Ripping Off College Students’ Economic Future

Previously, I had written on Fair Market Value and its use by the CBO’s Douglas Elmendorf to rate the risk of Student Loans as advocated by both The New America Foundation and the Heritage Foundation. A rebuttal answer to a partisan CBO, the right-leaning New America Foundation, and the conservative Heritage Foundation on the usage of Fair Market Valuation methodology in the same manner as what I would have used it for to rate the return on a piece of capital equipment is simple.

It is inappropriate for student Loans. There is little or no risk to loaning students money which can not be discharged through bankruptcy. The news media has been pandering to students promoting a generational war by advocating the theft of student’s futures by such programs as Social Security, Medicare, Medicaid, etc.

The Tom Friedmans, James Freemans, and others suggest baby boomers are ripping-off the X, Y, and Z generations with these programs. From the well-heeled segment and do not have to work anymore 1-percenter population, we find Stan Druckenmiller, Pete Peterson, the Koch brothers, etc. spending portions of their $billions advocating the discontinuance of Social Security to save the country, students, and themselves. Some are taking to college campuses with false data and advising students to protest the rip-off of their futures in a Days of Rage manner. All tend to ignore the real threat to students and their future. The threat is not likely to come from Social Security, Medicare, etc.

What is threatening the future wealth and income of college students is the increasing debt taken on by students seeking the education necessary to have a chance in a global economy where investments are seeking fewer Labor-intensive opportunities. The increased funding necessary to go to college is the result of decreased governmental funding of schools, declining or stagnant household incomes, financial strategies delineating the increased risk of student loans (CBO, The New America Foundation, Heritage Foundation, etc.), and the increased cost of attending colleges and universities (which as Alan Collinge of Student Loan Justice Org. states cost increases have outstripped CPI and even Healthcare).

Student Debt has quadrupled from 2003 to 2013 going from ~$240 billion to > $1,000,000,000. Up from 41% in 1989, 66% of all students now have an average debt of ~$27,000. The rise in average student debt is due to a sharp decline in state funding (25%) of public colleges since 2000. And a stagnation and decline of household income for the vast majority of US households over a similar time span.

As Dr. Elizabeth Warren pointed out in “The Coming Collapse of the Middle Class” where a high school diploma and a sound work ethic were once the ticket to into the middle class, the college education and two incomes are now the surest way into the middle class. Even so, evidence of the high cost of a college education and the resulting debt from a college education has begun to extract its toll on the financial futures of graduates, especially minority and low-income students. For most young adults chasing a college education requires taking on student debt.

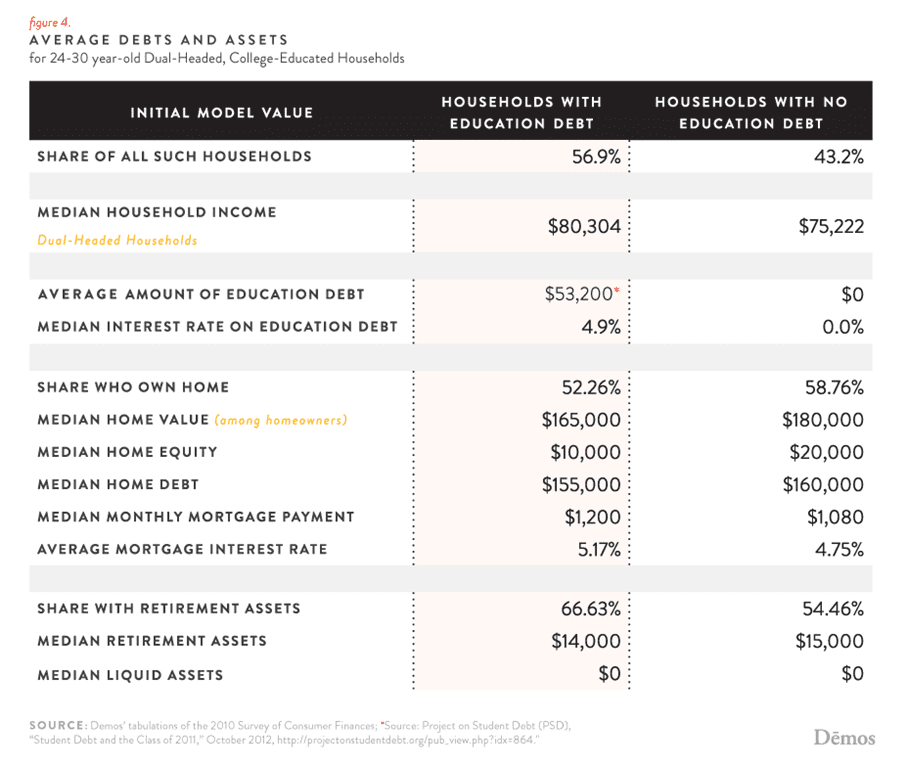

Reflected in an August 2013 study by Demos “At What Cost;” the amount of debt carried by student has not only increased, it also varies by amount of family income. 75% of all BA graduates coming from families with incomes < $60,000 have varying degrees of debt as compared to 48% of those coming from families with incomes >$100,000. 14% of all low-income students leave with loan debt > $30,000 as compared to 9% of students coming from higher income families.

