Canceling Outstanding Student Loans in Default

Some State AGs Take Action

Seventeen State Attorney Generals signed and sent a letter to Congressional leadership (Schumer, Pelosi, McConnell, McCarthy) calling on Congress (Friday February 19) to pressure President Joe Biden to cancel up to $50,000 in federal student load debt for borrowers as a part of pandemic relief. The AGs write:

“As the Attorneys General of Massachusetts, New York, Connecticut, Delaware, the District of Columbia, Hawaii, Illinois, Maryland, Minnesota, Nevada, New Mexico, New Jersey, Oregon, Virginia, Washington and Wisconsin, we write to express our strongest support for Senate Resolution 46 and House Resolution 100 calling on President Biden to use executive authority under the Higher Education Act to cancel up to $50,000 in Federal student loan debt for all Federal student loan borrowers.

Because we are responsible for enforcing our consumer protection laws, we are keenly aware of the substantial burden Federal student loan debt places on the residents of our states.”

Broad cancellation of Federal student loan debt will provide immediate relief to millions who are struggling during this pandemic and recession, and give a much-needed boost to families and our economy.

The current options for borrowers have proved to be inadequate and illusionary. For example, 2% of the borrowers applying for loan discharges under the Public Service Loan Forgiveness program have been granted a discharge. In addition, efforts by our Offices to obtain student loan discharges for defrauded students – to which students are entitled under existing law – have been stymied by the U.S. Department of Education for years.”

Just how serious is this?

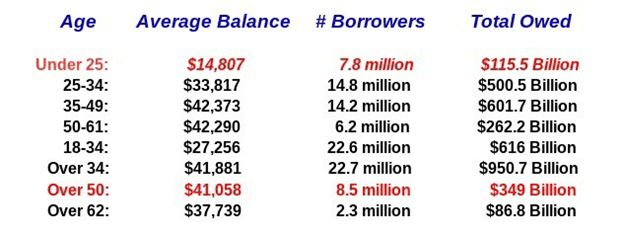

Alan Collinge of the Student loan Justice Organization did alternate calculations of student loan by age to arrive at a more definitive debt by age bracket which had not been displayed. The numbers in red represent totals (above) for the brackets he wanted to define. So it goes;

– There are ~7.8 million under 25 years of age student loan borrowers who have an average of $14,807 of student loan debt. This equates to a total of $115.5 billion

Let’s contrast this numeric to the other end of the age spectrum or those over 50 years of age.

– There are more people over the age of 50 with student loans. Approximately 8.5 million people owe on average $41,058 each. This equates to a total of $349 billion.

Older people outnumber the younger people with student loans (over 50 versus under 25) in this comparison and they owe far more. Just keep this in mind as we read further.

What Do the Politicians and Newscasters Say?

The popular meme has been, younger people have incurred student loan debt and they should pay it off in entirety like “we” did. If we look at the numbers again, most of the people over 50 have a good chance of going into retirement with student loan debt and may have their SS or SSDI supplement payments garnished.

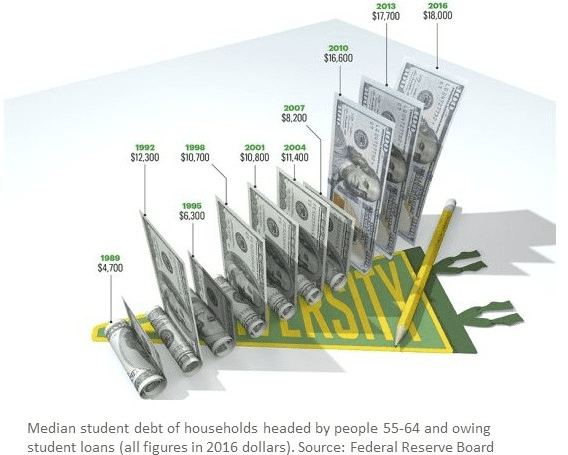

The percentage of families headed by someone 50 or older with student loan debt has more than tripled between 1989 and 2016. The AARP Public Policy Institute reports student loan debt has increased from 3.1 percent to 9.6 percent. Since 2004, student loan debt among those 60 and older has also grown the fastest of any age group. The 50-year-old adults on the brink of retirement who are carrying more debt than the 25 years-old graduates. It sure does not look like the “like-we-did crowd has done so well.

