Student Loan Debt Cancellation Will Not Benefit the Wealthy or Young?

Student Loan Cancellation will not Benefit the Wealthy, Alan Collinge, Student Loan Justice Org. Alan Collinge

History

In 1972, allegations about students abusing bankruptcy3 courts were beginning to make headlines. Major newspapers were publishing anecdotes about students who took out large college loans. Supposedly then, young graduates or students quickly declared bankruptcy to avoid paying them off. The Congressional Commission on Bankruptcy Laws issued a report7 in 1973 (Senator Biden’s first year in Congress) recommending government – backed education loans be barred from bankruptcy protections for at least five years after a student graduated.

The recommendation came after the report3 found 18% of all loans were in default of which 1% were discharged in bankruptcy. In 1977, a GAO report4 challenged the stories of students systematically gaming the bankruptcy system. It found less than 1 percent of all educational loans were being erased in bankruptcy.

In a later 2014 report, researchers at Harvard University and the federal government’s Consumer Financial Protection Bureau noted that the same GAO data at the time also “found that the majority of students were not filing for bankruptcy immediately upon graduation.”

It is during this period in the seventies, it was said the young were gaming bankruptcy laws. The accusation stuck and still exists.

Introduction:

With the exception of the first chart in this post, all the other charts have been updated with the latest Fiscal Year 2021 data. I have also edited Alan Collinge’s initial report (text) to reflect this new data.

The loudest, angriest complaint(s) I have heard against Student Loan forgiveness is about younger people being able to escape student loan debt. Joe Biden has blocked student loan forgiveness, as has Debbie Stabenow, and others. There is nothing special about making these loans other than the people having little or no credit history, income, or assets, and no right to protection under bankruptcy.

Those people with student loans from the seventies, eighties and nineties have aged and they are still paying these loans or in default.

Presently

Alan: The highest balance, highest earning borrowers are older people. It is they who have been harmed by student loan debt for years or decades. In the seventies and eighties, they were younger when Joe Biden was stomping around.

A number of beltway “experts” are currently claiming that cancelling student loans would benefit the wealthy. Adam Looney (The Brookings Institute), for example, claims8 broad student loan cancellation would be regressive because the highest earning 20% of student loan borrowers hold 30% of the debt. Adam Looney uses the example of a young, high-earning medical school graduate who earns more than a young non-college graduate to claim broad cancelling loans would be unfair.

A simple analysis of this claim reveals that not only is Adam Looney’s claim completely wrong8 both by his own measure and also when compared to other federal loan cancellation programs. Looney’s analysis is flawed and misleading.

First, the obvious

Brookings Blog Upfront8, Adam Looney claims the cancelling of federal student loans will benefit the “wealthy” because the top 20% of earners hold 30% of the debt.

Second

By way of comparison, let’s look at the Paycheck Protection Program (PPP). The top 20% of earners hold 75% of this debt. Thus, the top 20% would be the beneficiaries of this loan cancellation, compared to the bottom 80% of earners, who hold 25% of the debt. In this particular example, Looney would be correct if he were to compare such.

Third

Cancelling federal student loans would achieve nearly the converse of this, with the bottom 80% of earners receiving over 70% of the benefit. Using Looney’s data, cancelling federal student loans will largely benefit the un-wealthy. This becomes clear when compared to PPP loans.

It’s the Older People

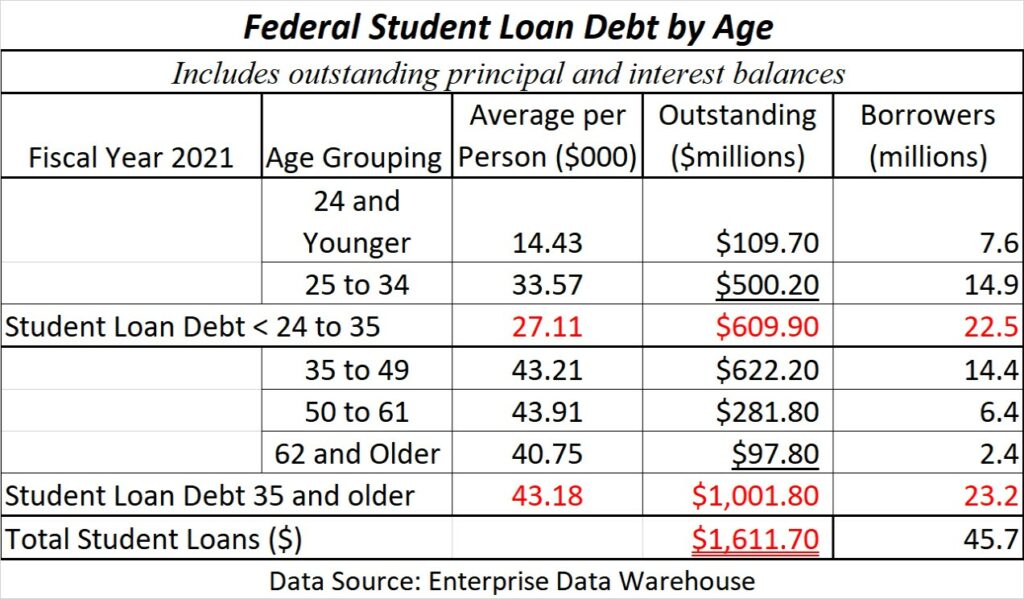

The highest balance and earning student loan borrowers are “not” young people at all. They are the older borrowers mostly to have been holding student loans for years or decades. Today, they owe far more than younger people, despite having borrowed less many years or decades ago.