80% of all African Americans graduates leave college with loan debt as compared to 65-67% of White and Latino students and 54% of Asian students. African Americans carry a higher level of debt as compared to students of other races.

The average debt load ranges from $20,200 – Public Schools to $33,000 – For Profit Schools with Private Non-Profit Schools at ~$28,000. The debt load resulting from For Profit Schools is 64% higher than at Public Schools.

Some at the Brookings Institute and The New America Foundation would argue interest rates do not matter as the incremental increase only accounts for a few more dollars monthly. Interest rates do matter over the long term as they extend the length of the loan over the 10 years or “more” needed to pay them off.

Brookings Matt Chingos dismisses first term Senator Warren’s idea of student loan interest rates being the same as what the FED Loan Rates to banks such as Goldman Sachs as being a cheap political trick. Senator Warren’s proposal does have merit and its only fault being it comes when the Fed is thinking of loosening Fed Policy. Perhaps, if Senator Warren was in office in 2008 the proposal to use Fed Rates for Student Loans would have come sooner. But then, maybe the crash would not have happened too? In any case, we would have been graduating one group of students with more manageable and less costly loans.

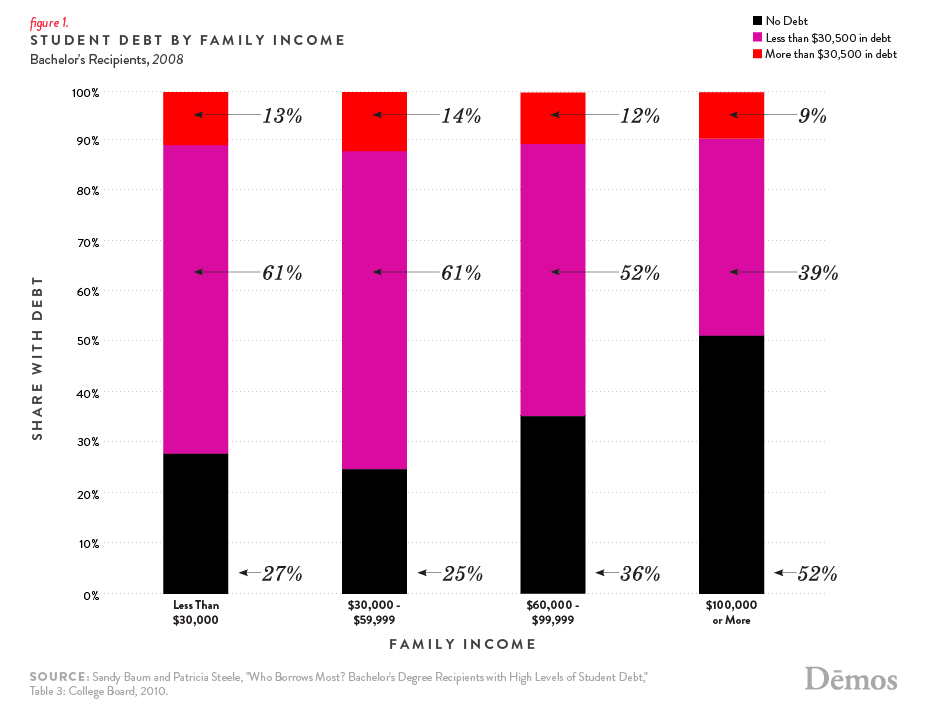

Young college educated students without student loan debt accumulate more retirement funds sooner, purchase homes sooner (more expensive homes), put down larger down payments, and paid lower interest rates.

