Manufacturing’s shift out of China is the shipping corridors

Manufacturing’s shift out of China is shaking up shipping, qz.com), Mary Hui

AB: This is kind of along the lines of what I was involved in with manufacturing overseas and moving components to various countries from the US. We would plan the necessary materials to a planned ship date. We would ship to Thailand, Philippines, China, Malaysia, etc. What is going on here, shippers are using Vietnam as a base to ship to. From there, the parts are moved to other countries.

Update: Shipping container rates have collapsed. Logistics executives foresee a freight recession dragging into 2024. Industry giant Maersk plans to cut at least 10,000 jobs as it struggles with falling profits and revenue amid overcapacity, rising costs, and lower prices.

AB: Not a surprise, the logjam is over as are the excessive orders (more orders mean higher priorities?). The container shippers were tooled up for higher volumes. Now things are back or returning to normalcy.

Intra-Asia shipping has found a new carrier.

Manufacturers seek to diversify their supply chains by shifting certain production segments out of China. There has been a growing demand for transporting raw materials and intermediate products within Asia. Container ship operators are ratcheting up their Asia services. In the past few months, various companies have unveiled new shipping lines connecting Asian ports.

In May, MSC, the world’s biggest ocean freight player, upgraded and expanded several of its Asian routes to increase direct connections between China and other ports in Southeast Asia. Other shipping companies, including Japan’s Ocean Network Express, Singapore’s Pacific International Lines, South Korea’s HMM, and China’s OOCL are following suit with similar announcements.

“Countries like Vietnam, Bangladesh, Cambodia are seeing manufacturing relocating to their countries,” said Sunandan Ray, CEO of US-headquartered global logistics and freight forwarding company Unique Logistics. “With that has come a fair bit of movement of raw materials into those countries, and there’s been intra-Asia trade developing.”

One country has emerged as a critical node amid the reshaping of global trade flows: Vietnam.

The Southeast Asian nation has seen surging foreign investment as companies plan to build new factories there. To support that additional manufacturing activity, shipping companies have ramped up direct connections between Vietnam and the US, as well as around Asia.

Data from UK-based transport economics consultancy MDS Transmodal bears this out. In 2019, Vietnam had 13 direct shipping routes to the US. By the third quarter of 2023, the number has almost doubled, to 23. By contrast, direct shipping routes between the US and China have largely stagnated: 56 in 2019 versus 58 in 2023.

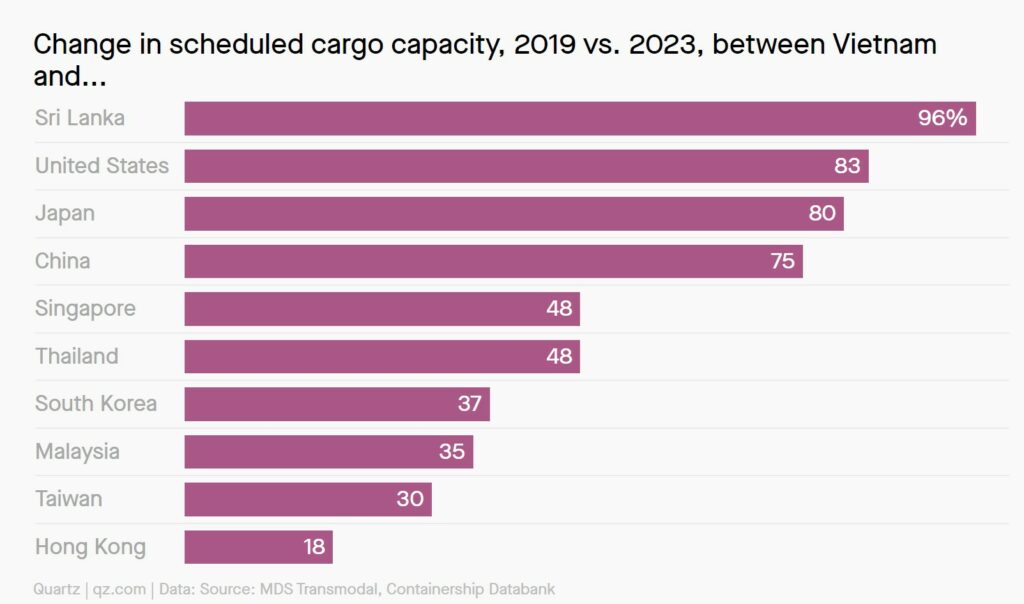

In the ranking of countries by number of direct shipping services to the US, Vietnam now places sixth—sharply higher than its 23rd-place position pre-pandemic. When it comes to the volume of goods criss-crossing the Pacific Ocean, scheduled deployed capacity between the US and Vietnam shot up 83% between 2019 and 2023. That compares with a 27% increase between the US and China over the same period.

“When we look at what’s happening in Vietnam, it’s quite remarkable,” said Antonella Teodoro, a senior consultant at MDS Transmodal, noting the speed of Vietnam’s rise in the maritime transport industry. “The quantum surprises me, rather than the fact itself—how much it is increasing, and how fast.”

Shipping connections between Vietnam and its Asian neighbors has risen dramatically.

