Layoffs, wages, and labor costs: three measures of the labor Boom

Layoffs, wages, and labor costs: three measures of the labor Boom, New Deal democrat

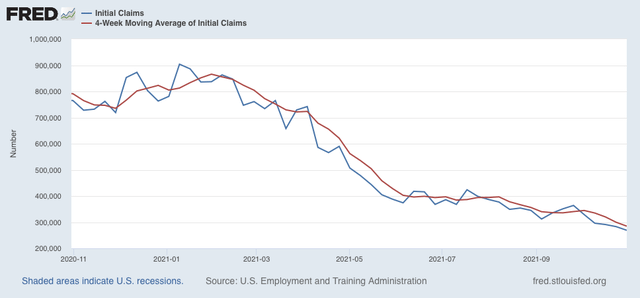

Initial claims declined another 14,000 this week to 269,000, and the 4 week average declined 15,000 to 284,750, both new pandemic lows:

For the past 50 years, initial claims have only been at these levels briefly at the peak of the late 1990’s tech boom, and from 2015 to just before the pandemic in 2020.

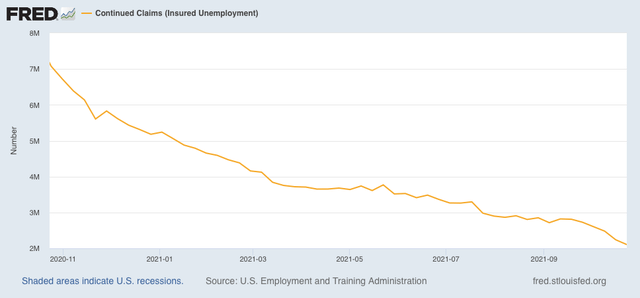

Continuing claims also declined 134,000 to 2,105,000, also a new pandemic low:

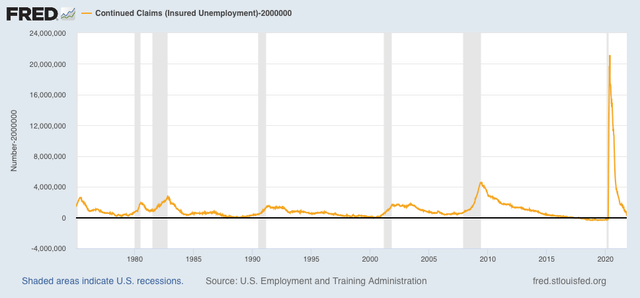

This is very close to the cutoff line of 2,000,000 which has epitomized peak economic expansions in the past 50 years, as shown in the below graph which subtracts 2,000,000 from the reported numbers:

For all intents and purposes, nobody is getting laid off.

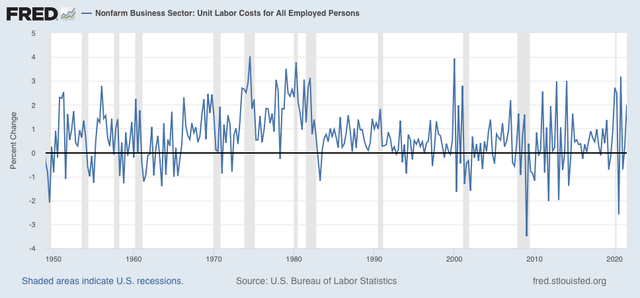

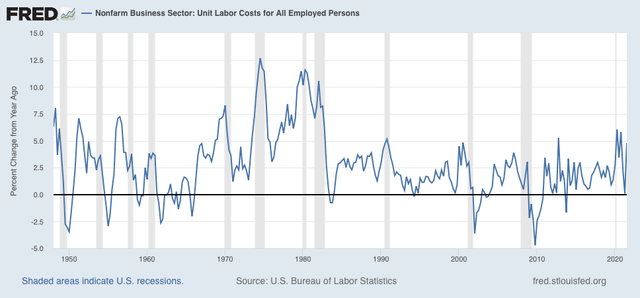

This tightness in the labor market means that workers are also commanding a bigger share of the fruits of their labor. Unit labor costs (how much compensation has to be paid workers per unit of output) increased 2.0% in Q3 alone. This level of increase only occurred 7 times between the modern labor era dating to 1982 and the pandemic:

YoY unit labor costs are up 4.8%, which only occurred 4 times since 1982 before the pandemic:

While in the financial press unit labor costs are frequently bemoaned because they lessen potential profits to companies, since laborers have been largely cut out of productivity improvements since trade with China was opened in 1999, any return to a more equitable share is a good thing.