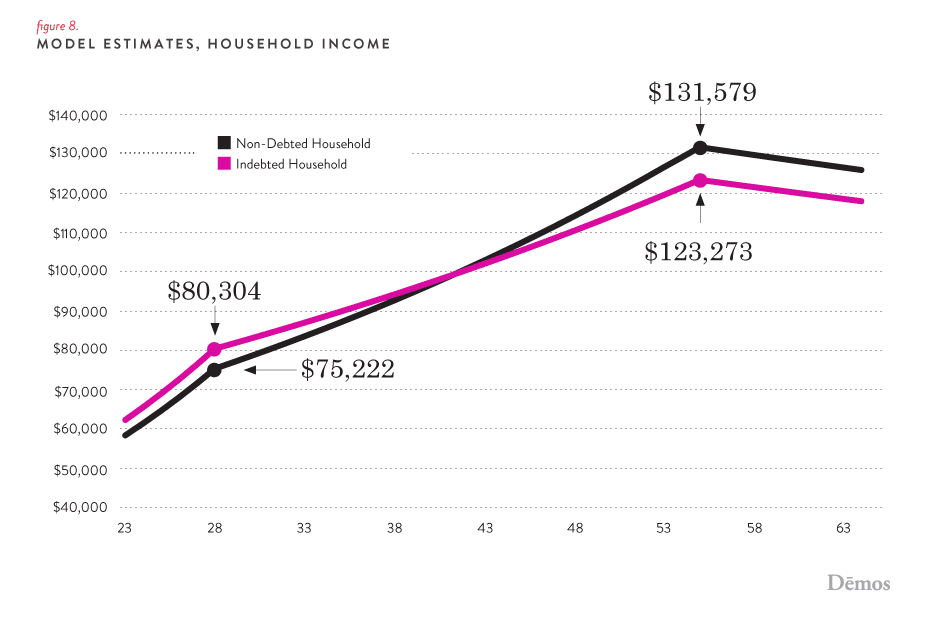

“Households with education debt have higher average incomes than those without. This is consistent with other research on the incomes of young college-educated households.”.

Much of that difference comes from the preponderance on getting a higher salary to offset the loan. The next chart suggests the increased salary is more than offset by increased wealth of those without debt.

As I have pointed-out to some proponents of higher interest (went unanswered), higher interest rates do make a difference in the long run of 10 years or more. The month-to-month marginal cost of a loan is not the issue. The issue is the total cost of the loan over its lifetime.

For example, a loan or ~$26,600 to one student over 4 years would cost a student ~$32,000 over an 11 year period if the economy remained good. There is the chance of at least 1 recession if not two which would lengthen the loan repayment period. Elmendorf, Delisle, and Richwine are quick to point out the costs to the government and taxpayers of making lower interest rate student loans.

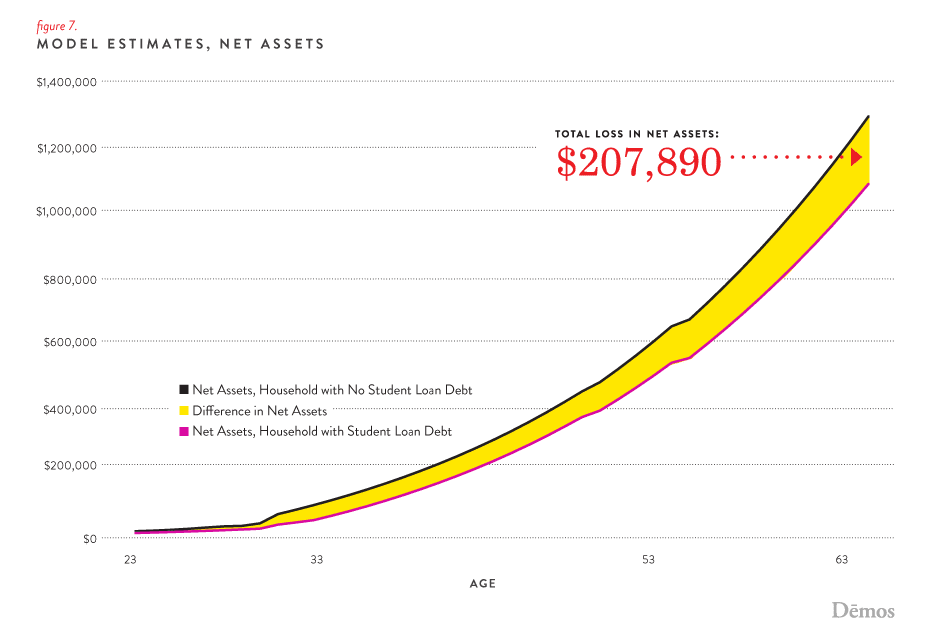

Druckenmiller is pushing the false argument the fully funded Social Security and funded Medicare programs are ripping off college students and their futures. All seem to miss the point the riskier assessment achieved through Fair Market Valuation of Student loans will result in higher interest rates costing students impacting theiir wealth and income over the decades. Burdened with student debt, a student can expect to lose lifetime wealth of ~$208,000 when compared to unburdened students. “’Nearly two-thirds of this loss comes from the lower retirement savings of the indebted household, while more than one-third ($70,000) comes from lower accumulated home equity; because of the two withdrawals from savings later in their lives, the liquid savings gap is just $4,000.’ In general, ‘it can be predicted a $1 trillion in outstanding student loan debt will lead to total lifetime wealth loss of $4 trillion for indebted households.’”

