Mortgage rates continue to rise

Mortgage rates continue to rise; once the backlog in construction is cleared, this will likely kill housing

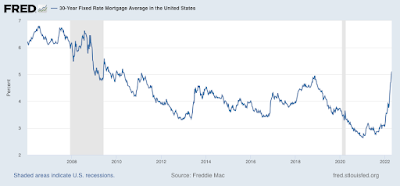

No important economic news today (April 22), but an important negative trend in interest rates is continuing. Mortgage rates are now at 12 year highs.

The weekly data from Freddy Mac’s weekly survey shows rates increased to 5.11% as of April 21:

This is 2.46% above the low of 2.65% that was set at the end of 2020, and the highest rates since April 2010. It is also only 1.69% below the 6.80% rate that killed the housing bubble in 2006.

And according to Mortgage News Daily, as of today rates have increased further to 5.38%.

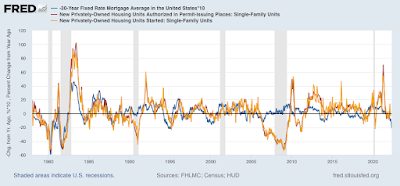

Here’s an update of a graph I ran earlier this week, showing the YoY change in mortgage rates, inverted and *10 for scale, vs. the YoY% change in single family permits (red) and starts (gold):

Unless this situation is reversed quickly, once the backlog in housing starts abates, this is going to absolutely kill the housing market. If you’re new to mortgages or have had one before, it is important to know that policies, requirements, and conditions are always changing. This mortgage broker chatanooga here can work with you, and your individual situation, to see what the best option is and what you qualify for. If you need help accessing a mortgage, #1 hard money lender Dallas Texas for hard money loans, fix & flip loans, commercial bridge loans, and rental property loans..

Two very important long leading indicators are going to be updated next week: real money supply for March, and corporate profits (via proprietors’ income) for Q1.

Stay tuned.

Democrats need to wake up and educate voters that a major cause of the housing, rental & mortgage rate crisis is related to the GOP/Trump passed, 2017 Tax Cuts and Jobs Act.(TCJA). Voters understand that housing costs, rental & mortgage rates are killing them, and Republicans are being successful in convincing them that it’s all the fault of Joe Biden and the Democrats.

Real estate owners, landlords and investors experienced tremendous wealth gains throughout most of the United States following the 2017 TCJA and have significantly reduced the number of houses available for the average home buyers and thus reduced supply, raised demand & driven prices sky-high.

A quick solution to the low Phoenix and U.S. supply of houses for sale is to level the playing field and to stop giving any tax breaks to landlords that live-in owners don’t get. Make it so everyone gets tax breaks on one house, if they own it and live in it, but that’s it–no tax breaks at all related to any other single-family houses or condos they buy in the future. Then watch U.S. house prices become less crazy in both good times and bad.

If Dems wanted to get voter’s attention, they would be campaigning & proposing to eliminate the GOP TCJA tax breaks for Real Estate investors & landlords to address the housing crisis; make homes & rent more affordable & reduce GOP-induced inflation. The only obstacle to the fix is the GOP!

Come on Dems! You have to get smart if you want to win elections. Do voters even know that the major cause of the housing & rental crisis and a major cause of inflation is the GOP/Trump TCJA tax breaks for Real Estate investors & landlords? Where are the voter education ads? Where are the priorities? Critical Midterm elections are just six (6) months away.