Rule Changes Offer Little Relief as Student Loan Payments Resume

If I was new to this dilemma, I would believe this is better news than prior announcements. But it is not good news, it is news coming too late for the borrowers holding exaggerated debt due to penalties, consolidation fees, interest, interest on that interest, and rate changes. If this was said a decade ago, it might make sense.

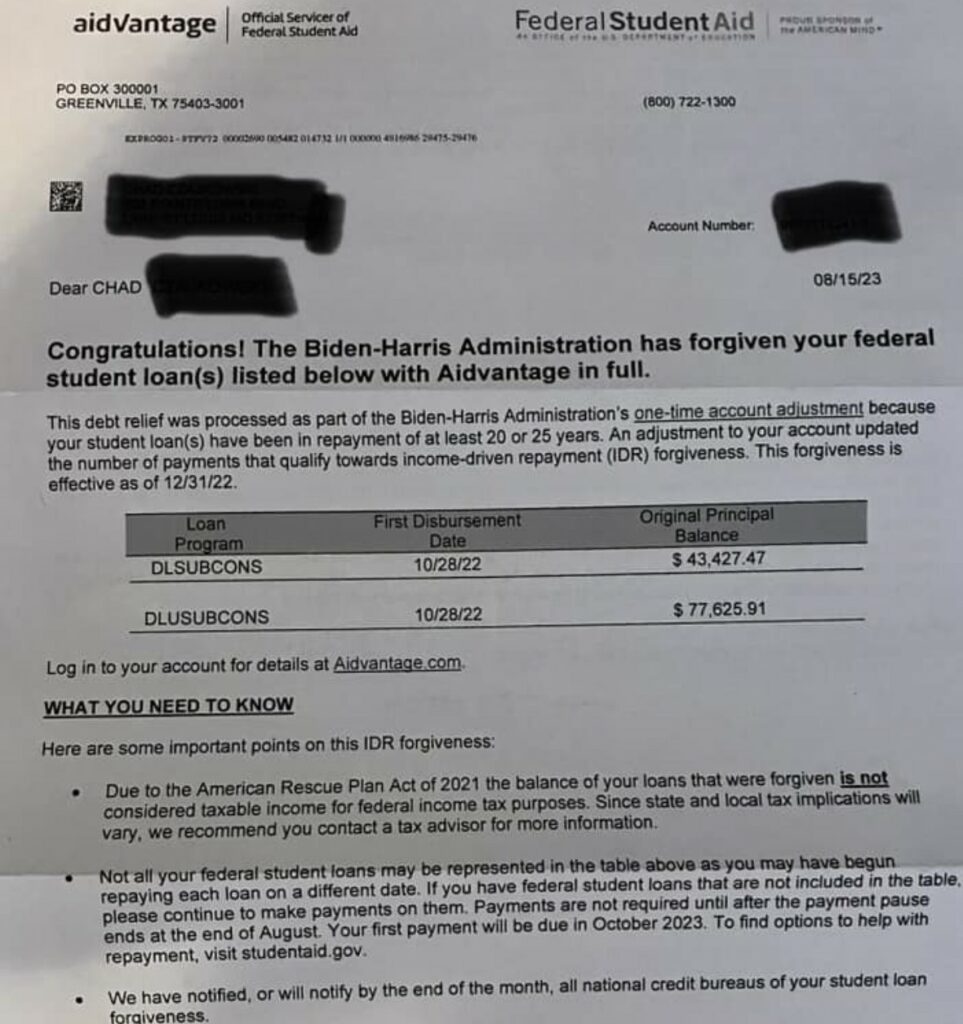

It is only now, the Department of Education has caught up with how old some of these loans are today. Why does this matter? If you are in deferment for 20-25 years, you are eligible for forgiveness of the remainer of the loan. This was said to be impossible to do in the past because the loans had been transferred between servicing entities. The age of the loans was claimed to be lost. Yet here we are, Pres. Biden and the Department of Education has been able to determine the loan ages. Two hundred and forty months appears to be the magic number for forgiveness. Alan may tell you differently by a few months. His facebook site is Student Loan Justice | Facebook. Here is one loan which was forgiven:

In an exchange of emails, Alan said there was an approximate 2% of the loans in his group being forgiven. Not much considering there are 40-something loan holders. Some of his one million followers have seen some relief already. I believe the key is to be in a deferment mode. This requires a yearly document to be submitted to a servicer such as Mohela.

