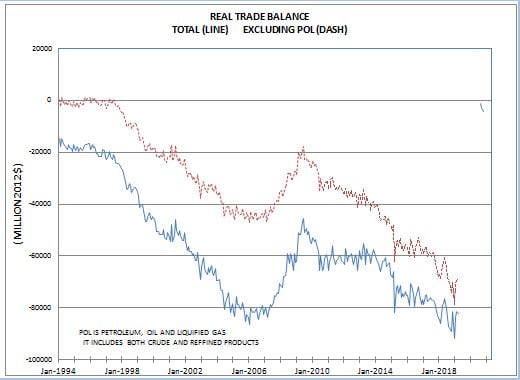

REAL TRADE BALANCE

The real trade deficit ( million 2012 $) increased from $81,558 in February to $ 82,054 in March. The March observation was between the January and February data points so it was not large enough to generate a significant change in imports 0.58 percentage point contribution to first quarter real GDP growth. In the first quarter real GDP report the significant contribution of foreign trade to real GDP growth has been interpreted by the administration as a sign of success with its trade policies. But the underlying real import and export data suggest that it is premature to call it a trend change.

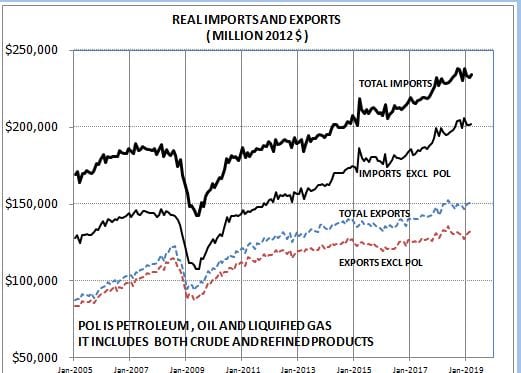

In evaluating the trade balance it is important to remember that it is the difference between two very large numbers so that a small change in either imports or exports can generate a large change in the balance. Recently real imports have been some 150% of real exports. This implies that even if imports and exports have the same growth rate the trade deficit would still widen. For the trade deficit to improve, exports need to growth much faster than imports.

Over the past year both real imports and exports have flattened out after several years of strong growth for both. One series that does appear to be still growing is real imports excluding POL (Petroleum, Oil & Liquefied Gas). But in the first quarter it was only up 2.5% from first quarter, 2018. The chart clearly shows that over the past year we have been seeing volatile monthly data on real imports and exports bouncing around a flat trend. As a consequence the real trade balance has been highly volatile and it is hard to say that the apparent improvement in the first quarter is a trend change or just random noise.

One significant change in real trade over the past year has been the virtual elimination of the deficit in energy as exports of fracked oil are how almost as large as the continued large oil imports. But, surprisingly, the sharp drop in the energy trade deficit has not generated much of a change in the overall trade balance as non-POL imports have surged enough to offset the improvement in the energy deficit. I take this to be a demonstration that the real cause of the large US trade deficit is the impact of the federal deficit on the domestic savings-investment balance — what we use to refer as the twin deficits. Trump is trying to deal with the impact of the federal deficit on the domestic savings-investment gap by addressing the trade deficit. But he is dealing with the symptoms of the problem, not the underlying cause. As long as the savings-investment deficit remains large the trade deficit will also stay large.

this month’s trade report included revisions going back to October, which gave me pause in trying to figure out it’s impact on Q1 GDP vs the advance GDP report…i assume you graphed from the new data, which would thus incorporate those revisions…problem is that the 2nd estimate of GDP will not include trade revisions to Oct, Nov, & December, so that it will be less accurate than the data available…however, all that gets corrected with the annual revisions to GDP due out later this summer…

I used the revised data.