Actually, Only Banks Print Money

by Steven Roth (originally posted at Asymptosis)

Actually, Only Banks Print Money

I’m thinking this headline will raise some eyebrows in the MMT community. But it’s not really so radical. It’s just using the word money very carefully, as defined here.

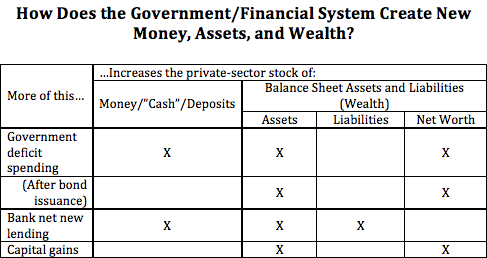

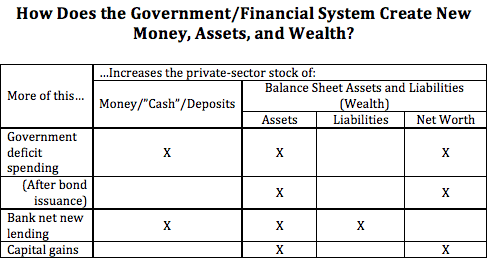

Starting with the big picture:

You can compare the magnitude of these asset-creation mechanisms here. (Hint: cap gains rule.)

The key concept: “money” here just means a particular type of financial instrument, balance-sheet asset: one whose price is institutionally pegged to the unit of account (The Dollar). The price of a dollar bill or a checking/money-market one-dollar balance is always…one dollar. This class of instruments is what’s tallied up in monetary aggregates.

A key tenet of MMT, loosely stated, is that government deficit spending creates money. And that’s true; it delivers assets ab nihilo onto private-sector balance sheets, and those new assets are checking deposits — “money” as defined here.

But. Government, the US Treasury, is constrained by an archaic rule: it has to “borrow” to cover any spending deficits. So Treasury issues bonds and swaps them for that newly-created checking-account money, reabsorbing and disappearing that money from private sector balance sheets.

If you consolidate Treasury’s deficit spending and bond issuance into one accounting event, Treasury is issuing new bonds onto private-sector balance sheets. It’s not printing “money,” not increasing the aggregate “money stock” of fixed-price instruments.

This was something of an Aha for me: If you look at the three mechanisms of asset-creation in the table above, only one increases those monetary aggregates: bank (net new) lending.

Arguably there might be one more row added to the bottom of this table: so-called “money printing” by the Fed. But as with Treasury bond issuance, that doesn’t actually create new assets. The Fed just issues new “reserves” — bank money that banks exchange among themselves — and swaps them for bonds. That leaves private-sector assets and net worth unchanged, and only increases one monetary aggregate measure: the “monetary base” (MB).

I’ll leave it to my gentle readers to consider what economic effects that reserves-for-bonds swap might have.

I print money all the time, and I’m not a bank. I needed a $50 oil change and the mechanic is a friend of mine, so I wrote him a piece of paper that said “IOU $50”. He paid that IOU to his worker as wages. The worker paid my IOU to the grocery store, the grocer paid that IOU to his worker, and that worker, who rents a house from me, paid it to my in rent.

Mike:

Welcome to Angry Bear. First time commenters go to moderation to weed out “spam and advertising.” You appear to be legit (did the visit to your site) and do not appear to be either. Friend or not, I do not know anyone who expends money to do work free of charge based upon a paper IOU. It is a nice thought.

Mike Sproul’s comment has some historical truth. During the 1930s “bank holiday” travelers wrote checks that could not be cashed until the banks reopened. Recipients often used the checks, endorsed to a third party, for further transactions. Eventually, the checks were cashed, but they served as money when money was needed.

I think of the Tbill market as an exchange of paper for money. The total supply of money is unchanged if you count the money given the Treasury as money in circulation. In reality, the Treasury takes our money and gives you a note bearing interest in return. The only new money is the interest. Does this describe the transaction adequately?

***I print money all the time***

As Hyman Minsky said – Anything that is accepted as money, is money

“The Fed just issues new “reserves” — bank money that banks exchange among themselves — and swaps them for bonds That leaves private-sector assets and net worth unchanged”

That’s accurate but incomplete The process also creates what everyone agrees is money (i.e. bank deposits owned by non-bank entities). That was the whole purpose of QE .

The lessen the Fed learned from the 1930’s is that if you allow deposits to follow loans when loans are collapsing it snowballs into a monumental avalanche of collapsing bank deposits

This time the collapse was prevented as can be seen on this graph

https://fred.stlouisfed.org/graph/fredgraph.png?g=mx77

It is correct to say that QE did not change the amount of money the private sector held, but if you accept that statement then you have to accept that the issuer of the bonds the Fed purchased was the entity that created the money

In 2008 there was about 750 Trillion dollars transferred on Fed Wire. In 2009 the amount was 125 trillion less. The reason for that drop was an enormous amount of stuff that was accepted as money in 2008 was no longer accepted in 2009. And that enormous drop in the accepted money supply was the cause of the Great Recession.