We Really Need to Talk Fertilizer

Six billion.

I have written and rewritten the first line of this over and over and over again. Six billion. That is the amount of current US dollars American farmers have to come up with this year as fertilizer prices hit highs not seen since 2008, on top of higher prices last year. The difference is that in 2008 we had a financial meltdown, a run on energy markets, and global calamity. This year, we have supply crunches due to war, restrictions, and energy rationing, with the potential of a global financial meltdown. One thing holds true, fertilizer production is an energy intensive, dirty process that is far from green and as such, had been on the decline in the US. Had been; we might see a new found appetite soon enough, however, the costs are huge. Headwinds for new factories and the red tape are thick. Taming the current trends would need governments to unclip wings and five years to build. This wedge isn’t going anywhere soon. But let’s focus on the here and now.

The University of Illinois has the most succinct reporting on this that I have seen. As per their analysis:

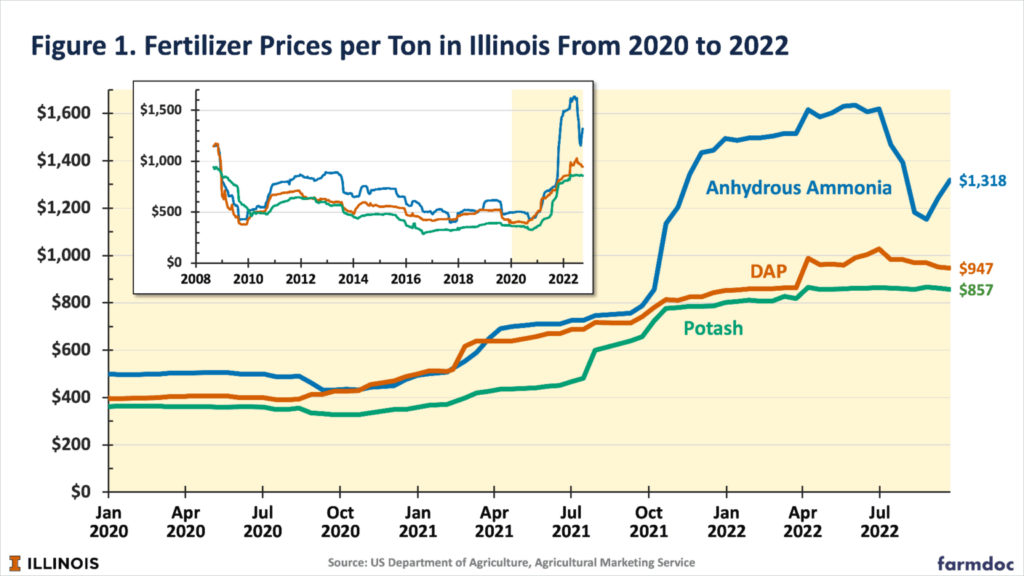

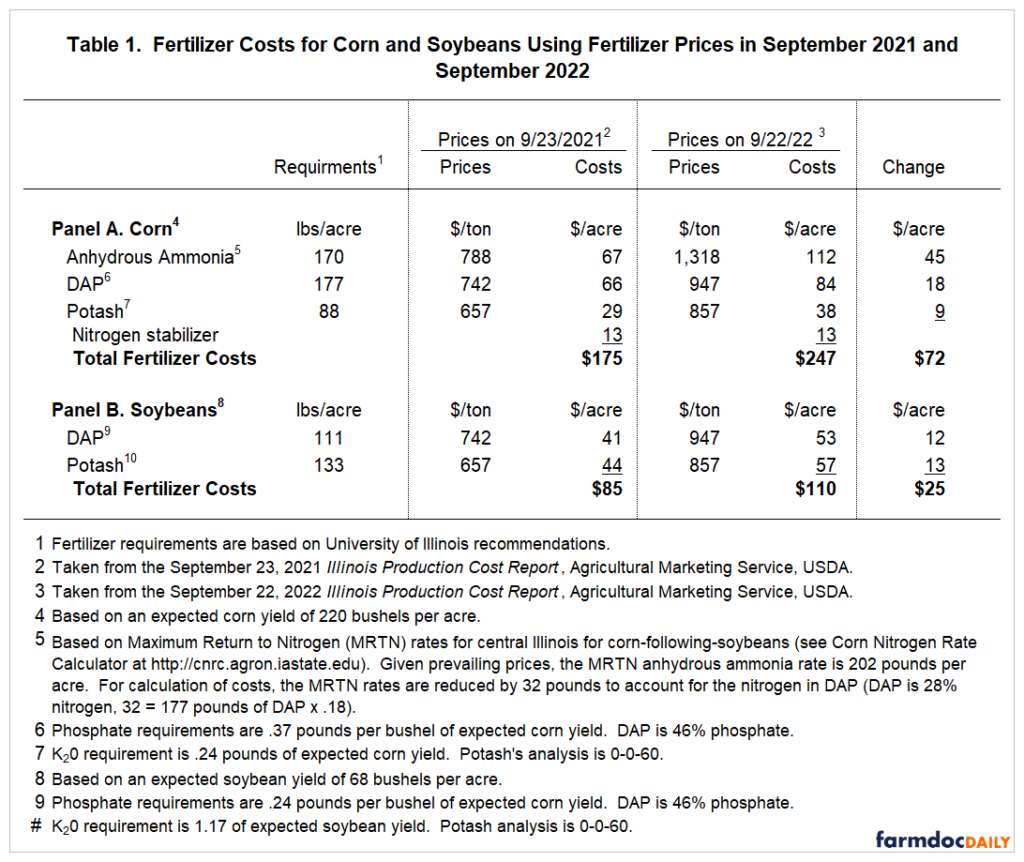

Anhydrous ammonia prices continue to surpass all-time highs reached during the 2008 financial crisis. In the fall of 2008, anhydrous ammonia reached a high in Illinois of $1,161 per ton. […] Then, anhydrous ammonia again increased, reaching $1,318 per ton on September 22.