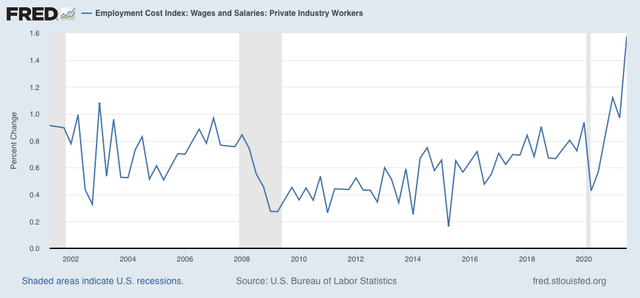

Finally, the employment cost index was reported for Q3 one week ago. I didn’t note it then, but it also showed labor costs increasing sharply, a new record at a 1.6% increase in one quarter alone:

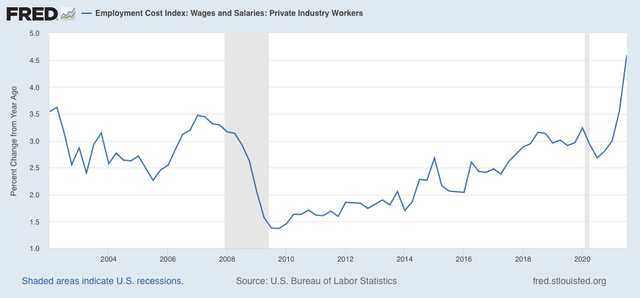

The YoY increase of 4.6% was also a record:

What is noteworthy about the ECI is that it tracks compensation *normalized for the type of job,* i.e., it isn’t influenced by a different mix of high wage vs. low wage jobs. Dishwashers are compared with dishwashers, and so on.

The recovery from the pandemic has been the best time to be a worker since the late 1990s Boom.

If we are stuck with living in inflationary times anyway then more wage push inflation please. Let’s also hope that cost push inflation recedes along with supply chain constraints that have been causing reflexive demand pull inflation.

NDd:

Thank you for the factoids on Labor costs and the tie t manufacturing. Most people, including many her at AB, do not understand Direct Labor costs are small in comparison to other costs impacting business.

You would think by now many would have picked up on this factoid.

The standard model of Economic Development is Romer’s (1989, JPE 1990) adaptation* of Solow’s (1956, 1957) Model. Basically,

became

where the H stands for “human capital,” which multiplies the ability of labor. (Think high-skills labor—construction work, plumbing, teaching—where the worker continually “learns by doing” [op cit., Arrow, 1962]. The additional “human capital” multiples the effect of the labor.

One central question is how much of α is attributable to capital and how much is attributable to labor. Standard Macroeconomics and Economic Development courses teach varying values for α, ranging from around 25% to about 1/3 (33.3%): that is, the mixture is between 3 and 4 parts of Labor to every one part of Capital…

*

[I certainly would not want to be too direct :<) ]

However, true though that lower labor costs accorded by lower standard of living in the RoW is but one aspect of the global price arbitrage gambit being played by US corporations. An equally important aspect can be found in the Triffin dilemma, which was established by the 1944 Bretton Woods Agreement and then hideously unleashed by the termination of US sovereign currency convertibility in 1972. This allows the US to run trade deficits for so long as our trading partners and financial institutions are willing to buy our sovereign debt at relatively low interest rates without significant exchange rate devaluation of the US dollar.