January JOLTS report consistent with a softening, but still very strong, labor market

January JOLTS report consistent with a softening, but still very strong, labor market

– by New Deal democrat

This morning’s JOLTS report for January, unlike the recent payrolls report, generally showed further softening in the labor market.

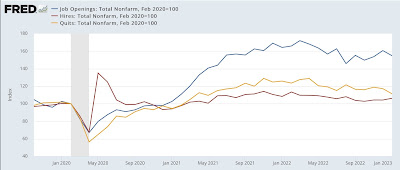

While hires (red in the graph below, normed to a value of 100 as of February 2020) increased 121,000, quits (gold) declined 207,000, and openings (blue) declined 410,000:

The downward trend in quits is most noticeable. Since employees voluntarily quit more, the more confident they are about new job prospects, this is a clear sign of *relative* weakening. The increase in hires is more a flattening of the trend, which had been decelerating. The trend in openings does appear to be softer, although given the increase in the last few months before January, that is more questionable.

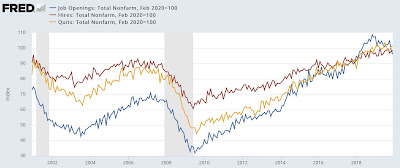

For comparison purposes, here is the same graph covering the period since the inception of the series through 2019:

Note that all three appeared to be weakening just before the 3 recessions since 2000; but openings have continued to increase on a secular basis. That businesses may have been maintaining job postings even when they were not actively looking, but just to troll for resumes; and further that that behavior has probably been spreading throughout industry; is one reason why I do not place as much value in this series as I do in others. Still, the overall trend is useful evidence of the status of the jobs market.

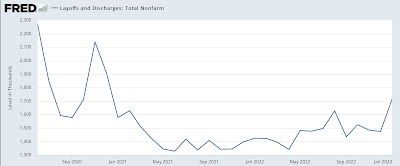

Finally, layoffs and discharges increased sharply, by 241,000, in January, to their highest level since October 2020:

Here is their record before the pandemic:

Note that the current level of layoffs and discharges would be very good for any period since 2000 up until the pandemic hit.

To summarize: the January JOLTS report is most consistent with a continued very strong labor market, but one which is softening in comparison with even stronger levels during 2021-22.

A weakening of this report, particularly as to job openings, is one of the main indicators I have been looking at for evidence that broader employment metrics are beginning to capitulate. I don’t think this report puts us there in any meaningful sense. Still, in Friday’s employment report I will be focusing most intently on whether employment in three leading sectors – temporary jobs, manufacturing, and residential construction – has either continued negative (as to the first sector) or turned negative (as to the last two).

JOLTS and jobless claims: the labor market remains a strong positive, Angry Bear, New Deal democrat

Jobs Report to Offer Fresh Reading on Labor Market’s Tenacity

NY Times – March 10

After a blockbuster opening to the year, economists expect the February data to show the return of a gradual slowdown in hiring.

After an explosion in job growth at the start of the year, new data on Friday will show whether employers moderated their hiring in February — and whether any slowdown was enough to fundamentally upend the labor market’s momentum.

Forecasters estimate that the economy added 225,000 positions last month, which would constitute a return to a gentle downward trend that January interrupted with an unexpected jump of 517,000 jobs. Labor Department surveyors have struggled to account for wildly varying seasonal factors, as well as whiplash from the pandemic, which is why revisions of data for December and January will be closely watched.

On the surface, employment growth has reflected scant impact from a series of interest rate increases as the Federal Reserve works to contain inflation. Although goods-related industries have faded as consumers shift their spending back to traveling and dining out, backed-up demand and a reluctance to let go of scarce workers have prevented mass layoffs.

And so far, the sharp cuts that have been announced in the technology industry haven’t spread widely. …

Analysts broadly expect the data to show little if any change in the nation’s unemployment rate, which last month reached a half-century low of 3.4 percent. Americans left the work force in droves at the outset of the pandemic and have been slow to return, helping to keep the job market exceptionally tight — there were still nearly two jobs for every unemployed person in January, the Labor Department reported Wednesday.

Wage growth, which has been the Federal Reserve’s primary concern, is forecast to have sped up on a year-over-year basis, while remaining below last year’s blistering high.

