About Medicare and the Costs of It

Everybody talks about Medicare, Medicare4All, Medicare Advantage. Few talk about costs or what Medicare consists of for those who qualify for it. How can someone be in favor of Medicare4All, if you do not understand what regular Medicare consists and what it costs.

I am guessing most people believe it would be free. What if it isn’t and you paid what many people pay today for Medicare and its supplements?

Some Absolutes:

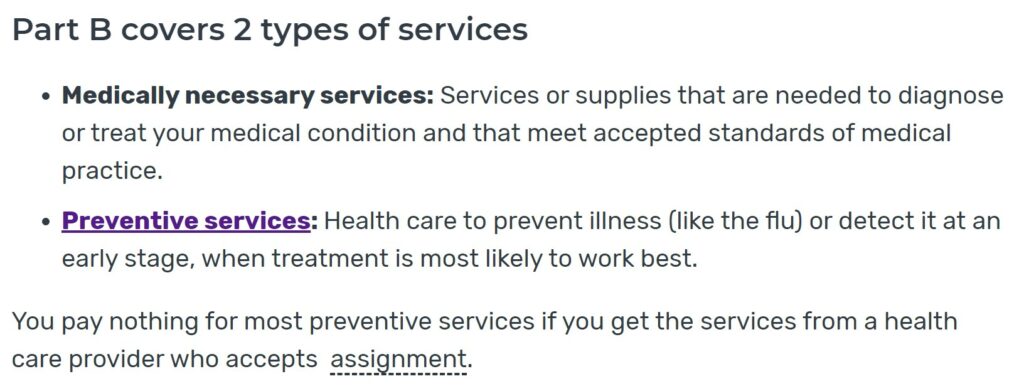

Traditional Medicare Part B:

1. Part B Traditional: No matter if you choose traditional or Advantage, you will pay a Medicare Part B monthly premium which is deducted from your SS benefit. Part B premiums can vary by income. One big difference between traditional and Advantage is; Traditional Medicare is Single Payer and Advantage (MA) is not. MA is commercial insurance and each company pays the hospital or doctor’s bill. Traditional Medicare admin pays all the bills which reduces administrative costs.

2. Traditional, will have a monthly premium ($148.50/month – 2021) for Part B and a deductible of $203 in 2021. Also with satisfying the Part B deductible, there is a 20% CoPay of the approved amount. MediGap covers the 20%:

- Most doctor services (including most hospital doctor services)

- Outpatient therapy

- Durable Medical Equipment (Dme)

MediGap or Part G covers much of the 20% not covered in Traditional Part B or Part A.

3. Traditional Medicare has a base monthly premium of $148.50/month (2921) for Part B besides a 20% Co-Pay for approved billings.

The cited base monthly premium is set using taxable income. I was citing the a premium for those making less than $88,000 for a single person or $176,000 for a couple. If your modified adjusted household gross income (MAGI) exceeds $88,000 (single) or $176,000 (couple), the Part B premium will be higher ($207.90).

Approximately 5% all Traditional Medicare beneficiaries currently pay higher Part B premiums.

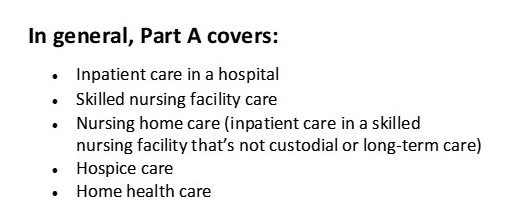

Traditional Medicare Part A:

Traditional Medicare Part A will not completely cover OBSERVATIONAL hospital stays. You have to be admitted to the hospital for full coverage.

Premiums are based upon quarters of years of WORK history.

- No premium if you have 40 quarters of work history pre-Social Security (Detail here Medicare Part A costs [2021])

- A premium of $259 If you have worked 30 to 40 quarters.

- A premium of $471 If you have worked less than 30 quarters.

1. You will pay Federal Income Tax for Social Security above a certain income.

- Individuals with a combined income between $25,000 and $34,000 are taxed on 50% of their Social Security benefit. If your combined income exceeds $34,000, 85% of your Social Security income could be taxable

- Married couples face tax on 50% of their Social Security benefit if their combined income is between $32,000 and $44,000. Up to 85% of Social Security income is taxable for married couples with a combined income that exceeds $44,000.

2. Traditional Medicare is Single Payer: It pays all approved bills submitted by doctors, hospitals, etc. However, It does not establish hospital budgets, set doctor fees, or regulate pharmaceutical costs/pricing.

Commentary

Traditional Medicare sounds expensive, yes? It is expensive as it is not complete and uses Commercial Healthcare insurance to fill the gaps. Paying Part A and Part B deductibles if you have no MediGap insurance. The link will detail each.

