Will tomorrow’s real retail sales report forecast a recession, or just a continued slowdown?

Will tomorrow’s real retail sales report forecast a recession, or just a continued slowdown?

No economic data today (May 16) of significance; but tomorrow one of my favorite economic indicators, retail sales, will be reported for April. Since real retail sales lead employment and generally are a short leading indicator for the economy as a whole, I wanted to update on what I see as their importance right now.

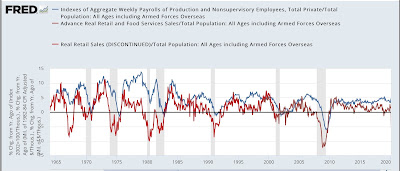

Here are real retail sales per capita (red) vs. real aggregate payrolls per capita (blue), both normed to 100 as of last May (note: I chose May because of the stimulus fueled spending spree in March and April that abated by then):

As you can see, payrolls have continued to grow by about 10% since then, while real retail sales per capita have for all intents and purposes been flat for the 10 months since, up only 0.3% as of March.

Why is this important? Here is a look at the same two metrics going back 60 years measured YoY:

Two important relationships ought to jump out. First, while the relationship is noisy on a monthly basis, over the longer term real retail sales lead payrolls, usually on the order of about 6 months. Second, real retail sales being negative YoY for any sustained period of time is an excellent harbinger of recession. Not only have they turned negative YoY in advance of every recession in the past 50+ years, but on the few occasions where a recession did not follow a negative number that was sustained for more than a month or two – 1966, 1987, 1994, 2002 – there was a marked economic slowdown that was not far off from recession.

Now let’s take a look at the same numbers for the past 3 years:

Note that payrolls were up 20% YoY in April 2021, and real retail sales jumped 50%! Since the biggest previous advance was about 12% YoY, had I included this data in the long term chart above, everything else would have been squiggles.

Note also that real retail sales per capita were negative YoY in March. They will presumably remain negative in April because they are being compared with the stimulus spending spree last April. For purposes of a pre-recession marker, the real marker is whether they will be down compared with last May, after the spending spree. Since consumer prices increased 0.3% in April, retail sales must increase 0.3% just to keep pace. A decline of -0.4% or more would make them negative compared with last May.

Because my suite of long leading indicators has not indicated a recession this year, I am expecting real retail sales to escape such a negative reading. But not necessarily by much. At the moment, they are forecasting a marked slowdown in the economy continuing this year. We’ll get the update tomorrow.

the retail report was out today…copying the notice i got this morning:

outside of that, i haven’t looked at it yet…

i do wonder with inflation involved…does that sort of mess using cost as a way to judge how the economy is doing?

every metric used in figuring GDP is adjusted for inflation with its own price index…for instance, nominal sales of non-durable goods rose at a 12.0% rate in the first quarter, but average prices for non-durable goods rose at a 14.9% rate, so real non-durable goods fell at a 2.5% rate in the quarter and subtracted 0.38 percentage points from 1st quarter GDP…

the quarterly prices indexes for all of the components of GDP going back to Q2 of 2018 can be viewed in Table 4 here: https://www.bea.gov/sites/default/files/2022-04/gdp1q22_adv.pdf

a few highlights from today’s report:

Retail Sales Rose 0.9% in April after March Sales Revised 0.9% Higher

March sales were originally reported at $665.7 billion, up 0.5% from February; they are now indicated to have risen 1.4% to $671.6 billion, while February adjusted sales were concurrently revised from $662.4 billion to $662.3 billion…the net of those revisions to February and March sales would increase first quarter sales by about a $23.4 billion annual rate and add about 0.38 percentage points, give or take, to 1st quarter GDP when the 2nd estimate is released at the end of the month.

i find that core retail sales were up by roughly 1.4% for the month….since the April CPI report showed that the the composite price index of all goods less food and energy goods was 0.2% higher in April, we can thus figure that real retail sales excluding food and energy will show an increase of roughly 1.2%…then, while nominal sales at food and beverage stores were 0.2% lower, real sales of food and beverages would have 1.2% lower in light of the 1.0% higher prices for groceries…..and while sales at gas stations were down 2.7%, there was a 6.1% decrease in price of gasoline during the month, which would suggest that real sales of gasoline were actually up on the order of 3.6%, with a caveat that gasoline stations do sell more than gasoline, products which should not be adjusted with gasoline prices, so the actual increase in real sales at gas stations was likely smaller…bottom line, by mimicking the procedures used by the BEA to figure GDP, i figure the income and outlays report for April will show that real personal consumption of goods rose by around 1.2% in April….however, FRED is going to report real retail sales only rose by 0.6%..