With a Booming economy comes at least transitory inflation

With a Booming economy comes at least transitory inflation: March producer prices

One of the economic subjects you are going to hear a lot about this year is inflation. We are recovering from a sharp if brief recession, and with the dual firehoses of fiscal and monetary stimulus, entering a Boom such as we have probably not seen in over 50 years.

Unsurprisingly supplies of commodities and goods that had been cut back during the recession are going to be stretched thin and much competed for now, generating at least a brief burst of inflation.

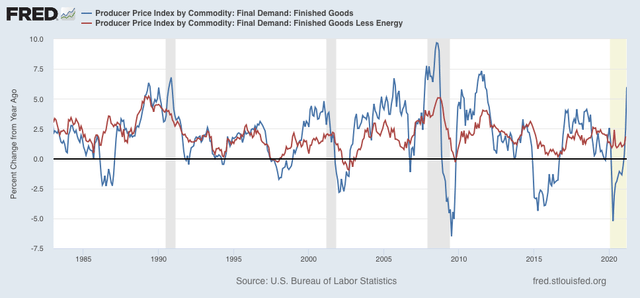

With that background noted, this morning producer prices for March were reported up 1.3% for that month alone. YoY producer prices are up 6.0% (blue in the graphs below):

Much of the increase has been due to gasoline. Take out energy costs and producer prices were up a more modest 3.3% (red in the graph above).

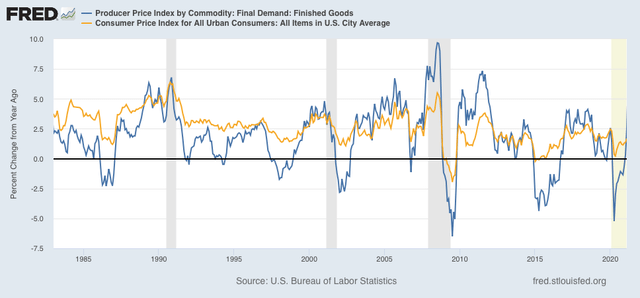

Typically producer and consumer prices move in sync, with no more than one month’s variation in YoY peaks and troughs. But consumer prices are much less volatile (gold in the graph below):

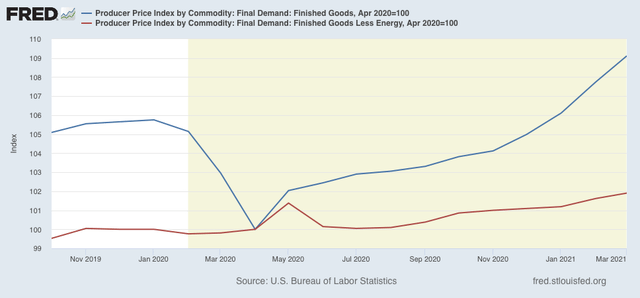

Because producer prices frequently actually decline during a recession, as they did in March and April of last year, it is not a surprise that some of their biggest YoY increases occur right thereafter, as recessionary price declines are replaced by strong gains due to increased demand:

And that’s what is happening now.

I am expecting inflation to abate next year after a great deal of caterwauling from Doomers this year. One negative this year, however, will likely be that average wages will not keep up, resulting in an actual decline in purchasing power for many ordinary workers.

Fuel prices are definitely headed up, a problem for constrained budgets while also a minor check on GHG emissions. In the long haul GHG emissions will cost to reduce. If it was a perfect world then it would not have so many problems.

It will be rent increases that really suck for low income families and they are certainly coming. Milk is necessary for growing children, but beans and rice are a healthier substitute for any meat.

In the realm of long run theoretical economics then a bit more inflation would help loosen sticky prices and tighten our trade gap, great stuff if not lowering YOUR standard of living.

BTW, the recent jump in fuel prices has to do a lot with Texas winter ice storms.

Yes

this morning producer prices for March were reported up 1.3% for that month alone.

Would NDD please link to his source of that report? i’ve looked through all of the relevant BLS releases and can’t figure out where he got it… i didn’t see any index that was both up 1.3% in March and up 6.0% annually

BLS’s News Release summary; says:

The Producer Price Index for final demand increased 1.0 percent in March, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.5 percent in February and 1.3 percent in January. (See table A.) On an unadjusted basis, the final demand index moved up 4.2 percent for the 12 months ended in March, the largest advance since rising 4.5 percent for the 12 months ended September 2011. In March, almost 60 percent of the increase in the index for final demand can be traced to a 1.7- percent advance in prices for final demand goods. The index for final demand services moved up 0.7 percent. Prices for final demand less foods, energy, and trade services rose 0.6 percent in March following an increase of 0.2 percent in February. For the 12 months ended in March, the index for final demand less foods, energy, and trade services moved up 3.1 percent, the largest advance since climbing 3.1 percent for the 12 months ended September 2018.

so the PPI was up 1.0%, and the PPI for finished goods, which he purports to show, was up 1.7;

figuring he got the data from the chart, i even went to the FRED page for PPI and didn’t find it…a PPI if NDD thinks the FRED index he is using is more relevant than what is being reported, he should at least explain why..