Since January, the persistent strength of the labor market appears to have fueled a renewed acceleration of economic indicators such as retail sales, as consumers continue to spend down piles of cash that accumulated during the pandemic. Even the housing market has recently shown signs of unfreezing, with new-home sales picking up as mortgage rates sank slightly (though they bounced back up in February).

The brighter tenor of the data flow has prompted Fed officials — including Jerome H. Powell, the chair, during two days of testimony this week on Capitol Hill — to warn they may have to push interest rates higher than anticipated to suppress prices.

US Added 311,000 Jobs in February; Unemployment Rate at 3.6%

NY Times – March 10

Employers added 311,000 jobs in February, the Labor Department reported Friday, continuing a hotter-than-expected streak that has created abundant job opportunities while frustrating the Federal Reserve in its drive to contain stubborn inflation.

The unemployment rate ticked up to 3.6 percent, still an exceptionally low level brought about by robust job creation and workers’ slow return to the labor force after the pandemic. It was 3.4 percent in January, the lowest since 1969. …

Speaking of jolts…

Silicon Valley Bank collapse on Friday

NY Times – March 10

Silicon Valley Bank on Friday became the biggest American bank to fail since the collapse of Washington Mutual in 2008, at the height of the global financial crisis. …

In recent years, fewer banks have gone under, thanks in part to stricter regulations that were put in place in the wake of the financial crisis. Before Silicon Valley Bank, the last firm to fail was in late 2020, as the coronavirus was ravaging the country.

It’s unclear whether the collapse of Silicon Valley Bank will spread to the broader industry. The bank was best known for its lending to technology and health care start-ups, and it had $209 billion in assets at the end of last year — making it the nation’s 16th-largest bank. But that is still small in comparison with the top three, which hold more than a trillion each and have much more diversified business models and customer bases. …

The regulation that was put in place for the nation’s biggest banks after the financial crisis includes stringent capital requirements, which means they must have a certain amount of reserves for moments of crisis, as well as stipulations about how diversified their businesses must be.

But Silicon Valley Bank and others its size do not have the same regulatory oversight. In 2018, President Donald J. Trump signed a bill that lessened scrutiny for many regional banks. Silicon Valley Bank’s chief executive, Greg Becker, was a strong supporter of the move. Among other things, it changed requirements for the amount of cash that these banks had to keep on their balance sheets to protect against shocks.

On Friday, as the trading of Silicon Valley Bank’s stock was halted and the federal government began taking over its business, several other mid-sized institutions began to feel the weight of the collapse.

Shares of the First Republic and Signature banks tumbled on Friday, with Signature down nearly 23 percent at the end of trading. The S&P 500 fell 1.4 percent on Friday, ending the week down 4.5 percent — its worst weekly performance of the year.

Some of the nation’s largest Wall Street firms, however, including JPMorgan, Wells Fargo and Citigroup, saw their shares nudge higher. …

‘This hit like a ton of bricks’: Troubles at Silicon Valley Bank ripple across Boston tech scene

Boston Globe – March 10

The abrupt failure of Silicon Valley Bank and its takeover by federal regulators Friday sent a shock wave through the Boston technology and biotech communities, with companies and depositors unable to withdraw funds and facing the prospect of not being able to pay bills or make payroll.

One of the largest and most influential bankers to the Boston-area startup community, SVB was taken over by the Federal Deposit Insurance Corp. on Friday and all accounts were frozen until Monday at the latest, when withdrawals will be limited to $250,000 per account. …

The sudden failure, the second-largest in US history, was triggered by SVB’s disclosure on Wednesday of growing losses on government bonds due to rising interest rates. The announcement prompted a run on the bank. As depositors withdrew their savings this week, the bank had to sell Treasury bonds it owned at a loss, eroding its capital. …

SVB has a large office in downtown Boston and often hosts events on behalf of startups and venture capital firms. When the office opened in 2020, SVB said it had more than 250 employees in Boston and Newton working on tech and health care banking and related services. In 2021, SVB acquired Boston Private Bank & Trust, which caters to wealthy individuals and has branches in Boston, Cambridge, Wellesley, and Beverly.

The bank ranked 11th largest in Massachusetts, with $5.5 billion of deposits as of June 30, according to FDIC data. …

Buying opportunities abound, but they might abound even more in a week or two!

