New jobless claims continue to decline

New jobless claims continue to decline, just above the pandemic low

New jobless claims are likely to the most important weekly economic data for the next 3 to 6 months. They are going to tell us whether my suspicion that, as a critical mass of those vaccinated is reached, there will be a veritable surge in renewed commercial and social activities and attendant consumer spending, leading in turn to a strong rebound in monthly employment gains considerably greater than the roughly 250,000 we saw in February, is correct.

This week, the *relatively* good news continued. On an unadjusted basis, new jobless claims declined by 47,170 to 709,548. Seasonally adjusted claims declined by 42,000 to 712,000, only 1,000 above November’s pandemic low. The 4-week moving average declined by 34,000 to 759,000.

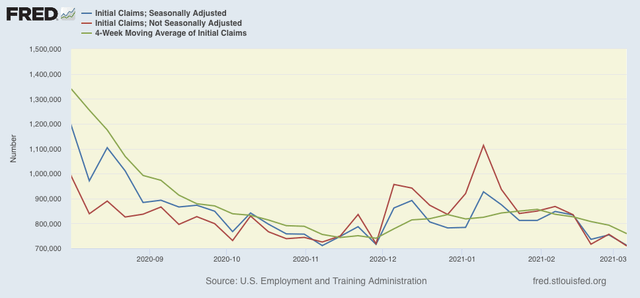

Here is the close up since the end of July (these numbers were in the range of 5 to 7 million at their worst in early April):

While both adjusted and unadjusted claims remain above their worst levels at the depths of the Great Recession, it is safe to say that the outbreak-related wintertime surge has abated.

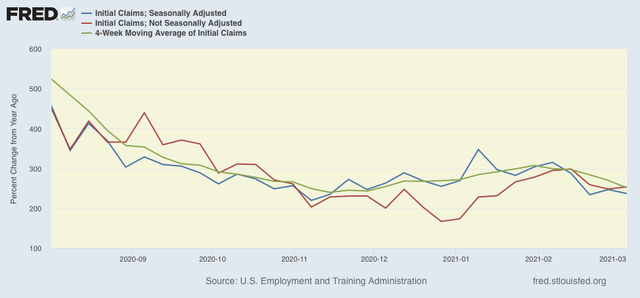

Because of the huge swings caused by the scale of the pandemic – typically claims only vary by 20,000 or less from week to week, but since the start of the pandemic, swings of 50,000 or 100,000 per week have happened as often as not, recently I began posting the YoY% change in the numbers as well, since they will be much less affected by scale. As a result, there is less noise in the numbers, and the trend can be seen more clearly:

This is at levels last seen in November and December, and confirms that the recent increase in new claims has reversed.

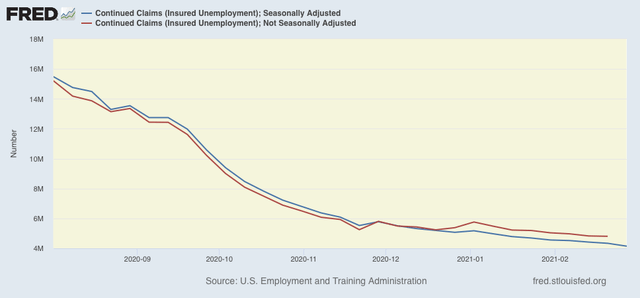

Meanwhile continuing claims, which historically lag initial claims typically by a few weeks to several months, made new pandemic lows yet again this week. Seasonally adjusted continuing claims declined by 193,000 to 4,144,000, while the unadjusted number declined by 263,642 to 4,584,706:

Nevertheless seasonally adjusted continued claims remain at levels last seen in late 2010.

For the last several weeks, new jobless claims have validated my belief that with spring beginning in the warmer parts of the country, and consequent increased outdoor activities, together with an ever-increasing pool of vaccinated people, the worst of the job losses would be behind us.

Now that further COVID relief has also been passed by Congress, I expect to see a continuing strong increase in consumer spending, which in turn will drive fewer layoffs and larger monthly gains in employment. Let me set a few objective targets: I am looking for new claims to be under 500,000 by Memorial Day, and below 400,000 by Labor Day.

Here’s hoping I’m right.