Oil Prices Up 55% and Natural Gas Prices Up 47%

Oil prices rose 55% in 2021, the most since 2009, while natural gas prices rose 47%, the most since 2016, Focus on Fracking, RJS

Oil prices rose for a second week after the initial Omicron selloff, as oil traders and most everyone else have become convinced that Omicron poses little risk to oil demand . . . after rising 4.3% to $73.79 a barrel last week on trouble in Libya, a big drawdown on US crude supplies, and on a refinery explosion in Texas, the contract price for US light sweet crude for February delivery opened lower on Monday amid new Omicron related travel restrictions, as traders worried if Omicron risks had been prematurely dismissed, but then reversed the early morning losses to rally to one month highs despite surging Omicron infections, chasing equitiy prices higher after the resumption of multilateral nuclear talks with Iran in Vienna, and settled 2.4%, or $1.78, higher at $75.57 per barrel on hopes that the Omicron variant would have a limited impact on global demand in 2022 . . . oil rose another 2% to fresh one month highs early Tuesday along with rallying equities and a sagging U.S. dollar index, after the CDC shortened the recommended quarantine times for those who have tested positive for COVID-19 from ten days to five days , but pared a portion of the earlier gains in afternoon trading on a stronger US dollar ahead of the weekly release of U.S. inventory data from the American Petroleum Institute, to settle with a gain of 41 cents on the day to $75.98 a barrel . . . oil contracts again traded higher Wednesday morning after the API’s weekly report, and then spiked to new one-month highs after the EIA reported big withdrawals from crude and oil product inventories, but turned lower amid profit-taking ahead of end-year accounting and the upcoming holiday weekend, while later recovering to settle 58 cents higher at a five week closing high of $76.56 a barrel, as Americans resumed year-end travel and festivities after being assured of lower risks from Covid’s Omicron variant . . . after initially moving lower, oil prices again rose to new intraday highs on Thursday, as fading omicron concerns and signs of strong uptake of energy-related assets helped to support year-end buying, and settled 43 cents higher at $76.99 a barrel, driven by data showing strong demand along with falling inventories and production levels in the U.S. and elsewhere still below pre-pandemic levels…oil’s seven session rising streak, the longest since an eight-session rally ended February 10th, finally came to an end on Friday, when prices tumbled steadily to end $1.78 lower at $75.21 a barrel, largely due to profit taking after recent gains, but still ended 1.9% higher on the week, and 13.7% higher for December, and more than 55% higher for the year, to clinch its sharpest annual increase since 2009.

Natural gas price quotes finished slightly lower on a change in the cited contracts, even as the now current February contract price ended higher . . . after rising 1.1% to $3.731 per mmBTU last week on signs of an impending polar air mass intrusion, the contract price of natural gas for January delivery opened 6% higher on Monday after forecasts showed that a bout of cold temperatures would spur heating demand for large parts of the U.S. this week, and continued rising to settle 32.9 cents higher at $4.060 per mmBTU, the largest one day price jump in over a month . . . natural gas prices held onto those gains on Tuesday, slipping only a half cent to $4.055 per mmBTU, on forecasts for milder weather and less heating demand over the next two weeks than was previously expected, while the more heavily traded February natural gas contract fell 5.7 cents to $3.885 per mm BTU at the same time, [http://additional%20warming%20in%20the%20forecast/]reflecting[http://additional%20warming%20in%20the%20forecast/] additional warming in the longer term forecast…after an initial spurt 5% higher on the potential for cold weather to last a couple of weeks, Wednesday’s trading in the contract for January gas expired with gas priced 3.1 cents lower at 4.024 per mmBTU, while the incoming front-month February contract settled at $3.850 per mmBTU, down 3.5 cents from Tuesday’s close . . . with the contract price of natural gas for February delivery now being quoted as the price of natural gas, prices tumbled 28.9 cents or 7.5% to a six month low of $3.561 per mmBTU on Thursday, following a 10% slide to a three week low in European gas prices despite a bigger-than-expected storage withdrawal and colder forecasts, as domestic gas production continued to rise . . . however, natural gas prices rebounded to recover more than half of that drop on Friday, settling 16.9 higher at $3.730 per mmBTU, on a heating degree days forecast over the next two weeks that was higher than the 30-year normal for this time of year . . . natural gas prices thus finished the week a tenth of a cent lower than last week’s closing quote, while the February contract price, which had finished last week at $3.630 per mmBTU, ended the week 2.8% higher….for the year, natural gas prices finished over 47% higher, their biggest annual percentage rise since 2016.

