Housing: permits and average starts decline, while construction remains at peak

Housing: permits and average starts decline, while construction remains at peak

The data on housing construction this month was mixed. While starts rose, their 3 month average, at 1.511 million annualized, was the lowest since September through November 2020. Meanwhile total and single family permits both declined, both to the lowest since June 2020:

This year I’ve also been looking at the record number of housing units that had permits, but had not yet been started. These have been at 50 year highs, and distort the economic signal from permits, because it is construction itself that is the actual economic activity. And here, the evidence is mixed.

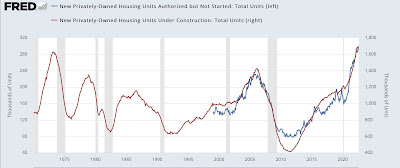

From the long term point of view, both housing units permitted but not started and housing under construction continue at record peak levels:

But a shorter term view shows that units not yet started have been flat since March, and housing under construction has increased only 2% since April:

Historically, housing permitted but not yet started has typically peaked only shortly after permits. Housing under construction has peaked with a longer delay:

We appear to be very close to (housing under construction) or even slightly past (housing not yet started) the inflection points for both of these metrics.

For the past two months I have emphasized that “Housing under construction is the ultimate coincident marker of housing economic activity. Once that begins going down, housing’s contribution to the economy is negative in real time.“ We appear to be close to, but not quite at, that point.

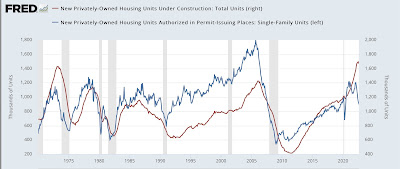

With that in mind, here are single family permits (blue, left scale) vs. housing under construction (red, right scale) since the latter statistic started in 1970:

Historically a recession has usually followed within a year of single family housing permits down 25% from their peak, as they are now. In several cases (1969, 2001) the recession had already started. There are several exceptions, notably 1966 and 1984, when either large fiscal stimulus (Vietnam war and Great Society spending) or interest rate reversals occurred. At the moment neither of those are in prospect.

At the same time, with the sole exception of the 2020 pandemic lockdown recession, construction – an even smoother metric than single family permits – has always peaked at least 6 months before the onset of recession, with a median time of 18 months, and as much as 47 months; and has declined at least 6.5%, and as much as 34%, with a median decline of 20% from peak.

So, permits are telling us that we are likely heading for recession, while actual housing under construction is telling us, by no means yet.

Housing can be a complicated supply and demand problem. Generally more children demands bigger home and more family formations demand more homes. Low pay and job insecurity demand fewer home sales with families either renting or stacking up. Investment in second homes, which are often just vacation rentals for other people, grow with demand (as in post-pandemic boom), but eventually run dry crowding onto less and less available property. Rising gas prices are better for urban renewal than they are for urban sprawl, but urban renewal is more expensive than mowing down virgin forests which can be sold for pulp wood or lumber mill processing.

I live in a house built in 1959 in that last conundrum, but vacation with my wife in a condominium in that next to last conundrum.

P.S. Condo is a rental for me and racket for someone else partly on FEMA’s dime.