In 2018 (latest numbers I can find[see chart above]), the 55 – 64 year old cohort has a median student loan debt of $18,000 which is up from 2010.

As I said above, Social Security benefits and Social Security Disability Insurance (SSDI) payments can be garnished to pay child support and alimony; court-ordered restitution to a crime victim; back taxes; and non-tax debt owed to a federal agency, such as student loans or some federally funded home loans. The garnishment rate for defaulted student loans is also 15 percent. The only caveat being student loan debt garnishment, unlike tax garnishment, can not leave you with less than $750 in benefits a month.

What Is the Impact?

I think I searched many different places over the internet to see if I can find sources for the number of people having their Social Security or income garnished. The only data is from 2015 which I thought is kind of odd. I can believe higher numbers exist and are not being publicized. This is the data I could find:

In fiscal year 2015 almost 114,000 borrowers age 50 and older had portions of their Social Security benefits seized to repay defaulted federal student loans, according to a 2016 GAO report. (Private student loans are not subject to Social Security garnishment.)

Called offsets, these Social Security repayments increased more for Americans 50 and older than for younger borrowers. Between 2002 and 2015, offsets jumped 407 percent among 50 to 64-year-olds and 540 percent for those 65 and older.

Most of the people who had their Social Security payments appropriated due to student loan delinquency were receiving disability benefits rather than retirement or survivor benefits (GAO).

The problems are not just confined to the younger adults as many make it out to be the issue. With this issue comes decreased economic productivity.

Delinquent student loans are the gift that keeps on giving. Their giving started with the passage of a series of laws beginning in 1972 which made it impossible for students to declare bankruptcy. Then newly elected Senator Joe Biden began working to eliminate any means of reducing debt from student loans or declaring bankruptcy.

The 2005 Bankruptcy Abuse Prevention and Consumer Protection Act was his best effort

Walking Uphill Both Ways and Responsibility

In 2018, Joe Biden while thinking about running for the presidency had this to say to Millennials while talking to Patt Morrison of the Los Angeles Times (Newsweek print) to promote his new book.

“The younger generation now tells me how tough things are—give me a break. No, no, I have no empathy for it, give me a break. Here’s the deal, guys, we decided we were going to change the world, and we did.”

The tune changes in 2020. Here is Biden speaking to youth while accepting the nomination;

“I hear their voices and if you listen, you can hear them too. And whether it’s the existential threat posed by climate change, the daily fear of being gunned down in school, or the inability to get started in their first job — it will be the work of the next president to restore the promise of America to everyone.”

And now after winning the presidency, the thought of a $50,000 or complete loan forgiveness is slipping off of the table.

He is not the only one who has had an attitude for the issues of the younger generations and student loan debt. I went to a Garden Party in Brighton, Michigan for Senator Debbie Stabenow disguised as an old silver haired white guy (didn’t have to do much to pull this off). I had a question to ask of the Senator about student loan debt and what she was doing to help students as she sat on the Senate Financial and Banking Committee. Old white guys are safe bets to talk to, yes?

I got my chance and asked and received a litany of excuses and a reason of “not being in the majority.” Today, Dems are the majority and I intend to ask again. I also want to know why she would make a statement of their having to learn Social Responsibility by being challenged on student loan debt.

Eighteen – year-olds are signing for student loans to pay for college. They have little understanding of the legal ramifications of the loans. Many are trapped for a life time of payments with no way out. And the servicers often times do not understand the loans either. The US bankruptcy laws are unforgiving and these young adults are not like our previous president who goes through multiple bankruptcies because the law allows it.

Alan’s additional calculations (above) breaks out debt by age group. He makes a point of the age group older than 50 having more student loan debt than those 25 and under. In comparison, younger cohorts have lower debt when compared to the older cohort.

Biden and Stabenow are intent on punishing younger cohorts for debt and supposed irresponsibility. At the same time larger numbers of older people are going into retirement with higher debt which they will likely not pay off and there is no relief. If they default, they will have 15% of their skimpy Social Security benefits taken above the $750 to payoff loans. The loans accumulate penalties, additional interest, and are being collected by private collection agencies.

Political Environment Today

Biden is reneging on $50,000 loan forgiveness and is hesitant on paying off $10,000 of student loan debt which is a pittance. The $10,000 will mostly go to interest and penalties before touching principal and collection agency fees. That is the way if works for forbearance, etc. You pay all the interest and penalties first. If you are going to only do the $10,000, then kill all the penalties and accumulated interest first and apply the $10,000 to principal.

My background? As a dad, I was right there with my three plotting what schools they would go to, grants, scholarships, loans, etc. they would have including the student plus loans. The only words of wisdom I offered were; “if they are offering scholarships and grants, they want you. If they are offering Stafford loans as well as other loans, say thank you and walk on to the next school.

The entire student loan debacle is BS.

Older people outnumber younger people with student loans, and they owe far, far more. | by Alan Collinge | Medium, Alan Collinge, Student Loan Justice Org., December 25, 2020

Attorneys General Press Congress On Student Debt Cancellation, Citing ‘Defrauded Students’ | Talking Points Memo, Zoe Richards, TPM, February, 19, 2021

To make student loan debt fair, it too should be dischargeable in bankruptcy. Thanks, Joe, for this gift to your generation! It used to b, but Biden et al carved it out in the tightening of bankruptcy laws.

To me, all student loans should have non-capitalizable interest (it’s really immoral to charge interest on interest, and should be legally forbidden, but even more so on student loans). Student loan interest rates should be pegged to the lowest Treasury rates. Some loans, such as mine, are at really high rates from the 1990s. This is wrong.

If we really think, as a society, that people need a college education, then we should get rid of all student loans.

Carol:

I agree. If we were to charge interest, it should be less than 3%, not applied if in forbearance, and forgiven after a period of time. Education has become the wild west of funding, returns from it, and ultimately not leading to an equitable job.

Carol:

There is a lot going wrong with student loans along with the predators who service the loans and benefit from those loans.

I think we should forgive $10K to those who stupidly attended for-profit schools and have no piece of paper to show for it.

I have very little sympathy for people over 62 who owe student debt. You had 40 years to pay it off.

Dave:

I think penalties and interest on those penalties and then interest on the interest accumulated from the penalties is something that is not tolerated in regulated loans where people are allowed to declare bankruptcy even if they were bankrupt before. These are usurious practices disallowed by the UCC governing business practices and for that matter personal loans involving banks and people. You are being ridiculous with your accusations.

QE for all student loans. Have the FED buy them all, reduce the interest rate to zero, and increase the term to 100 years.

Then work on making education affordable.

well, here we go again.

education has been made unaffordable*. that’s a shame. but if the country in its wisdom decides that education is not worth the cost to it, then i think we might just consider staying out of school. that might get the colleges to put pressure on the government to find a way to make college affordable. i had a friend in college who decided it was not worth it for him. he became a plumber and probably made three times as much money as i did by sticking it out even though i hated it. and the funny reason i hated it is because i thought it was supposed to have something to do with education, and frankly never saw a sign of education the whole time i was in college.

that said the real culprit here is the privatization fad that took over the country some time between clinton and bush. and the second culprit was the crime of making student loans not dischargable through bankruptcy, and the third culprit was not prosecuting the fraud schools… which might have led to a gray area… i’d have called my first college a fraud… until i found out all the rest were pretty much the same.

pretty sure this will all sound a bit crazy to most of you… buti think there is at least an element of insanity in the way we as a culture worship education… or at least having a degree.

please note: i said “the way”.

