Medicare Advantage and Medicare Issues

Why the hell would I go back to 2019 and cite a Nancy Altman complaint about Trump’s Executive Order?

Some Introduction

There were already issues with Medicare Advantage in $billions of over charges as Ms. Altman cites in her commentary. Secondly, Medicare Advantage is not “single payer” like Medicare (even without creating hospital budgets, setting doctor fees, and controlling pharma) is. We should be looking at improving Medicare to true Single Payer rather than fooling around with more commercial insurance hoping it will do better than traditional Medicare in care and costs to provide care.. Thirdly, without government help and Medicare, Medicare Advantage can not and will not compete with Medicare.

This is nothing new and during the trump administration insurance companies were on vacation as CMS Administrator Seema Verma did little to recoup overpayments to insurance companies. Indeed, the practice of overcharges continues.

Aetna Medicare Advantage program targeted in OIG audit, Modern Healthcare, Nona Temper

(Washington, DC) — The following statement from Nancy Altman, President of Social Security Works, on the Medicare executive order Donald Trump signed October 2019 sums up the issues with Medicare Advantage.

“Medicare Advantage is a hustle designed to allow for-profit corporations to suck up public dollars. For years, Republicans have shoveled money into Medicare Advantage plans and allowed them to offer benefits that traditional Medicare is forbidden from covering. This is a ploy to push seniors into Medicare Advantage plans instead of traditional Medicare. Medicare Advantage is stealth privatization intended to undermine traditional Medicare, which is an effective, popular government program and therefore loathed by Republican ideologues.

Under the Trump Administration, the thumb on the scale has turned into an entire arm. They’ve been flooding seniors’ inboxes with advertisements for Medicare Advantage. What these emails don’t mention is Medicare Advantage plans often have narrow networks, restricting which doctors and hospitals patients are allowed to use. Worse, a recent government report found Medicare Advantage plans improperly deny care “in an attempt to increase their profits.” It’s no surprise older, seniors are more likely to drop Medicare Advantage plans.

Medicare Advantage plans are also a terrible waste of public dollars. They have overcharged Medicare by $30 billion in the past three years alone.

Today’s executive order (Trump) is yet another giveaway to the corporations that run Medicare Advantage plans. Ironically, the Trump Administration is framing the executive order as an attack on Medicare for All. In fact, the massive flaws of Medicare Advantage epitomize the need to get for-profit greed out of health care by improving Medicare and expanding it to cover all Americans.

Medicare, like Social Security, works. Republicans want to privatize both of them. We have to stop them and instead, expand both.”

Medicare Advantage Health Plans Overbill Taxpayers By Billions Annually, Audits Show : Shots – Health News : NPR

Tossing more money into Medicare Advantage is symptomatic of what is wrong with healthcare today. Healthcare in the US is little more than a money pit and inefficient. No matter how much money patients and the government shovel into it, it will never be enough as prices rise regardless of costs remaining the same (something called increased value of the medicine in application). Until we begin to talk about cost versus price and whether the value claimed justifies the increased price, we will always be at odds with the healthcare industrial complex. Medicare Advantage is no more sustainable than ordinary Commercial Healthcare insurance.

Payments to Medicare Advantage

Discrepancies in payments attributed to patient risk analysis are still a major issue with Medicare Advantage as reported in the 2020 Agency Financial Report .

