Debt and Taxes IV: This Time It’s Personal

It seems that many people have concerns about Larry Summers’s concerns about overdoing the Covid 19 Relief bill. My first reaction to his op-ed is here, but I realize that I had more nearly relevant things to say in the Debt and Taxes series and, in particular in debt and taxes I and debt and taxes II. (the one with plain ascii algebra and only 2 comments but I promise it is relevant).

I’m going to try to focus. First, Summers really criticizes giving an additional $1400 to most US citizens. He discussed the bill in general, but his concerns are about the wisdom of that (huge) provision and not the money for supplementary unemployment insurance, unemployment insurance for people not eligible for regular unemployment insurance, money for vaccine distribution, money for schools or general aid to state and local governments (indeed he could have been clearer in his op-ed).

On this he has two concerns

- The huge deficits might overstimulate the economy

- There are other better uses of the money so the bill is a waste of economic and political resources.

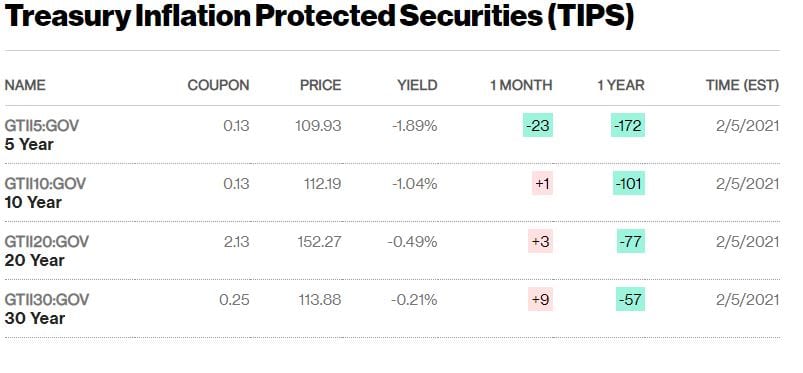

This time, I am going to address them in reverse order. Concern 2 really regards the $1400 checks only. On economic resources, I question the absolutely standard argument that one must decide if some spending is the best use of limited available funds. The key issue (as in the debt and taxes series) is that the US Federal Government can borrow at extremely low interest rates — the 30 year real interest rate is currently negative . Since it will change, I am going to screen cap.

Investors are glad to pay the Treasury to keep their wealth safe. Now consider the US Federal Government intertemporal budget constraint — the present value of spending must be less than or equal to the present value of revenue. What is the present value of revenue ? It is calculated by discounting revenues which grow approximately proportional to GDP by the inflation rate which hmm carry the one, round off a bit works out to roughly INFINITY.

If the Treasury can borrow at an interest rate lower than the trend rate of GDP growth (r<n), then the US Federal Government does not have a binding intertemporal budget constraint. This is the point of debt and taxes I, which turns out to be highly relevant to the Washington Post opinion page printed the day before yesterday. A totally standard calculation implies that there is not now a limit to “economic space” now. This is the normal pattern post WWII except for the period 1980-2000 — indeed the US managed the huge WWII debt with no noticeable trouble. Another way of putting this is that, if r<n then debt never has to be repaid. It can be rolled over forever and will shrink as a fraction of GDP until it is negligible. This is not a heterodox position — the link is to an AEA Presidential Address which is the epitome of orthodoxy.

Summers is also concerned about political limits to other spending. That is the real issue. It is outside of my field of expertise (it is also outside of his officially credentialed field of expertise, but he is clearly generally expert). Many people (too many to link so I will stick to Waldman) have argued that the political limit is public approval of Democrats and is relaxed by giving people what they want. I think it is clear that Democrats suffered in 2009 and 2010 from reckless caution — the backlash was related to doing too little and caring too much about keeping the public debt low. Notably Summers argued this repeatedly from 2010 through 2020 (I just googled [Summers fiscal).