Besides an impact to accumulated wealth, there is also a difference in income as well. From 40 years of age onward the difference in income peaks at ~$8,000 annually. It continues until retirement between those carrying student debt and those without. In a demand led economy, the difference in incomes would impact purchasing power. ~57% of all households between the ages of 24 and 30 have some type of Student Loan Debt.

Are students being ripped off by government entitlement programs? Yes, they are being ripped off. It is not by Social Security or Medicare as Stanley Druckenmiller suggests. Nor are student loans costing the federal government and tax payers as much as the recent analysis of student loans done by the CBO’s Douglas Elmendorf. In reality, the risk to the government and taxpayers comes from these students being less successful in accumulating wealth and increasing income which as DEMOS has suggested would cost $4 trillion is wealth alone. Unburdening students from a lifetime of student loan debt would benefit the economy.

References:

Fair-Value Estimates of the Cost of Federal Credit Programs in 2013; Douglas Elmendorf

Fair-Value Accounting Shows Switch to Guaranteed Student Loans Costs $102 Billion; Jason Delisle

Sorry Kids, We Ate It all; Tom Friedman

Stanley Druckenmiller; How Washington Really Redistributes Income; James Freeman

Geoffrey Canada ’74 and Stanley Druckenmiller ’75: Generational Theft Stanley Druckenmiller;

Student Loan Justice Organization; Alan Collinge

The Coming Collapse of The Middle Class; Dr. Elizabeth Warren; http://www.soyouthinkyoucaninvest.com/2009/04/elizabeth-warren-coming-collapse-of.html

At What Cost; How Student Debt Reduces Lifetime Wealth; Demos, Robert Hilton Smith

Do Student Loan Interest Rates Matter?; Beth Akers

Run, you never answered the question of your title?

Now tell me and the readers – whom be ripping of America Talibans?

Getting a college education is a benefit to the individual and society. That education comes at a cost, and the student decides how much debt to assume for a degree at a specific institution. Leverage a high debt load against the prospect of a high paying career, or assume less debt for a potentially lower paying career. Depends on how much risk you are willing to bear. Nobody is ripping students off. They make their own decisions (albeit weighty ones) that can either payoff big or not quite so much. My debt took 20 years to payoff and was more modest. It was a better gamble considering my aspirations that more debt.

Patrick:

Nonsense and your anecdotal comment is not germane to what is being experienced and the real risk.

“They make their own decisions (albeit weighty ones) that can either payoff big or not quite so much.”

Nonsense indeed. Claiming that college grads with debt are being ripped off is nonsense. They gain a tremendous earnings advantage against those who don’t pursue a college education. The price for that economic choice is debt, and in the long run that decision works to their benefit.

Claiming that they are being “ripped off” is as specious as claiming that I am being ripped off by the bank for getting a mortgage, because I am spending money that could be otherwise spent on investments, etc.

Patrick:

“Claiming that they are being “ripped off” is as specious as claiming that I am being ripped off by the bank for getting a mortgage”

Heh, heh “specious” huh? Such might be a remark coming from for an attorney who may use it in a discussion to show dominance. Your comment(s) is and are still nonsense and the comparison between student loans and mortgages even more so as it now shows a lack of knowledge of either. You need to find a better reference point to base a discussion off of, if you are going to attack student loans as not being a rip off as I claim. There is no comparison between getting a mortgage and a student loan nor the return.

Tell me how many 18 year olds can discuss risk with an understanding of how it will impact them in the future? Do you think they really understand or understood what they are signing up or signed up for with their signature? Can you suggest what the outlook is for graduating students going into the future (or even today) when taking into account a falling Participation Rate, a US economy tied to Wall Street Gambling, and in a global economy tied to MNC shifting labor from LCC to LCC? The overall evidence is showing the costs of a student loan is outweighing the advantages one (or two) may experience when taking into account economic growth and the risks. You may want to read a few of the latest studies such as the one I cited or pick up on the words of Dr. Warren “The Coming Collapse of The Middle Class” or “Two Income Trap” to get better understanding on what we are foisting upon students who wish to be a part of the middle class. Furthermore, I have cited a chart or two which support my stance there is a growing problem and risk with todays financing structure for student loans. Other than a couple of anecdotal sentences, your stance is unsupported.

I have not even touched upon the real issues.

The same group of college students smart enough to get into college are also smart enough to figure out how much debt they can shoulder. There are plenty of statistics available on job prospects for their degree, what they can expect for income, housing costs, etc. That anyone is surprised to find that the world they expected after college is different from reality just tells me they didn’t bother doing their homework.

This issue I have is in arriving at the conclusion that students are being ripped off by comparing those with debt, to those without. Those externalized costs are aren’t paid for by nobody. They are paid for by parents who have reduced their potential savings, retirement portfolios, home equity, etc. They made an investment that not all parents can make, and it came at a cost similar to those students with debt.

