September Durable Goods: New Orders Down 0.4%, Shipments Up 0.4%, Inventories Up 0.9%

Commenter and Blogger RJS at Marketwatch 666; “September Durable Goods: New Orders Down 0.4%, Shipments Up 0.4%, Inventories Up 0.9%“

September Advanced Report Durable Goods Manufacturer Shipments, Inventories, and Orders, US Census

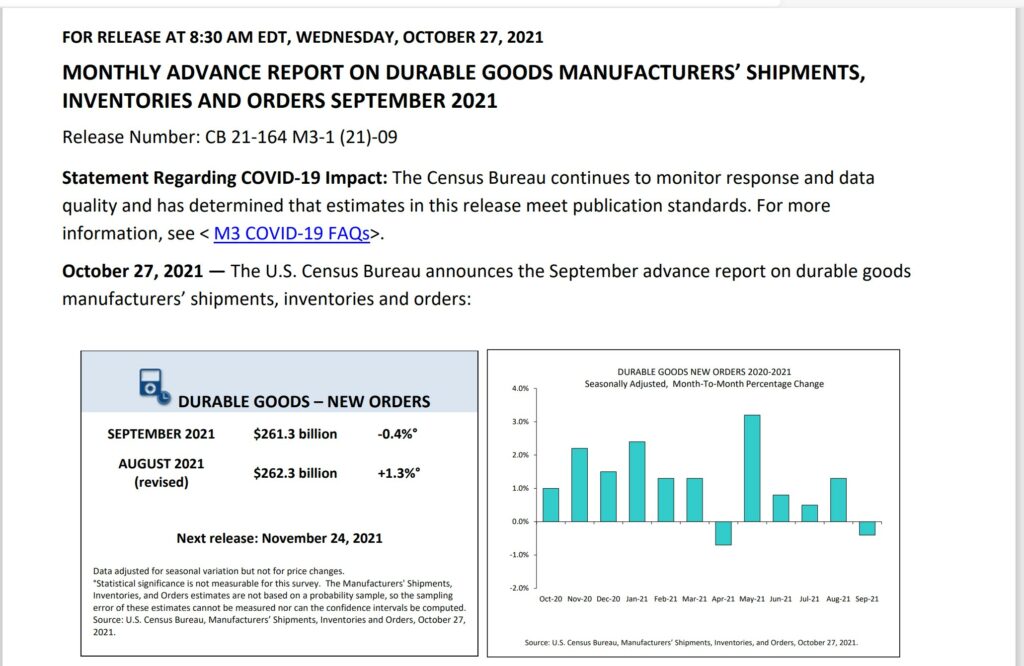

The Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders for September (pdf) from the Census Bureau reported that the value of the widely watched new orders for manufactured durable goods fell by $1.0 billion or 0.4 percent to $261.3 billion in September, the first decrease in five months, after August’s new orders were revised from the $263.5 billion reported last month to $262.3 billion, now a 1.3% increase from July’s orders, rather than the 1.8% increase previously published . . . however, year to date new orders are still 23.4% above those of 2020, albeit down from the 24.7% year to date increase we saw in this report last month….

The volatile monthly change in new orders for transportation equipment was responsible for the September orders decrease, as new transportation equipment orders fell $1.8 billion or 2.3 percent to $77.7 billion, on 27.9% decrease to $10,844 million in new orders for commercial aircraft and a 2.9% decrease to $49,998 million in new orders for motor vehicles and parts . . . excluding orders for transportation equipment, other new orders rose 0.4%, and excluding just new orders for defense equipment, new orders decreased 2.0% . . . meanwhile, new orders for nondefense capital goods less aircraft, a proxy for equipment investment intentions, rose $619 million or 0.8% to $77,712 million, after rising 0.5% in August, on a 1.1% increase in new orders for machinery…

The seasonally adjusted value of September shipments of durable goods, which were included as inputs into various components of 3rd quarter GDP after adjusting for changes in prices, rose for the 4th time out of five months, increasing by $1.1 billion or 0.4 percent to $257.0 billion, after the value of August shipments were revised from from $256.1 billion to $255.934 billion, still down 0.5% from July . . . a $0.6 billion or 1.7 percent increase to $37.3 billion in shipments of machinery led the increase, while shipments of transportation equipment fell 1.0% to $72.5 billion on a 2.3% drop in shipments of motor vehicles, without which other shipments rose by $258 million or 1.0% to $184.47 billion . . . meanwhile, shipments of nondefense capital goods less aircraft were up 1.4% at $75,893 million, their seventh monthly increase in a row ..

Meanwhile, the value of seasonally adjusted inventories of durable goods, also a major GDP contributor, rose for the eighth consecutive month, increasing by $4.0 billion or 0.9 percent to $462.7 billion, after August inventories were revised from $457.9 billion to $458.665 billion, now 0.9% higher than the prior month . . . an increase in inventories of transportation equipment were responsible for part of the September inventory increase, as they rose $1.0 billion or 0.7 percent to $154.6 billion, on a 2.0% increase in inventories of motor vehicles….

Finally, unfilled orders for manufactured durable goods, which are probably a better measure of industry conditions than the widely watched but volatile new orders, rose in September for the eighth consecutive month, increasing $8.8 billion or 0.7 percent to $1,247.1 billion, after August’s unfilled orders were revised from $1,239.3 billion to $1,238.3 billion, now a 0.9% increase from July . . . an increase of $5.2 billion or 0.6 percent to $825.0 billion in unfilled orders for transportation equipment was responsible for much of the increase, but unfilled orders excluding transportation equipment orders rose by $3,584 million or 0.9% to $422,053 million at the same time . . . compared to a year earlier, the unfilled order book for durable goods is now 4.9% above the level of last September, even as unfilled orders for transportation equipment are just 0.2% above their year ago level, largely due to a 5.7% decrease in the backlog of orders for defense aircraft…