OK now the hard part: what about overstimulating ? The first point is that we will not have to accept inflation higher than we desire. The Federal Reserve Open Market Committee (FOMC) can cool down an overheated economy by raising the target Federal funds rate. It is clear from bond prices that investors don’t expect this — bond prices would fall if they did and they have increased even as Democrats won control of the Senate and turned out to be very determined to add to the deficit. Low nominal yields imply that investors don’t expect interest rates to go up. The lack of much change in the difference between nominal ant TIPS yields implies they don’t expect inflation to increase and their expectations about inflation have changed little. Before going on, I note that the high interest rates used to cool down an overheated economy have some but very little relevance for the infinite present value of future revenues calculation — a few months of high interest have a finite effect on the calculation which, again, yields the answer infinity. Just to repeat what is often noted by Summers and others (especially Krugman) the risk of stimulating the wrong amount is extremely asymmetric — the FOMC can raise interest rates and prevent overheating. it can’t lower interest rates much, because the current safe short term interest rate is 0.08%. It is, as Summers notes in his op-ed, much better to err on the side of excessive stimulus.

The real issues are that loose fiscal and tight monetary policy will crowd out private investment and drive up the value of the dollar. In my debt and taxes series, I considered a closed economy, so I will just note that the FOMC absolutely can keep the value of the US dollar down. The Fed just has to sell it’s dollar denominated assets and buy foreign currency denominated assets. A monetary authority which is trying to prevent depreciation of the national currency can run out of foreign exchange reserves — a monetary authority which is trying to prevent appreciation can’t run out of domestic reserves — it can create unlimited amounts at will.

So should we worry about crowding out private investment ? The first point is that the investment which will be crowded out is investment in structures (not equipment and software). High interest rates reduce the value of long lived assets which, in the real world, means buildings — mostly houses. The investment relevant to macroeconomists and IS curves and such is mostly to almost entirely residential investment which is left out of almost all macroeconomic models (all models I know of the weasel word “almost” was added from an abundance of caution). Even huger houses are not the way the US will deal with slow productivity growth or stagnant real wages.

But also, the fact that the *safe* interest rate is below the trend rate of GDP growth implies that higher welfare can be obtained with lower private investment. The fact that the expected return on the private investments is greater than the trend growth rate does not rule this out. This is the point of debt and taxes II

Importantly. In that model, it is simply assumed that the economy is always at full employment. There is no possible role for stimulus, in fact no way to drive up output in the short run. It is simply assumed that public debt crowds out private investment one for one. Furthermore it is assumed that all private investment causes higher wages, because all private investment is in plant and equipment used by workers. In spite of all those crazy assumptions (which hurt the case for more public debt) it is shown how to make everyone (in the simple model) better off with a policy which starts with the government just borrowing and giving the money equally to everyone.

The model exactly addresses the question of whether it is good policy to send everyone a check even if there is no need to stimulate, no GDP effect of stimulation, and a fiscal multiplier of zero. The answer is that yes it is good policy so long as the government pays an interest rate lower than the trend rate of growth of GDP, and so long as the distributional effects are handled by increasing taxation of capital income and reducing taxation of labor income (a policy for which there is an abundance of political space and also one which Republicans will resist even at the cost of electability which uh is a cost I am eager to let them bear).

After the jump, I will go on and on about the model

There is a puzzle as to how can the safe interest rate be so low while the average return on physical capital is so high. This is called the Mehra Prescott puzzle and also called the equity premium puzzle. Models in which it is assumed that there is one representative consumer can not fit this fact.

In those models, people live forever so they don’t ever have to sell their shares of stock. They are rational and hold the market. They don’t have to think about the price of stock — they hold it for the dividends. It is a stylized fact that the present value of future dividends grows smoothly over time. Any explanation of the puzzle must rely on the fact that people plan to sell stock and care (a whole lot) about its price. It is absolutely possible to model this using an OLG model (the same sort of model as in Debt and Taxes II). The key second modification of the standard model is eliminating the assumption that everyone has rational expectations and introducing irrational investors or “noise traders”.

Interestingly Summers and friends (especially including Brad DeLong) did exactly this 30 and 31 years ago. The 31 year old model is, I think, the right model to use to address the question. It can be modified to create an argument for the $1400 checks.

Also, the model (or the even more standard model in Debt and Taxes II) implies that the really smart policy is for the government to sell bonds and use the money to buy stock (randomly or an equal share of all firms). This is the proposal for a sovereign wealth fund. I am reasonably confident that there must be some argument against doing this, but I have never seen one.