I started paying $450 a month in my Junior year, 1992. Do I feel like I was ripped off by college debt? With the alternative being no college education and the income prospects of a high school grad, of course not. That, is the proper comparison.

Patrick:

Quite frankly, I do not care what you paid in monthly payments. This is not about you. And quite frankly, we do not have a full history of what your predicament was; however, we do have a rather detailed history of what has happened to many students who were promised the golden parachute of making the proverbial $1 million more than those without a degree. When in fact, the issue turns out to be falling wages for those without a degree made up the expected $1 million for those with a degree. Your own anecdotal history is not at issue here.

You grab mortgages as an example and those can be discharged in bankruptcy. There are plenty of statistics available is not am answer. Maybe you expect me to look them up for you? No, you look them up. I have presented adequate data and you wish to come here and present supposition, conjecture and opinion. Which junior college did you attend that accepted an opinion as fact?

So, this is really about grievances.

Nobody was promised anything other than an education and debt. By all reckoning, those with more education still fare far better than those with less education, even accounting for the debt. Here’s to hoping that you soon come to grips with differences between opportunity and outcome.

Patrick:

It has little to do with grievance Again you do not appear to grasp it and “by your reckoning” the depth of your knowledge on the topic is minimal and anecdotal. I provide the data in the text of the post and you come with what? An opinion. Suffice it to say, it is not enough. Please provide a thread of evidence to support your stance.

“Labor market indicators give us some clues. Much has been made of the college wage premium, that is, the difference between incomes of college graduates versus non-college graduates. According to analyses of Census Bureau surveys, a bachelor’s degree recipient can expect to earn an average of $1 million more in lifetime income than a wage-earner without a degree.

But behind that headline number is a more troubling trend. The growing gap between college graduates and others isn’t really due to rising starting wages for the average college graduate – it’s that the wages of those without a degree are falling rapidly. In fact, when accounting for inflation, young college graduates have found that starting wages are falling. “CFPB: Rohit Chopra Addresses Major Financial Issues to the Federal Reserve Bank of St. Louis”

I offered a data point (my experience, with data) which you refer to as an “anecdote”. Judging from your conversational style, I’m certain you understand the meaning of anecdote. I shared because my education, the benefits, and the struggles in paying back the debt show a different side of the story that might enrich your interest in this topic. Let’s get back to your central premise, which is that college grads with debt are getting ripped off because they don’t accumulate as much wealth as their peers without debt.

It’s a silly premise because it compares those who (by luck) ended up getting a free ride, against those who had to pay. They both compare far better than those with only a high school education, but that is not in contention. Had you written about how a college education doesn’t get you as much bang for the buck as it did in generations past, that would have been an interesting and salient article. We both know how globalization and union busting has resulted in nearly flat or diminished earnings for many Americans. But that’s not what the article is about.

When I read comments such as “promised the golden parachute” and “ripped off” when discussing how much more one could have had if it were not for debt, I see a grievance which is really nothing more than envy.

Patrick:

Your experience in 92(?) is not comparable to what is happening today as compared to my experience in the seventies when my Masters was $350/course (at a Tier one University) and paid for by the GI Bill (mostly). There is no golden parachute and as you must know there is no remedy to student loans other than forbearance, public service (if you have a function they can use), living in poverty for 20+ years, death, disability, etc. Your experience is not the same as what students are experiencing today. To compare your experience to their experience given the change in the cost of education and the changing of the rules for bankruptcy, your comparison of your experience to theirs is inconsequential. It has no bearing other than to say when I when to school and it was up hill both ways. Well it was not and we had an easier time of it.

In case you did not know and I suspect you do know (legal); here is a rendering of what has occurred since the seventies:

Student loan debt hasn’t always been exempted from bankruptcy. Restrictions began in the 1970s out of concern that recent graduates in fields with lucrative career paths would simply accrue as much debt as needed and then discharge it via bankruptcy immediately after getting their degrees.

Congress implemented a reform in 1976 for five years’ wait after completion of a degree before debtors could declare bankruptcy. In 1990, this was increased to seven years. The intent was to allow students to advance up a career ladder and develop good credit they would be reluctant to mar with a bankruptcy filing.