A Bank Failure Jolts Markets, Sending Stocks Down Sharply

NY Times – March 10

The collapse of Silicon Valley Bank added to worries about the economy. The S&P 500 suffered its sharpest weekly decline of the year.

The collapse of a small bank in California on Friday set off a wave of concern over the health of the banking sector, amplifying fears for the broader economy and sending global stock markets lower. …

Though it’s a relatively small lender, SVB’s failure overshadowed an upbeat report on the labor market, upended expectations for the path of interest rates and entrenched concerns about the health of the economy.

The S&P 500 skidded 1.4 percent on Friday, ending the week down 4.5 percent — its worst week of the year. The decline was led by SVB’s banking peers like Western Alliance Bancorp, which plunged over 20 percent, and Signature Bank in New York, which fell by almost 23 percent. …

Treasury Secretary Janet L. Yellen, testifying before the House Ways and Means Committee on Friday, said she was monitoring the situation. “There are recent developments that concern a few banks that I’m monitoring very carefully,” she said. “When banks experience financial losses, it is and should be a matter of concern.”

Ahead of Friday’s drop, the outlook on Wall Street had already turned gloomy after the Federal Reserve’s chair, Jerome H. Powell, told lawmakers on Tuesday that the central bank might have to raise interest rates more than it expected, and possibly at a faster clip, as it tried to rein in inflation. Higher interest rates weigh on stock prices, and raise the risk the Fed’s actions may tip the economy into a recession. …

The yield on the two-year U.S. government bond, which is sensitive to changes in interest rate expectations, reflected the shifting narratives in financial markets. The yield rose above 5 percent on Tuesday for the first time since mid-2007 after Mr. Powell’s comments as investors began to bet on higher interest rates to come.

The move rapidly reversed course, however, as SVB’s collapse created concerns about the effects of higher interest rates on the economy and the positive news on the labor market tempered the need for further increases. The yield on the two-year bond ended the week at 4.58 percent.

“Interest rate hikes are slowing the economy, and that is weighing on the U.S. economy,” said Lauren Goodwin, an economist at New York Life Investments. “What is happening to the banking sector is indicative of what investors fear could happen to other parts of the economy if interest rates continue to go up.”

As it happens, the Dobbs Index is now slightly negatively for the year, having been up a bit after being down 20% last year.

re “collapse of a small bank in California”

maybe small to New York, but the 16th largest bank in the US…& also the 2nd largest bank collapse in US history..

NYT: Washington Mutual, which was heavily involved in risky mortgages and became the largest bank to fail in U.S. history, was sold to JPMorgan Chase. …

JP Morgan/Chase being the largest US bank. Perhaps it’s time for Bank of America (#2) to step up and take on Silicon Valley Bank, show what they are made of.

NYT: SVB is ‘the nation’s 16th-largest bank. But that is still small in comparison with the top three, which hold more than a trillion each and have much more diversified business models and customer bases.’ …

‘In 2018, President Donald J. Trump signed a bill that lessened scrutiny for many regional banks. ‘

Trump, being no stranger to bankruptcy, clearly understood how ‘lesser’ banks should be entitled to such advantages as he enjoyed.

US, UK try to stem fallout from Silicon Valley Bank collapse

Boston Globe – March 13

(AP) — Governments in the UK and U.S. took extraordinary steps to stop a potential banking crisis after the historic failure of Silicon Valley Bank, even as another major bank was shut down.

The UK Treasury and the Bank of England announced early Monday that they had facilitated the sale of Silicon Valley Bank UK to HSBC, Europe’s biggest bank, ensuring the security of 6.7 billion pounds ($8.1 billion) of deposits. …

U.S. regulators also worked all weekend to try to find a buyer. Those efforts appeared to have failed Sunday, but U.S. officials assured all depositors that they could access all their money quickly. …

In a sign of how fast the financial bleeding was occurring, regulators announced that New York-based Signature Bank had also failed and was being seized on Sunday. At more than $110 billion in assets, Signature Bank is the third-largest bank failure in U.S. history. …

Ostensibly, such banks are failing because of recent interest-rate actions taken by the Federal Reserve, it seems. Perhaps coupled with feuding over the US budget by Congress & the President, i.e. the GOP & Dems.