Income and Spending Decline, Savings Rate Increases

Real personal income and spending decline in May, while the saving rate increases (not good!)

In May nominal personal income rose 0.5%, and spending rose 0.2%. But since the personal consumption deflator, i.e., the relevant measure of inflation, rose 0.6%, real income fell -0.1%, and real personal spending fell -0.4%.

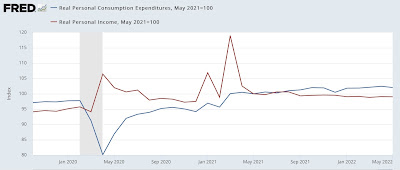

While both real income and spending are well above their pre-pandemic levels, I have stopped comparing them with that, but instead with their level after last winter’s round of stimulus. Accordingly, the below graph is normed to 100 as of May 2021:

Since then, real spending is up 2.1%, while real income has actually declined by -1.0%.

Comparing real personal consumption expenditures with real retail sales for May (essentially, both sides of the consumption coin) shows the decreases in both:

Finally, the personal saving rate turned slightly higher, up 0.2% to 5.4%:

This is not necessarily good news! Usually the savings rate has tended to decrease as expansions grow longer, leaving consumers more vulnerable to shocks (e.g., gas prices).

The personal saving rate this year has been the lowest of any period in the past 60 years except the two months after 9/11, and the 2004-2008 period when home equity refinancing from the last housing bubble was all the rage. That means households have been making up shortfalls by digging into savings or tapping another source of credit. Households reversing that, and feeling the need to increase their saving is a signal that a recession is beginning.

Given the poor retail sales report earlier this month, I was expecting a negative in the personal spending report. And the fact that April and May averaged together are still positive is encouraging. But this report is yet another in the drip, drip, drip of a deteriorating economy.