This assumes farmers buy their inputs now.

Based on their research, the cost per acre has increased by $72 just for the chemical fertilizer inputs, which is by far the highest cost inputs, but also comes in conjunction with high seed costs, high equipment costs, and high fuel costs; inflated everything. The 80 some odd millions of acres to be planted multiplied by $72 additional dollars per acre are somewhere in the ball park of $6 billion USD, with the total chemical fertilizer charge for those planted corn rows coming in at just shy of $20 billion, and that’s just fertilizer alone. Chemical fertilizer increases of 40% year over year leaves farmers attempting to pinch another six billion dollars in market sales to offset the increases. Farmers will do one of three things: a)plant and demand higher bushel prices, b)plant and fertilize less, dropping yields and causing supply shortages, or c) plant something else, or nothing at all, also causing supply shortages. The above examples will all play out together. The farmer who mortgages the farm to pay for the inputs will get higher prices because some non-irrigated corn farmer in Kansas will refuse to plant corn in conjunction with an irrigated field in Iowa using less nitrogen and having yield cut by half. The latter two create shortages which makes commodities more expensive, thus thrusting prices up higher so the farmer who mortgages his place can pay for the high input costs. The farmers will be fine, commodities always have a market, it’s the excess costs to downstream processors and consumers that are the true pain points.

This alone is why I am forecasting inflation to stay out well into next year. Why is this happening? In 2021 Russia cut off all exports to us. China followed in suit. Domestically we import tons and tons because, much like refining oil, fertilizer production is messy and there is no appetite domestically to build and deal with governmental and public obstacles. European producers are now facing an energy crises where production facilities are either currently idled, or will be as the Euro Block grapples with energy shortages and a forecasted rough winter where priority will be keeping the population from freezing and food on the shelves.

What should consumers know?

The high input costs, high land and land rent costs, high equipment costs, and growing fuel costs coupled with another La Niña spring is going to rile the markets. Another sand paper t-shirt is the fact that last year most farmers planted soybeans because of the high nitrogen prices starting in October 2021. Those fields now have to plant corn, if they should so choose. Back to back corn crops on land is never wise. Nitrogen requirements for corn are very high. In summary, higher prices everywhere. For perspective, we use a 24-5-5 NPK mix on our farm, or for seed starts a 5-1-1. If we extrapolated by tonnage, for every five tons of phosphorus, we would need 24 of nitrogen.

Food inflation will be hot well into next year. I would even suggest well into 2024, assuming La Niña is done in May. Current ENSO modeling suggests that, but head high by the 4th of July will be hard to pull off on dry land.

What to look for:

Higher dairy (milk, eggs, cheese, lattes) as feed prices increase dairy herds will decrease.

Higher meat prices. All meats. Almost all livestock is fed grain silage. Only grass grown and grass finished beef will escape those confines.

Higher cooking oil prices. Soybeans or “vegetable oil” will be more expensive. As will anything containing soy or any derivatives.

Food overall will remain high priced, no matter how much the fed ratchets. The rate of incline will start this fall as harvest truths get sold into the market. The USDA WASDE report will start to reflect the poor yield. Plant ’23 will start in earnest in the south around April, and northerns folks will pull out their planters in May or June much like we saw this past spring, to the tune of higher costs to sow seed and fertilize it. The fall of 2023, assuming no unforeseen calamity, there will be another inflection point, which will spill over into February and March of 2024. Global exports will be key.

Especially important and fine analysis.

well done. thanks.

Nitrogen fertilizer production in the US is on the upswing due to our cheap LNG. We’ve reduced our dependency on imports by half in the past decade.

Yes, but commodities prices are still at all time highs. With Freeport terminal (my old home town) exporting LNG to Europe, gas will be more expensive as we backstop the fuel shortages to Europe over the winter. Lake Charles, LA also exports LNG out of that terminal, but again, we will be backstopping the loss of Nord Stream. All in all we still have relatively cheap gas prices in comparison, which will drive investment, but we have to be careful about what we call investment in nitrogen production. Nutriens New Orleans build out isn’t for ag production but for some type of modified nitrogen diesel conversion. Josh Linville of Stone X analytics is a good follow. Unfortunately it’s complicated, but the market price per ton of urea or any available nitrogen will still be high for the next few years.

We also have to be cognizant of the fact that a lot of fert is shipped via barge to the Midwest up river through the Mississippi, which is experiencing low levels. Barge operators are not able to float at max capacity and will not risk groundings. Also the LMR terminals might be compromised even though the Corps have been dredging for weeks. The solution has become to lighten loads to float, therefore causing shortages and higher shipping costs. This also complicates harvest as bulkers are having trouble getting grain out of the Midwest down to port. Rail is an option but is expensive.

As close to a perfect storm as we can get. Grass fed beef depends on grass, and drought measures mean fewer pastures around here are getting enough irrigation water. The monsoon storms helped a lot, but they are gone now.