The decline in new jobless claims stalls, as the “delta” variant is ready to strike the unvaccinated States

The decline in new jobless claims stalls, as the “delta” variant is ready to strike the unvaccinated States

New jobless claims continue to be the most important weekly economic data point, as increasing numbers of vaccinated people and outdoor activities have led to an abatement of the pandemic, with both new infections and deaths at their lowest point since the onset of the pandemic in March 2020. I’ll have more to say on the intersection of the pandemic with claims in the conclusion.

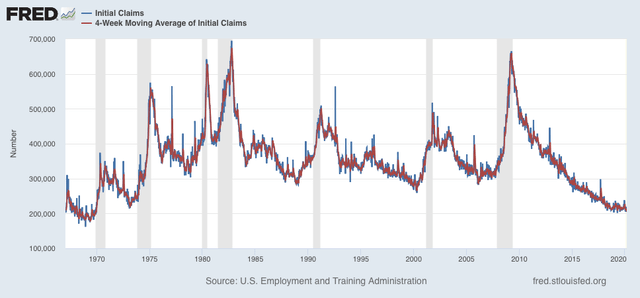

My final objective is for claims to average 325,000 or below, which would signify a return to normal expansion levels in the past 30 years.

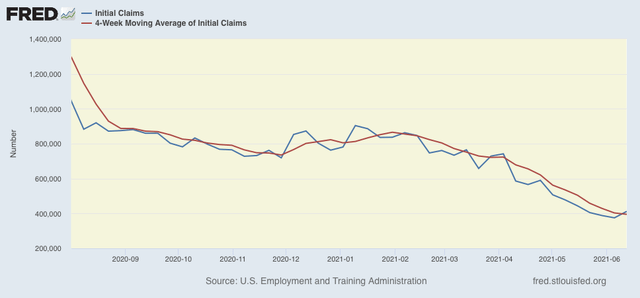

Turning to this week’s report, new jobless claims rose 37,000 to 412,000, the first increase in weekly claims in nearly 2 months. The 4 week average of claims declined by 8,000 to 395,000, a new pandemic low. (Note that I have discontinued comparisons of non-seasonally adjusted claims, as the period of lockdown distortions YoY has passed.)

At the peak of the pandemic lockdowns, new claims were running 6 million to 7 million per week. Here is the trend since the beginning of last August:

From late February into May, claims had trended down an average of roughly 100,000 per month. In the past few weeks, this has slowed to a rate of decline of roughly 50,000 per month, indicating that the “opening” of the economy is getting nearer to an endpoint. This also implies a slowing down of net job creation from the last 3 months’ levels. At their current level, claims are consistent with early mid-expansion levels in the past:

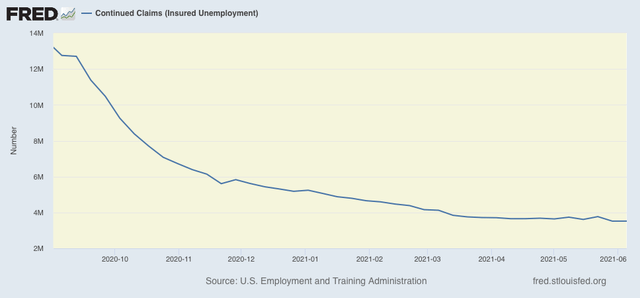

Continuing claims, which are reported with a one week lag, and lag the trend of initial claims typically by a few weeks to several months, rose 1,000 from last week’s revised pandemic low of 3,517,000. Still, over the past 2 months these have only declined about 7% from roughly 3,750,000:

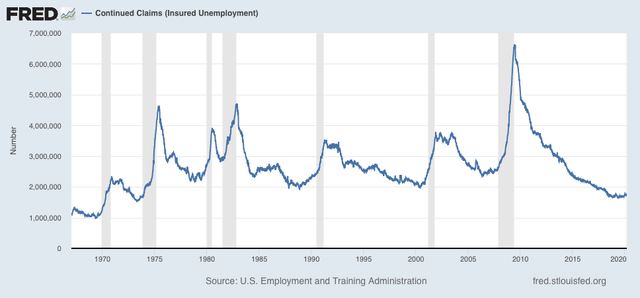

The long term perspective again shows that these are equivalent to the worst levels of most previous recessions, or early in the expansions, versus at 2,000,000 or below later in strong expansions:

I want to conclude with some remarks on how the new “delta” variant of COVID, together with the premature “victory” declaration in many States with low vaccination rates, who have also terminated enhanced unemployment benefits, may change the picture for the worse from here.

I wrote last week that “I think we are going to see two tracks going forward from here, as near-normalcy does return to the more vaccinated parts of the country, while attempts to return to normalcy fail in the laggard regions.”

Across the Deep South and most of the interior West, plus West Virginia, Indiana, and Missouri, less than 40% of the population is fully vaccinated. Most likely less than 50% of the population has received even one dose. Over the next 6 to 8 weeks, these States are ripe for a serious outbreak of the highly infectious new “delta” variant of the disease. Many people in those States are probably going to retreat to their prior, cautious behaviors to protect themselves – and that means decreased economic activity and increased layoffs in those States. The cutoff in pandemic benefits will further curtail spending in those States, which will also lead to increased layoffs.

In short, I am even more convinced that the US is heading towards 2 separate tracks: one of growing vaccinated regions and one of stagnating or renewed contraction in the unvaccinated regions.

i’ve been watching daily new case numbers in the UK, where the delta variant has now become dominant; they’ve more than tripled in the past month, despite their vaccination rate that’s equivalent to ours…so how can you figure that even 70% vaccinations will protect the US?