Two sharply contrasting reports on the economy to start September

Two sharply contrasting reports on the economy to start September

We got two contrasting views of the economy this morning. (Tuesday)

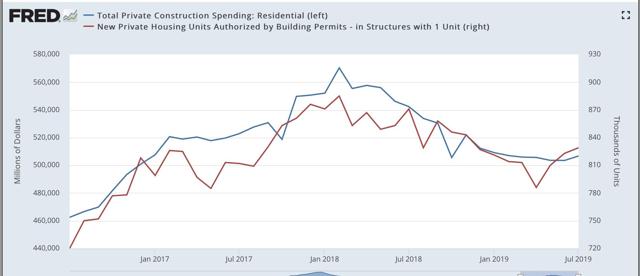

First, the good news: residential construction spending increased in July. Below I show it in comparison with single family permits:

Typically construction follows permits. In the past few years, it has been almost coincident with permits. This is more good news for the important and leading housing sector, indicating that the decline that started in early 2018 has ended. With the continued recent further decline in mortgage rates, I expect further advances, although possibly not strong.

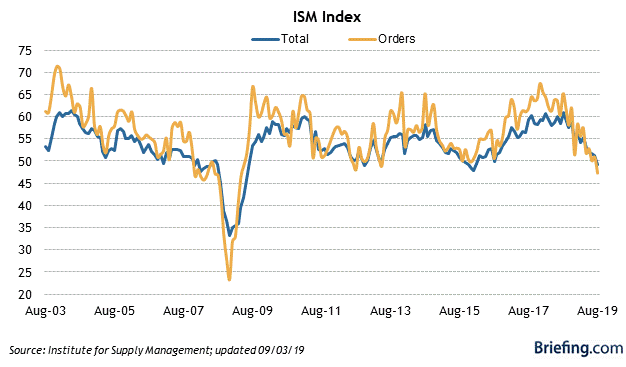

Now, the bad news: the ISM manufacturing index fell below 50 to 49.1. Worse, the leading new orders component fell to 47.2, the worst reading since the Great Recession:

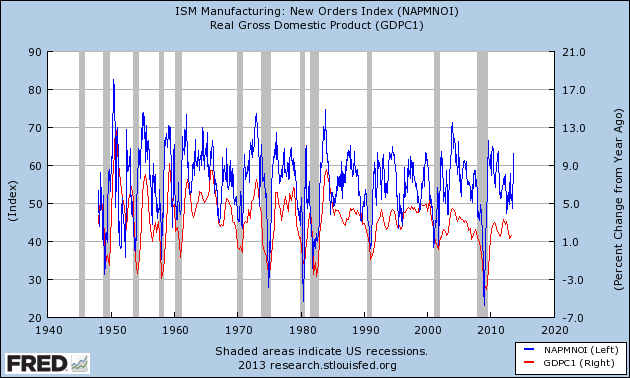

Typically it takes at least two readings below 48 for the ISM manufacturing index to indicate recession. But the new orders index is already at a level which has been consistent over the past 70 years with a recession in the very near future – although it is also consistent, as for example in 1966, with a slowdown only:

Nevertheless, it does tip the balance of short leading indicators from neutral to slightly negative.

May be seeing ISM and new order decline due to tariff saber rattling. Heavy machinery manufactured here and sold around the world is sensitive to tariffs, and FX in current climate. Remove the tariff and uncertainty about global trade and we might be a bounce.

I could care less about RE. That cracked up until March 2001 before it got pinged by the spring(right before the bubble really blew up) due to a similar interest rate mechanism.

Fixed nonresidential investment is faltering badly right now.