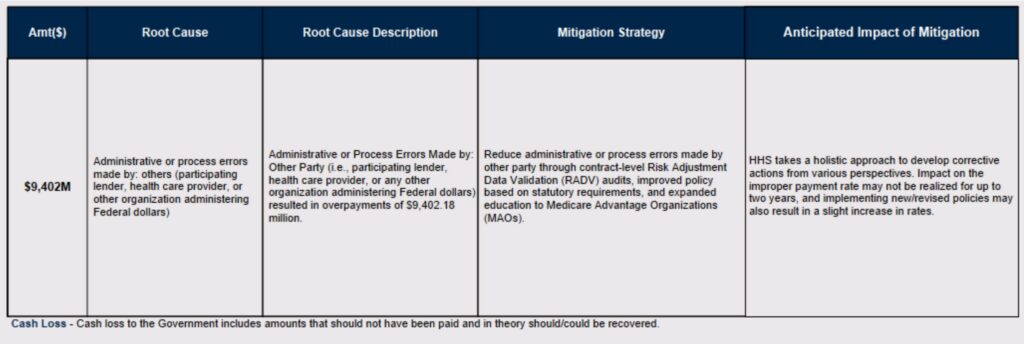

“The Medicare Part C gross improper payment estimate for FY 2020 covering 2018 is 6.78 percent or $16.27 billion of funds paid out to Insurance companies. This is a decrease from the prior year’s estimate of 7.87 percent.” Page 39 of 45, FY 2020 OMB Supplemental Data Call, Department of Health and Human Services, HHS.pdf (cfo.gov).

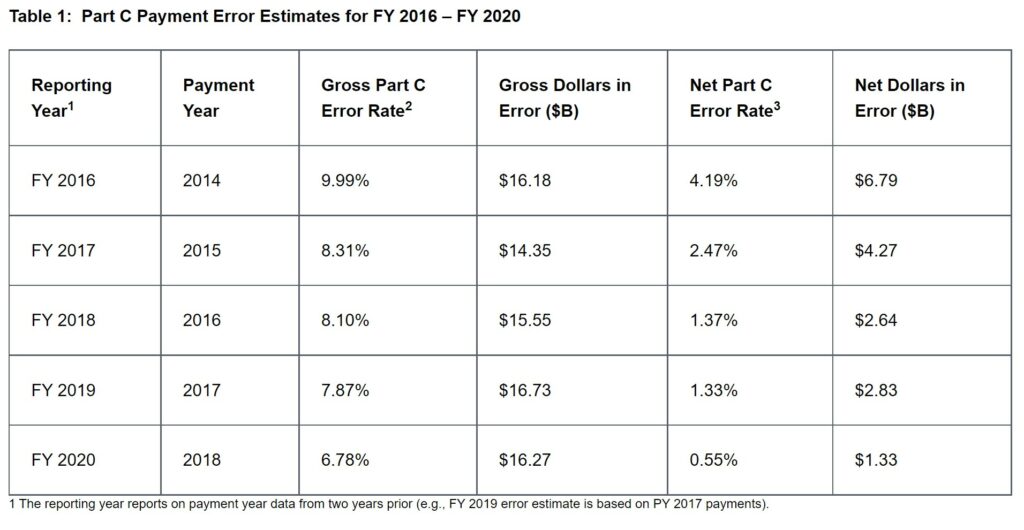

CMS submits an annual Part C improper payment estimate (Table 1 [below]) taken from the sampling of data (estimation methodology) to Congress in the Agency Financial Report (AFR). The report highlights important details about the payment error rate and provides useful links and resources to learn more.

