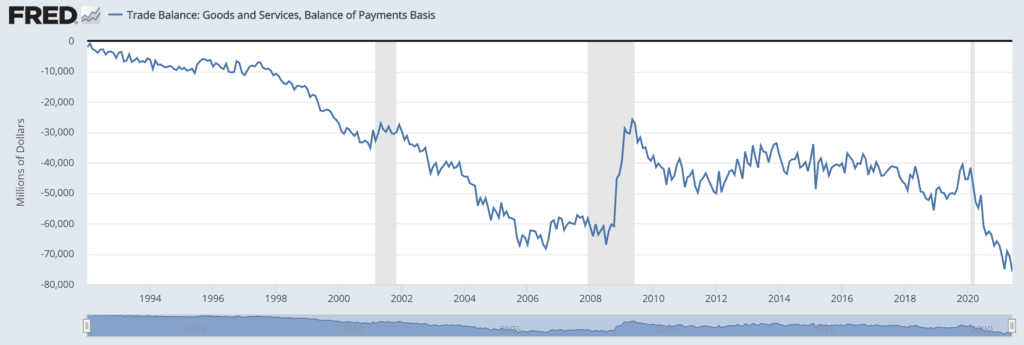

Trade Deficit at a Record High in June, Rises 6.7%

on Surge in Imports of Industrial Supplies and Materials, Commenter/Blogger RJS at MarketWatch 666

US trade deficit was at a record high in June after rising by 6.7% from May, as the value of both our exports and our imports increased, but our imports increased by nearly five times as much . . . the Commerce Department report on our international trade in goods and services for June indicated that our seasonally adjusted goods and services trade deficit rose by a rounded $4.8 billion to a record $75.7 billion in June from a revised May deficit of $71.0 billion, which had previously been reported at $71.2 billion . . . the value of our June exports rose by $1.2 billion to $207.7 billion on a $0.3 billion increase to $145.9 billion in our exports of goods and a $0.9 billion increase to $61.8 billion in our exports of services, while our imports rose by $6.0 billion to $283.4 billion on a $4.3 billion increase to $239.1 billion in our imports of goods and a $1.6 billion increase to $44.3 billion in our imports of services . . . export prices were on average 1.2% higher in June, so the increase in the month’s real exports would be relatively less than their nominal change by that percentage, while import prices were 1.0% higher, meaning that the increase in our real imports was likewise relatively smaller than the nominal increase by that percentage..

June’s exports of goods increased even as our higher exports of industrial supplies and materials was more than offset by lower exports of foods, feeds and beverages . . . referencing the Full Release and Tables for June (pdf), in Exhibit 7 we find that our exports of industrial supplies and materials rose by $1,177 million to $53,506 million as an increase of $1,643 in our exports of our exports of crude oil, a $570 million increase in our exports of fuel oil, and a $487 million increase in our exports of natural gas were partly offset by a $598 million decrease in our exports of non monetary gold and a $461 million decrease in our exports of precious metals other than gold . . . in addition, our exports of automotive vehicles, parts, and engines rose by $195 million to $11,564 million on a $343 million increase in our exports of new and used passenger cars, our exports of consumer goods rose by $46 million to $18,004 million as a $871 increase in our exports of pharmaceutical preparations was partly offset by a $465 million decrease in our exports of gem diamonds, and our exports of other goods not categorized by end use rose by $124 million to $5,729 million . . . mostly offsetting the increases in those export categories, our exports of foods, feeds and beverages fell by $1,222 million to $12,780 million on a $485 million decrease in our exports of soybeans and lower exports of meat, poultry, corn and other foods, and our exports of capital goods fell by $93 million to $43,731 million as an increase of $1,193 million in our exports of civilian aircraft was more than offset by a $325 million decrease in our exports of industrial machines other than those itemized separately, a $299 million decrease in our exports of medical equipment, and decreases in exports of several other categories of capital goods.

Exhibit 8 in the Full Release and Tables gives us seasonally adjusted details on our goods imports and shows that rising imports of industrial supplies and materials and of capital goods were responsible for the increase in March imports, and that those increases were partly offset by lower imports of consumer goods and automotive vehicles, parts, and engines . . . our imports of industrial supplies and materials rose by $4,635 million to $56,943 million on a $1,151 million increase in our imports of nonmonetary gold, a $459 million increase in our imports of finished metal shapes, a $425 million increase in our imports of iron and steel mill products, a $389 million increase of in our imports of organic chemicals and a $346 million increase in our imports of fuel oil, while our imports of capital goods rose by $841 million to $63,417 million, led by a $321 million increase in our imports of computer accessories . . . in addition, our imports of foods, feeds, and beverages rose by $627 million to $16,013 million led by a $226 million increase in our imports of meat products, and our imports of other goods not categorized by end use rose by $372 million to $10,118 million . . . partially offsetting the increases in those categories, our imports of consumer goods fell by $1,601 million to $62,391 million on a $782 million decrease in our imports of pharmaceutical preparations, a $672 million decrease in our imports of cotton apparel and household goods, and a $315 million decrease in our imports of televisions and video equipment, and our imports of automotive vehicles, parts, and engines fell by $704 million to $28,482 million on a $620 million decrease in our imports of new and used passenger cars…

