The Housing Affordability Crisis

The Housing Affordability Crisis

This morning both the Case-Shiller House Price Indexes for September, and Third Quarter Median Asking Rent were reported, as was the rental vacancy rate. Together they reveal that all types of shelter costs, whether housing or apartments, are at or near record levels.

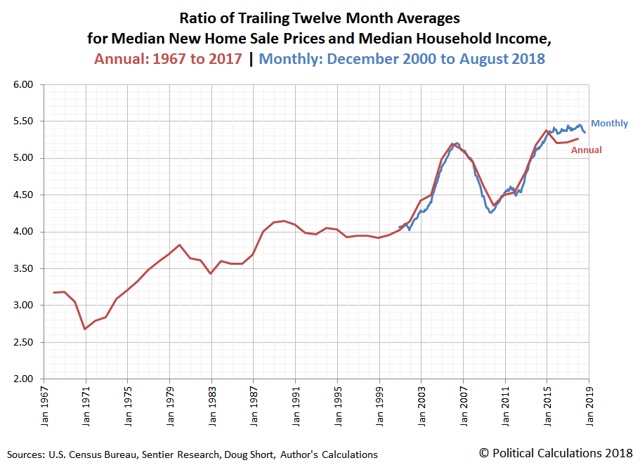

The Case Shiller 20 City index was reported up 5.5% YoY, and the National Index was up 5.8% YoY. Meanwhile median household income, as reported by Sentier Research one month ago, was only up 2.8% YoY. So while the media is generally reported the “good news” that house prices are appreciating less than the 6%+ rate they had been recently, “real” homeownership costs continue to be near a record multiple of household income, as shown in this graph from Political Calculations:

Meanwhile median asking rent increased about 5% just in the last Quarter, and is up over 10% from one year ago:

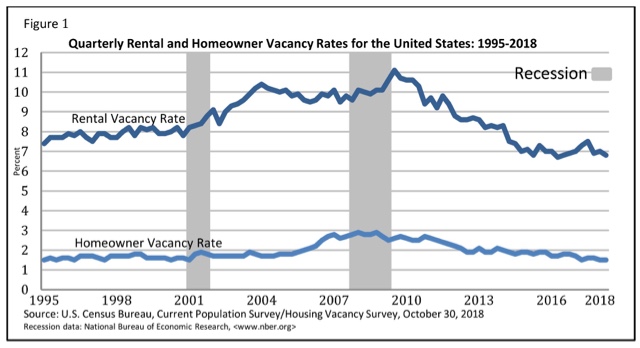

Because, *relatively speaking,* renting is still less expensive than purchasing a house, the rental vacancy rate continues near record lows:

A few years ago, HUD put out a report speaking of a “rental affordability crisis.” I think we are past that now. All forms of housing costs, whether ownership or renting, are at crisis levels.

With a weak housing market builders drop out of the lower end of the market so there are no “starter homes” but only “macmansions,

This tend to skew the price data sharply upwards. So I wonder if traditional ratios of home prices to income provide the same information that they once did historically.

The Case-Shiller index of repeat sale prices is suppose to address this problem, so maybe ratios using Case-Shiller prices are not distorted as much as other house price indices.

At least that is was what Case was trying to do when he first developed the repeat sale price index.

It will be down by April 2019.

The drop in the rental vacancy rate since the Great Recession suggest to me that not enough apartments are being built.