GDP Growth Caused By Tax Cuts Has Never Happened

Mike’s post here got me thinking. I’ll telegraph my conclusion. He dramatically understated his case.

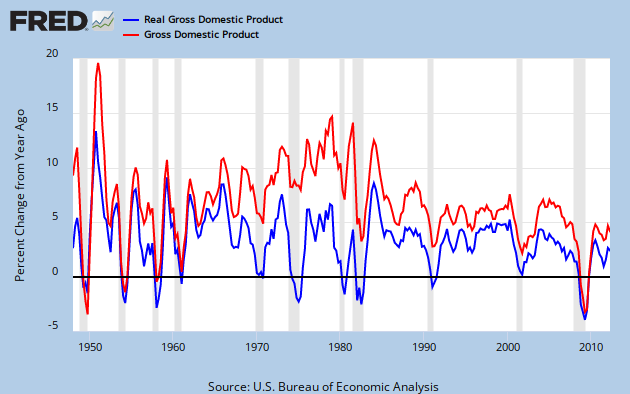

You can see the long range view of nominal and inflation adjusted GPD growth in Graph 1 of FRED quarterly YoY percent change data.

Nominal GDP Growth was in a secular up-trend from 1960 through 1980. However, inflation adjusted GDP growth quickly peaked after the Kennedy-Johnson tax cut, reaching a maximum value of 8.5% in Q4 of ’65 and Q1 of ’66. It then dropped dramatically for the next four years. This peak value has been matched only once since: in 1984, during a sharp rebound from the double dip recession of 1980-82.

Since then, in the wake of numerous tax cuts, the rate of GDP growth has been anemic. To get a look at the rate of growth, I took an 8 year average of the annual percent change data presented above, and then plotted a 5 year rate of change for that data. This is essentially the 2nd derivative of GDP, or GDP acceleration, as shown in Graph 2.

Inflation Adjusted GDP acceleration peaked in Q3, 1966. Fueled by the inflation of the 70’s, NGDP acceleration stayed high until Q1, 1980, then plummeted for 9 years. It has been relentlessly negative since.

Inflation adjusted GDP acceleration has not done quite as badly in this disinflationary era, but has been below zero more than half the time since 1970. This is a little bit worse than coasting.

This all might seem a bit abstract, but the message is clear. If tax cuts were good for the economy, then GDP growth would be increasing. In other words, acceleration would be positive and most especially so after a tax cut. The data is not consistent with this notion.

Clinton’s famous tax increase preceded increased GDP growth by either measure, and an upturn in acceleration. The Bush tax cuts preceded decreasing GDP growth.

I’m not going to get into a correlation vs causation discussion. I’ll simply say that tax cuts over 5+ decades have been an utter failure at stimulating real economic growth in any inflationary environment. Since the real world data correlation is counter to the received conservative wisdom, it might be worth trying an anti-conservative approach.

It might also give the NGDP targeting enthusiasts something to ponder.

Cross posted at Retirement Blues.

Some posed the idea that wealth inequality harms growth.

Taxes are an equalizer……

To republicans and a lot of democrats “all men are created equal..” only applies to deregulating and libertarian dogma.

Second Fact Check On Spending

The last budget of Bush spent 3510B

Actual spent in fiscal 2012 was 3540.

The 2013 budget projects spending at 3800B.

That indicates that Obama will increase spending

from 3510 to 3800 or 8.3% for four years.

Compare to Reagan 80% and Bush 90% (1830 to 3510)

One big problem is failure to tax to get revenue to pay our way

thereby creating the horrid debt burden.

In fiscal 2012 we borrowed 1100B. A shame. While corporations made record profits and richest got much richer. We have the income to pay our way.

The revenue in fiscal 2012 was 2450B is why we rank below only Chile and Mexico as Least Taxed in OECD nations. The 2450 is 17% of our National Income.

Runaway unfunded spending is in Medicare and Pentagon.

We must cut the runaway spending and tax wealth more to start paying down the debt.

Medicare spending is growing so fast because of for-profit medicine. We’re last place in the world at controlling healthcare costs. Smarter countries put healthcare before wealth care.

Few things. One tax cuts have been tilted toward the higher marginal rates rather than dignificant cuts for households earning less than say $150k.

Two, rates have increased during many periods mentioned. OASDI was 5.08% in 1980 increasing to 6.2% in 1990.

