The impact of supply constraints on the US economy in 3 easy graphs

The impact of supply constraints on the US economy in 3 easy graphs

The two most important purchases ever made by most consumers are (1) their houses, followed by (2) their motor vehicles. Indeed, according to Prof. Edward Leamer‘s forecasting model, ever since the end of World War 2 almost all American recessions have been preceded by, first of all, a decline in new home purchases about 6-7 quarters before, followed by a decline in the purchase of new motor vehicles about 9-12 months before.

By all reasonable accounts, the US economy Boomed last year, with real GDP up 5.5%, industrial production up 3.4%, manufacturing up 3.9%, and employment up 4.7%.

So one would think that the production of houses and motor vehicles would approach prior expansion peaks. Well, let’s take a look.

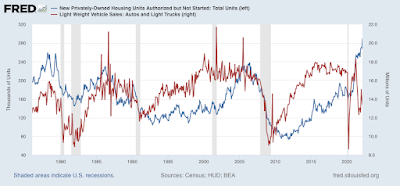

The below graph shows houses where permits have been issued, but construction has not yet started (blue), and sales of cars and light trucks (pickups and SUV’s)(red):

On average over the past 50 years, in any given month the number of new houses where construction has not yet started has averaged about 180,000. The number of new car, pickup, and SUV sales have averaged about 16-17 million during expansion years.

Here’s a close-up from just before the pandemic:

As of one month ago, 300,000 new houses had been authorized but not yet started. Light motor vehicle sales were 13.4 million. That’s 40% more houses than usual, and 25% fewer light vehicles than on average.

In short, supply constraints (e.g., lumber and semiconductors) have seriously impacted the production of the two most important consumer staples.

Unsurprisingly, the prices of both have skyrocketed, up about 20% since the end of 2020:

This is a very simple explanation of the most serious economic problem in the US right now.

Near us homes are being built hand over fist. New tracts or phases get finished in about half the time they took 20 or 30 years ago, and the dust hasn’t settled (literally for the tract as a whole) before the move-ins. I thought some construction worker was showing off his new Corvette. No, that was the new owner and by the next week half the block had multiple cars in the driveway.

The tract planned and graded and utilities in to the street for in the vacant field behind us has been sitting fallow since 2007. They were putting utilities to the interior lots two weeks ago. Different builder, of course. And based on the tract this will be an add-on phase to, very good for our property values. Probably $100K over the new home prices from 2006 when our home was built, about a 30% increase.

Jane:

Same house as to what we closed on last November, + $60,000. I am waiting to see how this plays out here. Large influx of CA and east coast people who have cash to spend. Almost two years ago, we would bid a house @ +10,000 over asking and still outbid.

With this house, our name was drawn out of a raffle. It fit our needs and was the right size, so we took it.

we sold our house last year, for almost 180,000 more than when we bought (brand new) back in 2017

NDd,

No worries, the FED has this under control with regard to Supply Chain. They will raise FED rates. Then people will have to borrow at a higher interest rate. Many consumers will drop out and demand will decrease for autos and housing. Kind of a backwards way of fixing an economic issue caused by supply chain allowing sellers to manipulate the market.

i some how doubt that raising rates will do more than reduce demand, but will have no impact on supply (might even shrink it even more…since part of the reasons for that is that demand just about crashed in 2020 . started to recover last year. this year we arent back to where we were before the pandemic)., so raising rates probably will just shrink demand. but wont fix the supply chain problems

we sold our house last year, for almost 180,000 more than when we bought (brand new) back in 2017

Good time to be cautious when the supply chain for intermediate goods stretches the price elasticity of demand to its breaking point for finished goods that are dependent upon those inputs. An exuberant lack of caution often precedes a crash.

https://themortgagereports.com/91581/fed-hikes-rate-by-50-basis-points-may-2022

…Mortgage rate growth could slow, for now

The FOMC reiterated its need to take a firm stance with its monetary policy. As inflation, employment and household spending all remain elevated, it felt an aggressive hike and MBS selloff were appropriate.

These measures indicate economic expansion and combat high inflation. They were also telegraphed in previous meetings, so they come as expected. Although rises in the Fed rate normally precede mortgage rate growth, lending markets may have already accounted for May’s hike.

“MBA is forecasting that mortgage rates are likely to plateau near current levels,” said Mortgage Bankers Association SVP and Chief Economist Mike Fratantoni. “The financial markets have attempted to price in the impact of Fed actions over this cycle, and they are likely also pricing in the economic slowdown that will result.”

While this move by the Fed may have already been baked in by lenders, similarly large hikes are anticipated for each of the remaining FOMC meetings in 2022 — hikes not yet factored into the market.

What this means for borrowers

Rapid interest rate growth has thus far defined 2022 lending — something that could actually help bring balance to the extreme seller’s housing market.

While the MBA predicts tepid interest rate movement following the latest FOMC news, that could be short lived.

The FOMC meets five more times this year with hikes expected to follow each of them. The next committee meeting falls on June 14-15, so if you’re looking to buy or refinance, move quickly.

Bottom line: the most likely outcome is interest rates may never be lower than they are right now.

When long term and short term expectations cross paths, then some term rate inversion will ensue, but depending upon underlying reasons that bond markets follow different paths between short and long term, then the only rub may be the securities trades that depend upon rate spreads for extraction of economic rents rather than suffering losses in economically requisite financial silos. OTOH, if the Fed pulls the short term rate string too hard, then the retail sector could suffer substantially enough to cause a significant economic downturn.

It depends is always a good answer, but it depends upon what is always a better answer.