early 2004. The boom in early 2020 took a while to lift off due to pandemic drag. Mortgage interest rates will need to clime a lot more to get sellers to sell for less than what they paid. Thanks to Internet lending then mortgage shoppers with good credit can still get cheap loans for homes and banks are at just over 5% for 15 year fixed, same as I paid in April 2004. Back in the city higher real estate prices and especially rents are being fueled by transportation costs, roughly what we wanted to do with a carbon tax. People are wanting to live closer to where they work.

When we account for state-level variations, the estimated housing deficit is even greater in some states because housing is a fixed asset. A surplus of housing in one area can do little to help faraway places. For example, vacant homes in Ohio make little difference to the housing markets in Texas. We estimate that there are currently 29 states that have a housing deficit, and when we consider only these states, the housing shortage grows from 2.5 million units to 3.3 million units.

https://www.freddiemac.com/research/insight/20200227-the-housing-supply-shortage

Ron

Thanks for this. It’s complicated enough that I don’t think I am likely to ever really understand it…takes eperience to acquire that much knowledge. But if I am getting the ist of things. it’s “expectations” that matter. So one woners why the Fed and the pliticians and the press are feeding the expectations of inflation along with the Fed’s “one arrow” interest rate hikes.

for what it’s worth i have “paid” 10% interest on a house loan…except that I paid the loan off in three years instead of 30, somewhat reducing the “interest cost.” I do no know if this was the optimum strategy for playing the game, but it made me feel better. I guess I could have been hurt if I had lost my income during those three years and could not meet the regular payments…which is where I think the real expectation anxiety lies, I had no problems, but I have watched people at the mercy of banks lose… or almost lose if not for my intervention…their homes because of what looks to me like bank fraud…written into their contracts…”no promises by the bank are binding unless they are in writing.”

You would think due dilligence would have saved them. But it’s hard for an ordinary person to anticipate what the fine print will turn out to mean. [it may not be only the banks, except to the extent that banks write the laws. which tells me at least, that we are not dealing with the “natural laws of economics” here, but the Law of the Jungle, where the predators have seats at the foot of god’s throne and the meek get what’s coming to them.]

Meanwhile, I wonder if interest rate hikes are not just to help bond holders wait out inflation until economic conditions return to “expectations” of profits to be made. you might think that that raising rates would injure those conditions, but — i am thinking — the conditions of unprofitable markets come first and while interest rates may prolong those conditions, on the whole the rate hikes are better for the class of people who have excess money. anyway, itis just a thought.

Coberly,

Expectations of future inflation plays a bigger hand in actual monetary inflation; i.e., too much money chasing too few goods under normal or consistent market circumstances. Supply shocks are not that. Supply shocks are too few goods, but not normal. Recent wage increases are not too much money since they came at the expense of lower employment participation rate.

Yet it is only natural to expect the Fed to fix inflation just as much as it is natural to believe the Fed has powers which it does not actually have. When the Fed buys US debt in Treasury bonds (quantitative easing), then it is bolstering the price of bonds, which is to say lowering interest rates that depend upon bond markets. That was Bernanke and this is now.

The Fed does need to prepare the way for shock therapy tightening bank lending, so that banks will slow the economy. That may be slow going if banks are still flush with cash, but I cannot say whether that is the case. In retirement, I still understand institutions and economic theory, but as a pensioner with defined benefits have more interest in farmers’ markets than financial markets.

In any case, climate change and the war in Ukraine have more influence now on inflation than the Fed. Note, that inflation is global. How did the Fed do that? How can the Fed undo that? If the Fed tanks the US economy before the supply chain issues are resolved, then the economy would not be able to bounce back in the manner which it did after the Volcher shock in 1982. If we give the inflation hawks what they want without fixing the underlying supply chain issues, then we might in up in a deflationary spiral, a not so great depression.

Please note that I have found a roughly equal split between I-sources that state the Fed’s inter-bank lending discount rate is set by the Board of Governors vs. those that state the rate is set by the FOMC. Not having the time to refer to primary federal rules docs, then I might add that the confusion is likely because of the large overlap in constituents along with the split in voting versus non-voting members. It has been over a decade since I have been fresh on the technical details, but the big picture has never faded.

Ron

well, the Volker fix took too long to be called a fix. And the Reagan Recession was real enough…that i am not sure it ever ended for people like me. I thought at the time..and i was not “political” at all then…that the Reagan Recession was engineered to end the hippie menace…and create the Yuppie carrot. And, reading a famous Economist’s textbook at about that time that blamed inflation on workers demading wages higher than they were worth…made me skeptical of “economists.”

in the present-is circumstances, blaming inflation on the biden bailout of workers struk me as unlikely because the “extra” money was just replacing the “lost” money due to Covid shutdowns. the Covid recession itself was not serious enough to have much effect on Social Security finances, so I suspect the worker-bailout did exactly what it needed to do, though I would have financed it from an emergency “unemployment” tax..so those still working would help pay for those not still working, on the theory that it was insurance for the still working in case they lost their jobs. But that does not seem to be the way people think.

Don’t worry about the loss of technical details. I still need to look up SS details, though the big picture has not changed in 30 years that I know of. (that is, the thirty years i have been paying attention, not that there might have been changes that i do not know of.)

Climate change, the war including Putin’s piracy, supply chain issues including price gouging all have and will have upward pressure on prices..bu this is not “inflation”, it is just less goods chasing the same number of dollars, not more dollars chasing the same amount of goods. There is a real difference. And as always, it appears, where there are “more dollars” it is because someone else has less dollars. this can drive up prices because the haves outbid the have nots..but again, that is not inflation. or not “workers demanding higher wages that they are worth.”

Though by now there is certainly an “expectation” that prices are going to go up.