China remains a linchpin in global industry and trade routes. For both the US and Vietnam, it is the country with by far the highest number of direct shipping connections. However and since 2019, Vietnam has added 46 direct shipping services with China and more than with any other Asian neighbor.

This underlines the fundamental dynamic of the global friend shoring and de-risking trend: Governments and companies are diversifying beyond China. They will not be fully substituting the world’s industrial powerhouse anytime soon. One effect is that supply chains are getting longer.

AB: A fact; With longer supply chains inventory costs increase as does risk of delayed shipments. I can vouch for this from my own experiences.

“Vietnam is now an extra call in the route, rather than an alternative,” Teodoro said. “This shows there’s some intra-Asia movement that can confirm that Asia is becoming the manufacturer of the world. It’s not only China.”

To fully capitalize on the increased demand for intra-Asia shipping, however, Vietnam will need to invest in infrastructure.

That means boosting efficiency at ports to handle cargo quickly; widening channels to allow bigger ships to pass; having terminals that can deal with containers once they’re offloaded from vessels; and building robust rail links between ports and inland container depots.

Much of that investment could end up coming from China, which, along with Taiwan and South Korea, is often a key investor in such infrastructure, said Ray of Unique Logistics.

AB: If the US was wise they would invest there.

Of course shippers will look for cheaper alternatives. China payrolls are going up for an established, reliable trade partner. Towards the end of 2025 China’s economic numbers will reflect a formidable financial nation. Investments in China now should result in nice 3 year returns on par or better than anywhere else.

@old,

“Investments in China now should result in nice 3 year returns on par or better than anywhere else.”

The word “should” is doing all the work in that sentence.

Towards the end of 2025 China’s economic numbers will reflect a formidable financial nation….

[ Already happened and will be continuing to happen:

https://www.imf.org/en/Publications/WEO/weo-database/2023/October/weo-report?c=924,532,546,111,&s=PPPGDP,&sy=2000&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

October 15, 2023

Gross Domestic Product based on purchasing-power-parity (PPP) for China and United States, 2000-2022

2022

China ( 30,762)

United States ( 25,463)

ltr,

Thanks for the link, Ooof. IMF is credible enough for anyone.

About 15 yrs ago was at a family BBQ table and told all the jr. high school kids learn how to read, write, and speak Mandarin. Everyone laughed out loud.

olddog:

People seem to miss the point of Customs-Ocean-Customs. Just coming back to the US, plan a month. Inventory with Labor added in more costly than Labor input. Sit-around throughput. China is not paying for inventory costs.

Since 2011 and the Wolf Amendment, the United States has been waging an economic war against China to try to undermine and stop Chinese development. The increasingly harsh efforts have so far been unsuccessful and I think will prove self-defeating, nonetheless the efforts are continuing:

https://twitter.com/BenjaminNorton/status/1731265486145605863

Ben Norton @BenjaminNorton

New cold war: US Commerce Secretary Gina Raimondo called on corporations and allies to join the tech war on China, calling it “the biggest threat we’ve ever had”. *

She said the US wants to make sure China does not “catch up” technologically.

Back in 2021, Raimondo admitted the US goal is “to slow down China’s rate of innovation”. **

* https://www.scmp.com/news/world/united-states-canada/article/3243657/us-commerce-chief-warns-against-china-threat

** https://pbs.twimg.com/media/GAavpaLacAAsew3?format=jpg&name=360×360

5:53 AM · Dec 3, 2023

Ah, yes. The South China Morning Post. A totally objective source for advice on China.

“Since the change of ownership in 2016, concerns have been raised about the paper’s editorial independence and self-censorship. Critics including The New York Times, Der Spiegel, and The Atlantic have alleged that the paper is on a mission to promote China’s soft power abroad.”

https://en.wikipedia.org/wiki/South_China_Morning_Post#:~:text=The%20South%20China%20Morning%20Post,newspaper%20owned%20by%20Alibaba%20Group.

LOL!

Maybe you shouldn’t try to pass off propaganda as reporting.

Joel:

I believe they have an English version also. I needed something to read while killing time at breakfast or in my room. Or I would have the Chinese or Korean waiters or waitresses say a word in their language and I would attempt to spell it in English.

My favorite time was when my boss’s boss asked a question of my boss whether I understood the issues in their language. I answered them in English.

https://www.nytimes.com/2023/12/07/us/politics/lawmakers-biden-china-tech.html

December 7, 2023

Lawmakers Press Biden Administration for Tougher Curbs on China Tech

Republican legislators argue that the Biden administration has been ill-equipped and unmotivated in a technology fight with Beijing.

By Ana Swanson

Republican lawmakers are faulting the Biden administration’s enforcement of restrictions on China’s access to American technology, saying that the administration is still allowing semiconductors and other American innovation to flow to Beijing that could ultimately aid China in a military conflict.

In a report released on Thursday, the House Foreign Affairs Committee said the administration had failed to enforce export controls that limit sales of advanced technology to China. The federal government has been steadily ramping up limits on sales to China of advanced chips and chip-making equipment over the past few years. The United States has also placed restrictions on Chinese companies or organizations accused of aiding the Chinese military or Russia’s war effort, or participating in human rights abuses in Xinjiang.

But Republican lawmakers said the administration had not done enough to enforce the rules and criticized the office in charge of policing export controls….