High Interest Rates Restricting Housing

An abbreviated portion of Preston Mui’s “Where High Rates are Restricting Investment,” Employ America. This portion of his economic commentary discusses housing and in particular Multifamily.

Preston Mui: The Federal Reserve has held rates at the current level for nearly a year. The majority of the committee appears confident that monetary policy is currently restrictive. From the perspective of their confidence, the question for monetary policy is how long rates will need to sit at this level of restrictiveness.

Despite the Fed holding rates at the highest level in over twenty years, the US economy remains strong: overall growth is robust and consumption is strong. The unemployment rate remains near historic lows. Neel Kashkari makes the case monetary policy may not be so restrictive,

“I’m looking at real economic activity . . . real economic activity in the US looks quite robust.”

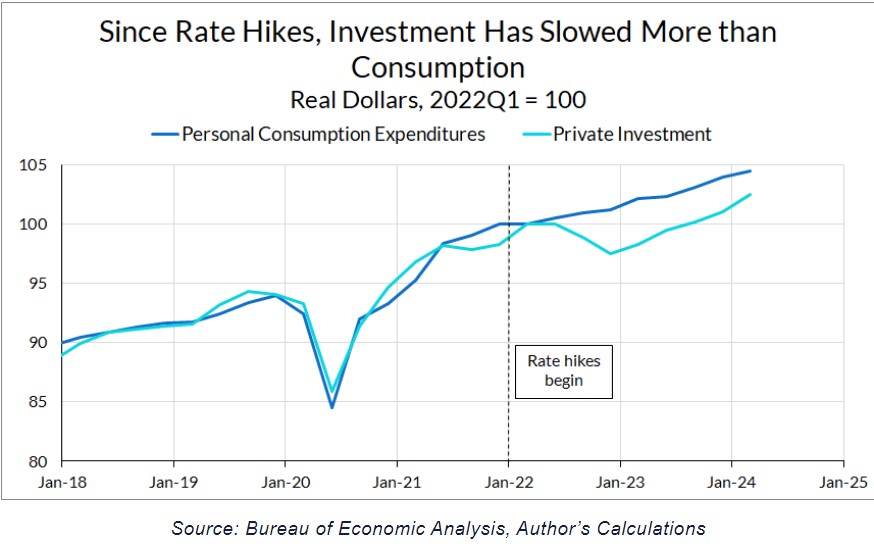

“Are interest rates restrictive?” oversimplifies the effects of monetary policy on the economy. The question isn’t one-dimensional. Changes to monetary policy have different effects on different parts of the economy. Not all sectors are equally sensitive to interest rates and different sectors are sensitive in different ways. This much is clear in the marked divergence in the paths of investment and consumption ever since the Fed’s hiking cycle began.

As FOMC members are finding out, it’s difficult to gauge just how monetary policy is constraining activity. There are substantial cross-currents in the lingering (but diminishing) effects of pandemic-era fiscal supports, industrial policy, whiplash effects from reopening, and supply chain improvements.

Housing Looks Restricted, Especially in Multifamily Permits

Are rate hikes constraining the housing sector? The experts argue housing has remained resilient even with interest rate hikes. The trajectory of housing inflation being the main determinant of the overall inflation picture. Chair Powell and other FOMC members point out, the sharp increase in rental inflation can be traced back to decades of underinvestment in housing supply (Angry Bear would argue differently).

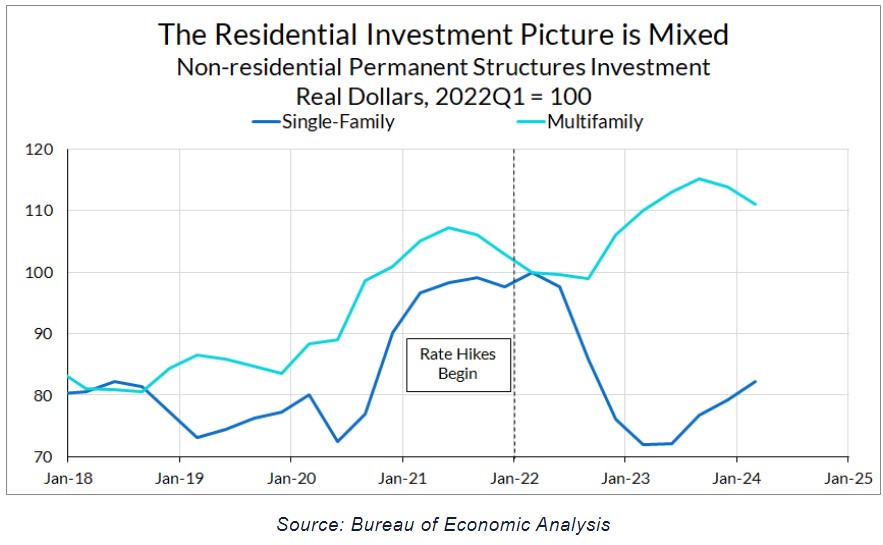

How much the Fed is restricting the housing sector depends a lot on which measure you look at. Home prices have been rising over the past year, suggesting less restrictiveness on the demand side. Looking at fixed investment in residential structures on the supply side, the level of investment has been substantially restricted relative to their pre-rate-hike trajectory.