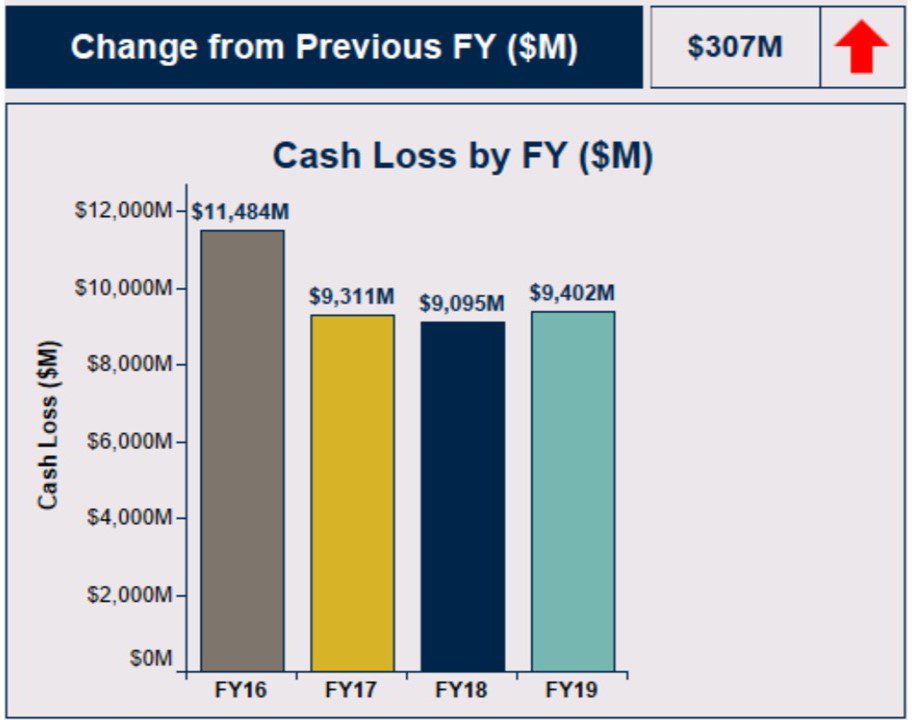

The Cash Loss by FY ($M) in the OMB Supplemental Data Call (above) is taken from the Improper Payment Report (IPM) as shown below in the Part C (Medicare Advantage) Error Estimates for FY 2016 – FY 2020.

Part C (Medicare) Payment Error Rates from FY 2016 – FY 2020

The Gross Part C Payment Error Rate steadily declined from 9.99% in FY 2016 to 6.78% in FY 2020. Table 1 presents results from the Part C Payment Error Estimates for FY 2016 – FY 2020 as taken from batch sampling.

Sampling Detail Explained: “The sample for each payment year is a stratified random sample of 930 beneficiaries, with 310 beneficiaries selected from each of three risk score groups: low, medium, and high. The eligible cohort consists of beneficiaries who were enrolled in contracts active in January of the year for which risk adjustment payments were made. The data collection period for each calendar year Part C IPM sample spans January 1 through December 31 of the previous year.”

Recent Sampling Results:

From Modern Healthcare, we get an update on two more Medicare Advantage plans or offerings caught with their hand in the cookie jar.

– In April 2021, the OIG recommended that Louisville, Kentucky-based Humana return nearly $200 million to CMS. The OIG found. Humana charged taxpayers for care its Medicare Advantage members did not need in 2015.. This was the largest gap ever recorded between reported care costs and the actual price of the treatments (OIG report).

– A month later, the OIG issued a similar report recommending Indianapolis-based Anthem return about $3.5 million to CMS after finding that the insurer miscoded more than half of its Medicare Advantage claims which resulted in inflated payments. The OIG declined to comment on CVS Health’s ongoing audit.

Similar to other Medicare Advantage programs, Aetna’s Medicare Advantage reimbursement is based on regional trends and utilization in traditional fee-for-service Medicare. The adjustments are based on policyholder’s risk scores determined from there health. A patient with chronic healthcare conditions such as cholesterol, blood pressure, obesity, etc. has a higher risk score. The government adjusts payment to each Medicare Advantage plan according to the risk scores determined by the insurance company.

Payment based upon risk assessment is meant to incentivize plans to cover all Medicare-eligible people, regardless of risk rather than cherry-pick the healthy to reduce payouts. Recent whistleblower lawsuits allege health plans have been adding unnecessary codes or inflating scores to increase the health-risk allowing them to be eligible for more money.

It is the numerous and/or additional risk assessments made by the plans which are being disputed by CMS. By sampling the medical findings of Aetna, Humana, etc., and finding errors in the sampling; CMS can determine a percentage of medical assessments which may be erroneous.

The companies dispute the findings, how they are found, and push for the CMS to review all of the coded assessments to identify each and every erroneous finding to date. It has been a stand-off between insurance companies and the CMS. These findings are what fueled the commentary by Nancy Altman about the $30 billion in over charges more-than-likely owed to the US.

What Medicare Advantage companies proposes (CMS reviews all the data rather than sampling) is the opposite of what is done in other samplings (ie. parts and data) when errors are found are found by companies with suppliers. In which case upon reporting the errors or rejected parts, the issue lies with the supplier and not the buyer (Medicare) of the service, material, or components. When errors are found during the process or in inspection, the entire lot is rejected and the supplier inspects the lot for more flawed parts. Payment is withheld until the parts are reviewed and found to be within specification. Too many occurrences and a supplier can be decertified and/or placed on probation which may require 100% inspection.

Risk calculations are made from the previous year’s patient evaluations and updated in the present year.

