The Economy Is a Ponzi Scheme

I don’t think there’s anything eye-popping or revolutionary this post, but it’s thinking that I’ve been finding useful.

Long before Larry Summers bruited his recent ideas about secular stagnation and the need for bubbles, I came up against this great line from Nick Rowe (April 2011):

The economy wants a Ponzi scheme.

I’ve been pondering that line ever since. (As usual with Nick, read the whole post.) Pretty quickly, I came to an even more radical belief:

The economy is a Ponzi scheme.

Economies are exercises in log-rolling, but with magical logs that expand when more people climb aboard and run faster, and and contract when people slow down or fall off. People can fall off because there’s not enough room on the log, because they can’t run fast enough, or because they try to stand still or run too slowly. (Sorry to torture the metaphor so.)

To put it another way:

Economies are confidence games.

When people are confidently optimistic (the two are not synonymous), more people jump on the log and run harder, because they think there will be personal profit in it.

But where does that confidence come from? I would suggest that most people form their expectations for the future based on the present and recent past. (A very reasonable Bayesian stance.) How much money do I have? How much is coming in? How do those compare to the recent past? (Market monetarists: Idle guesses, surmises, and predictions about the Fed’s future policy stance seem wan, weak, and feckless compared to those very tangible and tally-able present indicators.)

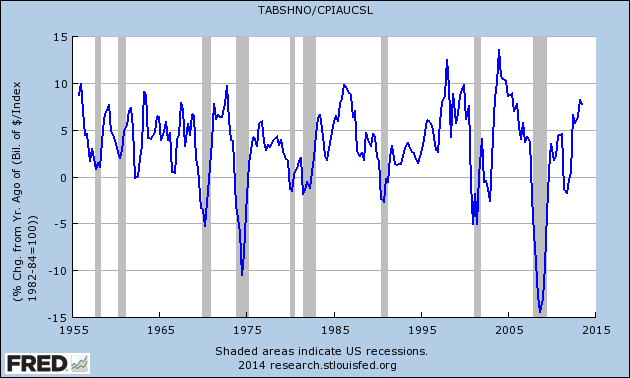

Which bring me back to a current favorite graphic, showing that every recession since 1960 was preceded by a decline in the inflation-adjusted (“real”) value of household assets:

There are only two instances (since 1960) where this measure fell below zero and there was not a recession: 2002 and 2011. (Maybe these times are different?? Think: massively higher household debt.)

The confidence story I’m telling here: people give huge weight to their current wealth/assets/net worth, and recent changes in those measures, when forming expectations for future growth — far more weight than they give, for instance, to their predictions of Fed behavior (the huge mass of people have no such predictions). This may be foolish or it may not be, but it’s what people do. (They undoubtedly also give big weight to current income and recent changes in income. I’ll let somebody else graph that.)

Or you could say: declines in household assets means there’s less money. (All financial assets embody money.) And at that point you can invoke a straightforward monetarist explanation — with a Minskyish self-perpetuating component added — for recessions.

The key point: the decline in real household assets always precedes the recession. It’s at least a leading indicator of real production declines, and at most a cause. When people feel poorer, they act poorer. (I told you this post wasn’t revolutionary thinking.) They spend less. So there’s less production. (In an 80% service economy with just-in-time production of many physical goods, if spending doesn’t happen, production doesn’t happen.) So there’s less (demand for) labor. The log shrinks and slows down. GDP and employment (growth) slow or decline.

Okay, yeah, Wealth Effect, blah blah blah. But the assertion I’m making is that people don’t just spend more when they feel wealthy or wealthier. They raise their expectations of future wealth, and consume/invest according to that. You get a positive or negative self-perpetuating feedback effect.

Going abstruse with this: Given the widespread belief that quantitative easing only really achieves any effect by buoying financial-asset prices (I include deeds in that class of assets), is it reasonable to suggest that the Fed is actually (and unconsciously, and arguably incompetently) engaged in Real Household Asset-Value Targeting (RHHAVT)? Can they limit the feedback effects? Should they shift to level targeting (RHHAVLT)?

Cross-posted at Asymptosis.

Steve –

You’ve made an important observation here.

“(They undoubtedly also give big weight to current income and recent changes in income. I’ll let somebody else graph that.) ”

I looked at least in that direction and found lock-step correlation between PCE and disposable income.

http://angrybearblog.strategydemo.com/2012/02/income-and-consumption.html

It’s not obvious to me how to reconcile these observations.

I didn’t look at changes in in DSPI, nor at how it relates to recessions.

Maybe there’s a clue there?

Cheers!

JzB

Steve

I don’t want to follow the economics-theory implications of “the economy is a ponzi scheme,”

but i would like to point out that when the big liars call SS a ponzi scheme they know they mean it in the same sense you use the word.. that is in the same sense that “the economy is a ponzi scheme.” we all do better as long as there are “new contributors” … just like in the stock market.

the difference is that in a ponzi scheme the new contributors will stop coming in the door because they can see the whole thing is a fraud and has to stop. with Social Security, and the economy, the thing is NOT a fraud and the people have to keep coming in the door because that’s the way they make their living… or pay for their retirement.

with the stock market as a whole, on the other hand, i am not so sure.

No it’s not.

@Jazz:

http://research.stlouisfed.org/fredgraph.png?g=qV9

Looks like:

1. It’s generally a concurrent or trailing indicator of recessions (hence not attributable as a cause).

And

2. There are lots of false negatives and positives.

FWIW…

“You get a positive or negative self-perpetuating feedback effect.”

Actually, you are just talking about positive feedback, regardless of whether the self-perpetuation is positive or negative.

New contributions in the new technology, more people, (or in other times, new land grabs) can stem the negative or provide a new stimulus for the feedback to turn into a bubble.

People talk about how the economy should grow as productivity improves, but has that ever been a predominant factor?

.

I go silent for a year and half and you guys figured it out all for yourselves. I just knew I was not that important to the debate. More interestingly is what policy conclusions flow from this observation?