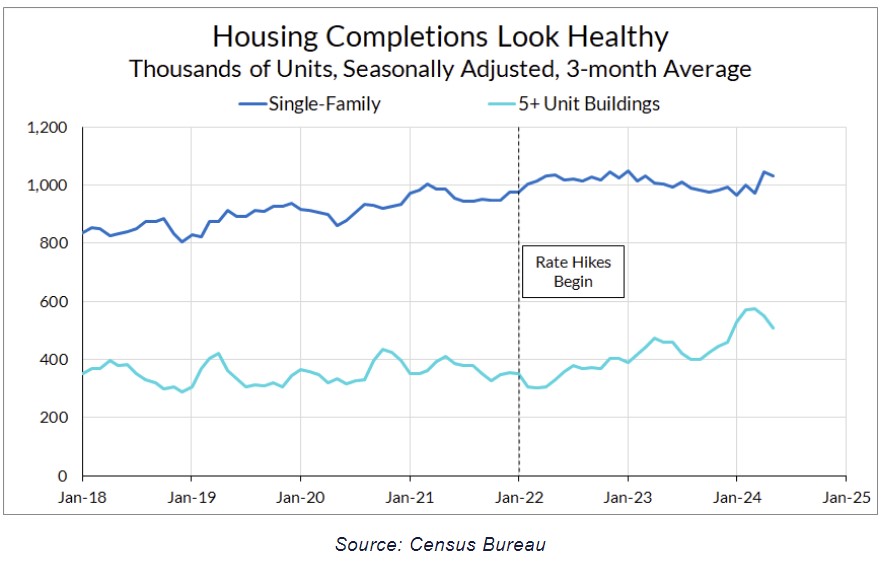

The supply-side news hasn’t been all bad though. Housing completions have also been relatively stable, with a surge of multifamily units coming on board in recent months. This favorable “supply-side” development is poised to lower rent and OER inflation readings in the coming quarters.

Does this mean that Fed policy is not restrictive when it comes to housing? Not necessarily. The completion data may simply reflect a large backlog of housing production accumulating during the immediate aftermath of the pandemic.

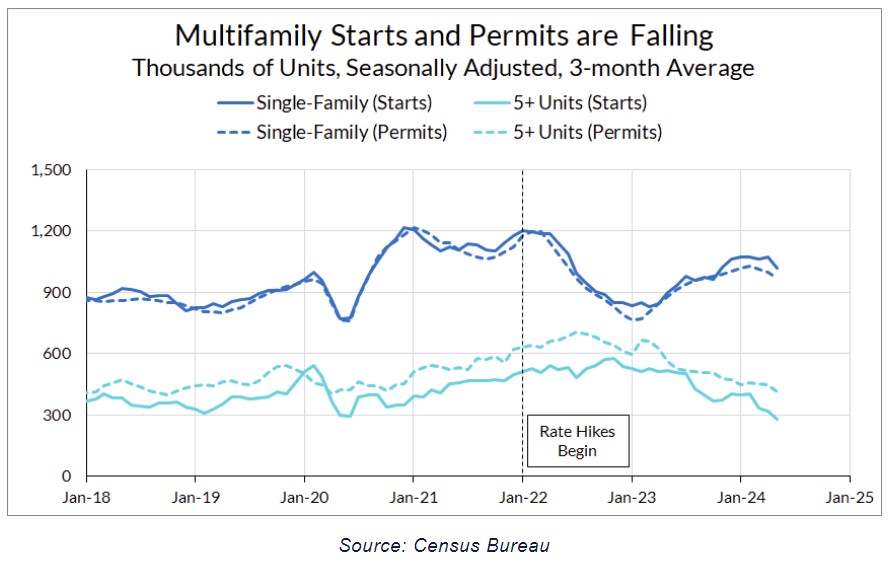

Look at the housing permits and start data, the power of rate hikes to throttle investment becomes clearer. Housing starts and permits took a huge step back after rate hikes. While single-family starts and permits have rebounded in recent months, multi-family starts and permits are back down to pre-pandemic levels. This is exactly the level of underbuilding leading up to the rental inflation crisis we face today.

What are the Fed’s high interest rates really accomplishing in the housing sector? The results are ambiguous. Higher rates probably, on the margin, reduce demand for housing and rental prices right now. As Conor Sen argues, the constraints on housing production are likely to come back to bite the Fed by worsening the undersupply of housing begun in the 2010s.

When asked about this problem, Tom Barkin acknowledged the longer-term effect on housing supply. He also maintains the need to reduce inflation in the near-term. The Fed seems to be operating under the theory that high rates will bring inflation down quickly enough and they will be able to reduce rates before further damage is done to housing supply.

This seems like an awfully precise maneuver to pull off using only the blunt tools available to the Fed. Unlike the demand-side effects on rented housing, which are not particularly obvious, the supply-inhibiting effects of rate hikes on rented housing are more readily identifiable.

Where High Rates are Restricting Investment, Employ America, Preston Mui