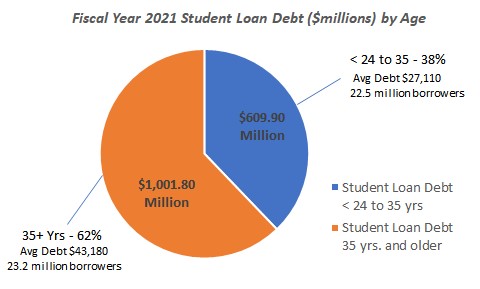

People over the age of 35 slightly outnumber (23.2 million to 22.5 million) people under 35 with federal student loan debt. The older cohort owes ~60% more Student Loan debt than the younger cohort in total.

Further Up the Age Bracket:

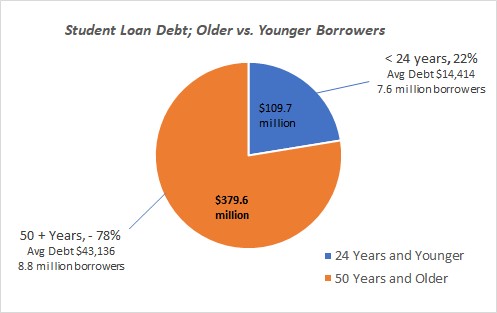

An even wider age gap of people over 50 vs. people under 25 exists. The disparity is much worse for older people. Borrowers over the age of 50 significantly outnumber those under the age of 25 (8.8 million people vs. 7.6 million). The older borrowers have triple the debt of the younger cohorts as measured in total debt, and average loan balance. (see Pie Chart below)

Looking at the data in this context illustrates how broken the federal lending system has become. A system where there is no escape and people end up dying in debt.

The beltway’s argument falls apart with this more accurate analysis. Having nothing to do with net worth, defining loan holders as being “wealthy” is ill – fitting. These borrowers are being hurt.

“Wealthy” people don’t struggle to repay their student loans into their 40’s, 50’s, and beyond.

Furthermore, older people earning more than younger people does not mean they are “wealthy”, and not deserving of loan cancellation. Indeed, the opposite is true.

Their loan balances have exploded. They are owing far more than younger borrowers while having borrowed far less many years or decades ago. Again, this demonstrates how broken the lending system has become. Cancelling student loans is not only necessary, it is becoming inevitable.

Parent Plus Loans

Some suggest Federal Parent Plus Loans allowing parents to borrow to pay for a child’s education explains the debt for older people.

FPPL’s account for about 6% of all federal student loans ($100.6 billion over 3.6 million borrowers). Subtracting these loans from the “over 35” data (the appropriate age group for these loans) increases the average student loan debt of the remaining borrowers in this age group. Parent Plus Loan debt decreases – not increases – the average debt of this age group.

High Earning Students

Interestingly, the relatively few young, “high-earning” student loan borrowers tend to refinance their loans out of the federal program with private lenders6. In the end, they will not benefit from any federal student loan cancellation.

Adam Looney pointing to rare, young, high earning borrowers as representative of high earning, high balance student loan borrowers is misleading, wrong, dishonest, stirring the pot, etc. Pick one. Looney and like-minded colleagues in Washington D.C. ought to be held accountable for misleading the public and defending this predatory loan program.

Summation

Large numbers of older loan holders have been exploited by predatory student loans. Pitting old against young makes no sense unless one wishes to confuse the issue by blaming younger loan holders for the larger debt. However, younger borrowers today will be older borrowers tomorrow. They will be much, much worse off than today’s older loan holders do unless the Student Loan lending system is overhauled.

The present federal student loan system has been a failure by all rational metrics. Forty percent of the borrowers never graduated. Eighty percent are “underwater” on their loans and were even before the pandemic. Most student loan borrowers were not making payments. Default rates for 2004 students borrowing which is less than a third of the borrowers today is a whopping 40%. The subprime home mortgage default rate, by comparison was only 20%.

The Student Loan lending system is finished, and no amount of beltway spin can make this not true.

In The End

The failure is a direct result of the removal of consumer protections from Student Loans by Congress. Removing bankruptcy protections and statutes of limitations from federal student loans left borrowers vulnerable. Removing Truth-in-Lending laws and Fair Debt Collection laws adds to their vulnerability. And state usury laws are not applicable to federal student loans. A draconian debt collection regime serves to enforce through garnishing wages and inflate the loans with penalties, fees, etc. pushing the lending system over the brink of legitimacy.