The battle for more forgiveness is still not over. As you can see the document on the right shows a total forgiveness of $121,052. Keep in mind much of this is probably accrued interest,

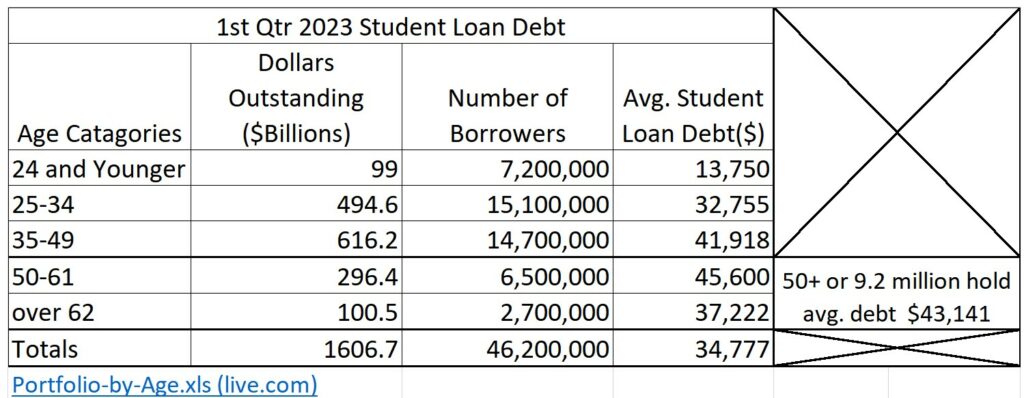

Also of the 46 million student loan holders as of 2023, 9.2 million are over the age of 50. Their loans being paid off by 65 is unlikely for a majority of them. Portfolio-by-Age-Debt-Size.xls (live.com) They will have their loans past the age of 65.

Roosevelt Institute has a piece about the rule changes for student loans payments starting this month. People can always go back into deferment if needed. I would suggest they claim deferment by filling out the yearly form. If they can, pay the interest.

Rule Changes Offer Some Relief to Borrowers as Student Loan Payments Resume, but Questions and Challenges Remain, Roosevelt Institute, Alí R. Bustamante

Loan forgiveness would have relieved up to $20,000 in debt for millions of borrowers. In striking down the Biden administration’s student debt cancellation program, the US Supreme Court left the $2 trillion student loan crisis in place. For 43 million Americans and their families, student loan interest accumulation resumes today. The financial burden of payments returns on October 1, coming after a three-and-a-half-year pandemic-related payment pause. Rule changes to student loan payments may provide some relief by lowering required monthly payments. However, it is unclear how many borrowers will benefit from these changes.

The good news is, if current economic conditions hold, a strong labor market and decelerating inflation should dampen the impact on borrowers of student loan repayments restarting. Employment levels have rebounded from the pandemic and, adjusting for inflation, average weekly wages for most workers have increased by 3.1 percent since January 2020. A strong economy will complement important changes to repayment terms made by the Department of Education last January that had a stated purpose of “[making] student loan repayment more affordable and manageable than ever before.”

Furthermore, rule changes to the student loan income-driven-repayment (IDR) program may enable approximately half of borrowers to qualify for reduced monthly payments.1 The new Saving on a Valuable Education (SAVE) plan from the IDR program dampens the economic hit borrowers are set to face this fall by capping student loan payments to 5 percent of annual income earned above $33,000 per year and forgiving accrued interest if payments under the program fail to cover monthly interest charges. What’s more, borrowers with annual incomes below $33,000 will not be forced to make any loan payments.

Our estimates show that loan repayment rule changes could allow American families to keep more than $3 billion a month that would otherwise be spent on student loan servicing. While that amount is trivial compared to the $26.5 trillion American economy, the impact of those savings is extremely meaningful to the borrowers who count on this income to make their families’ lives better. Based on the composition of student loan borrowers, average monthly payments are likely to drop from $393 to around $200, reducing the monthly amount stripped from about 18 million student loan borrowers’ budgets by about half.

However, it is unclear how many borrowers will benefit from the IDR program rule changes that can reduce student loan payments. Data show that there are currently 8.5 million borrowers enrolled in the IDR program, representing only one in every five federally held student loans. Historically, the IDR program has covered less than 25 percent of all student loans, as most borrowers used the default standard repayment programs instead of opting into IDR plans. The Biden administration has taken steps to streamline enrollment into IDR plans and to automatically enroll borrowers who are delinquent or have defaulted on payments. However, whether most borrowers choose to enroll in IDR plans remains a question given the program’s enrollment history. Promoting greater enrollment in IDR plans through multiple approaches must be a priority for the administration, or the overwhelming majority of borrowers will simply return to the standard payment plans they had prior to the pandemic.

Additionally, without guardrails on repayment guidance from student loan lenders and student loan servicers, borrowers will continue to be vulnerable to fraud and processing mistakes. The Department of Education has implemented greater consumer protections for student loans through the implementation of robust accountability and quality control mechanisms, but the student loan industry continues to harbor bad actors and is rife with unsavory practices by lenders and servicers. With student loan payments resuming, the administration needs additional resources to enforce existing consumer protections and proactively prevent fraudulent activity.

Still, for 43 million Americans and their families, the burden of student debt servicing will be felt with or without enrollment in the IDR program. Softening the blow of repayments is good policy, but eliminating all student debt held by the government would be better. The broad popularity of the movement to cancel student debt made it clear that Americans are demanding access to debt-free college education. It is time for policymakers to change the failed education policies of the last three decades and take action to end the student debt crisis once and for all.

Analysis based on data from: Congressional Budget Office (CBO).

45 and Now 46 million strong Owning Student Loans 2023, Angry Bear