The law was reformed again in 1998 to exempt federal student loans from bankruptcy. In 2005, this exemption was extended to private loans with the passage of the Bankruptcy Abuse Prevention and Consumer Protection Act. Since then, student loans can now be discharged only in very rare cases of “undue hardship” — usually the most dire of circumstances, such as the development of a debilitating medical condition. http://www.mainstreet.com/article/moneyinvesting/credit/debt/we-have-let-students-go-bankrupt-again

When Jason Delisile of The New America Foundation and Jason Richwine of the Heritage Foundation suggest we should be utilizing Fair Market Valuation (the same as what I would use to consider a capital investment for manufacturing with a negative basis being a positive return) which uses commercial risk as a foundation for student loans, I can claim students are being ripped off as the risk for student loans is minimal due the utilization of signature locking them into the loans . . . something neither you nor I experienced. Yes, we would have suffered ruination of credit rating by reneging on debt; but, the department of Education/Gov would not have garnished wages, disability benefits, social security benefits, block you from all federal programs such as unemployment training, etc. Federal Student loans make money in default exceeding the money loaned out and are loaned at a cost less than what is loaned. Students are being ripped off with the present state of affairs without even considering the free rides some may have (where did I mention such?).

For you to preach to me how you lifted yourself up by your own bootstraps is repugnant to me as I earned my right to an education through other methods and I stand here as a result when so many of us are not here to enjoy the same benefits. Certainly by the charts, graphs, and verbiage presented you can surmise what you are espousing “Had you written about how a college education doesn’t get you as much bang for the buck”? What do you believe those graphs are there for? Furthermore as the second on three and possibly 2 more additions, I am not done. The topic is just that big. The article is salient to the dilemma students face.

I am not even going to address Globalization and Labor here as it is another topic and one in which I work in to explain. Your information is anecdotal and has no bearing on today’s environment.

Thank you for you thoughtful responses. I’ve been meaning to write back, but a large number of days on the road takes precedence. I disagree about the relevance of my experience working endless shit jobs while living in crappy apartments and eating pb&j to pay back my loans. That said, I do respect your opinion, and I hope you continue to share your thoughts about how entirely fucked up our priorities are as a Nation when it comes to education.

As my father who is in his late sixties recently said to me “sorry your generation got screwed”, something I’m quite cognizant of as I lose twenty grand selling a home to pursue a career. In the meantime, time to bust some ass and take care of what is in our power to affect.

Best wishes,

Patrick

Patrick:

I hope you come back and read the words on Angry Bear. There are many fine writers here and many knowledgeable economists. We tend to write to the left of center. I am not far behind your father in age and the years left to me to work are few. Yet together, my children and I are close to paying off the debt owed by them and my signature loans. At 65, it has taken a long time. I came from blue collar and yet we existed my father who never graduated grade school with advanced degrees.

It seems with each recession, I have found myself on the street taking whatever measures I could to protect my family and home from loss. It is no easy task to resort to gaffing up trees, cutting them down, and making chips of them. That and landscaping/cutting grass kept us from losing whatever we had and also keeping my family in a home and a place they became familiar. Three and 1/2 degrees plus an ability to work with my hands as taught by my father allowed us to survive. I did what was necessary and gave up on pride. I understand “shit” jobs and made the best of it while having been married 40+ years.

I am not sure what you do; but, I am looking for a Procurement Leader for the Americas. The position is located in Detroit, MI. If of the ability with a knowledge of stampings, etc., the position will eventually replace me. I can be found on hotmail. run75441 has been around a long time on Slate’s The Fray as starred by its editors and here at Angry Bear.

Your story is all too familar.

I was introduced to angrybearblog by a banker friend of mine a year ago. Much of what of is written goes over my head. The larger brush strokes are inline with my politics, which is not to say that against the grain does not inherently merit less respect.

You are of my father’s generation, who came from blue collar roots with a mom who stayed at home and a father who delivered the mail in Florida. We never had much, but never felt that what we had was inadequate. If we are to believe that an economic system should serve the interest of the people at large, this one clearly is not working. To be sure there will be winners and losers as there have always been, but a system defined by colossal hoover vacuums at the top is clearly not in the interest of this nation, nor her people.

Be well.

Patrick:

I was hoping you would return. My dad never finished grade school while my mom graduated high school (an event in itself). Spaghetti was the meal of the week. Together they spawned 4 children with advanced degrees. Out of work at times and gaffing up trees, chipping wood, and cutting grass. It is not easy at times; but, you have to keep at it.

I am only catching this thread now, but I’d like to throw a few facts out that will hopefully cause Patrick to revisit the question of whether or not students are being “ripped off”. I’ve no quarrels with any of his statements, as they might apply to ANY OTHER type of loan in this country. Student Loans, however, are different.

Bill already explained that student loans are exempted from bankruptcy protections, but what is most compelling is what has happened as a result… consider the following

The ENTIRE lending system, from collection companies, to the big lenders like Sallie Mae, to the guarantors, and EVEN THE FEDERAL GOVERNMENT now MAKE money on defaults. Under the FFELP program (most loans outstanding are of this type), the federal government actually made more money on defaults than it did on healthy loans. (This was a point of contention between our group and people like Jason Delisle, but his analytical method in proving otherwise was demonstrably grossly erroneous).

