The FED’s Year 2000 Transcripts

After reading the recently released FOMC transcripts from the year 2000, Dr. Altig laments on The Woes Of Making Policy In Real Time. Dr. Altig also provides excerpts of Greg Ip’s FOMC transcript summary from the WSJ. In 2000, as the economy slowed from the booming ’90s, the Federal Reserve, for the most part, missed the slowdown.

Here are some representative comments from Chairman Greenspan in May 2000:

“My own judgment, and what I plan to recommend to the Committee, is that we have an opportunity now to move the funds rate up 50 basis points, remain asymmetric, and effectively adjust our longer-term posture to a better position than the one we are in at the moment. The reason I am not concerned about moving the rate up quickly at this stage is that I think the evidence indicates that productivity, indeed perhaps underlying GDP, is still accelerating.

…

I believe the risks in moving 50 basis points today are not very large because I think the underlying momentum in the economy remains very strong.”

FED Chairman Alan Greenspan, May 16, 2000

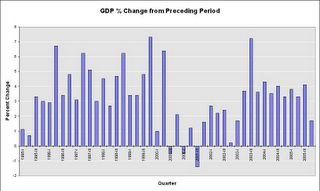

The following graph shows that Greenspan couldn’t have been more wrong. The above FOMC meeting was in May (Q2 2000), the last quarter of solid growth before the recession of 2001.

Click on graph for larger image.

At the time of the FED meeting, the NASDAQ had already sold off close to 30%. My feeling is the FED underestimated the impact of the bursting of the stock market bubble and the subsequent impact on business investment.

This could be relevant to today, but this time with the housing market.

The transcripts also contain some amusing comments, like Greenspan’s comments on the Conference Board’s leading indicators. Also, there was significant discussion on the impact of future budget surpluses on interest rates and FED policy. Too bad that discussion was unnecessary.

Best Regards to all, CR Calculated Risk