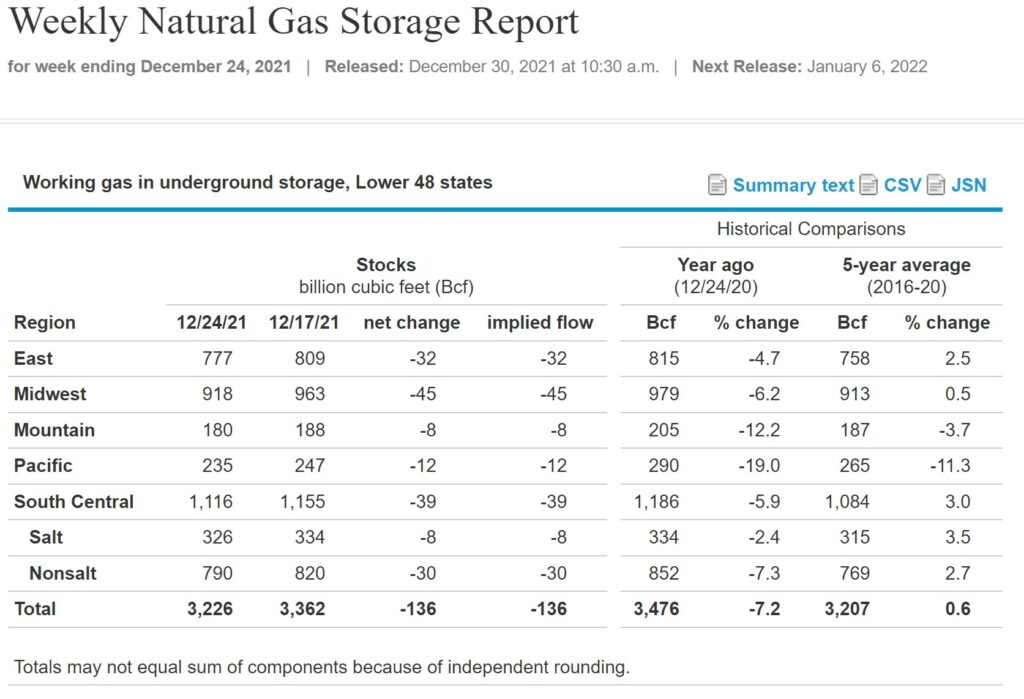

The EIA’s natural gas storage report for the week ending December 24th indicated that the amount of working natural gas held in underground storage in the US fell by 136 billion cubic feet to 3,226 billion cubic feet by the end of the week, which left our gas supplies 250 billion cubic feet, or 7.2% below the 3,476 billion cubic feet that were in storage on December 24th of last year, but still 19 billion cubic feet, or 0.6% above the five-year average of 3,207 billion cubic feet of natural gas that have been in storage as of the 24th of December over the most recent five years . . . the 136 billion cubic foot withdrawal from US natural gas working storage this week was more than the average forecast for a 127 billion cubic foot withdrawal from a S&P Global Platts’ survey of analysts, and was also more than the 121 billion cubic feet that were pulled from natural gas storage during the corresponding week of 2020, and more than the average withdrawal of 120 billion cubic feet of natural gas that have typically been pulled out natural gas storage during the same week over the past 5 years.