The Medicare Advantage companies have backed themselves into a corner by over assessing risk. If there is no or a lesser medical issue, they have shown a degree of medical incompetency or are deliberately mischaracterizing a finding. The CMS must force them to refund monies paid to the MA companies and also force the accuracy of charges. I stop short here.

Health and Human Services is applying Root Case Analysis to guide and determine the resolution for supposed clerical and administrative errors causing over-payments to the companies providing Medicare Advantage.

Is Sampling Accurate?

It is not unusual to take a sampling of data to test for accuracy or to check parts to see if they meet specification. In lot-type of manufacturing, the Quality department will do a random sampling during and after completion of the lot. It will also check critical dimensions pre-startup of production to insure the parts are being made to specification. The data found points in a direction to which further action must be taken to find the “root” cause. Data gathered points in a direction and an analyst must do the additional study to make sure the findings are accurate. In this case SMS/OIG has done precisely the review and is pushing Medicare Advantage companies to fix their errors.

Denied Care or Reimbursement

The other route to increased profitability. Medicare Advantage uses a capitated payment model which pays a fixed amount per patient for a prescribed period of time. There is an incentive to deny access to care or deny reimbursement to patients for health care services in order to maximize profits. The result of which is increased profits for managed care plans. Since payment is already predetermined for an individual from the prior year, a plan can cut cost by denying care as being presently unneeded. HHS Office of Inspector General will be issuing a report in 2022 covering the denial of services.

Few people will appeal a denied claim or reimbursement. In which case, a denied claim leaves insurers free to avoid repayment (New York Times) resulting from the denial. Those who do appeal will often succeed. Historically, approximately three-quarters of appeals succeed on appeal at a first level of review.

Going to Medicare Advantage

As I have mentioned previously, signing up for traditional Medicare – MediGap, and Part D Pharmaceutical coverage must be done in the first year of eligibility. Leaving traditional Medicare and MediGap for Medicare Advantage in the first year or later can be problematic if one decides to return to traditional Medicare and MediGap. While Medicare will accept you back, you may be denied MediGap coverage or coverage for other conditions while not covered by MediGap.

Primary care doctors Kevin Burke, MD, and Deepak Azad, MD are members of a delegation sponsoring resolutions to explain the difference between traditional Medicare and Medicare Advantage making the difference more transparent upon enrollment. They believe Medicare should not let people with serious health risks enroll in MA plans from the beginning.

Medicare Advantage Benefits the Younger and Healthy

Part C Medicare can cover a broad array of health services at low cost when one is healthy. That same broad array of health services can become expensive when one gets sick. Out-of-pocket costs can soar. And getting out of a MA plan can make coverage even less affordable as I pointed out above.

I have covered an array of issues in this post. Medicare Advantage companies milking Medicare with over-charges, examination of yearly over-charges, briefly explaining the difference between traditional Medicare and Medicare Advantage, re-enrolling in traditional Medicare, MA denying coverage and payments, not allowing people with serious conditions to enroll in MA, etc.

I just scratched the surface . . .

Well yeah, but Medicare Advantage was probably what the Reagan Democrats had in mind back in 1986&87, when they repealed the 501(c) tax exemption for commercial nonprofit health insurers (1986) and then providers the following year. Once those pesky nonprofits were out of the healthcare system then the for profits could run wild and take over the entire healthcare system. It would just be a matter of time.

I am extremely happy with Medicare Advantage.

Kaiser provides one-stop shopping for me. I never deal with any other parties. Never. Drugs-Kaiser. Urgent care visits (2)-Kaiser. Surgeries (4)-Kaiser. Chemotherapy (6 months)-Kaiser. Eye exams-Kaiser.

My total out-of-pocket costs over 6-1/2 years are about $3500.

dB

Your endorsement does not make it any less a ripoff. No worries, your time will come.

That actually sounds better than my Blue Cross Advantage plan

here in MA. But I did have open heart surgical valve replacement

shortly after joining up, which is six-figure surgery, and I did

not even see a bill, so I can’t complain. (It is fair to note that

this might well have been the case with ‘ordinary’

Medicare, especially in the ACA era.)

Us elderly men tend to have very

costly medical needs.

