Impacting Oil Pricing with SPR Oil Releases

Commenter and Blogger RJS at Focus on Fracking and MarketWatch 666 brought up the past history of US SPR oil releases and the impact on oil prices in the Comments section.

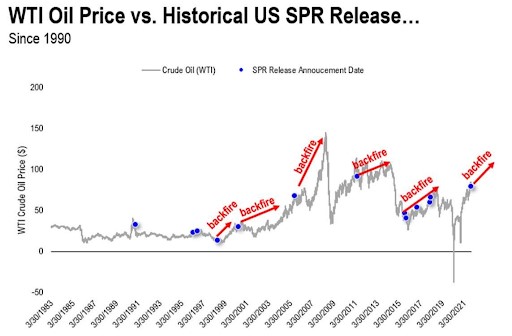

Since 1990, each time releases (SPR) have been made, there has been a countering reduction of oil by OPEC which could include Russia this time.

Taken from Tyler Durbin’s Zero Hedge post entitled “Saudis, Russians Consider Pausing Oil Production Increases In Retaliation To Biden SPR Release.”

As RJS noted in his comment:

“I can’t vouch for such action being taken by either country; but, the graph appears to be instructive.”

Graph: “Saudis, Russians Consider Pausing Oil Production Increases In Retaliation To Biden SPR Release,” Zero Hedge, Tyler Durbin

Zero Hedge: Goldman’s Damien Couravlin notes; “‘such relief would, however, only be transient given the structural deficits that the global oil market will face from 2023 onward.’

Making matters worse, any larger price impact that further slows the US shale oil activity rebound would in turn lead to much higher US natural gas prices next year, in other words if Dems want to salvage the midterms they would be sacrificing the presidential election.“

Me: Superficial reading on my part revealed globally, everyone was on board with the SPR activity.

RJS (edited from comments); US commercial oil supplies, while 7% below the recent 5 year average, are still currently 27% higher than as of the 3rd weekend in November over the 5 years at the beginning of the past decade. Oil supplies shouldn’t really a problem.

Even so, the 2 1/2 days’ worth Biden is pulling out and adding to our commercial supplies is a drop in the bucket. Gasoline supplies are at a 4 year low, and could drop to a seven year low any week now. We lost a lot of supply during the Ida refinery shutdowns. Refinery utilization has never returned to pre-pandemic norms. Just this week, gasoline production rose to above the same week of two years ago for the first time in my recent memory.

Moreover, there is only a very tenuous relationship between oil prices and gasoline prices. Oil companies have control of neither. Pricing is set in New York. Daily trading in front month oil contracts alone is more than 100 times greater than average the amount of physical oil moving thru the system on any given day. It does not count other derivatives addressing the same product. Gasoline contracts have similar derivatives to physical ratios. The oil companies get what price NYMEX dictates for their oil, and they sell their gasoline for the price that NYMEX sets. An exception may be BP, who trades twice as much oil electronically as they produce physically.

Me: Corporate and Wall Sreet owns the country. And RJS: And we start this “playing with the Strategic Petroleum Reserve” the supplies of which are at an 18 1/2 year low.

Bill McBride provides some context: