January personal income and spending show how important government stimulus has been to keeping the economy afloat

January personal income and spending show how important government stimulus has been to keeping the economy afloat

This morning’s report on January personal income and spending shows just how important the stimulus packages enacted by the federal government both last spring and last month have been to sustaining the economy.

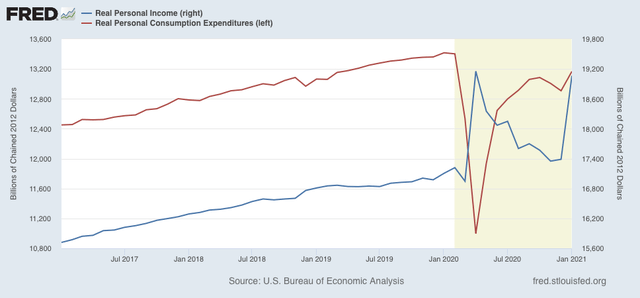

After adjusting for inflation both personal income and spending rose in January, by +9.7% and +2.0%, respectively:

The huge increase in income is not a mistake. It follows from the renewed Congressional stimulus package providing $600 checks to most households. And it’s pretty obvious that had an impact on spending, which rose to levels equivalent to 2019 and only about 2% off-peak.

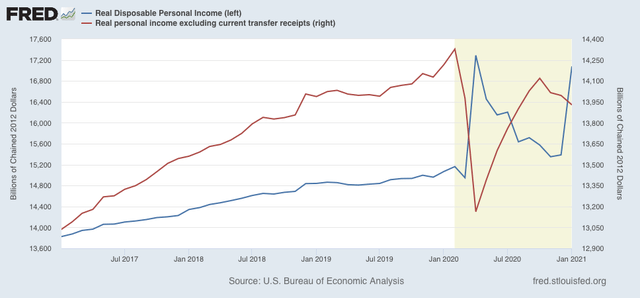

The importance of the stimulus is shown dramatically when we subtract government transfer receipts from the equation, shown in red in the graph below:

Real personal income excluding government transfer receipts fell for the third month in a row, down -0.5% in January.

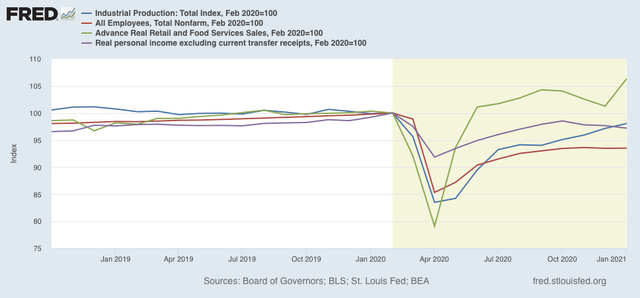

Since this last metric is the last of the four coincident metrics to be reported for January, we can now plot the general outline of the economy through last month, including production (blue), jobs (red), real retail sales (green), and real income (purple):

Industrial production has powered through the last 9 months and is now only -1.8% below its level last February. Real sales are actually higher by 6.4%. Job growth has generally stalled in the last 3 months, but only declined outright in the month of December. But without transfer receipts from the government, income is down -2.8% since last February.

*IF* we continue to make good progress with vaccinations, and they prove effective against the new variants of covid-19 as well as the original virus, then by mid-year, we could see production higher than before the recession, most likely leading the NBER to declare that the recession was a brief but very deep two-month affair (last March and April) with one year+ recovery which is turning into a full-fledged expansion.