What About the Part A and B Deductibles? If you do not have MediGap (Part G), the deductibles and other costs become yours to pay.

MediGap Part G

- To cover the Part A deductibles, Part B deductibles, and get additional coverage for hospital and Hospice; you buy a MediGap plan. You may not need the best plan (G or F) and you can look at the other plans. MediGap Plan N is a good plan one and less expensive. It will cover Part A deductibles and much of the Part B deductibles. MediGap Plan N will have doctor copay of $20 and an ER copay of $50..

2. AARP uses United Healthcare for MediGap. You get a decreasing reduction in monthly premium payments for the first 10 years. There may also be other plans which are similar. The VA covers me also. There is also Blue Cross and Blue Shield as well as other plans.

Pharmaceuticals Part D

- Under traditional Medicare, you will also need a drug plan called Part D. Your selection will depend upon what type of drugs you take. Plans will cover Tier 1 drugs for free. Many plans will cover Tier 2 with a copay of ~$6.00 per 30 days of drugs.

- If you have Tier 3 or 4 drugs, your costs will be higher in Traditional and you should get a different plan to cover the higher deductibles.

Commentary

Again, is Traditional Medicare expensive? Yes it is. If you start looking at the costs of Part B, Medigap and Part D plans, you may be paying ~$320/month or more per month for good coverage. Medicare Advantage may not have premiums and also will offer the same.

Why Medicare?

- You can go anywhere in the nation with Traditional Medicare. MA plans can have narrow or limited healthcare providers within a region. If you go out of network – Advantage can charge out-of-network fees.

2. With Traditional, the monthly fees are always the same. If you fall into an upper income bracket you will pay more in monthly Part B fees to the Gov.. If you have a disorder or disease, your copays etc. will not increase, and neither will they kick you out of the hospital early. However, your MediGap premium may increase a small amount.

3. Advantage can have or it can increase costs to you in the form of CoPays, deductibles, etc. It can limit where you can go for care. Remember, this is Commercial Healthcare Insurance in disguise as a form of Medicare. MA is not Single Payer and it incurs the same costs in administering it as Commercial healthcare.

4. If you go with a MA plan, you can “probably” find a plan which may be free when it comes to monthly payments (more later) other than Part B.

5. MA has been overcharging Medicare by assigning higher risk determinations which are used to charge higher charges for patient care. I documented the issue in Medicare Advantage and Medicare Issues, for over assigning risk, denying coverage, etc. It is estimated $30 billion in over payments paid to MA programs.

Two doses of an IVIG infusion over two of the 4 days at $28,000 a dose (list). Platelets increasing to ~40,000 and was discharged. Scheduled for more infusions of Rituxan to be done at the Cancer Center an eerie place as everyone there is stricken although they may not look so. Weekly visits of 4-6 hours at ~$30,000/dose. Four doses.

Outcome and Information

If you choose Medicare Advantage when you sign up, you may lose the chance to ever get MediGap under Traditional Medicare without an exam and then they may refuse to cover pre-existing conditions.

The Medicare link I provided will answer many of your questions. There are help centers which will answer more. Reviewing the link will expand your understanding of Medicare.

Oh, and the guy who had all the infusions? I paid ~$20 for two lunches and parking fees. There were people there I talked with who were sicker and far younger than I. My 3rd bout.

while Medicare maybe sort of expensive, it depends on what you compare it too, and how much coverage is bought the costs seem to not be out of round, if compared to an employer with excellent health plan coverage(which today are extremely rare), but if you compare it to a bare bones plan, you will find that what you save in premium costs are more than made up with co-pays, deductibles, etc. and most of those plans are only good for certain locations. now if we look at the ‘health insurance’ offered by insurers, you will find that costs rise based on what is covered, basically this is insurance in name only, it doesnt offer much coverage, and is expensive. which sort of works for those less than 30 years old. but this is also a bit market for private insurance since what they get paid in premiums doesnt usually get used, since their market is so healthy. remember that for later.there is a reason that insurers dont want to cover the elderly. they have a tendency to have more health issues, and some of those can be very expensive to address. its why the industry had no real care to offer coverage to them. but the Medicare does cover the elderly, as that what it was originally designed to do. but if you could get the identical coverage from the industry for those 65 and over, you would find it to be very expensive, co-pays, deductibles, etc added to you premiums. the idea that medicare for all tries to do, is lower the cost medicare by actually allow the younger folks to sign up for it ( remember that those under 65 tend to have less need for health care) which would help lower the costs of the plan. sort of like, if medicare today, covers 4 folks (all =>65), that have higher needs. balanced by 6 that have lower needs (and costs). course if we try to compare our ‘health care system’ to other countries, we find not only do we pay many times for care, but get much worse results

dw:

I will keep it simple.