Fred:

I have had this disorder since I was in my early thirties. Three times all involving hospital stays. I just pack a suitcase, go to the ER, and tell them what I have. They seclude me, admit me, and the Greys Antinomy crowd shows up the next day. I remain a stop for show and tell till they start the infusions. If the $30,000/dose Rituxan did not work, it would be N-Plate.

It will get me one of these times.

When I checked this thread again the pop-up ad was for myhealthpolicy.com for shopping Medicare Advantage. The data collectors driving the pop-up ads seem to know more about the web page that I am on than they know about me, but do they have an aware sense of irony.

At least it is medical rather than auto or home owners insurance.

I just signed up for Medicare. Now I’m dealing with which way to go. My local BC does not offer the old Plan 65 plan that filled the gap. All they offer is Medicare Advantage. None of them are really good when you understand the max out of pocket. Frankly, the options are not much better than what I had under the ACA. Sure, I can get a plan that won’t cost me beyond my MC coverage cost, but I best not go out of state and need health care.

Few people really understand just how F’d up our system is. Choice? Just another word for “middle man” business structure. Getting a piece of the action.

Having to go through the signup process annually? How is that a desirable thing? Of course, I’m confident the industry counts on people just giving up and letting the signup happen automatically. That is no choice is actually being made past the first choice.

Not to mention the size of the issue for a provider’s office having to deal with all these different plans. An auto dealership has less work dealing with banks when selling a car. A realtor has less work dealing with banks when helping a person get financing.

My first desire was to go with a medi gap plan, but right now I can’t find anything that doesn’t suggest the price will rise significantly as I move past age 65.

Copays? Just a fake out for the average citizen. They think that $20 copay is a bargain and all that matters.

It just sucks.

Daniel:

I would urge you to go MediGap and Part D the first couple of years till you figure things out. Premiums may increase over time but those premiums will not be a much as the copays and deductibles in Advantage over time. As you age, your costs will increase in Advantage.

https://www.aarpsupplementalhealth.com/content/dam/ole/MedSuppDocs/BenefitsTable/StatePlanVariations/FA730_121_MA_Plan_%201A_wc.pdf

I have Plan N which costs me $140/month plus $32 for Meds. It pays all of my deductibles and I can take that anywhere for care. Advantage is not that liberal.

Thanks Run for the suggestion. Your monthly noted is plus the medicare part A?

Daniel:

You are welcome. If you go to Medicare Advantage in the first year and have pre-existing conditions, you could lose access to MediGap if you find you do not like Medicare Advantage. You most likely will have to answer questions about you health and anyhting determined to be a pre-existing condition can be denied coverage or you could be denied MediGap insurance altogether. With MediGap, Part D and Medicare; you can go anywhere for care in the US. You still have the $203/month to pay regardless if you do either plan. Plan N will cover all Part A deductibles and aslo has 60 days of hospital coverage without copay. MA can have copays after 4-5 days.

This covers Part A and Part B.

I was hospitalized for 3.5 weeks with ITP till Medicare approved Rituxan infusions for me. My payment was very small ( I forget). My last bout included 4 days in the hospital and 4 infusions of Rituxan + plus two IVIG. I paid $20. Your costs in traditional Medicare will be in premiums + Part B deductibles. You may have $20 copay for doctor visits or a copay for ambulance dependent upon which plan you take.

Have you talked to AARP? Have you talked to Dan?

Thank you again Run. No, haven’t talked to AARP but have been reading stuff they have sent. Lot of other reading. Haven’t talked to Dan either. I’ll be checking it all out.

When I became eligible for Medicare about 10 years ago, a couple of

years before Mrs Fred, I looked around at options here in Massachusetts.

I was told (by ‘experts’) that in our state (*), Medicare Advantage was the

way to go, for the sake of simplicity. At that time, Mrs Fred had been

dealing with medical coverage for her retired mother, who was a

retired NJ teacher on traditional Medicare with supplemental

coverage. She spent much time on the phone dealing with

‘coverage issues’ regarding that supplemental plan.

So, I went with Blue Cross Advantage; she later

joined me in that plan, and have had no problems.

* – Elsewhere ‘Medicare Advantage’ would probably

not be ‘advantageous’ at all, I was told.