New Student Loan Payment Schedule

Alan Collinge’s Student Loan Justice Facebook page.

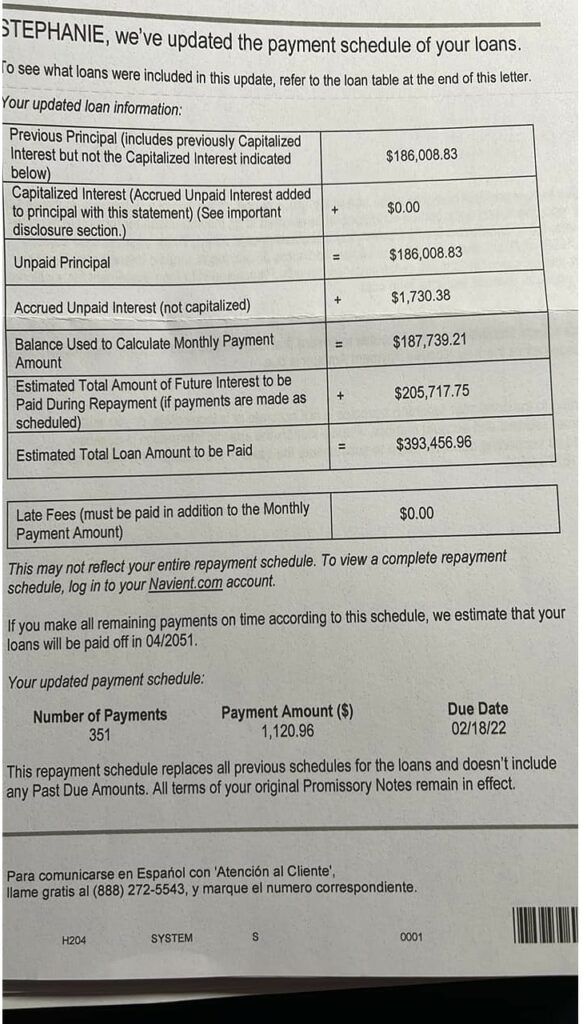

I keep talking about how the consolidation fees, late fees, forbearance interest, etc. and the interest on the previous adds up over time. Pretty soon, it surpasses the original loan balance. There are probably worse examples of this occurring. As it is, the non-principal payments are more than twice the original principal.

The original loan was $105,000. As you can see there is ~$81,000 in interest capitalized into the loan resulting from nonpayment, consolidation, etc. (mentioned above. Future interest is calculated at almost $206,000. Typically in these loans if a payment is not made as in forbearance, the interest must be paid first before any funds are applied to the principal.

As you can see, much of the balance is accumulated interest on various items mentioned above making it harder to even make a payment. We are arguing about a loan of which the amount originally loaned is far less than the balance.

This loan will never be paid off for obvious reasons as described below. The relief? Die . . .

Payment Schedule

The story:

“This was my Christmas present from our government! I am 56 years old and have survived cancer 3 times. According to Navient, I will not be able to die till I am 85 years old! That is how long it will take me to pay off this crap! If you wonder how I got this high Balance, ask Sallie Mae. I left school with a balance of a little over $105,000 but thanks to the fees and interest I now owe this! Anyone who thinks this crap is not corrupt needs to do some research. This has to stop!”

There are other consequences to owing money to the government. You are blocked from other programs, etc.

Well, I had total loans of $50,000 and owe about $200,000. The interest rate is 8.5%. To me. charging interest on interest is usury.

Those street skills I developed in the sixties and seventies served me well in the aughts, when I made a vaguely friendly gesture in a generally eastward direction and dropped out, again. Promises of deferment for entering “education” were not kept and regardless of payments made on the roughly thirty-five k borrowed to finance a mid-life career change by the Bush Recession were twice that, thrice when I walked and probably two-fifty today in spite of minimal payments garnished from my social security.

This is an econ blog, I don’t comment very often ‘cuz I’m not an econ, but to coach it in an econ perspective and outgrowth of the business degrees I borrowed to pay for when the woods shut down and I was forced to learn something new … it was a bad investment. And that’s kinda’ hazy ~ I wouldn’t be who I am if I hadn’t late-in-life gone to college and university, grad school, but the return on the investment hasn’t been worth what I put into it. Certainly not the price put upon it.

There’s no telling what would have happened if I had, for example, gotten as serious about building stuff as I was getting into law school, proving I wasn’t a dumb f’in logger, but I don’t know anyone from back then that’s (still alive) doing any better.

Just think how much money I save not going to the gymnasium!? What with all the rolling with the punches. treading water, rowing against the flow …

Thank you for sharing my struggle. My intent when sharing my story was to educate others on this tragic systems that is designed to ensure we fail. I would never have taken out these loans had I known that at 56 years old I would still be struggling to pay them off. I hope I live till 85 to actually see them paid off. When I received this letter before Christmas, I did the calculations and cried. I cried because the thought of being forced to work till I am 85 was more than I could emotionally handle at that time. I cried because here I was getting ready to work through yet another holiday and would miss out on time with my grandkids. I cried because I recalled how hard I fought cancer to live only to realize this is not really living…I work nights, 10 hours a day to make money to pay these debts knowing that even if I pay every penny I make this balance will probably continue to increase. I cried because I know I cannot pay every penny I make because I also have to live and that requires my paycheck to cover a mortgage, car payment and taxes as well. I cried because frankly, I am exhausted.