Most people who are screaming for Medicare4All believe Medicare is cheap. It is not. A family of 4 would be paying $300/month for each person to acquire similar deductibles, copays, and coverage.

Furthermore, there is still the issue of pharma costs, budgets for hospitals, and varying doctor fees which Medicare does not touch. Medicare is single payer for its coverage alone. You still have premiums to pay for commercial insurance to cover the 20% gaps, hospice, days in the hospital, etc. Tat also adds costs for administration for insurance companies.

The trend prepandemic was the employees had less and less appetite to offset the costs, so a family of four was closer to $600-800 per month in premiums alone

only that cheap if your employer has a union. for the rest of us, we are the mercy (ha!) of our employers for how much our premiums cost (and if the employer is still contributing to it). i think employers had less and less apetite to offset costs, so passed on the yearly increase, with less of their contribution (lately this has changed some….since employers all of sudden are having immense trouble getting workers back (even after the states that dropped the extended UE benefits….showed no increase in employees..maybe employees dont trust employers with their lives?)

Michael:

For my wife and I, Medicare is ~$640/month or $320/person/month. I think we are paying more; but, the coverage is better in this hybrid.

not sure it will be that cheap, but when you consider getting your health insurance through work, you are looking at about $700 per month or more, if your lucky. cant forget trying to buy the same coverage from a health insurance company , the cost if they would even offer it, would be maybe 800 per person …per month and the companies have no interest in offering policies to thos over 64 at all…except for the special case of Advantage programs where a good chunk is still covered by Medicare) ( and considering the likelihood that including younger people in those in Medicare, how would it not shrink from what it is today? after all, younger people dont have as many ailments as the older folks do (did i mention there is a reason that health insurance isnt offered, and its not just Medicare, its that those older than 64, have lots more health conditions than the younger folks do) while Medicare isnt perfect (but its much much much….did i mention much better than health insurance is). course there is a lot of cost in the private health insurance that doesnt exist Medicare

dw:

Medicare does not consider your age and neither will a Single Payer plan. MediGap does charge more if you use it although it only cover 20% plus deductibles and other care. The issue with commercial healthcare insurance is precisely what you describe. I said the cost would be ~$320/month for one person for Medicare plus MediGap and Part D based upon what it covers today.

If your healthcare is $700 per month, you have already saved. Medicare already has commercial elements in it. Going to single payer eliminates the commercial elements. Sure it is cheaper. Single payer is even less cost.

Medicare is only available to those over 65 today. so yes it does. the only reason its exist is for those over 65. now if you were talking about Medicaid, that program is for all ages (including those 65 and older….cool fact, a large part of those on Medicaid are over 65)

dw:

It is true they may be taking Medicaid “too.” This supports what I have been saying also. If you can not afford Supplemental Insurance or no longer qualify for it, you can be on Medicaid. Supplemental is not expensive but it is not cheap either Commercial Supplemental Healthcare Insurance Plan N will go for over $100 per month initially. A low cost Commercial Insurance Part D will go for $30 per month. Then you have your monthly payment for Medicare of $148/month.

If you are getting $1200 / month in SS, you may find it impossible to pay for Medicare, Supplemental, and Part D. SS will lower the Medicare premium and you can get Medicaid for the balance. Medicare is for those 65 or older. Medicare does not increase payment based upon age for an 85 year old as compared to a 65 year old. Commercial Healthcare Insurance does consider age and Medicare Advantage does too.Indeed the gov. supplements MA for the riskier and the older patients.

dw:

I will have another post up on Medicare as compared to adjusted ACA pricing recently passed by Biden and Democrats in March. 130 members of the House have signed on to a bill lowering the age of Medicare to 60.

The topic? How do they compare.

I am a huge fan of Medicare Advantage.

I think Kaiser is great.

I have done two “tests” of the system: colon cancer and perianal abscess.

dave:

I am happy you have received good care. If you have read my other posts on Medicare and Medicare Advantage, you would know MA over charges Medicare for the care it gives to seniors. They do so by over-diagnosing their customers with higher risk calculations which Medicare uses to pay them. In other cases, they have denied care to seniors. In one of my last posts, it was pointed out in Ann Altman’s commentary, Medicare Advantage plans have bilked Medicare out of $30 billion. In another post, I talked about more recent issues with billing.

My own example with Medicare was a good one also and far less costly minus the commercial insurance.

The US should be getting away from commercial healthcare insurance and going to more of Medicare or Single Payer minus the subsidies to commercial healthcare insurance and with more of the elements of single payer. Only one source of payment, set budgets for hospitals, set fees for doctors, and set prices for pharmaceuticals. More to come on this approach coming from what has been utilized in Europe, etc.