Trump and the Economy

As usual Trump is bleating about the upcoming election and how he will be cheated through fraudulent actions if he loses. Another point being made in this commentary is the pricing of goods which went up 14% while corporate profits when up five times as much. A Kroger Director admits such for some food products.

My argument over the years has been prices can increase unduly and not due to increases in cost. Companies can increase prices because they can do so and blame such on a national crisis. We did experience similar in the aftermath of 2008 in manufacturing. Suppliers then rolled out a “take it or leave it approach.”

Economies typically return to normal over time. The time for a reckoning may yet present itself.

Letters from an American

by Prof. Heather Cox Richardson

Former president Trump appears to have slid further since last night’s news about a new grand jury’s superseding indictment of him on charges of trying to overthrow the 2020 presidential election. Over the course of about four hours this morning, Trump posted 50 times on his social media platform, mostly reposting material that was associated with QAnon, violent, authoritarian, or conspiratorial.

He suggested he is “100% INNOCENT,” and that the indictment is a “Witch Hunt.” He called for trials and jail for special counsel Jack Smith, former president Barack Obama, and the members of Congress who investigated the January 6, 2021, attack on the U.S. Capitol. And he reposted a sexual insult about the political careers of both Vice President Kamala Harris and former Secretary of State Hillary Clinton.

Meanwhile, Trump’s campaign has today escalated the fight about Trump’s photo op Monday at Arlington National Cemetery, where campaign staff took photos and videos in Section 60, the burial ground of recent veterans, apparently over the strong objections of cemetery officials. Then the campaign released photos and a video from the visit attacking Harris.

Arlington National Cemetery was established on the former property of General Robert E. Lee in 1864, after the Lee family did not pay their property taxes. At the time, Lee was leading Confederate forces against the United States government, and those buried in the cemetery in its early years were those killed in the Civil War. The cemetery is one of two in the United States that is under the jurisdiction of the U.S. Army, and it is widely considered hallowed ground.

A statement from the Arlington National Cemetery reiterated: “Federal law prohibits political campaign or election-related activities within Army National Military Cemeteries, to include photographers, content creators or any other persons attending for purposes, or in direct support of a partisan political candidate’s campaign. Arlington National Cemetery reinforced and widely shared this law and its prohibitions with all participants. We can confirm there was an incident, and a report was filed.”

Republican vice presidential candidate Senator J.D. Vance of Ohio first said there was a “little disagreement” at the cemetery, but in Erie, Pennsylvania, today he tried to turn the incident into an attack on Harris. “She wants to yell at Donald Trump because he showed up?” Vance said. “She can go to hell.” Harris has not, in fact, commented on the controversy.

VoteVets, a progressive organization that works to elect veterans to office, called the Arlington episode “sickening.”

In an interview with television personality Dr. Phil that aired last night, Trump suggested that Democrats in California each got seven ballots and that he would win in the state if Jesus Christ counted the votes. As Philip Bump of the Washington Post pointed out today, Trump has always said he could not lose elections unless there was fraud; last night he suggested repeatedly that God wants him to win the 2024 election.

When asked his opinion of Vice President Harris, Trump once again called her “a Marxist,” a reference that would normally be used to refer to someone who agrees with the basic principles outlined by nineteenth-century philosopher Karl Marx in his theory of how society works. In Marx’s era, people in the U.S. and Europe were grappling with what industrialization would mean for the relationship between individual workers, employers, resources, and society. Marx believed that there was a growing conflict between workers and capitalists that would eventually lead to a revolution in which workers would take over the means of production—factories, farms, and so on—and end economic inequality.

Harris has shown no signs of embracing this philosophy, and on August 15, when Trump talked at reporters for more than an hour at his Bedminster property in front of a table with coffee and breakfast cereal at what was supposed to be a press conference on the economy, he said of his campaign strategy: “All we have to do is define our opponent as being a communist or a socialist or somebody that’s going to destroy our country.”

Trump uses “Marxist,” “communist,” and “socialist” interchangeably, and when he and his allies accuse Democrats of being one of those things, they are not talking about an economic system in which the people, represented by the government, take control of the means of production. They are using a peculiarly American adaptation of the term “socialist.”

True socialism has never been popular in America. The best it has ever done in a national election was in 1912, when labor organizer Eugene V. Debs, running for president as a Socialist, won 6% of the vote, coming in behind Woodrow Wilson, Theodore Roosevelt, and William Howard Taft.

