With the Fed already having begun to “stomp on the brakes,” inflation is still running very hot

With the Fed already having begun to “stomp on the brakes,” inflation is still running very hot

As promised, here is my second post on the April CPI number.

The YoY advance in consumer prices, +8.3%, is down from last month’s 8.6%, which was the highest 12 month rate since 1981. As I suggested last month, “the spike in gas prices may be – to use a recently dreaded word – transitory,” since gas prices had declined 5% month over month at the time of last month’s report. In the April report, energy prices declined -2.7%, and since they are 8% of the total weighted, that was certainly helpful. So far this month they have been more or less steady.

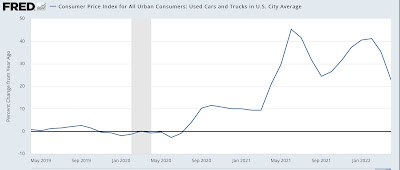

There was also good news in that the price of used cars and trucks fell -0.4% in April, after declining -3.8% in March. They constitute another 4% of the weighting of the CPI. As a result, the price of used vehicles was “only” up 22.7% YoY, vs. 41.2% YoY in February (which was the highest YoY increase in 70 years):

As I noted last month, used vehicle prices are down because they have become unaffordable for enough people that sales of such vehicles have also turned down.

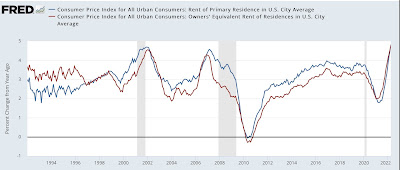

Now let’s focus on the housing component of CPI, which constitutes 32% of the total input. There, both rent, and the much larger CPI component of owner’s equivalent rent, which is how house prices are figured into inflation, rose 0.6% and 0.5% respectively, for the month, and are up 4.8% YoY, respectively. This is the highest YoY rate of housing inflation for either measure in over 30 years:

I continue to expect the housing component of inflation to worsen considerably. That’s because, as I first pointed out half a year ago, the major house price indexes – the FHFA index and the Case Shiller index – lead owners equivalent rent by roughly 12 to 24 months, particularly in major moves.

The below graph shows the YoY% change in both house price indexes in shades of blue, compared with the YoY% changes in the CPI measures of rent of primary residence, and owners’ equivalent rent in shades of red:

There have been 3 major pulses of house price increases in the last 25 years: in 1997-98, 2004-06, and 2020-present. In each case, after roughly a 12-24 month lag, both CPI rent measures surged as well. That’s because big surges in house prices make renting more attractive (or necessary for those on more limited budgets); this drives more demand for apartments, which drives rent increases. Further, the current rise in house prices of nearly 20% YoY, is significantly worse than either of the previous two – and has been up almost 20% YoY for the last 8 months running. With CPI housing inflation already at a 20 year high, we can further record CPI housing increases as this year progresses.

As I have also pointed out before owners equivalent rent is fully passed through into CPI, total inflation has normally cooled, as shown in the graph below:

That is because, faced with surging inflation, the Fed has embarked on a series of rate hikes (shown in black above) that culminated before owners’ equivalent rent peaked. The economy buckled, recessions started, and total inflation subsided as a result before owners’ equivalent rent had fully peaked.

Unfortunately, even after the record surge in house prices was in full swing over a year ago, the Fed stayed on the sidelines. Now, as both rents and owners’ equivalent rents surge as well, and the Fed has so far only increased rates by 0.75%. Last month I wrote that “now the Fed is almost certainly going to stomp on the brakes, with a hard landing to follow;” and I would say that last week’s 1/2 point increase, the first in 28 years, was just the beginning of that stomping.

Let me conclude this month’s installment by exactly restating my closing paragraph from last month’s installment because it certainly is the object lesson for the Fed:

“It’s too late for this cycle. But with three examples of surging house prices feeding through with a delay into the CPI in the past 25 years, in the future the Fed simply *must* pay attention to house prices as reflected in those indexes. Better a small tamping down of the economy early than a major sudden stop later.”

New Deal

you probably have better intuition about how the economy works than I do. But from the worm’s eye view, I remember Volker stomping on the brakes for two years before the brakes burned out and the truck rolled into a ditch and turned inflation into the Reagan recession, from which we all emerged better off than we were four years ago.

meanwhile this from your post stands out:

“used vehicle prices are down because they have become unaffordable for enough people that sales of such vehicles have also turned down.”

exactly. prices go up, people don’t really need a new used car right away, so they stop buying them. this should (i argue from Econ 101) lead to prices going down, and this should apply generally. Except in the case of food, perhaps, which people have to keep buying even when prices go up. But then they would stop buying other things, causing prices to go down. Why doesn’t it work this way? And what are the MMT people saying..they who would control inflation by taxing the rich?

And you do not note that housing prices are going up because the corporations are heavily investing in real estate and predatory landlordism.

Why is the only way to control inflation to cause a recession so the poor don’t even have inflated money to spend on what they need?

There is some evidence and even some opinion in Congress that this inflation is being caused by price gouging by industries in a position to get away with it. I don’t see price rises being driven by greedy worker demanding more than they are worth (the Paul Samuelson theory). It might be being fueled by high wage workers being willing to pay more because they can afford it, even while screaming about inflation because, after all, with lower prices they could buy so much more of what they have to have to maintain their lifestyle. And it might now being fueled by the war in Ukraine. But I (also) do not see it being controlled by discouraging investement by raising interest rates…although… when everybody was “investing” in derivatives because there was nothing real to invest in…the money being absorbed by the stock market might have helped control inflation by being sucked into an economically unproductive vortex of mindless speculation.

not sure used car prices have gone down (still hearing about 10 year old used vehicles selling for more than the MSRP when they were new). and stocks of new vehicles are about 1/4 of what is normal for them. some vehicles have less than 10 days of supply on hand. so i am not sure that raising rates will do much. and then there it seems to be that inflation isnt just a US problem, its pretty close to being world wide, with a few exceptions here and there. and as i as be able to determine demand isnt that much higher than it was 2019. and of course when the pandemic hit, demand and supply both crashed along with transport sector for goods. none of these will raising interest rates help resolve the underlying problem in a shape of form