*it used to be that only the rich went to college. the country got along okay. then the G.I. bill made college affordable, and for a while it was a good investment. a reasonable education could be had, and good pay could be expected as a result. then the NDEA act intended to build on that success… andmay have succeeded for awhile. but about that time colleges became cattle drives, “education” was basically purina chows, and … well, i think the taxpayers gave up on it when all us college students started causing trouble… about civil rights and vietnam. etc. etc.

employers kept requiring degrees, but only as a weeding-out tool. no one expected a college degree to mean much….except “mostly harmless.”

as for interest on interest

suppose i lend you a hundred bucks for a year and charge you 3% interest. at the end of the year you still need a hundred bucks and another three bucks to pay the interest. so i lend you a hundred and three bucks and charge you 3% interest on that.

you can finish the thought yourself. if you do it right you might wonder what the difference is between re-lending and charging interest on interest.

some great ideas are not well thought out.

it is true that banks play games with interest and late fees and penalties that amount to theft, but as long as they write the laws…

to make forgiveness of student more palatable to those who are opposed to it:

concentrate on provider fraud: cancel debts upon reasonable showing that provdiders (of either the promised “education” or of the servicers of the debt) engaged in fraud or failure to provide the advertised education/ job opportunities).

prosecute the frauds.

make student debt subject to the bankruptcy laws… preferably the ones in place before recent moves to deny protections of bankruptcy to all but Donald Trump.

maybe make the case clearly and in public that those who “paid for” their student loans may, we hope, have gottent the benefits they paid for, while many of those in default did not get the benefits they paid for.

envy is a sin. especially when it is based on a lack of knowledge.

Hi Coberly:

When I was talking about Biden, he had this to say back before he “wanted” to be “The Pres:”

He and many others believe it is just the younger crowd who are “whining” about help with student loans. And believe me, this is what Biden has been focused on since 1972. Here is how it all started (could not include this in my post as it was already too long).

There never was a problem of such magnitude. Biden at that time was hawking for the banks with MBNA being one of his benefactors and to which his son got a job with after college. There has been a progression of laws passed since then leading up to 2005 which was a bad year also.

What those laws have done is create a safe haven for student loan providers outside of regulation. Once you sign those papers for a student loan, you lost whatever protection under the law that even a scam-artist like Trump is protected by them. If you are 18 years of age, you are not.

So we have a Biden, Stabenow and other politicians saying the young need to have some social and fiscal responsibility; “ok and what-about,” the ~8.5 million who have an average $40,000 in student loans going into retirement. This group will have their SS garnished leaving them at least $750. Behind them is another 14 million 35 to 49 year oldswith an average of $42,000 in student loan debt.

Oh and the young crowd at less than 25 years of age? An average $Fourteen- thousand in Student Loans. Guess it wasn’t the young ones, heh?

Yes, some folks make more money becoming plumbers after high school than other folks do after college. So what? Many of us who went to college (and post-graduate school) didn’t see plumbing as an attractive and rewarding job for us. Remarkably enough, it isn’t always about money. Sometimes life satisfaction can’t be monetized. Yeah, I could have gotten an MD instead of a PhD and made more money. But I see physicians as highly paid servants. Yes, we need these servants, but that doesn’t mean I need to be one or would feel as fulfilled that way as I have being a research scientist/professor. It is deeply silly to blame colleges and universities. Higher ed is personnel-intensive.The student loan market in the US is a disgrace. All student loans should be dischargable through bankruptcy. That would put the risk where it belongs–on the lenders. But don’t blame students for choosing college. That’s just cheap and lazy.

Joel

I’m glad school worked out for you. It didn’t work out for me, but it took me until my second year of graduate school to realize it was not going to work.

Before that I met many, many people who hated school but felt they had to get the degree to get a job. Probably they were right, but only because the system artificially demands the degree. There is something wrong with that system.

I realize there are plenty of decent and smart people who have college degrees, and even an education. I don’t mean to overgeneralize. I do mean to ask people to stop and think if going thousands of dollars into debt for an education they don’t want, and a degree that won’t work as advertised, is their only hope, and to question whether perpetrating such a system is wise national policy.

Joel

deeply silly. cheap and lazy. are these well formed arguments?

@Coberly,”deeply silly. cheap and lazy. are these well formed arguments?”No, of course not. No more well-formed than many of yours.Yes, of course people should think before embarking on higher ed. Whether or not they take out loans for college, there is the opportunity cost. But people should also think about whether or not they should get married, have children, join the military or begin a career in plumbing. College is no different or special as a life decision. Not meant to be a well-formed argument, either, just an observation based on a lot of anecdotes. I’m sure you understand.

Joel

no, i’m not sure I understand…much of anything. And I’m not sure you understand what I am trying to say. And I’m not sure it isn’t my fault. Usually I try to avoid words like silly, cheap, and lazy…for no other reason than they cut off thought…the user’s thought first, and the target’s thought as soon as they are spoken. But I have been told that my own failures to avoid sounding like an angry jerk are sometimes spectacular.

“of course” people should think… but they rarely have the facts that make thinking useful. if we as parents don’t have the facts, and we as citizens don’t have the facts… to help them make good choices, they will … we will, as a country… make bad choices.

you did well. you appear to think that therefore everyone should do well… without quite saying “they should have read the fine print.” and yet we have a student loan “crisis” or at least what appears to be a terrible human problem. I have offered some suggestions as to what I think we ought to do to solve it and avoid it coming back. They are not very different from some of the ones you mention yourself. But besides seeming, to me, to be suggesting that everything is okay with the way we “educate” children and drive them into bad schools and unending debt, you and others offer poorly thought out magic solutions… “end interest on interest” struck me as particularly magic thinking. I won’t go through the rest of what I thought was just throwing rocks at a store window… because it is not going to get us anywhere. Thanks for trying to enlighten me. Sorry it didn’t work.

Coberly:

I believe you are misunderstanding Joel. Cheap and lazy is referring to the people who blame students for the predicaments created by student loans. It is easy to do and those that do blame students 100% are lazy in doing so.

Interest on interest is interest on penalties which incurs more interest and you pay the interest on it. This also occurs when there is not even a penalty and when a student goes into forbearance due to lack of a job or illness or etc. The clincher here being when you can start to pay off the student loan again, the loan servicers have you pay off all of the interest or interest and penalties (if such is the case) first and before you pay off any principal. If you are in an Income Repayment Program and someone else makes a payment for you it will go towards the same. It may take you years before you get to pay principal. This is why much of this is a scam which does not occur with regular loans.

Run

thanks for helping me understand Joel. But interest on interest has been a standard feature of any loan i have ever seen. The trick is to keep loans current so any interest accrued to date is paid and payment beyond that amount goes to principle.

i have seen big banks defraud their customers by playing games with penalties and deeply fraudulent customer “service,” but the idea of interest on interest is as old as interest on debt.

otherwise the silly, cheap, and lazy comment seemed directed at me because Joel only read the part of my posts that made him upset and didn’t bother reading the part when i agreed with him and proposed solutions that wouldn’t rile the people who thought cancelling student debt was unfair to those who had paid their debts.

to reiterate: yes there is fraud. debts for fraudulent “services” should be cancelled outright and the fraudster prosecuted. normal bankruptcy protections should apply to student debt.. the old normal, not the “banker wins” new normal.

in addition i suggest a kind of truth in lending…beginning witht he way a college degree is sold to people who ought to be able to get reasonable jobs without one. that won’t happen until a generation of people not over-sold on “college” passes.. which may not be forever since the college scam is so profitabe to so many.

and yes, i know that many people get good educations and do well in life. the problem is those who do not, and are stuck with paying for it for the rest of their lives. colleges may be better now, or since i went to school, but they were not good then, and i know of a recent example of a perfectly respectable school admitting someone who they knew would not succeed, then flunked her out and sent her family a huge bill anyway.

Coberly:

You are still missing the point,

run

please try to explain to me carefully what the point is that i am missing.

somehow i keep thinking that you all are missing my point.

which is:

student debt ought to be dischargeable by reasonable bankruptcy.

student debt resulting from fraud in either the school or the lenders behavior should be dischargeable w/o bankruptcy, and the frauds prosecuted.

we, as a country, need to reexamine the role of “education” as it is being practiced now. if mass education is still valuable to us as a country, the country should pay for it. if valuable to industry, industry should pay for it.

if “only” valuable to individuals, the provider (school) and lender should assume the risk…. because betting on an education should not become a ticket to debt slavery for life. presumably the schools will learn their business and admit only students with a reasonable chance to succeed, and then work to aid that students success. remember these are kids. they can’t be expected to know what they are getting into.

wild eyed “solutions” that are…to put it practically…not going to be accepted by the electorate or the powers that be, only make it more difficult to address the current problems that I think we all agree are real, and not the “fault” of the kids.

– student debt ought to be dischargeable by reasonable bankruptcy. “yes”

– student debt resulting from fraud in either the school or the lenders behavior should be dischargeable w/o bankruptcy, and the frauds prosecuted. If it is truly fraud yes; but student loans today are legal-frauds (oxymoron?). They are legal because the government says so and they are fraudulent because they can not be discharged unless you die, become disabled, teach in a blighted area, do an Income-based-repayment plan. etc. All of these requirements are not required if take out a car loan. They just take the car and ruin your credit for 7 years. With a student loan they ruin your credit for life, garnish your salary and Social security and disallow you from federal programs such as job training.

– States used to fund higher and up to 60 percent (Michigan), Now it is much less and loans are required.

– The risk for the lender should come in the form of bankruptcy as the government loans are already funded through treasury bills. The government would have to pay the interest on these treasury bills ONLY.

– I do not know of an 18 year old who ever thought he would get stuck with a debt he could never get rid of.

Dale writes ” . . . you all are missing my point, which is: student debt ought to be dischargeable by reasonable bankruptcy.”

I agree with this point. I think you would find others here in agreement too.

But you posted this: “Before that I met many, many people who hated school but felt they had to get the degree to get a job. Probably they were right, but only because the system artificially demands the degree. There is something wrong with that system.

I realize there are plenty of decent and smart people who have college degrees, and even an education. I don’t mean to overgeneralize. I do mean to ask people to stop and think if going thousands of dollars into debt for an education they don’t want, and a degree that won’t work as advertised, is their only hope, and to question whether perpetrating such a system is wise national policy.”

Please explain anywhere in this you make your point that student debt ought to be dischargeable by reasonable bankruptcy. Take all the time you need.

@run,

thank you for trying to clarify. You did get my point exactly.

Joel

“take all the time that you need” sounds like snark to me. but it’s been a long time since i was a teen-ager. does it carry a different implication in the new days?

but it shouldn’t take any time at all, since you quote me making the point in your first sentence.

as for the rest of what you quote, what exactly is your problem with that?

or do you mean it as evidence that “i think (the part you left out of your quote) that you all are missing my point.”?

Joel

and in case you think that “in this” refers to only a few sentences in which I did NOT make the point in question, I refer you to my comment above, March 2 at 12:56. I am sorry I cannot make the same point every time I write something, Since you responded to my earlier comment, I suppose that is the one you were calling deeply silly, cheap, and lazy.

fwiw

it would help if you learned to read, and write, in connected sentences. when you just get excited and throw your used bananas at someone, it is hard for them to tell what it is that upset you.

it is true that by making an ugly face at a leopard you can sometimes bring him to a full stop. but it’s only because he is afraid he might get (variant) Cruetzfeld-Jacob disease from eating you.

2

coberly:

Did this gain you anything? I have not had time to explain to you yet but I will

run

“did this gain you anything?”

maybe (if I know what you are talking about). i take insults for a long time, but then, like my dog, I feel a need to woof back. just to show them how it’s done.

coberly:

My loveable Elkhound with lift his leg and pee on your foot.

Run

wouldn’t be the first time that happened to me. i would just rub his ears and tell him he was a good boy.

my current dogs are not what they used to be, but there was a time when we could walk through the valley of the shadow and feel no fear.

(big smile emoje here)

coberly:

You take the knuckle of your fore finger and rub inside his ear and he would lean into it and make groaning noise of pleasure.

Run

thank you for the explanation. i knew that already. Did you and Joel think I was DEFENDING the current student loan situation? if you did, i must be a much worse writer than i even imagined.

if you get me exactly backwards, there doesn’t seem much point in talking.

not much point in talking anyway if we aren’t going to [can’t] do anything about it. i thought i suggested a way to go about it that might be politically doable… but as said, not much point in it if no one understands a word I said.

To pay the interest on $1.1 trillion is $10 billion to $30 billion per year

@Dale,

“Did you and Joel think I was DEFENDING the current student loan situation?”

What part of “I agree with this point. I think you would find others here in agreement too” do you not understand?