What Republicans mean by “socialism” in America is a product of the years immediately after the Civil War, when African American men first got the right to vote. Eager to join the economic system from which they had previously been excluded, these men voted for leaders who promised to rebuild the South, provide schools and hospitals (as well as prosthetics for veterans, a vital need in the post-war U.S.), and develop the economy with railroads to provide an equal opportunity for all men to rise to prosperity.

Former Confederates loathed the idea of Black men voting almost as much as they hated the idea of equal rights. They insisted that the public programs poorer voters wanted were simply a redistribution of wealth from prosperous white men to undeserving Black Americans who wanted a handout, although white people would also benefit from such programs. Improvements could be paid for only with tax levies, and white men were the only ones with property in the Reconstruction South. Thus, public investments in roads and schools and hospitals would redistribute wealth from propertied men to poor people, from white men to Black people. It was, opponents said, “socialism.” Poor black voters were instituting, one popular magazine wrote, “Socialism in South Carolina” and should be kept from the polls.

This idea that it was dangerous for working people to participate in government caught on in the North as immigrants moved into growing cities to work in the developing factories. Like their counterparts in the South, they voted for roads and schools, and wealthy men insisted these programs meant a redistribution of wealth through tax dollars. They got more concerned still when a majority of Americans began to call for regulation to keep businessmen from gouging consumers, polluting the environment, and poisoning the food supply (the reason you needed to worry about strangers and candy in that era was that candy was often painted with lead paint).

Any attempt to regulate business would impinge on a man’s liberty, wealthy men argued, and it would cost tax dollars to hire inspectors. Thus, they said, it was a redistribution of wealth. Long before the Bolshevik Revolution in Russia brought the fears of a workers’ government to life, Americans argued that their economy was under siege by socialists. Their conviction did indeed lead to a redistribution of wealth, but as regular Americans were kept from voting, the wealth went dramatically upward, not down.

The powerful formula linking racism to the idea of an active government and arguing that a government that promotes infrastructure, provides a basic social safety net, and regulates business is socialism has shaped American history since Reconstruction. In the modern era the Brown v. Board of Education Supreme Court decision of 1954 enabled wealthy men to convince voters that their tax dollars were being taken from them to promote the interests of Black Americans. President Ronald Reagan made that formula central to the Republican Party, and it has lived there ever since, as Republicans call any policy designed to help ordinary Americans “socialism.”

Vice President Harris recently said she would continue the work of the Biden administration and crack down on the price-fixing, price gouging, and corporate mergers that drove high grocery prices in the wake of the pandemic. Such plans have been on the table for a while: Senator Bob Casey (D-PA) noted last year that from July 2020 through July 2022, inflation rose by 14% and corporate profits rose by 75%. He backed a measure introduced by Senator Elizabeth Warren (D-MA)—who came up with the idea of the Consumer Financial Protection Bureau—that would set standards to prevent large corporations from price gouging during an “exceptional market shock” like a power grid failure, a public health emergency, a natural disaster, and so on. Harris’s proposal was met with pushback from opponents saying that such a law would do more harm than good and that post-pandemic high inflation was driven by the market.

Yesterday, during testimony for an antitrust case, an email from the senior director for pricing at the grocery giant Kroger, Andy Groff, to other Kroger executives seemed to prove that those calling out price gouging were at least in part right. In it, Groff wrote: “On milk and eggs, retail inflation has been significantly higher than cost inflation.”

There has been pushback on the Harris price gouging proposal on groceries that grocery stores have a very low profit margin. However, our groceries are a result of farmers, middlemen, etc. so it would be more instructive to look at the entire supply chain.

Also while food prices have increased about 20% since Biden took office, so have wages and Social Security payments. I would argue for example that many seniors are better off now because for many of us our housing costs have increased less than the percentage increase in our Social Security. Many seniors have fixed rate mortgages and others have rental payments indexed to the cost of living increases.

I note the significant focus on grocery pricing. This seemed so obvious to me that I was very surprised at the level of pushback in pointing out that these particular prices stuck in the minds and emotions of consumers longer than the standard metrics of official inflation. So it seems that in roughly a month the approach of Dean Baker and others to hector people until the felt better has been retired to ‘we are going to do something!’ I’m not sure what would work economically, but at least as an approach to millions of people’s emotional state, it’s an improvement.