The Founders called for uniform bankruptcy laws and the right to bankruptcy should be applicable to student loans also. President Biden could order the Department of Education to stop opposing student loan borrowers in bankruptcy court. Congress could immediately return bankruptcy capabilities to all student loans by passing both S.2598 and HR. 4907

Recently, President Joe Biden ordered Secretary of Education Miguel Cardona to stop challenging this case of student loan forgiveness. after public outcry.

Joe Biden also has the power to cancel all federally owned student loans without congressional approval or appropriation. Doing so will add nothing to the national debt. The President should exercise his loan cancellation authority and end this national threat of a flawed lending program.

We can do better than this!

1 “No, Student Loan Cancellation will not Benefit the Wealthy” | by Alan Collinge | Jan, 2022 | Medium

2. Source: U.S. Department of Education (Q4 2021) Student Loan Debt by Age

3. “Joe Biden Backed Bills to Make It Harder for Americans to Reduce their Student Debt” | Consumer Bankers Association

4. “HRD-77-80 Study of Guaranteed Student Loan Bankruptcy” (gao.gov)

5. “Annual Report of the Student Loan Ombudsman” (consumerfinance.gov)

6. “Student loans, the racial wealth divide, and why we need full student debt cancellation” (brookings.edu)

7. “Report of the Commission on the Bankruptcy Laws of the United … “- Full View | HathiTrust Digital Library

8. “Student loan forgiveness is regressive whether measured by income, education, or wealth” (brookings.edu)

I had a real hard time not laughing when the dems asked me to vote for Joe Biden.

Then when you factor in his support by the southern softwoods farmers and it’s impact on an already faltering Pacific Northwest timber industry AND as VP he then cut off the little bit of unemployment that at the time was the only income for many older, unemployable people … like I said, I had a real hard time not laughing …

Ten:

Been writing for Allan’s cause for over a decade. Took on Stabenow and Durbin. Showed up at “Show Down in Chicago.” A week later I had full blown pneumonia and my Elkhound was laying on top of me trying to keep me warm. He knew.

We play with the hand we are dealt.

Run

Thank heaven for little dogs.

[cf Maurice Chevalier]

EYup …

I keep banging this drum, but his Administrations’ inability to pivot to what got him elected is going to lead to dramatic changes in the Congress appointments this year, and then the presidential election 2024.

We have the centrist Dems like myself and many others who, as like run says, we play the card dealt and make the best of what we have.

I don’t think the Left Loud Crowd can scream hard enough through their three masks to keep the Dems afloat this season on Political Opera Americana.

Depressing.

Smith

I urged leftists to vote for Biden because a Trump victory was too horrible to contemplate. I am mortified that I may have to do it again…if anyone will listen to me…for the same reason. Least bad is still better than Worst Bad. We can’t afford the luxury of staying home and sulking, sucking on our virtue.

Be glad to see you out there trying to make a difference, either in the Democratic Party, or in what the people can do regardless of what the Dems do.

Meanwhile I don’t see what you gain with your three masks crack. A thrill of virtue, perhaps? Do you want your doctor to rip his mask off in a display of macho while he is operating on your bad heart?

If it wasn’t so much fun to insult people you don’t know, we might even get a few people in small states to vote for us.

Being a “moderate Democrat” is nothing to brag about this season. Manchin? Synema?

Nothing quite like the rebirth of Green Lantern’s Magic Ring power to the President. I missed it during Trump’s four years.

Mask crack more about the hard left that have dug in much in the way the right has dug into the Trumpism. Both sides now have their crazy. We can’t even suggest that there might be addition information within an argument. This comes off the heels of a conversation a with a good friend of mine where I suggested natural immunity is still immunity, him hard left told me how wrong I was. Now CDC report says there is more to the story.

Michael:

Unless something has changed, it is not as strong. I would keep masking, maintaining distance, and stay away from crowds.

Smith

yep. we have crazies on both sides. but it is so hard to tell them apart from those of us who know everything.

I gave up on what “science says” about the same time the CDC became sensitive to “political reality.” I make my best guess, including as much as i understand of science, and try to leave others alone with their opinions. But I never liked people sneezing in my face long before there was Covid.

In fact, I believe, we lost the Covid war in Jan 2020 when we failed to socially distance, wear masks, contact trace , and quarantine before the virus had spread too far to be stoppable.

The masks are less reliable than they might be because people don’t wear them properly or reliably.

We could have had effective social distancing without great economic loss if people kept their distances, businesses that could provided separation or barriers, and for those that could’t

the government imposed an emergency payroll tax so people whose situations allowed them to work could help pay for the needs of those who couldn’t. another word for that tax would be “insurance” in case you were next.

but we had none of that. instead we had Trump, and the CDC was so proud of the vaccine (a year later) that they said no one needs to mask or distance anymore.

so where did the surge come from? well, as my book says, an unvaccinated person is safer in a crowd of vaccinated people than a vaccinated person is in a crowd of unvaccinated. note “crowd.” applies to “masked” too.

Run

Thanks for this. This is the way to do it. focus on the horrors and the injustice.

And the dishonest spin by the lenders.

As you do here.