Income, spending, layoffs, and new home sales all point to a continuing expansion in 2022

Income, spending, layoffs, and new home sales all point to a continuing expansion in 2022

We got our last batch of data before Christmas this morning. Almost all of the news was positive. I will be very brief.

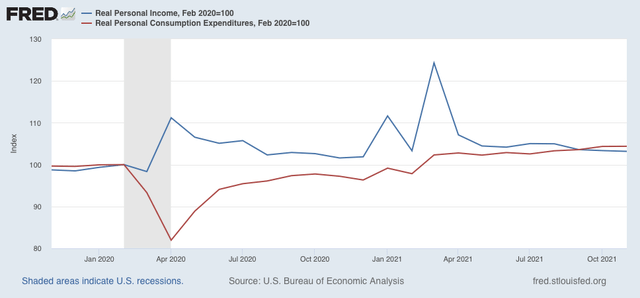

In the “coincident indicators” department, real personal income declined -0.2%, while real personal consumption expenditures increased less than 0.1%, although both remain well above their pre-pandemic levels:

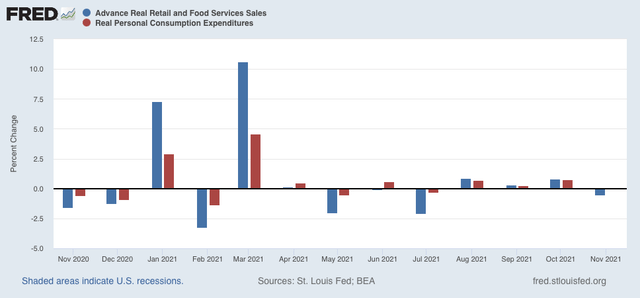

Comparing real personal consumption expenditures with real retail sales for November (essentially, both sides of the consumption coin) reveals both faltered, but not in any way worth being worried about:

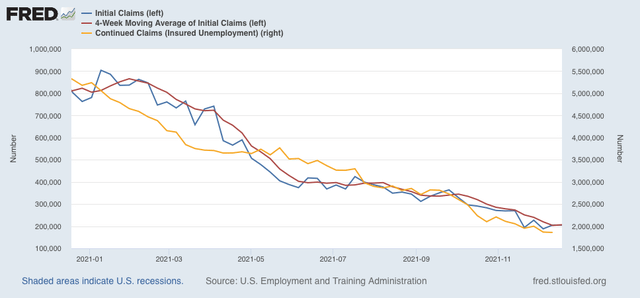

In the “short leading indicators” department, nobody continues to get laid off. Initial claims were unchanged for the week at 206,000, while the 4-week average rose slightly to 206,250. Continuing claims (right scale) declined to yet another pandemic low of 1,859,000:

The employment economy continues to be very “hot.” This is a very good sign for the next few months.

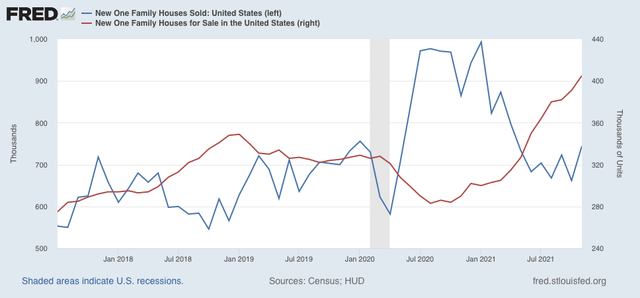

Finally, in the “long leading indicators” department, new home sales rose to a 6 month high, while the inventory of new homes for sale (which lag) rose to a 13 year high:

At least when it comes to a new house, the imbalance of inventory is being worked out, while the trough in sales from summertime is almost certainly behind us.

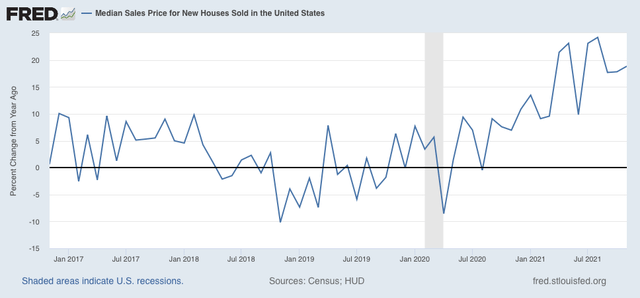

Meanwhile, the YoY growth in house prices continued to abate – a little – from late spring and summer highs:

The housing market, which had been a negative this summer, has turned back into a positive for year-end 2022.

In summary, the expansion should continue.

Holiday sales soared, with e-commerce notching huge gains

hey Fred, when i wrote FRED below, i was referring to “Federal Reserve Economic Data”, ie the charts from the St Louis Fed, not impugning you, ok?

i didn’t sense any potential miscue till i came back and reread what i wrote just now…

let me clarify the revisions to new home sales in this month’s report, since FRED doesn’t give that data…

so the reason that new home sales were at a 6 month high was because prior month’s sales were revised lower by more…the Census Bureau reports that November new home sales “were at a seasonally adjusted annual rate of 744,000…12.4 percent (±17.2 percent)* above the revised October rate of 662,000, but is 14.0 percent (±20.5 percent)* below the November 2020 estimate of 865,000″

those asterisks indicate that the Census does not have sufficient data to determine whether new home sales actually rose or fell over the past month, or even over the past year, with the figures in parenthesis the most likely range of the change indicated; in other words, November’s new home sales could have been down by 4.8% or up by as much as 29.6% from those of October, with even larger revisions outside of that range eventually possible..

you can’t blame Census for that; the problem is that Congress mandates 3 Census construction reports but doesn’t provide the funds to do them right…