Seriously? I have been getting Social Security for almost two years now, and I can assure you the increases in that haven’t remotely kept up with the increases in food and rent costs.

Infidel:

True. Two saving things. Two of us and adequate savings with growth we can pull from yearly and maintain principal with some growth.

Indidel,

I can’t speak to rent costs since I have a 30 year mortgage that will never increase. My homeowner insurance and property taxes have actually stayed the same since 2020. I am reading about price collusion in apartments by a company called Real Page, so again, price gouging in that sector.

I’ve been on Social for a lot longer than you, but we have had some good COLA’s the past few years, 5.9%, 8.7% and 3.2% the past three years. I figure I spend about $10 per day on food, say $300 per month. I shop almost excusively at Costco and Trader Joe’s, and I just haven’t seen a big increase in food costs at these two stores.

Also on the plus side, savings accounts have been paying around 5%, and the S and P 500 has increased 54% since January 2021.

I realize I am one data point, as are you. But overall I feel that the recent inflation has been manageable from my own financial picture.

@JHan,

I was laid off in June 2015, just two months after I turned 66 YO. So I went on SS + employee pension right away. In 2019 my 15 year mortgage was paid off. Since then money became of much less concern for me than age and the stuff that comes with that. My wife passed in October 2022. By a incredible stroke of luck I am now engaged to marry a lady that I jokingly refer to as my Barbie and I am her Ken or is that kin? In these parts the idiom is that we are like two peas in a pod.

But back when I earned a living in IT for 47 years most of that was applied statistics via programs that I developed in SAS to either process log data or inquiries and analysis from our implementation of the (Neu-) MICS performance and resource measurement SAS database application. All that is just describing my biases factor background. There is always an innate measurement bias hidden within data.

So, in applied statistics there is an old saying, “All things being equal – they never are.”

In that context, then SS COLA is based on national averages. Prices on both food and lodging have immense regional variation (even within individual US states – e.g., urban vs. rural, back country vs. coastal) and considerable local variation on lodging and considerable tastes variations on many food items. My fiance just moved from Tallahassee FL to Midlothian VA to live with her oldest son and his family. She telecommutes to her job in GA/FL region. Effectively her take home salary increased with the lower cost of living here and it will again when she moves in with me after we marry. Her son lives in a pricey upscale crowded upper middle class subdivision and I live in an exurban blue collar community with land price less than half that of her son which is less than half that of Tallahassee or anywhere else in coastal FL. In FL the seafood cost less than here and is fresher and better and there is a wider choice. However, most all other food costs more in FL than here. Here the more select (e.g., oysters, scallops, tuna) seafood prices have risen faster than anything else, roughly doubling in the last five years. OTOH, my dried beans and wild rice (my staples of choice) cost about the same now as then. BTW, wild rice is not always pricey as it is in the gourmet name brands that spend more on packaging than they do on content.

Seriously? I’ve been getting Social Security for almost two years now, and I can assure you the increases in that have not remotely kept up with the increases in rent and food costs.

As used by right-wingnuts, “Marxist”, “communist”, “socialist”, etc no longer have any meaning in the true sense of the word. As with “racist” or “fascist” when used by ideological leftists, they now just mean “anything we don’t like”.

Social Security Yearly Increases

‘I’m down to eating ramen’: Social Security benefits aren’t keeping up with inflation. CNN August 14, 2024

Many other senior citizens are also feeling the inflation squeeze. Social Security benefits have lost 20% of their buying power since 2010, according to a recent analysis by The Senior Citizens League, an advocacy group. Those who retired that year would need a boost of $370 a month, or $4,440 a year, on average, to regain the lost value.

Put another way, every $100 a household spent in 2010 would only purchase $80 today.

Every January, Social Security recipients get an annual cost-of-living adjustment, known as a COLA, but the increases often don’t keep up with the actual rise in prices – hurting senior citizens, many of whom live on fixed incomes and depend heavily on their Social Security benefits. Eight of the last 15 adjustments have come in lower than inflation for that year.

Social Security benefits have risen by 58% between 2010 and 2024, but the cost of goods and services purchased by typical retirees jumped 73% during that time, the league said. The prices of bread and ground beef, for instance, have shot up nearly 147% and 73%, respectively, over that period.

The surge in inflation in recent years resulted in some of the largest annual adjustments since the early 1980s. Beneficiaries received hefty increases of 5.9% for 2022 and 8.7% for 2023 – but only 3.2% for this year, since inflation has cooled.