The Fed buys tips, by the way. Thus tips are all but useless if it ever had any use other then hedging.

I think you give Summers too much agency. Summers works for people who have a great deal but resent anyone else has anything. As Joan Robinson used to point out, once the argument is established, the economic theory flows from it easily. It is possible that Summers actually believes the nonsense he spouts, however, the matter of what he believes is irrelevant for predicting the end results of any argument he might make.

@anonymous The Fed owns some TIPS, however, the FED does not own all the TIPS. The market price convinces ordinary investors to buy TIPS so it is useful. I think it best to think of the supply of TIPS to the public (AKA the private sector) by the whole Federal Government. The Treasury issues more TIPS than the FED buys. The Treasury (indirectly) to FED sales really are of no particular interest to investors.

@Kaleburg I have views on Summers’s agency based on personal experience. I think he says what he wants to say and doesn’t work for anyone else — he has tenure. I think he just believes what he wrote. If there is a side motive it *might* be resentment over not being hired by Biden. Oh and he wants attention. He loves attention.. But mostly I think he made an argument which would have been absolutely conventional a year ago. The political debate has shifted dramatically.

I note that OJ Blanchard agrees with Summers. Notably Blanchard is my main citation for my counterargument (second cite would be Summers on secular stagnation and third would be Blanchard and Summers on hysteresis). They should be among the macroeconomists most enthusiastic about the proposed bill.

@Kaleberg,

[Thanks for bringing up Joan Robinson. It made me look. I had misplaced her somewhere closer to Milton Friedman than Keynes and corrected that mistake.]

The Legacy of Joan Robinson

[That copy and paste did not work as planned – but moving on now.]

I asked Larry’s old room mate at Harvard bout this. His ans: Damned if I know.

Waldman

thanks for this. it’s nice to have an erudite analysis of what is fairly obvious: you spend what you have to to survive, if you have the money.

the “stimulus” is not, and should not be called, a stimulus. there is no need for a stimulus at this time, and no hope that a stimulus would do any good as long as people can’t work. the money in question is “aid in time of emergency for a big part of the work force, who would not otherwise survive (or pay rent).

and if the deficit were a problem we could pay for the aid simply by taxing the people who got a tax cut the last time the economy needed a “stimulus.”

this (except for the tax cuts and economic “theory) has been known since the beginning of the human race… which survived by sharing in times of scarcity, something the social darwinists (aka the rich) have been unable to wrap their minds around since the invention of wealth.

“Rescue”

@Coberly,

Thanks for keeping it real.

As far as I can tell Waldmann’s analysis is (as it should be, criticizing as it does, an argument that has relevance only to… ) an argument that has relevance only to investors. like all such arguments it depends on contrafactual assumptions and imaginary quantities: present value, future inflation, future interest rates, future investment… pretty much the same arguments that led to the Great Depression, which was only ended when the New Deal made the decision to ignore them.

I am not saying these arguments have no value…if nothing else they keep the herd moving in the same general direction. But they become stupid and dangerous when there is plenty of food, but we can’t buy it for the poor because we can make more money by investing it in “growth.” and of course we can’t give it to the poor because that would weaken their moral fiber .

@Coberly,

Keep hanging in there, Dude.

An interesting development of the pandemic is that we again have nouveau pauvre to counterbalance the nouveau riche. Of course this is not a first. We had the families of unemployed living homeless under bridges here in central VA back in 2009/10 and we were hardly one of the most hard hit regions in the US. Back during the Great Depression the elite class was fairly immune to the problems of poverty until such time that communists and bank robbers gave them cause to pause and consider their own limitations.

Waldmann

i read Sommers Post reply to his critics. It was not technical. Nor was it very convincing. I can think of several possibilities:

we are not understanding what he is saying (he seems to be saying in the Post “I like the Biden plan but be careful.”)

I don’t understand what he is saying (technical reasons).

He is capable of saying what he thinks I (we) want to hear.

He believes what he is saying…which is no guarantee he is right.

I believe he is operating at a level of abstraction that we can afford to take the chance that Biden is right, and whatever happens we can fix it then unless, as he says, the political space forecloses our options.

Remember, Africa is an under polluted continent. We can ship our waste to them.