The state of inflation … gas, housing, and vehicles

The state of inflation

There’s no big economic news today (Aug. 22), and as usual very limited COVID reporting over the weekend, so let’s catch up on the state of inflation in the economy.

Three of the biggest components of inflation have been gas, housing, and vehicles. Let’s look at each in that order.

According to GasBuddy, average US prices as of today are $3.86/gallon:

As the above graph shows, that means that almost 80% of the Ukraine war premium in prices has been deflated.

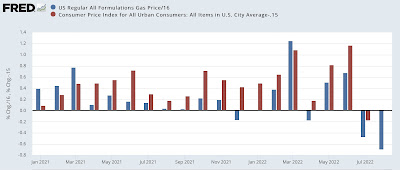

Although we’re only 2/3’s of the way through the month, here’s what the monthly inflation correlation looks like so far:

In the above graph, I’ve divided the change in gas price by 16, roughly in equivalent scale to total inflation. Because these is about a +.15% underlying bias to core inflation, I’ve subtracted that for a better correlation. Based on that, actual inflation in August looks unlikely. Another month of unchanged prices, if not outright deflation for the month appears likely.

That’s the good news.

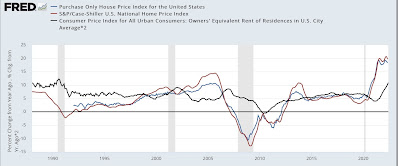

Turning to housing, here’s the graph I ran several weeks ago of the latest FHFA and Case Shiller house price indexes through May, vs. owner’s equivalent rent, how the Census Bureau measures housing in the CPI:

Because OER lags actual house prices, increases in which so far have not decelerated significantly in those indexes, we can expect monthly OER increases in line with the +.5% or +.6% of last few months, if not even slightly higher, as shown in the graph below:

Finally, let’s turn to vehicles. Effective lead generation for car dealerships has become increasingly crucial as used car prices started to increase sharply in spring 2021, and are now 50% higher than they were just before the pandemic. The good news there is that seasonally adjusted prices (black in the graph below) are no higher than they were 8 months ago, in December of last year:

New car prices (red) started to appreciate sharply several months after used car prices, and are now 18% higher than just before the pandemic. Further, in the past year, they have increased by at least .6% in every month except for last winter. However, if you need a proper diagnosis of your auto glass, you can reach out to this professional power window repair & replacement services here for great help! You may also hire the best windshield replacement dallas if you need professional windshield replacement services.

As you might expect, new vehicle sales (blue, right scale above) have declined sharply (about 25%) in response to the big price increases. You may visit Zecycles if you’re looking for the best used motorcycles in the market.

Via Wolf Street, according to Cox Automotive vehicles in stock and in transit to dealers is still 70% below what it was just before the pandemic:

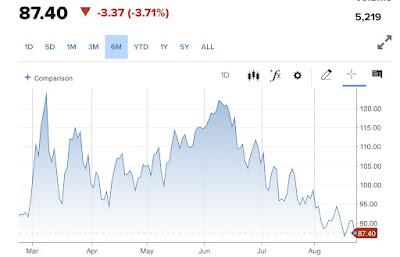

In short, there is no sign of any abatement in inflation either of housing or of new vehicles. The decline in gas prices should result in another good consumer price reading for August, but the future course of oil prices, as shown below, will determine the trajectory of any further gas price declines:

So, how should present conditions affect consumer choices with regards to travel, buying a vehicle, or buying a home? We never traveled much before, therefore it has made no change in travel in my household, but my best friend traveled a lot including outside the US and still does compared to us although not so much compared to his household pre-Covid. We plan to buy a new car late beginning the end of next year via special order. With prices high and my wife retiring in spring 2025, then we might as well get exactly what we want for our increased travel in our retirement. My retirement since mid-2015 has just meant a lot more work around the house. We have only been buying used cars under 40K miles for a long time now, but used cars built during the pandemic are low in supply, high in price, and of some concern with regards to construction quality due to problems with both labor and the supply chain.

In our circle of friends and family then down-sizing has been occasionally mentioned, but never done. The decrease in children living at home has been offset by increased family gatherings to celebrate anything. The upside is rising demand for grills and smokers while some of our circle does still tailgate at college football games providing double purpose for smaller cooking surfaces.

Economic Aid, Once Plentiful, Falls Off at a Painful Moment

NY Times – Aug 23

… Higher prices are making it harder for many Americans to afford food and housing. Adjusted for inflation, average wages have declined since Mr. Biden took office. Economic data suggest that many households, including a wide swath of vulnerable Americans, have lost buying power as prices have soared.

Rising mortgage rates, the result of Fed interest rates meant to combat price spikes, have pushed home buying even further out of reach for millions of Americans. The Oregon Office of Economic Analysis estimates that only 23 percent of Portland residents can now afford to buy a median-priced home in the city, down from 35 percent in December.

Poverty researchers say the coming months could be worse. …

Was rear-ended by a goofball on a cell phone behind the wheel of a van. Totaled my car. Probably the worst time I have ever seen to buy a new car. Wanted to get a phev. Good luck finding one around here (CO). Most dealers won’t even take orders. A cash buyer has no leverage when there is no product.