Still, over the past five years, only the 2023 adjustment has beaten the rate of inflation, the league said. The COLAs lagged inflation by as much as 1.1 percentage points the other years.

The annual adjustments are based on the percentage change in an inflation index from average for the third quarter of the current year compared to the same period in the prior year. Next year’s boost will be announced in October, but it is expected to be about 2.6% based on inflation rates through July, according to the league.

“Social Security benefits have lost 20% of their buying power since 2010, according to a recent analysis by The Senior Citizens League, an advocacy group.”

The group advocates using CPI-E.

Of course the increase in housing cost for someone paying rent versus someone with a 20 year mortgage are enough to skew the index.

The CNN article linked is rather poor journalism as nowhere does it indicate that the real question is what to include when you measure inflation. It also makes the true statement that inflation is a problem for people on a fixed income without noting that there really aren’t any such people. SS is NOT fixed income.

@Arne,

Thanks for pointing out that SS is not fixed income. Our 403b accounts are not fixed income, either, since they are invested. Annuities, I believe, are fixed income.

Yearly Adjustment (facetious?). However, if costs go up you are stuck. If costs go down, you are in the money.

My salary increases always were ahead of yearly costs. If not, I would change jobs. In the case of SS, you are there and may make up a part of the cost for the year and hope next year is less costly.

Yes, I am singing to the choir, and you and Arne know this.

Arne:

Are people in 2024 keeping up with the artificially increasing costs which are being manipulated? Not in 2024 and the adjustment will be far less. Secondly, the CNN article did say this: “Social Security benefits have risen by 58% between 2010 and 2024, but the cost of goods and services purchased by typical retirees jumped 73% during that time. The prices of bread and ground beef, for instance, have shot up nearly 147% and 73%, respectively, over that period.”

US Inflation Indicator

“Social Security’s COLA keeps the bulk of retirement income up to date with inflation.” I will take the 1.4% unaccounted. And that is 2021 numbers. We know SS increases yearly and the new number is cited in October(?). I live all the other 12 months till I see the increase the following year in January. A belated increase, yes?

COLA is announced in October and becomes effective end of December, so there is definitely a lag. A smoothed calculation uses year-over-year data (from CPI-W) for July, August, and September.

My complaint about the CNN journalism is that it does not note that they simply quote the CPI-E calculation and compare it to the CPI-W calculation without describing what they have done. I have seen Dean Baker, whose opinion I value, urge that CPI-E might be a better measure. No index is going to work for everyone as Jim Han’s reference to his mortgage indicates.

As many have noted, perception of inflation seems to focus on what is most often purchased even though rent is by far the largest single portion (36%). Gas(6%), Food (14%)

Arne:

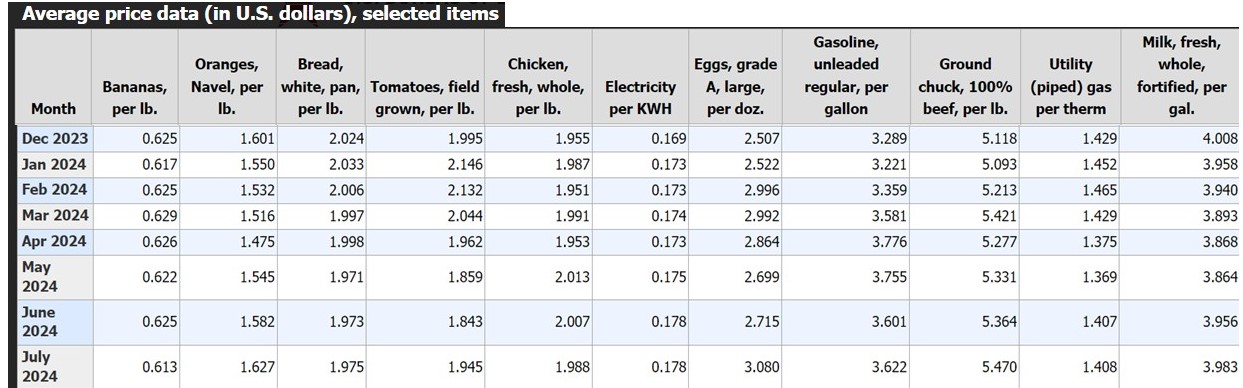

I was just getting ready to give another image of prices. This time Average Prices:

BLS

It is not an easy topic. I am secure and many people are not.