Real spending increases, real income declines in August

Real spending increases, real income declines in August

(Note: I’ll report separately on construction spending and the ISM manufacturing index later.)

Real personal income and spending held up well throughout the pandemic, due to a vigorous government response. This morning these were reported for the last full month of any assistance. In nominal terms, personal income rose 0.2%, and spending rose 0.8% (but with a downward revision of -0.4% to July).

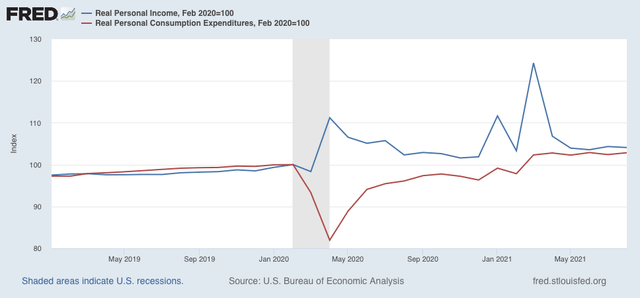

But in real terms, personal income (blue) declined -0.2%, while real personal spending rose 0.4%. Real income (blue) is 4.1% above where it was in February 2020, and real personal spending (red) is still 2.8% above its immediate pre-pandemic level:

The trend for the last months for both has been essentially flat.

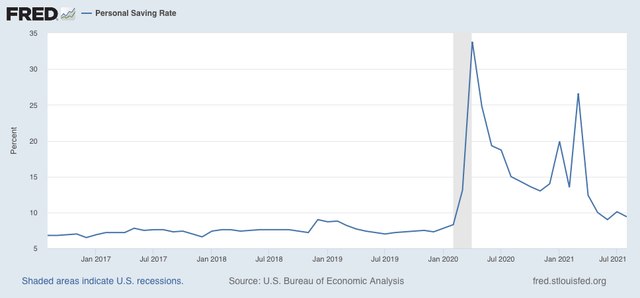

Meanwhile, the “cushion” in personal savings due to the emergency pandemic programs continues, as the savings rate remains significantly above where it was before the pandemic. In February 2020 the rate was 8.3%. In August it was 9.4%:

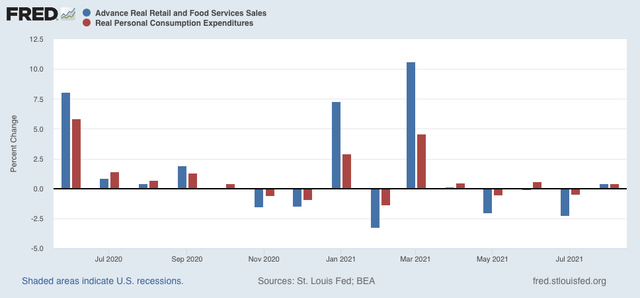

Real personal spending is basically the other side of the coin compared with real retail sales since they cover the seller and buyer of consumer transactions, which is over 2/3’s of the entire economy:

Both of these have returned to basically normal levels m/m, and both increased 0.4% in August. Needless to say, this is positive.

With the total expiration of emergency measures, the next few months will be much more challenging.