Pharmacy Benefit Managers (PBMs) are Hiking the Price of Drugs

A follow-up to the much longer report on Insulin (test on this later) and how PBMs impact pricing on other drugs. “Insulin A Drug Pricing Analysis,” Angry Bear. “Drug manufacturers alone set and raise drug prices, and PBMs are holding drug companies accountable by negotiating the lowest possible cost for drugs, including insulins, on behalf of patients.“

According to 46brooklyn, this is an overly simplistic view on drug pricing. It should be rejected, as it is not founded in the facts. In Money from Sick People Part IV: Paying a Premium for Drug Pricing Irregularity, we begin to see the analysis how pricing may not representative.

~~~~~~

The Federal Trade Commission in a report released Tuesday, drug middlemen known as pharmacy benefit managers (PBMs) appear to be hiking the price of drugs at the expense of everyday Americans suffering from life-threatening conditions.

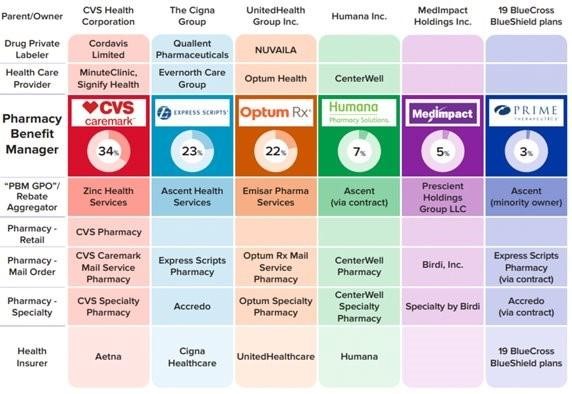

PBMs are part of complex vertically integrated health care conglomerates, and the PBM industry is highly concentrated. As shown in the image below , this concentration and integration gives them significant power over the pharmaceutical supply chain. The percentages reflect the amount of prescriptions filled in the United States.

The FTC said in its interim report that “increasing vertical integration and concentration has enabled the six largest PBMs to manage nearly 95 percent of all prescriptions filled in the United States.” Those six are Caremark Rx, LLC; Express Scripts, Inc.; OptumRx, Inc.; Humana Pharmacy Solutions, Inc.; Prime Therapeutics LLC; and MedImpact Healthcare Systems, Inc.

FTC’s Interim Report highlights several key insights gathered from documents and data obtained from the FTC’s orders, as well as from publicly available information:

Concentration and vertical integration: The market for pharmacy benefit management services has become highly concentrated, and the largest PBMs are now also vertically integrated with the nation’s largest health insurers and specialty and retail pharmacies. The top six PBMs control own 90% of the business.

Significant power and influence: As a result of this high degree of consolidation and vertical integration, the leading PBMs now exercise significant power over Americans’ ability to access and afford their prescription drugs. PBMs can exercise significant control over what drugs are available and at what price, and which pharmacies patients can use to access their prescribed medications.

Self-preferencing: Vertically integrated PBMs appear to have the ability and incentive to prefer their own affiliated businesses, creating conflicts of interest disadvantaging unaffiliated pharmacies and increasing prescription drug costs. PBMs may be steering patients to affiliated pharmacies and away from smaller, independent pharmacies.

Unfair contract terms: Evidence suggests increased concentration gives leading PBMs leverage to enter contractual relationships disadvantaging smaller, unaffiliated pharmacies. PBM contracts with independent pharmacies often do not clearly reflect the ultimate total payment amounts, making it difficult or impossible for pharmacists to ascertain how much they will be compensated.

Efforts to limit access to low-cost competitors: PBMs and brand drug manufacturers negotiate prescription drug rebates some of which are expressly conditioned on limiting access to potentially lower-cost generic and biosimilar competitors.

The result being the PBMs “profit at the expense of patients and independent pharmacists.”

FTC Chair Lina M. Khan said the findings show the middlemen are “overcharging patients for cancer drugs,” bringing them additional revenue of more than $1 billion.

In theory, PBMs are meant to be third-party companies that are middlemen between drugmakers and insurance providers. The FTC says this proves to be problematic as “the largest PBMs are now also vertically integrated with the nation’s largest health insurers and specialty and retail pharmacies.”

We pointed to this issue in the long “Insulin A Drug Pricing Analysis,” Angry Bear “46brooklyn report.

It creates a system in which “vertically integrated PBMs appear to have the ability and incentive to prefer their own affiliated businesses, creating conflicts of interest that can disadvantage unaffiliated pharmacies and increase prescription drug costs.”

Take, for example, the cancer drug Imatinib. The FTC found that it might cost $100 through an unaffiliated pharmacy. But PBM-affiliated pharmacies are sometimes charging more than $25,000 for both the drug and its home delivery. The PBM can also make higher profits at the expense of employer health care plans or government-funded insurance according to the FTC.

The report cited an email from a PBM executive who acknowledged just how outrageous the pricing models were. In his message the unnamed executive pointed out:

“We’ve created plan designs to aggressively steer customers to home delivery where the drug cost is ~200 higher. The optics are not good and must be addressed.”

FTC Chair Lina M. Khan:

“Thousands of cancer patients depend on these medicines to survive,. The PBMs marking up those drugs by up to 4,000 percent the average acquisition cost is enormously significant.”

~~~~~~~.

Drug middlemen PBMs are hiking the price of cancer drugs according to the FTC, Quartz

FTC Releases Interim Staff Report on Prescription Drug Middlemen, Federal Trade Commission