The press release for this month’s report summarizes Exhibit 19 in the full release pdf for March, which gives us surplus and deficit details on our goods trade with selected countries:

The June figures show surpluses, in billions of dollars, with South and Central America ($4.5), Hong Kong ($1.7), Brazil ($1.5), and Singapore ($0.6). Deficits were recorded, in billions of dollars, with China ($27.0), European Union ($19.6), Mexico ($7.2), Germany ($6.3), Canada ($5.5), Japan ($4.9), Italy ($3.7), India ($3.5), Taiwan ($3.3), South Korea ($2.8), France ($1.9), Saudi Arabia ($0.3), and United Kingdom (less than $0.1).

- The deficit with the European Union increased $1.1 billion to $19.6 billion in June. Exports increased $0.6 billion to $22.6 billion and imports increased $1.7 billion to $42.2 billion.

- The deficit with India increased $1.0 billion to $3.5 billion in June. Exports decreased $0.3 billion to $2.9 billion and imports increased $0.7 billion to $6.5 billion.

- The deficit with Japan decreased $0.9 billion to $4.9 billion in June. Exports increased less than $0.1 billion to $6.4 billion and imports decreased $0.9 billion to $11.4 billion.

In the advance report on 2nd quarter GDP released last week, our June trade deficit was estimated based on the Advance Report on our International Trade in Goods which was also released last week, just before the GDP release . . . that report estimated that our June goods trade deficit was at $91,207 million on a Census basis, up from the $88,160 million goods deficit reported in May . . . this report revises those figures and shows that our actual goods trade deficit in June was at $93,174 million on a balance of payments basis, and $92,050 million on a Census basis, and that the May goods deficit was revised to $88,108 million on a Census basis . . . together, those revisions from the previously published data mean that the 2nd quarter goods trade deficit in goods was roughly $791 million more than the estimates that were used in last week’s GDP report, or about $3.2 billion more at an annual rate, before adjusting for price changes . . . that would indicate a downward revision of roughly 0.04 percentage points to 2nd quarter GDP when the 2nd estimate is released at the end of August.

For our trade in services, the BEA’s Key source data and assumptions (xls) for the advance estimate of second quarter GDP provides aggregate exports and imports of services at annual rates on an international-transactions-accounts basis, indicating that the BEA assumed a $14.9 billion increase in exports of services and a $13.5 billion increase in imports of services on an annual basis in June . . . while there is no comparable annualized metric or adjusted data in this trade report that we could match that to, this release does show that exports of services rose $0.9 billion in June after May’s exports of services were revised $0.3 billion higher, and that imports of services rose $1.6 billion in June after May imports of services were revised $0.1 billion higher…that suggests that the annual rate for June exports of services used in the GDP report was on the order of $0.4 billion too high, while the annual rate for June imports of services used in the GDP report was about $20.5 billion too low…revising those annualized figures, and annualizing the services trade revisions for May vis a vis those reported, the annual rate for 2nd quarter services exports would be revised about $0.1 billion lower, while the annual rate for 2nd quarter services exports would be revised about $6.8 billion higher…the resulting upward revision of $6.7 billion to our total services deficit in NIPA terms should be enough to subtract about 0.09 more percentage points from 2nd quarter GDP…

Well that’s not good.

Meanwhile…

For GOP, Infrastructure Bill Is a Chance to Inch Away From Trump

Trump warns will be “very hard” to endorse Republicans who vote for infrastructure bill

Former President Donald Trump on Saturday again voiced his opposition to the large bipartisan infrastructure bill nearing passage in the Senate, saying it would be “very hard” to endorse Republican lawmakers voting in favor of the legislation.

President Joe Biden, Democratic Senate leaders and a group of GOP senators have been negotiating for months to pass a sizable bipartisan infrastructure bill. The talks resulted in a nearly $1 trillion package to fund roads, bridges, water infrastructure, public transportation and broadband internet. The legislation now appears nearly ready to pass in the upper chamber of Congress. …

A lone GOP senator is slowing down the Biden infrastructure bill