Think about this, Patrick. If a bank wants its borrowers to default, what sorts of things are likely to happen? Bad paperwork? Confusing information? Causing loans to default despite the borrowers best efforts? Well, all these and many more anti-borrower behaviors have been happening increasingly. One specific example: Sallie Mae paid $3.4 million to the federal government after it was determined that the company had thrown a large number of borrowers into default without even attempting to collect on the debt! The company submitted fake documents that purported to show that attempts had been made to contact the borrowers, when in fact no such attempts had been made.

Consider, Patrick: What if it turned out that JP Morgan Chase, and other home mortgage lenders were actually making more on defaulted home mortgages than healthy loans. That would be bad. Now…what if Fannie Mae and Freddie Mac (the guarantors of the loans) were found to be similarly incented to prefer defaults rather than healthy loans. I think we’d be seeing bankers being dragged from their homes, and physically beaten were this the case.

Now, let’s consider the ultimate betrayal: What if even the Federal Housing Administration was discovered to be holding a secret financial preference that subprime home mortgages go into default, and were quietly administering policy that tended to promote defaults. Saying nothing about the likely public outrage that would be justified… Do you think that would be enough evidence to claim “rip off”!

Well, that is, indeed, precisely analogous to the situation with the student lending system. It is a lending relationship that has been corrupted by bad faith financial incentives FOR YEARS.

I won’t say more. I’ll wait for your response, and hope this comment is posted at this late date.

Hi Alan,

I’m not surprised that someone, somewhere is screwing a consumer with debt through means that you’ve mentioned. However, that’s really not what Run75441 was writing about. I maintain that all things being equal, a college education is a great advantage for one’s economic future versus not getting a college education. To be sure there is more competition (domestically and in the global marketplace) and college costs much more. There are fewer jobs, and college grads have more debt now than they did in previous generations. Here’s an interesting anecdotal story from someone who had a similar amount of debt as I did, but did nothing about it for years: http://thebillfold.com/2013/06/i-defaulted-on-my-student-loans-heres-what-i-did-to-get-back-on-track/ Or a cautionary tale of what can happen when someone shoulders an enormous amount of debt without considering what happens after college: http://thebillfold.com/2013/04/i-chose-the-expensive-private-university-and-got-the-debt-to-go-with-it/

Cheers,

Patrick

To Patrick,

In response to your comment:

First: The issue at hand in this article, as it reads and as the title suggests, concerns the rise in the price of college and attendant indebtedness, as well as the unique characteristics of the lending instrument that has enabled it.

I agree with your comment, that (paraphrased) “All things being equal, college is a good thing”.

But Patrick, all things are NOT EQUAL. Student loans and their uniquely predatory nature has removed all standard underwriting, oversight mechanisms, and all standard good-faith lending administration protocol that even the worst of the credit card companies must abide by.

Its not that “someone, somewhere” is abusing these students by the predatory powers that are unique to this lending system. The abuse is systemic, and the abusers include the collection companies, the guarantors, and even the federal government, which MAKES does not LOSE money from defaults.

You use an anecdote meant to indict the borrowers for these ills, Patrick, and that is unimpressive, if not insulting to the intelligence of fair-minded observers to this dialogue. The tactic of using the principle of borrower responsibility as a cover to enable massive, systemic, indefensible, and intolerable abuse of student borrowers, as we have uncovered, exposed, and documented well over the past decade at Studentloanjustice.org, is a well worn one, used for years be those who would perpetuate this blatant injustice upon the citizenry.

I will not repeat my assertions regarding ROI propaganda, or the likely social outcome, and consequences for the lending system that perpetuating this system (as you seem so keen to do) is destined to bring about, Patrick. I will only suggest strongly that you open your eyes to the American Street, and get right, because at this point, I’d say the blood will be on your hands, and the street agrees with me.

The internet is a fascinating place where one moment you are accused of being a leftist, and the next the opposite.

As we seem to have diverging opinions as to what constitutes “predatory”, what is your definition? To use one example, Sallie Mae lends at a fixed rate of 5.74%-11.85%. At what point on that scale are rates predatory? Mine were at about 8.25%.

The strongest definition of a predatory lending system is one where the lender has a preference for the loan to default rather than remain in good stead.

Your definition is weak (ie subjective). I could make the case using the weak definition, but my argument is far stronger and supremely compelling by using the stronger, structural definition. The criteria that form the basis of the strong form are, of course, far more stringent, but for the case of student loans, they have been met. see http://www.studentloanjustice.org/defaults-making-money.htm

Alan, you and Run75441 are writing about different things. He is concerned about the amount of debt crushing students economic future, and you are writing about the injustice of debt. Please correct me if I’m wrong in that assessment.

