Early Read on Existing Home Sales in August

Lawler: Early Read on Existing Home Sales in August,

From housing economist Tom Lawler:

Early Read on Existing Home Sales in August

Based on publicly-available local realtor/MLS reports released across the country through today, I project that existing home sales as estimated by the National Association of Realtors ran at a seasonally adjusted annual rate of 3.88 million in August, down 1.8% from July’s preliminary pace and down 3.7% from last August’s seasonally adjusted pace. Unadjusted sales should show a slightly larger YOY % decline, as there was one fewer business day this August compared to last August.

Local realtor/MLS reports suggest that the existing single-family home sales price last month was up 3.5% from last August.

CR Note: The National Association of Realtors (NAR) is scheduled to release August Existing Home Sales on Thursday, September 19th at 10 AM ET. The consensus is for 3.85 million SAAR, down from 3.95 million in July.

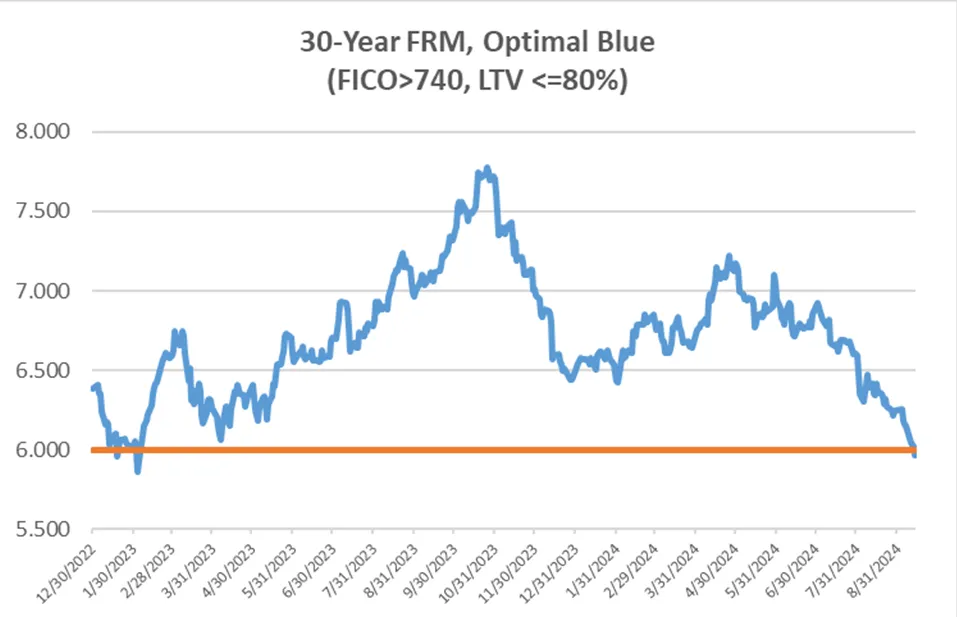

Mortgage Rates for Top-Tier Borrowers Fall Below 6% for First Time Since Early February of 2023

The Optimal Blue 30-Year Fixed-Rate Mortgage Index for borrowers with a FICO score above 740 and an LTV greater than 80% fell to 5.966% on Friday, the first time this index was below 6% since February 3, 2023. The Optimal Blue Indexes are based on actual rate-lock activity.

Nice numbers out on mortgages this morning. Is there a sweet spot for mortgage rates that will allow working folks to start being able to buy a house and the market starts to come back to some sort of normal? I am thinking a 5% rate would do the trick, as the pop in applications today shows the 7s were too much, 6s are nice, but I think a 5% rate would be a nice win for everyone, buyers and sellers, and will start to get the inventory tracking up. I remember in the late 80s, my father coming up to me and saying ‘Wow, mortgages are under 10%, that is crazy, now is the time to look for a house!’ I don’t know if he meant that as good solid advice on buying a home, or a hint to get the heck out!

Robert:

If banks can get by with 3 percent plus maintaining escrow accounts with interest, why would they need 5%? I had a 12% VA mortgage for a short time and then a 10% mortgage when we moved. Got down to an 8% mortgage through remortgaging. Today a 2.6% VA mortgage. Almost 50% equity and slightly more for interest. I would start to look at the costs of mortgaging.

@Bill,

Exactly. We got a 30-year mortgage back in 1987. We re-financed three times for lower rates and faster pay-off each time. Ended up paying it off in 20 years, just as our daughter started college. As a financial asset, it was a terrible investment. As a place to live, we liked it for the 35 years we lived in it. And you have to live somewhere.