I hear so many stories like mine that it is enough to put anyone into a depressed state. This is tragic. Misinformed people make comments like, we are all a bunch of deadbeats! We need to suck it up and just pay our debts. We are supposedly entitled cry babies looking for another government hand out! Wow! Nothing could be further from the truth. Story after story I read is the same. We work our asses off trying to provide for our family and feel stuck. These loans are sucking the life out of us. Many of us are over 50 and have worked our entire lives. We should be planning our retirement not worried about how we are going to work till we die! These loans services and our government failed us so they could line their pockets with gold!

Stephanie:

There are many stories like yours at the Student Loan Justice Org. The strategy being used on you and others is to do nothings you will grow weary of protesting. The costs being added to the original loan would not be tolerated under normal bankruptcy laws.

Hang in there, I believe Alan is taking the right approach with his petition having over 1.2 million signatures,

I am all for the bankruptcy route even knowing that I will take a hit again to my credit. At this point I am happy to. Here is why? I know that once 44+ million hit those courts there will be outrage from the judicial branches who are forced to work through these cases just like there was over the medical debt and payday loans that were crippling our military personnel. That will force changes! It is a start. That is way better than what we have now. I will run my happy butt to the nearest court house to file all the required documentation you can bet on that!

Stephanie

At least if bankrupt, you are done. They can’t hurt you or demand no more.

That is what I am counting on. To me it is worth it. I keep looking for a loophole that might quicken the process. Lol until then I will continue to fight the good fight.

Stephanie:

It will come. I think it is closer than ever before. Much of this was caused by Biden and now he has to reverse everything he did since the nineties. He is on the hook.

Here is another interesting topic that needs to be addressed and quickly. Let’s talk about the 10 page income driven Repayment (IDR) plan request we are all being sent. The PAPER form that you are required to fill out and return to qualify for one of those magical payment plans. If you are not scared shitless to fill this out let me help you…this form requires you to share your personal info and ssn; the plan you desire; how many children you have and how many people are part of your household. You also need to provide you marital status, if your spouse has student loans; your spouses ssn and date of birth. You then need to provide recent federal tax returns and if you did not file you are asked to disclose that as well. Oh that goes for your spouse as well. You are asked to provide all sorts of documentation by mail to an agency that has already proven untrustworthy when it comes to protecting you private info in a time when identity theft is a very real concern. Are you scared now? You sure should be! Now if your info on this form does not match the other government info on file, look out. You are going to get flagged and more trouble will ensue. You think life can’t get worse? Wait because it sure as hell can. Say this info falls into the hands of someone who uses it to set up accounts in your name. They have everything they need: income statements; income tax records: you want and DOB! It’s like Christmas for crooks. When do you think you will find out any of this happens? Way after the damage is done! Who will be on the hook for all of it? You of course. Your nightmare just got way worse! That is just the process to start to qualify for one of their tipis payment plans. Guess what? You get to repeat this process every year until the loans are paid off. Lucky you. So every year, you get to put your entire financial future at risk.

Now say you make it through all that and get on a payment plan! Troubles are over, right? Lol not a chance. Even if you follow every rule and pay religiously on time for 10-20-25 years you still have to apply for forgiveness! Lol it’s not guaranteed. If you get forgiveness, your 🍀 lucky until you get your taxes done! That $100k student loan is now considered income and you will owe taxes on it. Are you scared NOW????

Stephanie:

No, I am not scared. I have dealt with my three’s student loan and the Plus loans. We surfaced at the other end safe. One loan is involved in a n Income based repayment plan 15 years have passed on this one. I can not tell you the reasons why. It is there.

I went to a Garden Party as I am a Democrat and donated that year. Stabenow was there and is a part of the Senate Financial Committee. She signed the 2005 Financial Modification Bill. I asked her in public what she would do about it. Some of the younger people there were clapping. I am 73 this weekend and a Vietnam era XMarine Sergeant. As she was explaining, I interjected again. It is not safe to trust the gray-haired ones from the sixties. In the end, it got me no where other than a U of M person who scurried his as over as he was upset, upset because he helped to write that bill which holds you to 20-25 years of filing. It is horse shit. I am aware of it. I keep pressing.

I am aware and will keep pressing till someone listens or I am dead.

Yep, at this point I am also playing the game because it is really quite the learning process. The more I learn the less I trust the powers that be. I will either come out the other side beaten and broken or as some crazy revolutionary. Who knows. Lol. The journey has just begun. Lord knows there are way more problems with our current government than either one of us can even begin to address. This is just one.