Both are interesting topics. I’m well acquainted with studentloanjustice, and I have no doubts that someone, somewhere is getting screwed. However, that was not my experience and I got my loans through Sallie Mae in the early 90s and private lenders. Payback sucked. The education? Totally worth it, and I’d do it again.

You are wrong in that assessment. One of the primary consequences of a structurally predatory debt instrument is that the price of the commodity being purchased will go up in the absence of standard market mechanisms that bankruptcy provides towards the contrary.

There are other horrible consequences of a structurally predatory lending system, but inflation is one of the most important. For the case of higher education inflation, you really cannot talk about the topic without pointing to the unique lack of consumer protections.

Your own personal tales of success are, no offense, not relevant to this conversation except perhaps as an anecdote. I would also add that the 90’s were a LONG time ago, in terms of the amounts being foisted upon the nation’s students.

You should review the following. I think I already posted it, but will again so that you can understand the inextricable link between the removal of bankruptcy protections, and inflation in the price of higher education.

Hi Alan,

So my experience is only relevant as an anecdote at best? Interesting. According to your 2008 interview with the New York Times, we went to college at the same time and are a year apart in age. So while your “story” (this is what studentloanjustice.org calls “anecdotes”) is relevant because it supports your position, mine isn’t because it doesn’t. Check out some of the stories on your website. Many of them date back to the 80s (that would be a “LONG time ago”.)

So while I agree that there should be mechanisms in place to deal with debt and default as a result of health issues, I don’t have much sympathy for people who quit their job because they are not given a raise, and then default after not paying for 270 days because they are underemployed.

We can both protect the most vulnerable in society from being preyed upon by the powerful, as well as dissuading the able bodied from defaulting on their debt.

I don’t go around telling my personal story unless forced to, actually. What I DO do is point to the default rates. By my best estimations, the TRUE default rate was upwards of 25% EVEN DURING GOOD TIMES. This is higher than the subprime home mortgage default rate. Higher than credit card default rates, higher than payday lender default rates, higher, in fact, than the default rate of ANY OTHER LENDING INSTRUMENT IN THIS COUNTRY.

That is what is important, and that is what I talk about. You don’t seem to be interested in talking about what is important, I see. In fact, I would say that you appear to be on some sort of fishing expedition, seeking weaknesses in my argument. Good luck with that. There are none- There is only a vast number of citizens who are about to reject the entire student loan program in its entirely, to where almost no one will pay, unless justice is brought back to this unjust system. Keep fishing, keep delaying/perpetuating this problem, and we can watch the entire system fail together…but the blood, my friend, will be on your hands.

Alan,

If there is one thing I love, it’s good hyperbole. The whole blood on my hands and vast number of citizens rejecting the student loan system is precisely the kind of hyperbole that will prevent you from being taken seriously by the kind of people you’ll need as allies for your cause. Work on your PR.

The student loan system works well for millions of students, including myself. Without it, there was no way I was going to college and I’m guessing you were in the same boat. We both got an education out of it.

You’re argument has merit, and if you read a bit more carefully you would have picked that out of my last post. However, lenders need guarantees and those receiving loans need a bit of moral hazard as well as protections when their health conspires again them.

I am not interested in hearing your opinion about my claims. What I am interested in is sharing the truth about this important topic.

I am also not interested in what the lending system “requires”. The lending system requires a citizenry that accepts its legitimacy, first and foremost. And in actual fact, the way this lending system has been designed and administered, as well as the gross negligence, critical omissions of facts, and other activities by the lending side THAT WE HAVE FOUND OUT ABOUT are enough to render the lending contract null and void.

Every prediction I have ever made on this topic was downplayed as hyperbole since I began speaking publicly on this topic ten years ago. Yet, ever claim I made has proven to be not only absolutely correct, but actually conservative as the truth has come out.

So when I say that the general public is about to reject the entire lending system, I suggest you take it extremely seriously, friend.

I get it. Your claims are truths that I should accept uncritically. Sounds a bit like zealotry. Best of luck with that strategy.

Buddy, I’ve put up nothing but supportable facts on this, and every article I have ever written or commented on. You are the one throwing around bad data, anecdotes, opinion, and so forth.

Cut the bullshit, and cut the low blows. Creep.

I’ve been very patient with you. I have endured your comments with alot of toleration and effort. No more. I consider this thread finished.

You’re the guy who wanted to resurrect a great conversation I was having with Run75441. Then you’ve got the nerve to get offended when I don’t agree with all of your claims. What you are looking for is uncritical acceptance. When the stories support your position, you call them “stories.” When they don’t, you call them “anecdotes.” Heck, I’ve even agreed with you that there need to be reforms.

Respectfully, here’s a piece of advice from a “creep.” Work on finding common ground with people rather than insisting that they accept your worldview. You’ll get more support and earn valuable allies in the process.