We all expected inflation to arrive: now it’s here

We all expected inflation to arrive: now it’s here

This morning’s report on April inflation confirmed what we already knew: inflation, both from the demand and the supply side, was coming. Now it’s here.

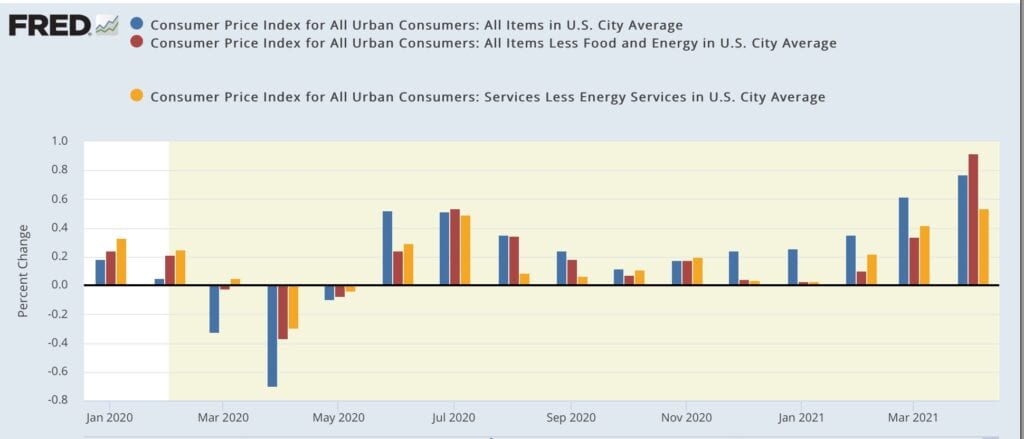

First of all, take the YoY numbers with a grain of salt. Last April saw actual price declines in the teeth of the worst of the pandemic deaths and lockdowns. Here’s the monthly %change since the beginning of 2020 in total inflation (blue), core, i.e., less food and energy (red), and less energy only (gold):

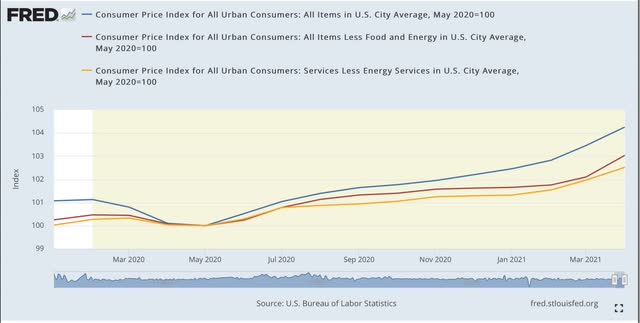

So let’s delete last April, and look at the price increases in the 11 months since last May:

Total prices are up 4.3% since then, but only 3.0% in the “core” groups, and 2.8% less energy. That’s not enough to excite the Fed into action just yet.

As I’ve previously pointed out, typically there’s no problem in the economy till CPI excluding gas prices exceeds 3%, and per the above, we’re not there yet.

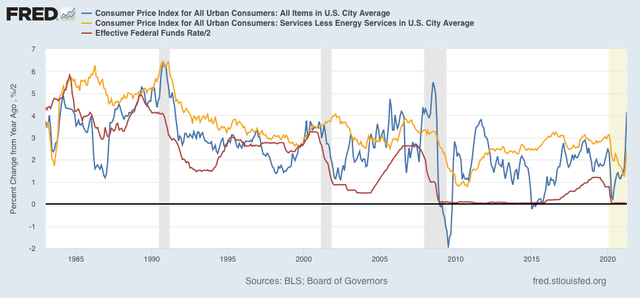

Further, below I show total inflation YoY (blue), inflation ex-gas (gold), and Fed funds rates (red, /2 for scale). As shown there, spikes in inflation for a month or two typically haven’t caused the Fed to raise rates (see, e.g., 1995, 2003, and 2013):

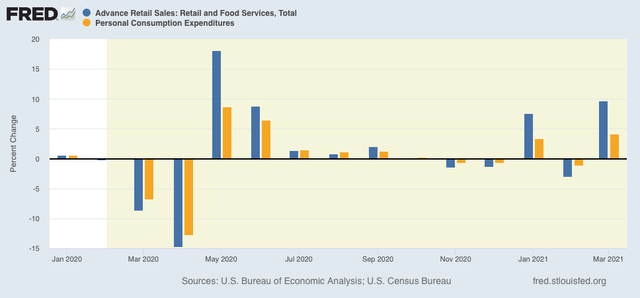

Last year, the demand-side effects on spending caused by stimulus payments petered out after a few months:

I expect the same to be the case this year.

So the question is whether the supply side bottlenecks persist enough to spook the Fed. While they might start making noises about raising rates if we get another number like this next month, I think it will take at least two more months of big jumps in prices to actually move them into action.

Reminds me that I need to check the air pressure in my tires. Since the pandemic began driving miles have gone way down along with checking air and liquid levels in the truck. That is changing now that it has been two weeks since my 2nd dose of Pfizer. Adjustments will be required getting back to prior normal.

Normal is relative; not my relative, but certainly somebody’s relative. How many new normals have we had so far in this century? Was post Volcker Fed a new normal too? Post 9/11 was life changing for air travel and all international travel as well. Post 2008 financial collapse was both a new normal and a new abnormal. So, post-pandemic, then will we be getting back to some old normal and, if so, which one? Rather than old new normal, will there be another new new normal instead?

I would be very surprised if the new normal is not quite different than the normal of 2019. Seeing friends for the first time in a year is one thing. Finding the grocery shelves stocked with all the products, brands, and sizes there used to be is something else.

I won’t be happy until I can buy my favorite ice cream instead of seeing an empty shelf and buy an 8 or 16 oz. can instead of a #10. Talk to me about inflation when that happens. The pandemic and its after effects are not done by a long shot.

@JaneE,

Where do you live?

Here in central VA there have been few shortages in groceries. Toilet paper suffered a run early on, but even that leveled out after a few months. Ice cream has not been a problem with Edy’s on sale frequently at Kroger’s and sometimes Publix. I live in eastern Henrico County, so there are no Whole Foods or Trader Joe’s here. Also, it has been a long chilly winter here, so demand for all ice cream has been low. Some stores put limits on how much beef that a customer could buy at one time, but chicken and pork have been in good supply most of the time during the pandemic. Right now we have a gas shortage, but that is hackers not the pandemic.