Three is deductions, 1986 was a tax increase. Bush lowered taxes but overall rates were still way above his father.

Cash for clunkers was a tax cut no? Dd it not effect car sales? If you lower taxes in a person earning $50k don’t they have more to spend?

Maybe the effect on GDP is negligible, but maybe it might have been lower otherwise.

Were the Obama stimulus tax cuts bad for the economy?

That was me just above – mcwop

mcwop –

Your points, in order.

1) True.

2) This post is addressing income tax effects. Whether OASDI is a tax is a moot point I will let you take up with Coberly.

I think it’s true, though, and probably to your point, that the net effect of Reagan’s 2 cuts and 11 increases was to shift the tax burden from high to low income earners.

3) overall rates lower for Bush Jr than Sr.? Please verify and elaborate.

4)Cash for clunkers was a tax cut no? No. It was a voucher for a specified end use purchase.

5) I think the tax cut portion of the stimulus package was an absolute waste. I can’t say for sure that it was bad for the economy, but I don’t have any reason to think it helped.

JzB

Jazz

Bush I top tax rate was 31%

Bush II lowered the top tax to 35% so his top rate was indeed higher than his father’s. also Clinton implemented the Medicare tax on all income, and Bush II left that in place. So again taxes at the top were higher under BUsh II than his dad, but lower than Clinton. Rates tv the bottom were lower under bush II at 10% versus 15 for dad.

While payroll taxes might not be a tax it does reduce someone’s pay nonetheless.

Mcwop

The times on the second graph look off.

“To get a look at the rate of growth, I took an 8 year average of the annual percent change data presented above, and then plotted a 5 year rate of change for that data. This is essentially the 2nd derivative of GDP, or GDP acceleration, as shown in Graph 2”

The years for Graph 2 go up to 2012. But the 8 year average takes us back to 2008, and the the 5 year window takes us back to early 2006, right? (6.5 years). If so, then we get this:

Inflation Adjusted GDP acceleration peaked in Q1, 1960. NGDP acceleration stayed high until Q3, 1973, then plummeted for 9 years. It has been relentlessly negative since.

That would put the decline of NGDP acceleration at the energy crisis and recession in the early 1970s.

mcwop –

You are right about the Bushes and the tax rates during their terms.

I stand corrected, and thank you.

Min –

You’re losing me. The value for the 8 year average of the annual percent change data is associated with year 8 of the series. Thus the value for 1968 is the average of the values for 1961 through 1968, inclusive.

The five year RoC for this value in 1968 is Avg(1968) – Avg(1963).

The calculated values are graphed as a function of time using this algorithm.

So, the extreme values for these data sets occurred exactly where I have placed them.

JzB

When are the economics and business communities going to admit that this constant argument about the effect of taxation on economic activity is little more than a red herring? There is a specific purpose to taxation. There are several widely accepted means of providing a nation with its tax revenue needs. The collection of such revenues in order to pay for the cost of federal, state and municipal services is part and parcel to the economies of all nations.

Taxes are one factor in a process, what we are calling the economy, that is so complex and multivariate as to defy the intention to hold out one factor as being able to skew that entire process. Taxation is the national income part of an economy. Look to cut wasteful costs rather than essential revenue. Then redefine your definition of “wasteful” in regards to a nation, a state or a town.

McWop:

Why would you think Medicare spending is running away when its growth is ~2.4% as opposed to ~8% for commercial insurance? In 2013, Obama has pledged to allow Medicare to negotiate more of its needs with the healthcare industry along with the greater cost cutting measures already and soon to be in place.

Run, I did not make the Medicare comment.

McWop:

Ok, It was anonmynous also. I thought it might be you also.

Jazzbumpa: “The value for the 8 year average of the annual percent change data is associated with year 8 of the series. Thus the value for 1968 is the average of the values for 1961 through 1968, inclusive.”

That’s the problem. The average should not be associated with an end point of the range. It summarizes the whole range. If it is associated with any point, it should be associated with the midpoint. It makes as much sense to associate the average with 1961 as with 1968.

I know that some people who use moving averages, such as stock market technicians, tend to associate the average with the end point of the range. But they do not know what they are doing, in that regard. The most representative point for the range is the midpoint.

Maybe it would be clearer if I gave an example with vectors.

What is the average of (1, 0) and (2, 4)?

Easy. It is (1.5, 2). 🙂

This comment has been removed by a blog administrator.